GM,

Here’s some event news to share: Blocktrend and the Web3 for All Reading Club will be hosting a Devcon7 Sharing Session next Monday (11/25) at 7 PM at Feidi Bookstore. Several Devcon attendees will share their insights and experiences from Bangkok. Plus, there will be exclusive Devcon7 memorabilia, such as books, stickers, and frog plushies, for early birds!

Event Details:

Topic: Devcon7 Sharing Session

Time: 7:00 PM, Monday, 11/25

Location: Feidi Bookstore (170-2 Zhonghua Road Section 1, Wanhua District, Taipei City)

Due to space limitations at Feidi Bookstore, in-person attendance will be capped, but there is no limit for online participation. We warmly welcome everyone to register!

Let’s dive into the main topic.

Recently, the prediction market Polymarket accurately forecasted Trump’s victory but was raided by the FBI after the election, sparking widespread controversy. While many suspect political suppression, Vitalik Buterin highlighted a broader opportunity for prediction markets. He believes that Polymarket’s potential goes beyond election forecasting—it can combat misinformation and enhance DAO governance efficiency. Let’s start with the recent controversy.

Prediction Markets

Last week, the FBI conducted a raid on Polymarket CEO Shayne Coplan’s residence, seizing his phone. According to Central News Agency,

Cryptocurrency prediction market platform Polymarket confirmed... Early this morning, federal agents raided Polymarket CEO Shayne Coplan’s apartment in New York’s SoHo district following the conclusion of the U.S. presidential election. During the election, bettors on Polymarket heavily wagered on Trump, placing large sums and indicating a much higher probability of Trump’s victory over Harris than polls suggested... The FBI and U.S. Department of Justice have declined to comment on the raid.

To date, the U.S. government has not explained the reason behind the raid, leading to speculation that the Biden administration may be seeking retribution. Meanwhile, the 26-year-old Coplan, after acquiring a new phone, posted on social media:

New phone, can’t recognize who anyone is anymore.

Polymarket debuted in 2020, functioning as a sort of futures exchange for real-world events, enabling users to wager on outcomes using cryptocurrency. For example, I could create a prediction market on Polymarket with the theme: “Will Bitcoin surpass $100,000 by year-end?” Participants could bet on “Yes” or “No,” with the outcome determined at the end of the year.

The standout feature of Polymarket is the ability to enter and exit positions at any time. As Bitcoin’s price nears $100,000, the “Yes” option might rise from $0.50 to $0.80. At that point, I could sell my position early to secure profits without waiting for year-end confirmation. Likewise, I could cut my losses if the trend seemed unfavorable.

Prediction markets are typically regulated by governments to prevent massive financial stakes from influencing outcomes and disrupting social order. Yet, Polymarket, like many blockchain-based applications, operates as a "ghost platform" in the eyes of regulators, skirting conventional oversight. Two years ago, the U.S. Commodity Futures Trading Commission (CFTC) charged Polymarket with unauthorized operations.

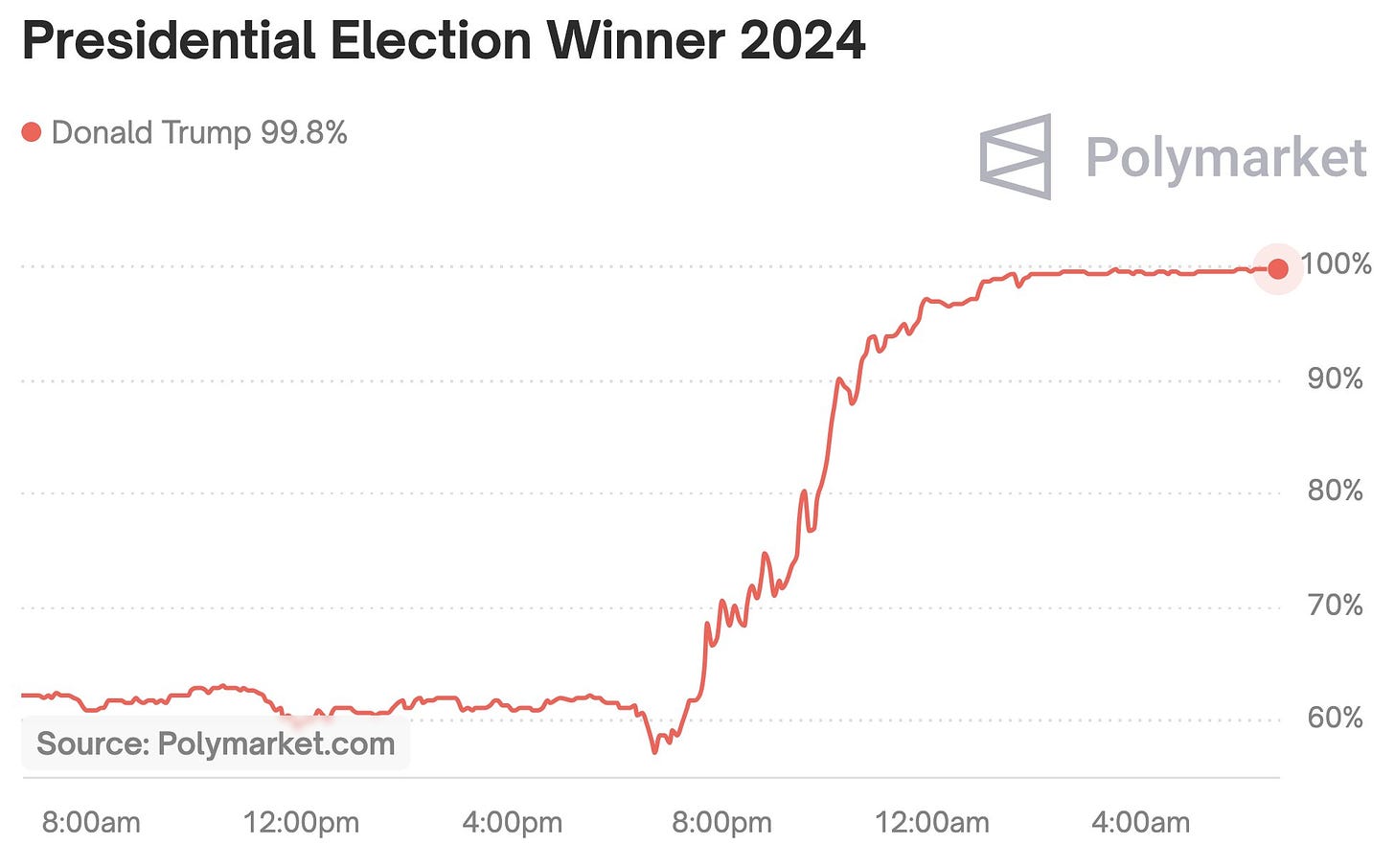

The case concluded with Polymarket blocking U.S. users and paying a fine, but the 2024 U.S. presidential election thrust the platform back into the spotlight. Polymarket’s trading volume reached $3.6 billion, far surpassing domestic prediction markets, and its forecasts often diverged significantly from mainstream media polls. While pre-election polls from various outlets showed a tight race, Polymarket gave Trump a 62% chance of victory—significantly higher odds than reported elsewhere.

This discrepancy sparked curiosity: were media polls failing to capture the true public sentiment, or were Polymarket bettors biased? Both sides had their arguments. Advocates for media polls claimed that Polymarket’s results were skewed by a few wealthy players manipulating the market. Meanwhile, Polymarket supporters argued that pollsters lacked respect for market mechanisms. Was the market manipulated, or were the experts overconfident?

The debate raged on until the election results were announced: Trump won by a landslide.

Trump’s Victory

Had Polymarket's prediction been inaccurate, it might have been dismissed as a joke, and Shayne Coplan might have avoided government scrutiny. However, its accurate forecast of the election outcome put Coplan under the spotlight. While this doesn't render traditional polling obsolete, it at least proves that Polymarket’s results were not blindly optimistic. I align with the perspective shared by Haseeb Qureshi, a partner at Dragonfly Ventures:

My point isn’t that Polymarket is right and polling models are wrong. The two aren’t that far apart. What I’m pointing out is something subtler: prediction markets consistently favored Trump’s chances more than the polls did. Prediction markets incorporate all existing information, including polling data and analysts’ insights. Yet Polymarket disagreed with pollsters. Analysts’ only explanation was that Polymarket was biased.

What they didn’t humbly consider was the possibility—just maybe—that Polymarket captured something polls couldn’t... It’s all clear now. Before the internet, polling was relatively accurate, with response rates exceeding 60% for landline surveys. Today, response rates are just 5%, leading to severe sampling biases.

Before the election, critics often dismissed Polymarket’s bettors as foreigners, implying they didn’t understand U.S. elections. The Wall Street Journal even highlighted a French high roller on Polymarket, arguing that such individuals underscored the limitations of prediction markets. They claimed that a small number of participants could disproportionately influence results and accused the platform of exploiting regulatory loopholes with opportunities for cheating.

But Trump’s victory validated the power of prediction markets. It demonstrated that participants’ nationality or background doesn’t matter. Prediction markets leverage money to bridge cultural, linguistic, and informational divides, ultimately reflecting reality more clearly than other methods.

Additionally, Polymarket’s monetary incentives enable it to report outcomes faster than mainstream media.

If you had initially bet on Kamala Harris winning but saw the tide turning, you could exit your position at any time. In this scenario, traditional election-night TV broadcasts, once considered the fastest way to follow results, no longer hold the lead. These broadcasts aim to boost viewership by building suspense and drama, which for Polymarket bettors amounts to unnecessary noise. They care only about the results, not the tension-filled narrative.

The principle “nobody stays in a losing game” drives Polymarket’s speed and accuracy. Even if one doesn’t participate in betting, simply observing market trends provides valuable insights. Vitalik Buterin refers to this concept as “info finance.”

Information Finance

According to Vitalik, Polymarket is not merely a betting platform for participants but also a source of news for everyone else. He illustrated this with the example of the Venezuelan presidential election:

In July, Venezuela held a presidential election. The day after, I noticed protests against alleged election fraud. At first, I didn’t think much of it. I knew Maduro was a dictator who would naturally rig every election to retain power. Protests were expected and bound to fail. But then I noticed on Polymarket that people were betting over $100,000, giving the effort to overthrow Maduro a 23% chance of success. It was the market that made me realize this was a serious attempt. Without Polymarket's initial signal—‘this is something to watch’—I wouldn’t have paid much attention to it.

Polymarket’s tagline is: “Profit from what you know best.” But for bystanders, simply observing the judgments of these “insiders” is immensely valuable.

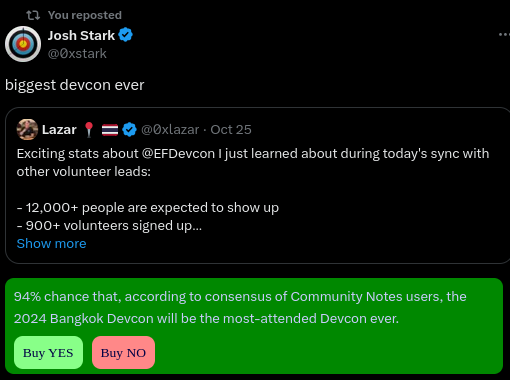

For example, Vitalik provided an illustrative scenario: when an Ethereum Foundation executive posts on social media, claiming that a recent Devcon was “the largest in history,” the average person may find it hard to assess the claim’s credibility. However, if Polymarket shows that 94% of insiders believe this statement to be true, it instantly raises the reliability of the information. This approach offers a faster, more lightweight form of fact-checking.

In the past, verifying facts required fact-checking organizations to confirm claims and publish detailed reports on their findings. When dealing with sensitive topics, such organizations might face accusations of bias. Prediction markets, however, offer a lighter alternative: even niche topics can have their own prediction markets, enabling collective verification by participants. When lies are uncovered, instead of arguing in comment sections, one can directly place a bet against the false claim—profiting from what they know best.

Additionally, Vitalik sees great potential for prediction markets in DAO governance to enhance operational efficiency. For example, routine expenditures could be reviewed via prediction markets rather than relying on passive voting, which can be slow and inefficient. However, not everything should be handed over to prediction markets. These markets cannot determine an organization’s goals or values, and critical decisions still require human discussion.

Returning to Polymarket's regulatory controversies, governments are concerned that prediction markets might disrupt societal operations, emphasizing the need for strict oversight. This concern arises from the high setup costs of traditional prediction markets, which have historically been limited to significant, widely shared concerns. But if future applications of Polymarket shift toward verifying the authenticity of social media posts or streamlining community governance, would such stringent regulations still be necessary?

Ultimately, which poses a greater risk: allowing money to influence information dissemination, or enabling the cost-free spread of misinformation? Polymarket may hold the key to striking a balance between the two.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.