OwlTing Goes Public in the U.S.! From E-commerce and Hospitality to Payments — A Stablecoin Meme Stock Wrapped in a Story

GM,

Longtime readers of Blocktrend know that writing this article carries some legal risk for me. The main subject, OwlTing, once filed both civil and criminal defamation lawsuits against me and three other netizens in 2020 — all because I criticized the government’s so-called “mosquito chain” project on Blocktrend, for which OwlTing happened to be the winning contractor. In the end, OwlTing and I reached a settlement in late 2023.

The “blockchain traceability system” I commented on back then is still technically running today. However, new forest product listings on the Forestry Bureau’s website no longer show any on-chain records, making it a true example of a mosquito project — infrastructure that exists in name only.

Recently, OwlTing made headlines again for going public on the Nasdaq. On its first day of trading under the ticker symbol OWLS, the stock triggered multiple circuit breakers. Some media outlets ran with headlines like “Market Cap Soars Eightfold, Then Crashes 90%,” while others described it as “Taiwan’s Beacon of Stablecoins.”

It turns out that in recent years, OwlTing has quietly shifted its focus from e-commerce and hospitality to stablecoin payments. The company was an early adopter of blockchain technology and even secured investment from Japan’s SoftBank. Yet, its actual achievements in the blockchain space have long been a mystery — no one seemed to know what they were really doing or how they made money. It wasn’t until their recent Nasdaq listing that I finally got a glimpse of the picture through the documents OwlTing filed with the U.S. Securities and Exchange Commission (SEC).

From E-Commerce and Hospitality to Payments

So, what exactly does OwlTing do? The answers online are all over the place. Some people say they’ve bought fresh milk through OwlTing; some guesthouses use it for booking management; certain companies mention that their press releases were syndicated by OwlTing; and venture capital firms praise its blockchain potential. OwlTing’s parent company, OBOOK, originally set out to build an e-book platform but later pivoted to small-scale agricultural e-commerce and blockchain applications. However, according to the SEC filings, all of that is now history — today, OwlTing defines itself as a financial technology company.

OwlTing explained that the company originally started as a small-farmer e-commerce platform. While working with local farmers, they encountered challenges around supply chain transparency, which led them to develop a blockchain traceability system — allowing regional farmers to sell “blockchain-certified rice.” Later, the company discovered that blockchain technology could also prevent double spending, and that the same mechanism could be applied to hotel reservations. This insight prompted OwlTing to expand into the hospitality industry, building booking and inventory management systems.

Eventually, the farmers and hotel operators who had long collaborated with the company also needed payment and cross-border settlement solutions. Naturally, OwlTing moved into financial and payment services, launching its flagship product — OwlPay. According to media reports:

In recent years, OwlTing has expanded into financial services with its OwlPay platform, which focuses on making cross-border transfers and payments between businesses faster and cheaper by leveraging stablecoins. Traditional international wire transfers can take several days and involve multiple intermediary banks, whereas OwlPay claims to make the process nearly instant while automatically recording every transaction on the blockchain.

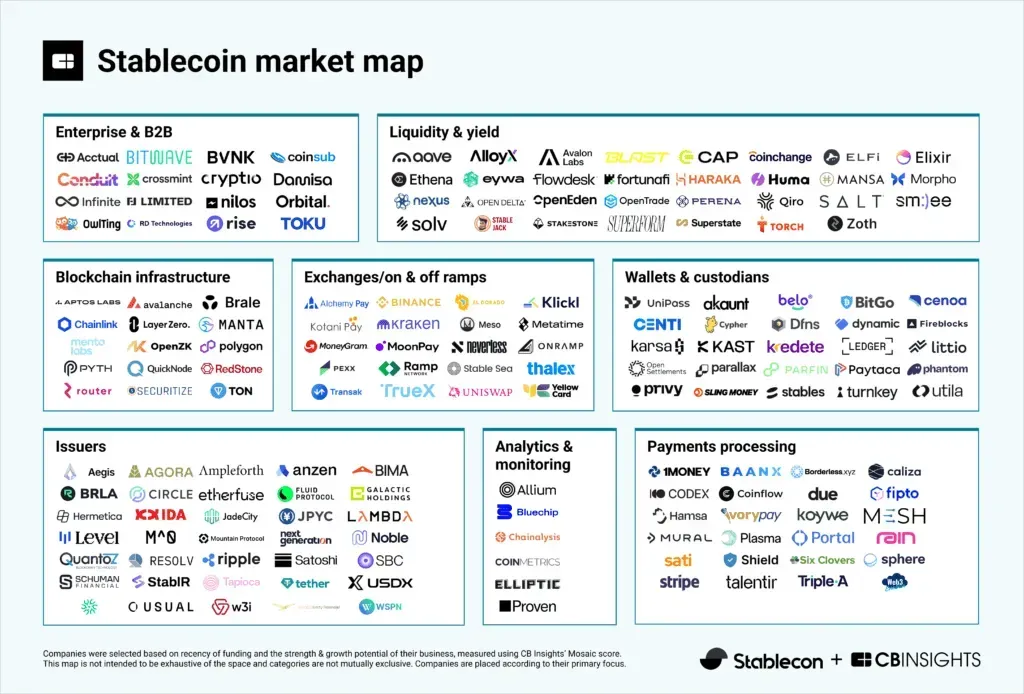

Using stablecoins for cross-border payments is one of the hottest narratives among investors today. OwlTing cites research firm CB Insights, claiming that it ranks among the top two companies worldwide in the “Enterprise and B2B” category — a statement meant to convince investors that it’s building the “Asian version of Stripe.” From its SEC filings to its official website, OwlTing’s presentation almost mirrors Stripe’s playbook. Reading their materials alone might make one’s heart race — if Stripe won’t go public, why not buy shares of a “Taiwanese rising star” instead?

Most investors buy into stories, but I prefer to try things firsthand. Since OwlTing has crafted such an elegant narrative, I became genuinely curious about its financial performance and actual products. Who knows — maybe it really is the “Taiwanese Stripe.”

The Numbers Tell the Story

After reviewing OwlTing’s financial statements, three key points immediately stood out:

- Highly concentrated revenue

- Losses expanding year by year

- Direct listing instead of an IPO

Some netizens claimed, “OwlTing is famous overseas — that’s why it chose to list in the U.S. Taiwanese people just don’t know about it because the company doesn’t do business locally.”

But flipping through its SEC filing completely disproves this argument. OwlTing admits four separate times that 99% of its total revenue comes from Taiwan —

We launched OwlPay in 2023. As of December 31, 2024, over 99% of our payment service revenue was generated in Taiwan. As of the same date, our non-payment service revenue from overseas markets was also less than 1%.

So maybe OwlTing is popular abroad — but it’s earning almost entirely from Taiwanese customers. I can confidently say that Stripe’s revenue is not 99% concentrated in the United States.

Some people also pointed to a research report about OwlTing published by the well-known crypto media outlet CoinDesk, which dubbed OwlTing “the future infrastructure for stablecoins.” The implication is: if the company weren’t truly important, why would such a reputable outlet go to the trouble of writing about it?

But upon closer inspection, that report turned out to be a sponsored article — funded by OwlTing itself. Although CoinDesk claimed the writing process was “completely independent and free from interference,” the reality is that when media outlets make money from advertorials, soft-pedaling criticism is just part of the business model.

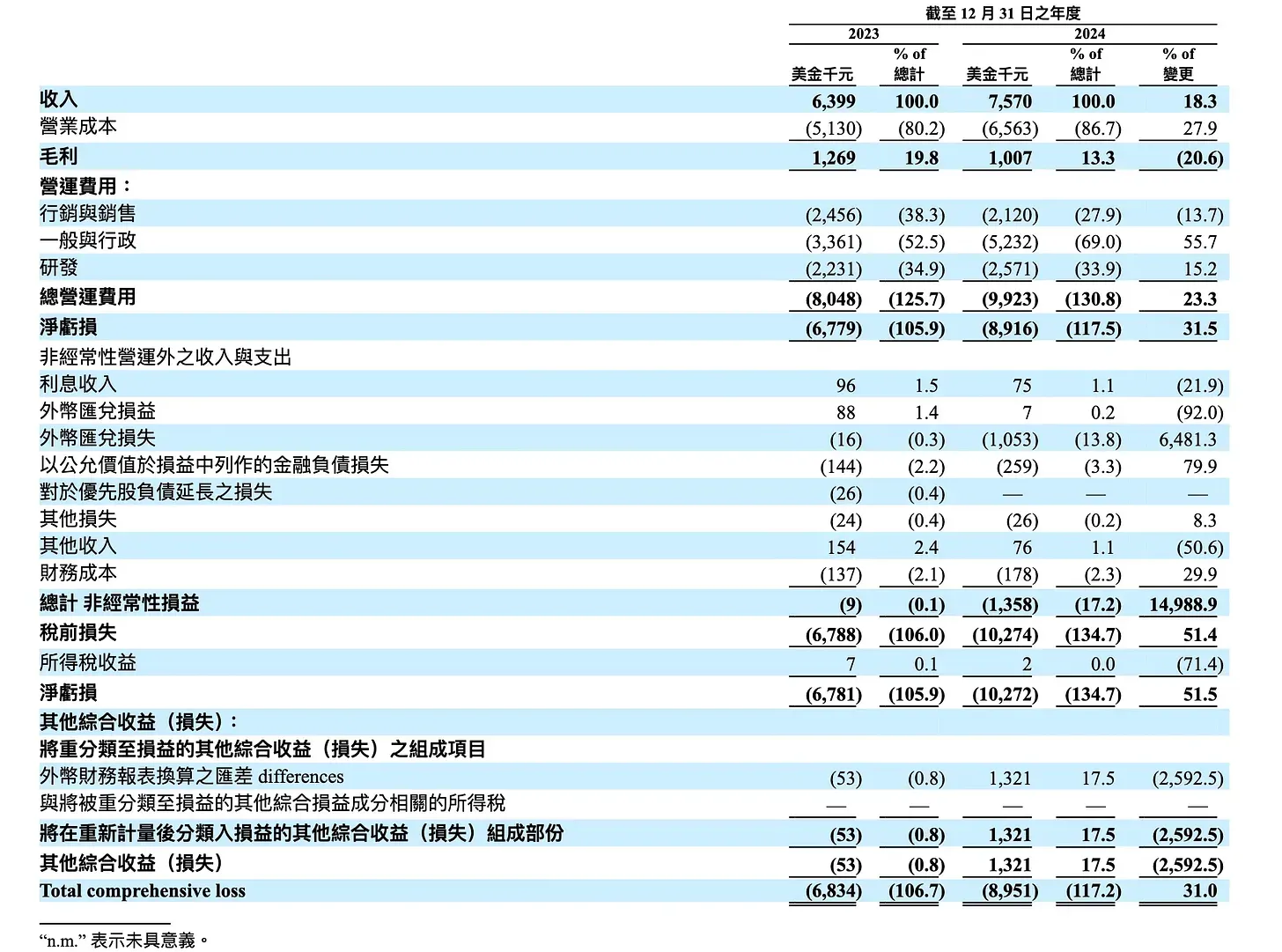

Looking through the financial statements, OwlTing’s financial condition appears far from healthy. In 2024, the company’s revenue did rise to US$7.57 million (+18%), but it actually made less money than the previous year. Its gross margin dropped from 19.8% to 13.3%, meaning that for every 100 dollars earned, only 13 dollars were kept as profit. What’s worse, the company’s expenses continued to climb — “general and administrative” costs alone increased 55% year-over-year. The result: while revenue grew, net losses widened to US$10.27 million, a 51% increase from the prior year.

In other words, OwlTing is slowing down in making money but speeding up in spending it. At this burn rate — and without new fundraising — its cash reserves will last less than 12 months. In financial analysis, this situation is known as a “going concern risk,” meaning that if the company cannot improve its cash flow or secure new financing within a year, auditors may have to flag the financial statements with a warning that the business might not survive the next fiscal period.

For a company that bills itself as one of the world’s top “stablecoin payment infrastructure providers,” this financial picture is rather ironic. Rather than listing on the stock market to fuel expansion from a position of strength, OwlTing appears to have gone public out of necessity — pressured by deteriorating cash flow. Normally, companies go public because they are profitable and want to scale up. OwlTing’s case is the opposite: it isn’t making money, it’s running out of cash, yet it had to rush into a listing — only to present it as a milestone in global expansion.

OwlTing also knows how to tell a good story. The company told the media that it chose a Direct Listing instead of a traditional IPO with new shares because its finances were strong and it didn’t need outside funding. The message sounded like: “We’re so financially sound that we don’t even need to raise money.” But anyone who’s read the financial statements knows the real reason — it was a technical exit, a mechanism allowing investors to cash out their shareswhile giving the company a bit of liquidity. This gap between narrative and reality also shows up in OwlTing’s products.

Storytelling as the Core Competence

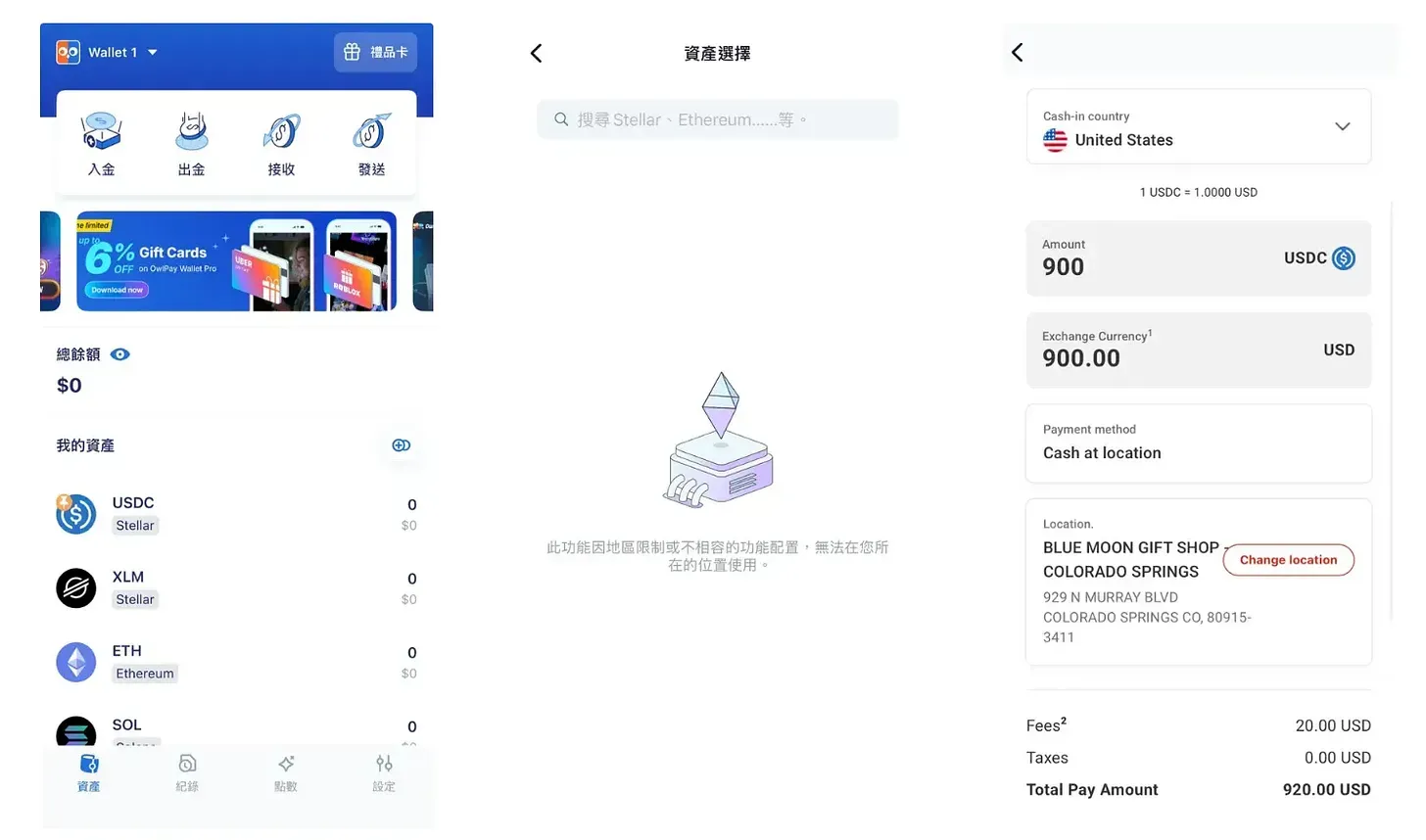

Among OwlPay’s four product lines, Wallet Pro is the payment product designed for individual users — the one that’s most accessible to the public. It advertises itself as a tool that lets users connect their crypto wallets directly to bank accounts for seamless deposits and withdrawals, which sounds somewhat similar to Fluidkey, recently featured on Blocktrend.

Wallet Pro focuses on the migrant remittance scenario and even announced a partnership with MoneyGram, a major global remittance company. I was initially hopeful that migrant workers might soon be able to send money home using stablecoins. But upon opening Wallet Pro, I realized it was just an ordinary crypto wallet.

The interface highlights “deposit” and “withdrawal” options, but users in Taiwan can’t actually use them due to regional restrictions. In theory, a user should be able to visit a MoneyGram outlet, buy USDC with cash, transfer it across borders via blockchain, and have the recipient pick it up in person. However, after testing it myself, I found that each deposit is capped at around US$900, and fees are as high as US$20 per transaction — not cheaper than traditional remittance at all. Wasn’t the whole point of using stablecoins to cut costs dramatically? This highlights OwlTing’s biggest problem: its stories always drift away from reality.

Successfully going public in the U.S. is a major milestone for any company. From its financial reports to its products, OwlTing has never lacked dazzling narratives — yet those stories fall apart under scrutiny. The company also knows how to tailor its story for different audiences: it tells American investors that “we’re well-known in Taiwan,” and tells Taiwanese media that “we’re popular overseas.” Both sides believe it, yet no one really knows what the company actually does.

In response to recent online criticism, OwlTing’s CEO once again cited legal warnings:

“If media outlets or individuals deliberately disclose information selectively or distort public disclosures in ways that influence investor decisions, such actions may constitute market manipulation or misinformation and can be subject to investigation and accountability under the law.”

Most people would say less after hearing that. In theory, having gone through that lawsuit myself, I should have “learned my lesson” too. But that’s precisely the chilling effect OwlTing hopes to create.

OwlTing is like the emperor wearing new clothes, terrified that a child might innocently point out the truth — that he’s not wearing anything at all.