The biggest news this week is undoubtedly the congestion of the Bitcoin blockchain due to a massive surge in transactions, causing transaction fees to skyrocket to the bull market levels of 2021. This even had some impact on the operation of the blockchain, leading to several instances of Binance exchange temporarily suspending Bitcoin withdrawals. This article explains the reasons for the congestion of the Bitcoin blockchain and the debate it has sparked over the direction of blockchain technology.

Bitcoin Congestion

BTC is like digital gold. Most people buy gold and store it in a bank or a vault, waiting for it to appreciate in value slowly. Bitcoin, similarly, doesn't have many fancy applications and is more of a "safe haven asset". This is also reflected in its usage on the blockchain.

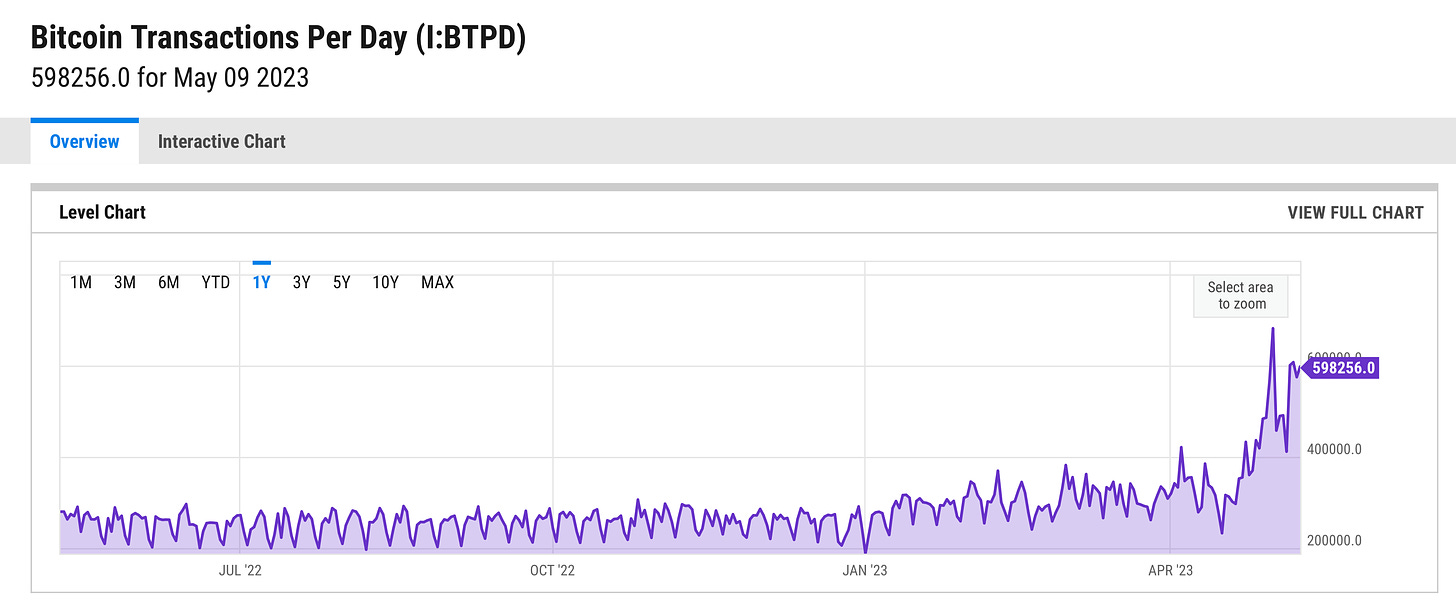

Since 2022, the Bitcoin blockchain has been processing an average of 300,000 transactions per day. Compared to Ethereum, which handles over 1 million transactions daily, the number of Bitcoin blockchain transactions is only about one-quarter to one-third of Ethereum. This shows that most people buy Bitcoin to hold, not to spend.

However, recent media reports suggest that the number of transactions on the Bitcoin blockchain has dramatically increased. As shown in the chart below, over the past year, the number of transactions processed by Bitcoin each day was around 300,000, but this number has nearly doubled in the past week to around 600,000 transactions per day.

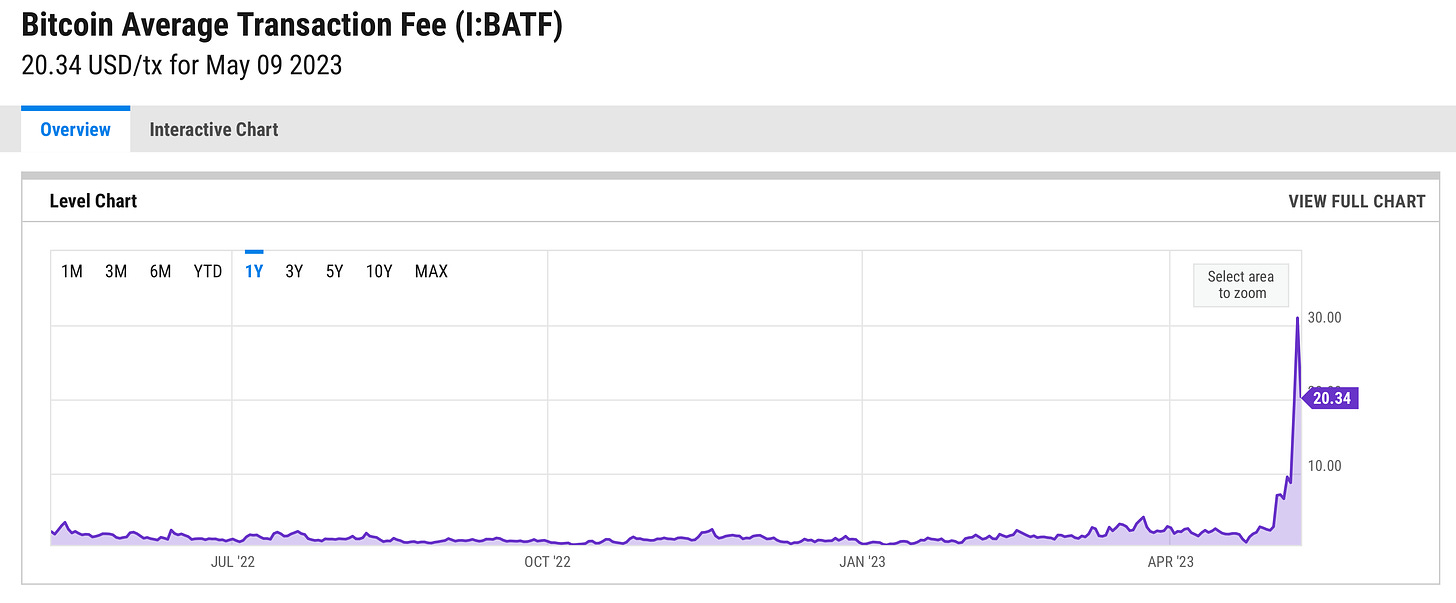

An increase in the number of transactions is directly reflected in the miner's fee, and the exchanges bear the brunt. Exchanges' withdrawal fees are generally adjusted dynamically based on the current status of the blockchain; fees are higher during a bull market to reflect costs and are lowered otherwise.

But if there's a sudden influx of transactions into the blockchain, pushing up the average transaction fee, transactions with lower fees can't be processed promptly. The chart below shows the Bitcoin transaction fee over the past year. Originally, each BTC transfer only required 1 to 2 US dollars. However, the fee has risen sharply over the past week, exceeding 30 US dollars per transaction at one point.

Binance, the world's largest exchange, was unable to adjust the miner's fee in time to keep up with the market situation, resulting in many transactions not being processed promptly. Although Binance did send out the transactions, they got stuck in limbo — miners felt these fees were too low and were unwilling to help record them on the blockchain. As a result, Binance urgently announced the suspension of Bitcoin withdrawals. On the one hand, it had to pay more miner's fee to ensure prompt processing. On the other hand, it had to raise the withdrawal fee for users to reflect the cost.

But why did such a large number of transactions suddenly appear on the Bitcoin blockchain? The root cause relates to the Bitcoin Taproot upgrade, which was introduced by Blocktrend at the end of 2021.

Smart Contracts

Back then, I called Taproot the "most overlooked major Bitcoin upgrade1". Taproot is a major upgrade that enhances Bitcoin's privacy, security, and scalability. At the same time, it introduces smart contract functionality to Bitcoin, allowing developers to write programs on the Bitcoin blockchain, such as creating multi-signature wallets to make transactions more secure.

According to CoinTelegraph's description:

The Taproot upgrade is a watershed for Bitcoin's usage, as it makes smart contracts on the Bitcoin blockchain lighter and cheaper. Smart contracts are agreements executed automatically by the blockchain based on code between individuals, creating secure transactions without intermediaries, such as creating loan services without the need for a third-party. The Bitcoin Taproot upgrade will attract people to deploy smart contracts, opening the door to decentralized finance for Bitcoin.

Taproot is like an operating system upgrade for a computer. Developers need to build new applications based on Taproot for users to feel the upgrade. A year later, a Bitcoin developer named Casey Rodarmor finally introduced an open-source software ORD, creating an NFT market for Bitcoin, called Ordinals.

Originally, Bitcoin was like banknotes, classified as fungible tokens. Your 1 BTC and my 1 BTC are priced the same, with no specific differences. However, if users send BTC through the ORD software, BTC can be turned into non-fungible tokens, or NFTs. According to Ordinals description:

The smallest unit of Bitcoin is Satoshi, not BTC. Each BTC can be divided into 100 million Satoshis and cannot be further subdivided. The theory of Ordinals allows each "Satoshi" to be collected or traded like an antique, with each Satoshi capable of being engraved with any content, creating unique native Bitcoin creations.

What people now refer to as 1 BTC is not the smallest unit, but a collection of 100 million "Satoshis". Just like 100 coins of 1 unit can also be called 100 units. Each 1-unit coin will have a unique casting year, and each "Satoshi" originally had its own casting order. It's just that in the past, no one cared about these numbers, just as we wouldn't ask the breakfast shop owner to make sure the change is "coins cast after the Republic of China 95".

However, ORD gives these originally insignificant numbers unique meanings, turning Bitcoin into an NFT. Some people might want to collect "Satoshis" with a sense of age or special meaning, such as the first Satoshi in the Bitcoin Genesis Block (Block 0) has a serial number of 0, the second Satoshi has a serial number of 1, and the last Satoshi in the first block has a serial number of 4,999,999,999. Simply put, NFTs on Bitcoin are like a digital coin collecting club.

Others have also developed a token issuance market based on the Taproot upgrade. Those who witnessed the chaos of Ethereum ICOs in 2017 know that it was almost like a storytelling competition. Every team's goal was to change the world, but the first step of the revolution was to issue an ERC20 token for fundraising. History is repeating itself. Now, some people are introducing BRC20 tokens on the Bitcoin blockchain, but instead of shouting slogans about changing the world, they are usually obscure meme coins.

Money is smart, but the market is irrational. Exchanges make money from transaction fees. Whatever the market pays attention to, that's the coin they list. After exchanges list meme coins, they generally push the coin price to a peak. People unfamiliar with the crypto circle often buy when they see the price rising and the trading market booming. Even seasoned players familiar with the logic of the crypto circle sometimes can't resist taking a bet.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.