Wallet Private Key Collision Machine: How High is the Chance of Winning the Bitcoin Lottery?

#563

GM,

First, let's start with some good news! If members received the RetroPGF airdrop from Blocktrend at the end of May this year and took additional actions to stake their OP tokens with me or other community representatives, they will receive OP token airdrops this week based on the amount and duration of their staking.

This week, Optimism announced its third wave of OP token airdrops, distributing a total of 19.41 million OP tokens (equivalent to 850 million Taiwanese dollars) to 32,000 wallet addresses. This airdrop is a reward for wallet addresses that have actively staked OP tokens and participated in community governance since 2023. Each wallet address can receive up to 20,000 OP tokens, approximately worth 880,000 Taiwanese dollars.

You can check your wallet and switch to the Optimism network to confirm if you have received the tokens, or you can search for your wallet address on this website. The airdrop will be sent directly to everyone's wallets without the need for additional actions. If you missed this airdrop, don't worry; by participating in staking now, you will have the opportunity to receive the fourth, fifth, and sixth waves of OP token airdrops in the future.

Now, onto the main topic.

In the world of cryptocurrencies, there are often pleasant surprises, and token airdrops are just one of them. Some individuals rely on mining, or even create new wallets in hopes of getting lucky. Recently, a member in the Blocktrend Discord asked whether solo mining is worth the investment. The consensus among the community was that it's better to go buy a lottery ticket. This article discusses the probability of winning in these "crypto lottery" scenarios.

Private Key Collision Machine

Every time people create a wallet, it's like buying a lottery ticket. There's an extremely, extremely low probability that when you open your wallet, you'll find a non-zero balance, indicating that it's a wallet that someone else is already using. Successfully creating this wallet means you've stumbled upon an identical private key, which grants you the ability to claim the wallet's balance as your own.

Why does this happen, and is your wallet still secure? Don't worry just yet! This occurs because the process of generating private keys within a wallet is based on random mathematical formulas. When we register a Gmail account, Google warns us if the email address is already in use to prevent multiple people from registering the same email. However, wallets and private keys are generated randomly without registering with a single entity, making it impossible to prevent collisions. The probability of such collisions is extremely low, bordering on the impossible. But the more unlikely the target, the more it attracts skilled individuals to attempt.

In 2016, there was a controversial research project on the internet called the Large Bitcoin Collider, which conducted a security experiment. Researchers wanted to determine if the way Bitcoin generates private keys is truly random and secure. They wrote a program that operated 24/7, generating wallet private keys based on mathematical formulas. If a wallet had no funds, they moved on to the next set, but if they found a wallet with funds, they would transfer the funds out and publicly record it.

Can you guess the outcome? This experiment has been running since 2016, and it has identified a total of 16 sets of Bitcoin wallet private keys that were confirmed to have been used by someone. The most recent discovery was in November 2017, where the wallet contained 0.54 BTC, approximately worth 470,000 Taiwanese dollars at current prices. According to the project's description:

The name of the Large Bitcoin Collider (LBC) pays homage to the Large Hadron Collider (LHC). It's a decentralized endeavor with the goal of finding at least one Bitcoin private key that someone is already using within a continuous range of 2160. These addresses will be cross-referenced with known BTC addresses holding assets. In very rare cases, wallet balances may be discovered. Searching for and colliding private keys is not illegal, but forcibly taking control of found funds may be illegal depending on the regulations of different countries.

The reason for doing this is that the prevailing consensus on this matter is "impossible." This has turned it into a technical challenge. Throughout human history, many things once considered impossible have later been proven feasible. This project takes a pragmatic approach to verify if Bitcoin aligns with the theoretical principles of cryptographic technology and asset protection.

Another article from 2017 provides slightly different data compared to the official website.

They claimed to have tried 3,000 trillion sets of private keys, out of which they found 30 sets of wallet private keys that could potentially be in use. Regardless of the exact numbers, this information would certainly raise concerns among Bitcoin holders. After all, these private keys are randomly generated from the source, and no one needs to hack into anyone's device – they can simply guess using mathematical formulas. If one day a hacker happens to guess your wallet's private key, even if your phone and computer are not compromised, your assets could potentially disappear.

However, please don't worry too much. Although this project did once find irrefutable private keys, their last achievement dates back to the end of 2017. Nearly 6 years have passed since then, and there has been no further activity. Why?

Economic Infeasibility

The simple answer is that the difficulty is too high, and the cost is too expensive, making it an endeavor that any rational person would be unlikely to attempt. Bitcoin wallet addresses look like this: bc1qnwlj2ek508l2g8nlgdvw9es29mxst6fkd63ye28q43eyf3jtlyesg5862k. They are not all numbers, and it's hard for people to imagine just how many possibilities lie behind it; it seems like something designed for machines to interpret.

In reality, the total number of Bitcoin addresses is 2^160, approximately equal to 1.46 x 10^48. This number is so vast that it can only be expressed mathematically, and no familiar mathematical units can help us comprehend it. To put it into perspective, one trillion is 10^12. In other words, the total number of Bitcoin addresses is 1.46 trillion trillion trillion trillion. But just like no one would say ten thousand is one hundred hundred, while technically correct, it would be a bit foolish to put it that way.

Quantities can indeed be compared. According to estimates by scientists, there are approximately 5 x 10^30 bacteria globally. So, the number of Bitcoin addresses is many trillions of times greater than the total number of bacteria on Earth. The more addresses there are, it's akin to having a larger space, and if the number of individuals using Bitcoin isn't significantly high, the probability of two people colliding becomes exceedingly low.

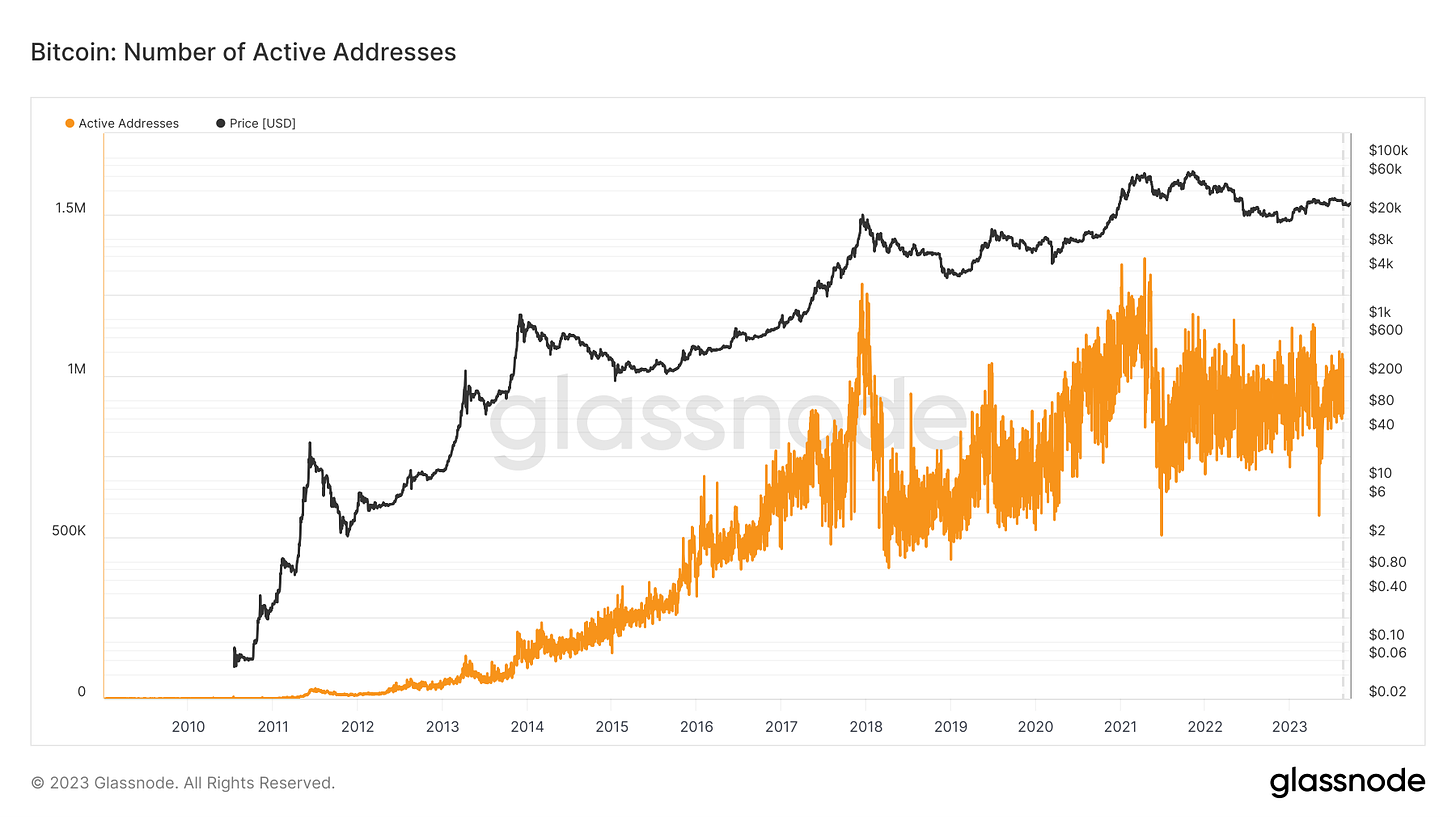

Now, how many people are currently using Bitcoin? There isn't an exact number available. However, from 2009 to the present, even during the peak of cryptocurrency prices, there have been roughly around 1 million active Bitcoin addresses globally.

One person can create multiple Bitcoin addresses. Let's assume that these 1 million addresses are indeed associated with different individuals, and perhaps they are all tech enthusiasts, each managing 1 million Bitcoin wallet addresses simultaneously. In other words, there would be a total of 1 trillion addresses in use globally. Despite this enormous quantity, when compared to the total number of Bitcoin addresses mentioned earlier, there would still be a difference of many trillions of trillions of times.

The Large Bitcoin Collider project can scan approximately 3,000 trillion addresses in a year. However, even if they significantly enhance computing power, in theory, it would take several trillion years to have a chance of finding one wallet address that someone is using. To put it into perspective, the universe has only existed for approximately 13.8 billion years since the Big Bang.

If we ignore time considerations, the resource consumption is also a significant issue. Computers consume electricity, and intensive, long-term calculations consume even more power. The Large Bitcoin Collider project is not funded by any organization; it relies on contributions from motivated individuals worldwide who join computational power pools to keep it running.

Conversely, this is the security mechanism of Bitcoin. Any hacker with a basic understanding of mathematical calculations would find the "probability of winning" in this scenario utterly hopeless. Even if they miraculously stumble upon a wallet that someone is using, there's no guarantee it contains any funds. The Large Bitcoin Collider project did find several sets of private keys that were once in use but had a balance of 0 at the time. It's mathematically meaningful but economically unfeasible.

In fact, simply buying a lottery ticket offers much higher jackpot odds and winning probabilities, without any criminal risk. Taking Taiwan's lottery, for instance, the probability of winning is 1 in 32, and the probability of hitting the jackpot is 1 in 13.98 million. Although each ticket costs 50 Taiwanese dollars, many would agree that playing the lottery offers a smarter "investment" opportunity with a better chance of overnight wealth. The more people who avoid fruitless endeavors, the less likely Bitcoin is to face attacks. Even if hackers have unlimited electricity and computational power, they can choose other attack targets.

Upon reaching this point, many might wonder if, despite the low probability, the Large Bitcoin Collider has succeeded multiple times. Is Bitcoin truly secure? The answer to that depends on how those colliding private keys were generated.

Unreliable Wallets

The approach taken by the Large Bitcoin Collider is actually quite scientific, not blindly attempting every possible combination from 1 to 100. Instead, it first filters out wallet addresses with existing balances and then attempts a "brute force" method to guess the generation method of the private keys behind these addresses.

Many might assume that "colliding" means accidentally finding an already-used private key, but the probability of this is exceedingly small. Even if this method were feasible, it would be utterly meaningless for participants in this project.

In simple terms, this project is about finding patterns rather than relying on luck. Private keys are generated by wallets using mathematical formulas along with random numbers. Because there are so many possibilities, even if you're lucky enough to find one, you have no idea where the next one is. Therefore, a smarter approach is to guess the random number patterns, but this requires collaboration with a non-professional engineer. If the engineers developing the wallet used a less-than-random random number generation mechanism, or if there was a pattern to it, then researchers studying Bitcoin colliders might have the opportunity to follow the trail and crack the private keys behind wallet addresses.

Around 2017, Bitcoin reached new highs, hitting $20,000, drawing global attention. However, most people were still unfamiliar with cryptocurrencies at the time. Not only were cryptocurrency exchanges frequently targeted by hackers, but people also often downloaded wallets from unknown sources with vulnerabilities. This can explain why the Bitcoin collider managed to find wallet private keys that theoretically would have taken several trillion years to encounter, all within a span of just two years.

Conversely, after 2017, the Bitcoin collider couldn't find new private keys. This not only demonstrates a certain level of security in Bitcoin's underlying mechanisms but also suggests that wallets currently in use are probably no longer susceptible to having their random numbers guessed.

Rather than expending effort guessing private keys, it's more worthwhile to go out and buy a lottery ticket, or as suggested at the beginning of the article, stake OP tokens and look forward to the next "airdrop lottery."

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.