GM,

Today is a typhoon day-off, and I hope everyone is safe. The day before yesterday, I recorded a video demonstrating the process of using the Slugs decentralized URL shortening service mentioned in my previous article and uploaded it to Blocktrend’s YouTube channel. Sometimes I upload videos like this unexpectedly, so make sure to subscribe to the YouTube channel to get notified right away.

Additionally, since Blocktrend resumed publishing three articles per week, the biggest benefit has been the increased flexibility in topic selection, allowing us to cater to the diverse needs of our readers. This article discusses developments in the financial and automotive industries.

Ethereum ETF Launch

The Ethereum spot ETF was launched in the U.S. this week, with its trading volume exceeding $1 billion on the first day of trading. Notably, the Ethereum ETF (ETHA) launched by BlackRock, the world's largest asset management company, has even made it into the top 50 ETFs in U.S. trading history. Bloomberg reported that this is a promising start:

The first batch of U.S. ETFs directly investing in ETH saw significant trading volumes on their first day. Within the first few hours of opening, trading volumes exceeded $1 billion. Although this is a far cry from the $4.6 billion trading volume recorded by the Bitcoin spot ETF in January, it is still a strong start for an ETF's first day of trading. Several of these funds are expected to rank among the top 50 highest-trading ETFs in U.S. history by the end of the day.

2024 is becoming the year of mass cryptocurrency investment, with both the entry threshold and risks decreasing.

The Taiwan Virtual Currency Association was recently established, marking the most significant milestone since Taiwan's first exchange was founded in 2013. In the future, people won't need to post online asking which exchange is the most reliable for buying and selling cryptocurrencies. The association is responsible for establishing standards and ensuring quality, theoretically meaning that association members are reliable operators. Of course, there may still be complaints about the varied quality of the listed members. However, building a system takes time, and some operators will be weeded out. The longer an operator remains on the list, the more reliable they are.

While Taiwan is starting to establish a system, U.S. exchanges are still in the "survival of the fittest" phase. Investors might consider publicly traded companies like Coinbase to be reliable, and Kraken, which has been around for over ten years and weathered many storms, also counts as reliable. But what about other exchanges? The U.S. Securities and Exchange Commission (SEC) is busy looking for evidence of exchanges violating regulations, hoping to apply securities exchange management rules to cryptocurrency exchanges without addressing the issues directly, making it difficult for investors to judge the reliability of exchanges. Fortunately, now people have a new option—holding cryptocurrencies indirectly through ETFs.

In 2024, the U.S. successively approved the listing of Bitcoin ETFs and Ethereum ETFs, with more cryptocurrency ETFs expected in the future. The market generally predicts that the next one will be a Solana ETF. The significance of issuing cryptocurrency ETFs is simple: it provides a new option for investors who previously could not (or did not want to) buy cryptocurrencies through exchanges. In the future, Americans investing in cryptocurrencies will no longer question "if" or "can," but only "whether they want to."

However, Taiwanese people cannot yet hold cryptocurrencies indirectly through ETFs, as the Financial Supervisory Commission (FSC) believes that cryptocurrency prices are too volatile and lack intrinsic value. According to a Central News Agency report:

Following a U.S. court ruling that invalidated the SEC's prohibition, an ETF tracking Bitcoin's performance was approved for listing by the SEC in January this year. Considering the high volatility and lack of intrinsic value of virtual assets, the FSC has preliminarily prohibited investors from buying spot and futures products linked to virtual assets through discretionary accounts. During a response to inquiries, Commissioner Peng Jinlong confirmed that the Securities Dealers Association has submitted a proposal to the FSC. Considering that not all countries have fully opened up—such as South Korea and Japan not opening up, and Hong Kong adopting conditional opening—the association proposed allowing professional investors to purchase virtual asset ETFs through discretionary accounts, with first-time transactions requiring the signing of a risk disclosure statement.

If someone criticizes the Taiwanese government for being conservative, I would be the first to refute that. They are blaming the wrong party. From the outcome, the U.S. government's ambiguous regulations ultimately guide most investors towards financial institutions, holding cryptocurrencies indirectly through ETFs. Regardless of how much BlackRock earns from ETFs, it is difficult to help the crypto industry develop further.

The Taiwanese government's approach is actually more radical than the U.S. government's. Restricting investors from buying and selling cryptocurrency ETFs through financial institutions essentially encourages people to hold actual cryptocurrencies through exchanges. Compared to the U.S. government funneling all the benefits of cryptocurrency investment to financial conglomerates, the Taiwanese government's approach is more supportive of industry development.

Maybe the FSC is actually an insider within the government supporting the crypto industry. Let's not expose them.

Toyota Develops Car Wallet

Last week, Toyota's Blockchain Lab released a report titled "How to Introduce Mobility into Public Blockchains: Exploring New Possibilities for Blockchain and Mobility." It was through this report that I learned Toyota even had a Blockchain Lab. Fortunately, the report included a brief introduction at the end:

Toyota Blockchain Lab is a digital organization established by the Toyota Group in 2019 to accelerate blockchain applications. Initially, we focused our research on internal projects such as traceability of parts and information. In recent years, we have expanded our research to include public chain-related topics such as Web3 and innovative finance.

It turns out that Toyota originally worked on private blockchains and only switched to public blockchains this month.

Access control is the core of IT systems. Companies and governments new to blockchain often struggle with the transparency and accessibility of blockchain data. Thus, creating a private blockchain to manage permissions becomes a reflexive action.

However, there haven't been successful examples so far. For instance, the blockchain project TradeLens, jointly developed by shipping company Maersk and IBM, once made a splash but ended in 2022. Since then, there have been few updates on their blockchain advancements.

Toyota also stepped into the same "pit." Although they did not specify the twists and turns they experienced, the result is that Toyota has shifted its future focus to public blockchains. According to the report:

Imagine a world where a car is equivalent to an account. Each car has its own account, connecting users to the world. This digital state represents how we interact with cars in the real world. In this article, we refer to the blockchain account as 'MOA' (Mobility Oriented Account). This is based on the most mainstream abstract account standard on Ethereum, ERC-4337. We are exploring how to design MOA.

Previously, Blocktrend introduced that Japan's largest telecom company, NTT, is developing a cryptocurrency wallet. Now, even Japan's largest automaker, Toyota, is developing a wallet for cars. At the beginning of the report, Toyota specifically thanked NTT for their technical assistance. It seems that adopting public blockchains has become mainstream in the Japanese corporate world. But why does Toyota want to add a wallet to cars?

In the mobility concept published by Toyota in 2023, our goal is to integrate mobility with social systems in the "Mobility 3.0" stage. Most mobility takes place in public spaces and is completed through interactions with other vehicles, people, traffic signals, and energy facilities. This means that mobility cannot be closed but must be a semi-public entity. A public blockchain that can share statuses with others might be a good choice for Toyota to achieve this concept.

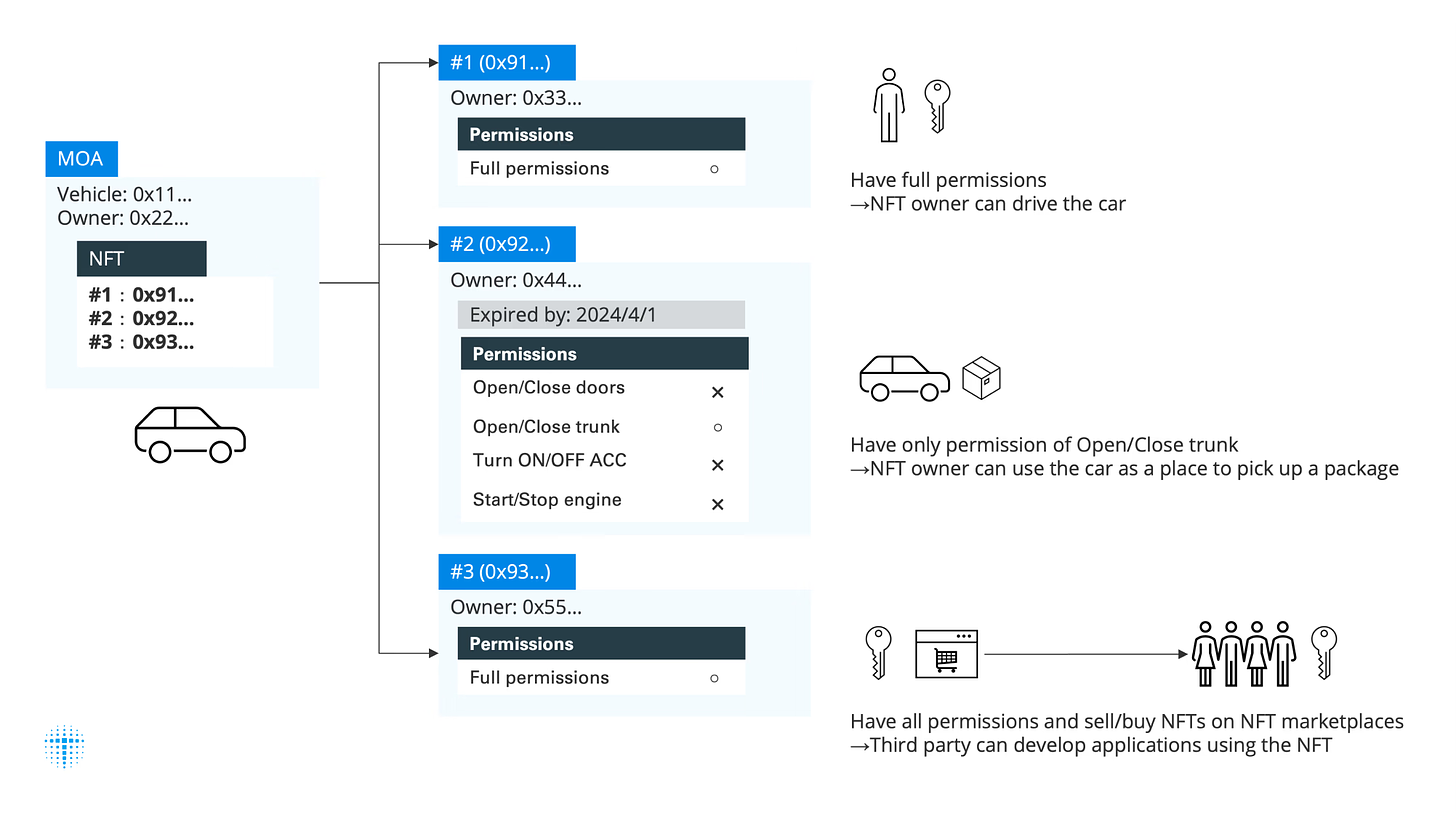

Toyota's development of a wallet is similar to the development of digital wallets by digital departments, focusing on facilitating multi-party collaboration, not necessarily for storing cryptocurrencies. The following diagram is a scenario illustration by Toyota. The car on the far left has its own wallet address (0x11), but the owner of the car wallet is someone else (0x22). The car wallet contains three NFTs, each representing different usage permissions for the car, somewhat similar to digital car keys.

The first NFT (0x91) is owned by the car owner. It holds full car permissions, and with this NFT, one can drive the car. The second NFT (0x92) is a derivative feature. It only has the permission to open and close the trunk but cannot start the car, serving the function of allowing the car to act as a temporary storage box. The third NFT (0x93) allows the car owner to put the car on other decentralized application transactions, such as renting, staking, or selling.

Although the usage scenarios are still very rough, the concept being conveyed is very clear — the car is not only digitized but also networked. Toyota certainly has the capability to create a digital car key, but they are looking further ahead.

My Gogoro key is a digital key, stored in the Apple Watch. Unfortunately, this key hasn’t gained additional application scenarios due to digitization; it only makes me carry one less physical key. It’s like scanning the Britannica into a digital file and saying it’s a digital encyclopedia. But Wikipedia is the true digital encyclopedia, searchable, collaboratively editable, and linkable.

Toyota has considered the interaction possibilities with other applications for the digital key, naturally eliminating the idea of building a private blockchain and turning to public blockchains.

Finally, many might think NFTs are already dead, but in reality, only the avatar-style NFT market has collapsed. People now tend to underestimate the application potential of NFTs. In fact, from domain names to car keys, NFTs can be excellent application scenarios.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.

haha let's not expose them~