GM,

Some people have had a double blessing this week.

Not only did the Taiwanese government announce a cash disbursement of 6,000 TWD to all citizens, but Ethereum's Layer 2 network, Arbitrum, also announced the issuance of its governance token $ARB last week, airdropping it to participants who have interacted with Arbitrum on-chain applications through their wallets in the past year. By connecting your wallet to the Aribitrum Foundation website, it will automatically show if you meet the airdrop conditions and how much $ARB you can claim.

Blocktrend previously invited Nina Rong, Arbitrum's Asia-Pacific head, for an interview in April 2022. Although Nina mentioned during the interview that the company strictly prohibited public discussion of whether Arbitrum would issue tokens, after Optimism's issuance of OP tokens last year, Blocktrend published an article predicting that the issuance of Arbitrum tokens was imminent, even calling it an "easy question" for airdrops.

However, I didn't expect it to take so long. Looking at the results, Arbitrum spent a whole year planning a "precision airdrop." This article discusses the significance of Arbitrum's token issuance and how this precision airdrop was executed.

Decentralization

Media coverage of Arbitrum's governance token issuance generally focuses on price predictions, which may lead outsiders to believe that the crypto community is "printing money out of thin air," creating a new wave of young crypto millionaires. Although this perception is misguided, it reflects the general public's impression of cryptocurrencies and reveals the inadequacies of past governance ecosystems and airdrop mechanisms. According to Arbitrum's statement:

The primary principle behind building Arbitrum is to securely scale Ethereum, which is also the driving force for pushing blockchain towards decentralization. Security and decentralization are inseparable. To create a secure and decentralized Layer 2, we need to eliminate any centralized control to enable the blockchain to operate in a trustless manner.

However, we can't "throw away the key." If we do, the blockchain will not be upgradable in the future. To remove centralized control without giving up on upgrades, we need to establish the Arbitrum DAO and distribute power to the community through $ARB tokens. That's why we're issuing tokens.

In theory, $ARB tokens have no direct economic value. Governance tokens are different from company shares; holders are not shareholders, and Arbitrum will not issue dividends based on operational performance. Each governance token is essentially a ballot that can be used to jointly determine the development direction of the blockchain when the Arbitrum DAO holds a "referendum." However, with people already busy with their day jobs, who has time to be a "digital volunteer" participating in on-chain governance?

As a result, many people's first reaction when receiving governance tokens is to sell them directly, treating them as gifts from heaven. However, the fact that $ARB can be sold and even experience price fluctuations reflects the indirect economic value behind the ballots. As long as the Arbitrum ecosystem thrives and the future development direction is promising, the value of the ballot (governance token) will increase. Conversely, governance tokens issued by insignificant blockchains will be worthless.

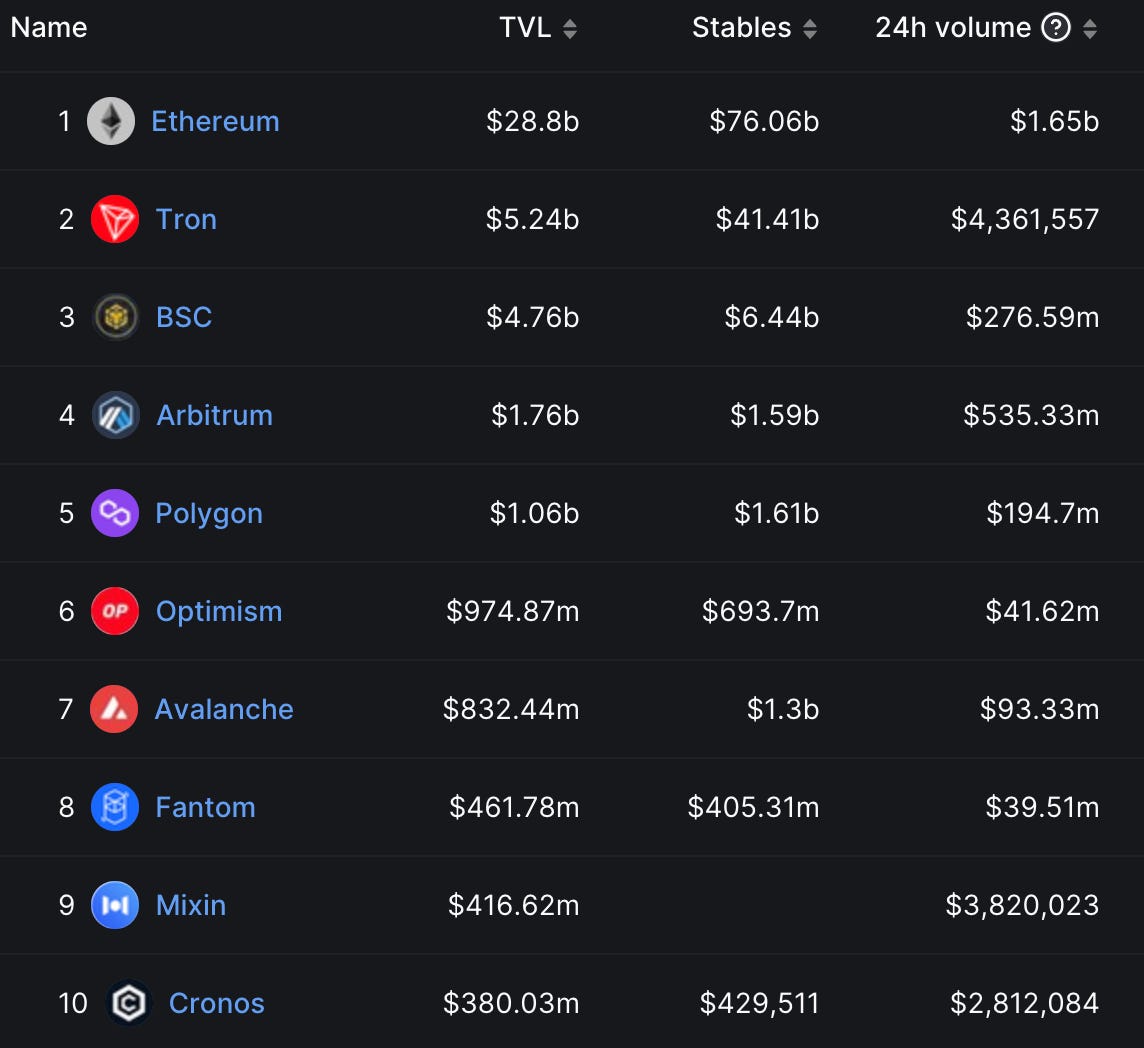

Arbitrum is the 4th largest blockchain in the market. A total of $1.76 billion in assets are parked on Arbitrum, which is higher than the well-known Polygon and Solana. In the past 24 hours, Arbitrum's on-chain trading volume ranked second, only behind Ethereum. Therefore, many investors are optimistic about the price changes after the $ARB airdrop this Thursday.

However, not everyone is rewarded in this $ARB airdrop, and the amount received by each user is not the same. It can be said that this is the most rigorous and precise airdrop in history. This has caused many long-ambushed airdrop hunters to return empty-handed.

Precise Airdrop

The Taiwanese government's universal distribution of 6,000 NTD cash is based on ID card number restrictions, and cannot be claimed repeatedly. However, there is no ID card number to compare on the blockchain, and everyone can create an unlimited number of wallet addresses. Without deliberate filtering, the governance tokens may eventually fall into the hands of "airdrop hunters." A temporary drop in token price is a minor issue, but the real crisis occurs if long-term blockchain governance is monopolized by speculators, with no one participating.

Therefore, this time Arbitrum collaborated with on-chain data analysis company Nansen to observe the on-chain activities of each wallet on Arbitrum over the past year and then formulate airdrop rules. They aim to distribute governance power to the most loyal users. According to Nansen's article:

Arbitrum aims to achieve optimal distribution of protocol governance through token airdrops. "Organic" activities on the blockchain can help develop on-chain applications and contribute to the on-chain economy or technology. However, token airdrops are quite complex operations.

A wallet that has initiated multiple transactions may not necessarily be a real user. Therefore, a major goal of on-chain data analysis is to identify "witch wallets," which are wallets that use Arbitrum only to obtain token-claiming eligibility. Witch wallets lead to a high concentration of governance tokens, which is contrary to the goal of decentralized governance. These behaviors can be measured based on on-chain data and time, categorizing each wallet's activity level to find the most accurate users.

As of February 6, 2023, a total of 2.3 million wallets have left activity records on the Arbitrum chain. However, to pick out the most loyal users, three important numbers must be considered: transaction count, duration, and amount. Wallet addresses with more transactions, longer participation times, and larger amounts are more likely to be loyal Arbitrum users.

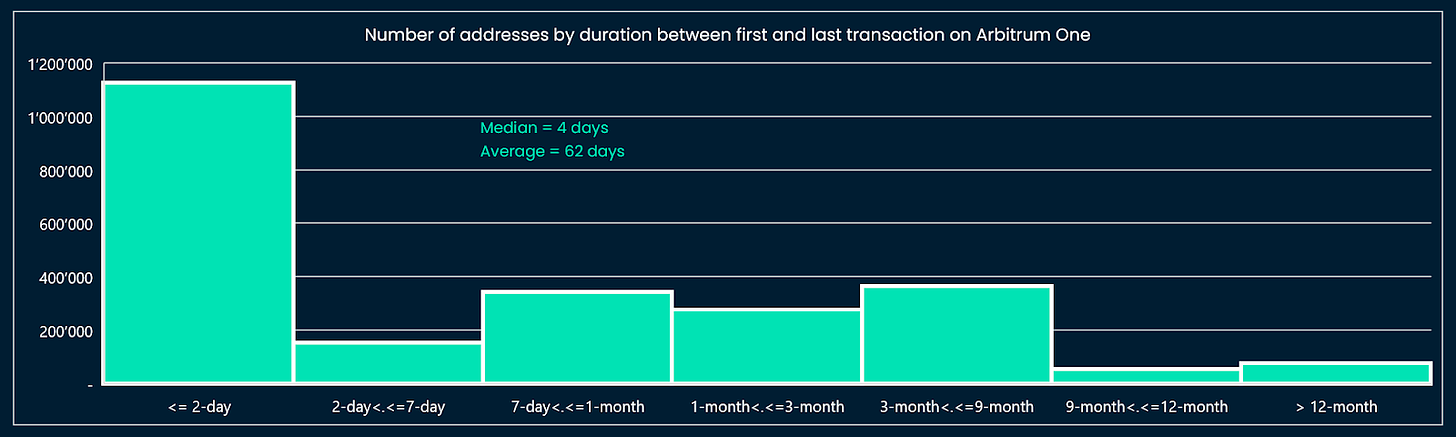

Therefore, Nansen extracts data from the chain to create bar charts like the one below for the Arbitrum Foundation to reference. The goal is to avoid setting the airdrop criteria too loose or too strict. In the example below, addresses with participation times of less than 2 days account for the vast majority. The median is 4 days, and the average is 62 days.

If the airdrop criterion is set at 5 days, it may be too loose, with nearly half of the addresses qualifying, diluting the number of tokens each person receives. However, if it is restricted to participation for more than 9 months, it would be too strict, and the token distribution would be overly concentrated.

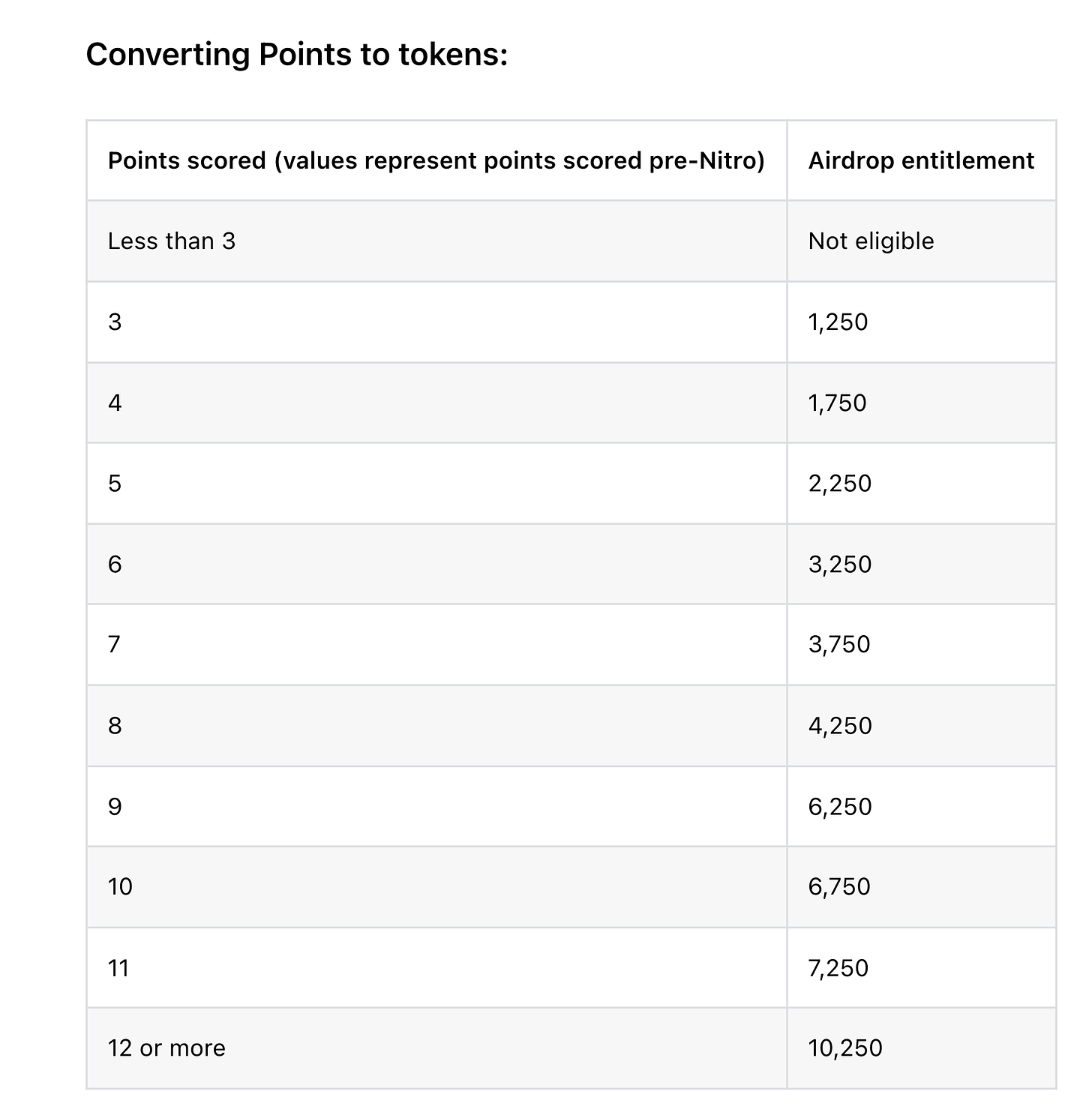

Therefore, Nansen and the Arbitrum Foundation continuously discuss and set the criteria for the airdrop. In the end, they introduced this tiered system – users must collect at least 3 checkmarks to be eligible for the tokens, and the more checkmarks collected, the more tokens they can receive. The quantity ranges from a minimum of 1,250 to a maximum of 10,250.

For example, wallets that have used Arbitrum in 2 different months can get 1 checkmark. Those that have used it in 6 different months can get 2 checkmarks. If used in 9 different months, 3 checkmarks will be awarded. The number of transactions initiated and the amount invested are designed based on similar logic. The highest score is 18 points, and the lowest is -3 points.

Yes, there is a deduction mechanism. If all transactions in the wallet are completed within a specific 48-hour window, the wallet balance is less than 0.005 ETH (within $10), or the wallet only has a single currency and has not used more than one smart contract, these are considered abnormal behaviors and are subject to deductions by Nansen.

After filtering, 625,000 wallets are eligible for the token airdrop, accounting for about 28% of the total number. However, the screening is not over yet, as Nansen still needs to identify which wallets are actually controlled by the same person from among these 625,000 wallets, also known as "airdrop hunters." Clues can also be found from the on-chain data.

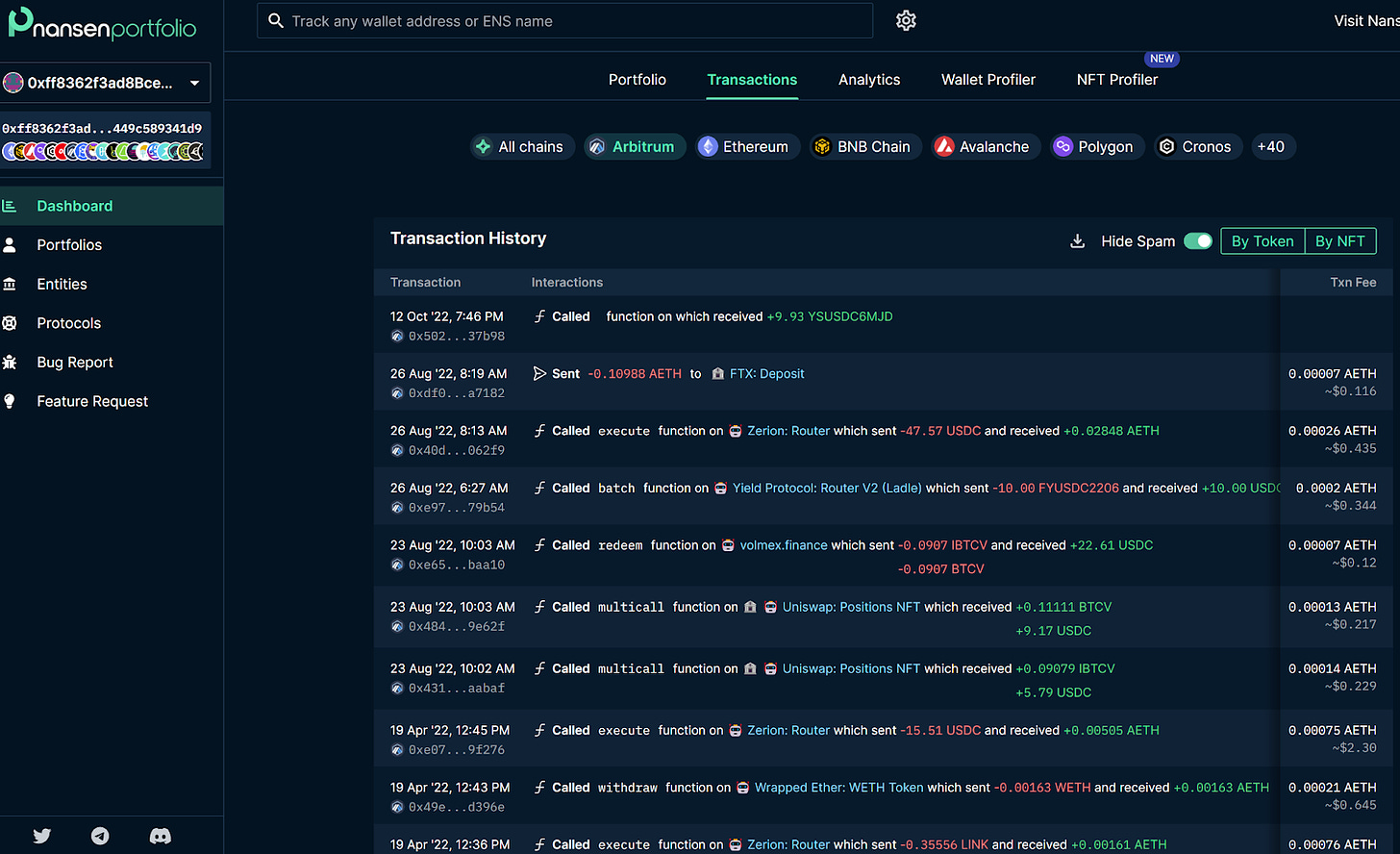

Using the following chart as an example, this is one of the suspicious wallets that Nansen has discovered. Although its on-chain activity is high, it is not only a long-term user but also has engaged in numerous smart contract transactions and asset transfers. It appears to be the model candidate for receiving governance token airdrops from the Arbitrum Foundation. However, Nansen discovered an unusual behavior of this wallet - it and 400 other similarly qualified wallets not only have extremely similar behaviors, but they also eventually transfer their assets to the same FTX exchange address.

It's common knowledge in the crypto world that each user's exchange deposit address is unique.

With some reverse thinking, Nansen can determine that it is very likely that the same airdrop hunter is controlling these 400 wallet addresses. There may be many similar identification methods, but Nansen has not made them public. In the end, they removed as many as 135,000 wallet addresses with behaviors too similar to airdrop hunters from the 625,000 eligible airdrop recipients. The remaining wallet addresses are the truly loyal users who are eligible to receive governance tokens.

Real test

Arbitrum's collaboration with Nansen on this governance token airdrop can be said to have fully utilized on-chain data analysis tools and set a new benchmark for the industry. All data on the blockchain is publicly available on the internet. Even if Nansen does not know whether users behind different wallets are the same person, they can infer their relationships from their behaviors.

This is similar to how Google may not know where each person's home or workplace is, but most people work during the day and go home at night. By observing users' mobile GPS locations and time, Google can make a pretty accurate guess. However, in the past, people's data was controlled by companies, making it not only inaccessible to third parties but even to the data contributors themselves.

I believe that more teams will collaborate with data analysis companies in the future, combining decentralized identities such as POAP6 and Gitcoin Passport7 to precisely airdrop tokens to the correct users. This will also mean that "airdrop hunters" will become less and less profitable.

In the past, people would envy airdrop hunters for making money quickly with governance tokens, but in the future, the most efficient way to participate in token airdrops will no longer be to search for strategies online but to find your favorite on-chain application and become a true Web3 user.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.