One Sentence from Coinbase Turned the Tables: Self-Fulfilling Prophecies and Reflexivity in Prediction Markets

GM,

It’s currently earnings season for U.S. stocks, and last week, the American cryptocurrency exchange Coinbase held its earnings call. As the meeting was coming to an end, CEO Brian Armstrong admitted he was a bit distracted, then proceeded to read out a series of keywords: “Bitcoin,” “Ethereum,” “blockchain,” “staking,” and “Web3.”

While everyone was still confused, the host quickly grabbed the microphone and hastily ended the meeting. Yet, that 20-second interlude became the biggest highlight of the entire call. The clip was edited and widely shared online—some cheered Armstrong as a “legend,” while others criticized it as “a blatant mockery of institutional trust.”

Why did those few words stir up so much controversy? To understand that, we need to start with what happened that day.

Coinbase Earnings Call

Coinbase, the first publicly listed cryptocurrency exchange in the United States, was officially added to the S&P 500 Index this year.

Last week, Coinbase released its financial report for the third quarter of 2025, delivering impressive results. Quarterly revenue reached nearly $1.9 billion, marking an over 50% year-over-year increase. Earnings per share came in at $1.44, beating analysts’ expectations of $1.10, while net income hit $430 million, doubling from the same period last year. Overall trading volume grew 24% from the previous quarter, with institutional trading surging 122%.

Several Wall Street brokerage firms raised their price targets for Coinbase stock after reviewing the report. Normally, the earnings call would have proceeded smoothly, and a few hours later, glowing headlines would have followed. But in the final two minutes—right after the CFO finished answering a question about market competition—CEO Brian Armstrong suddenly went off-script:

I hope we’ve answered your question. I got a little distracted earlier because I was looking at a prediction market that’s guessing what Coinbase would say during this earnings call. So before we wrap up, I just want to make sure we cover a few keywords: Bitcoin, Ethereum, blockchain, staking, and Web3—just to ensure they’re all mentioned.

After Armstrong finished speaking, there was a brief moment of silence. Then Anil Gupta, Coinbase’s Vice President of Investor Relations and the host of the call, quickly grabbed the microphone and said: “Alright, we’ve addressed all the questions. That concludes today’s call.” It was clear he realized the boss had said something he probably shouldn’t have.

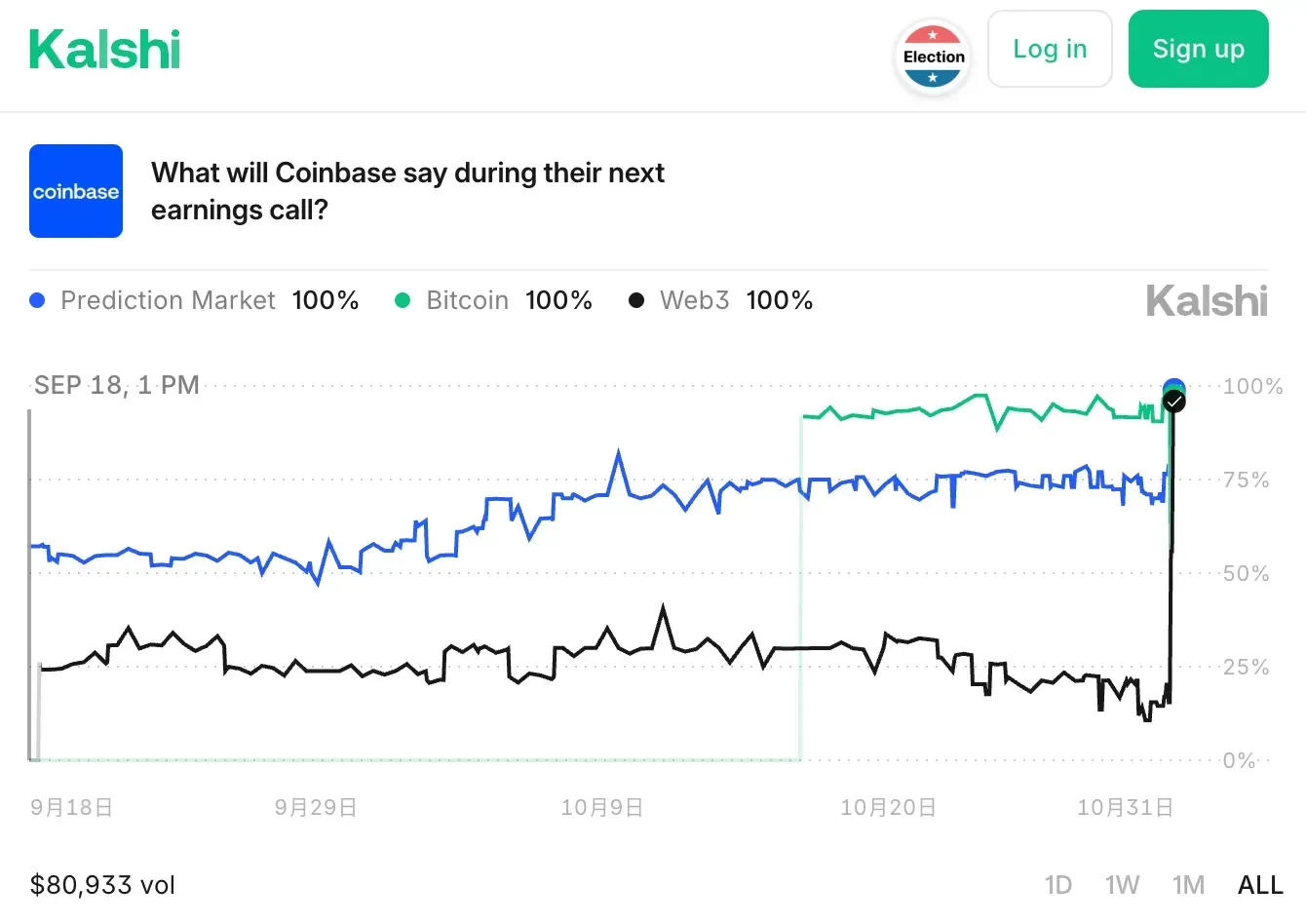

As it turns out, during the call, someone in Coinbase’s internal chat group had shared “bets” from two prediction markets—Kalshi and Polymarket. One of the bet types on these platforms is known as a “Mention Market,” which allows participants to wager on whether an executive at a company will mention specific keywords during an earnings call.

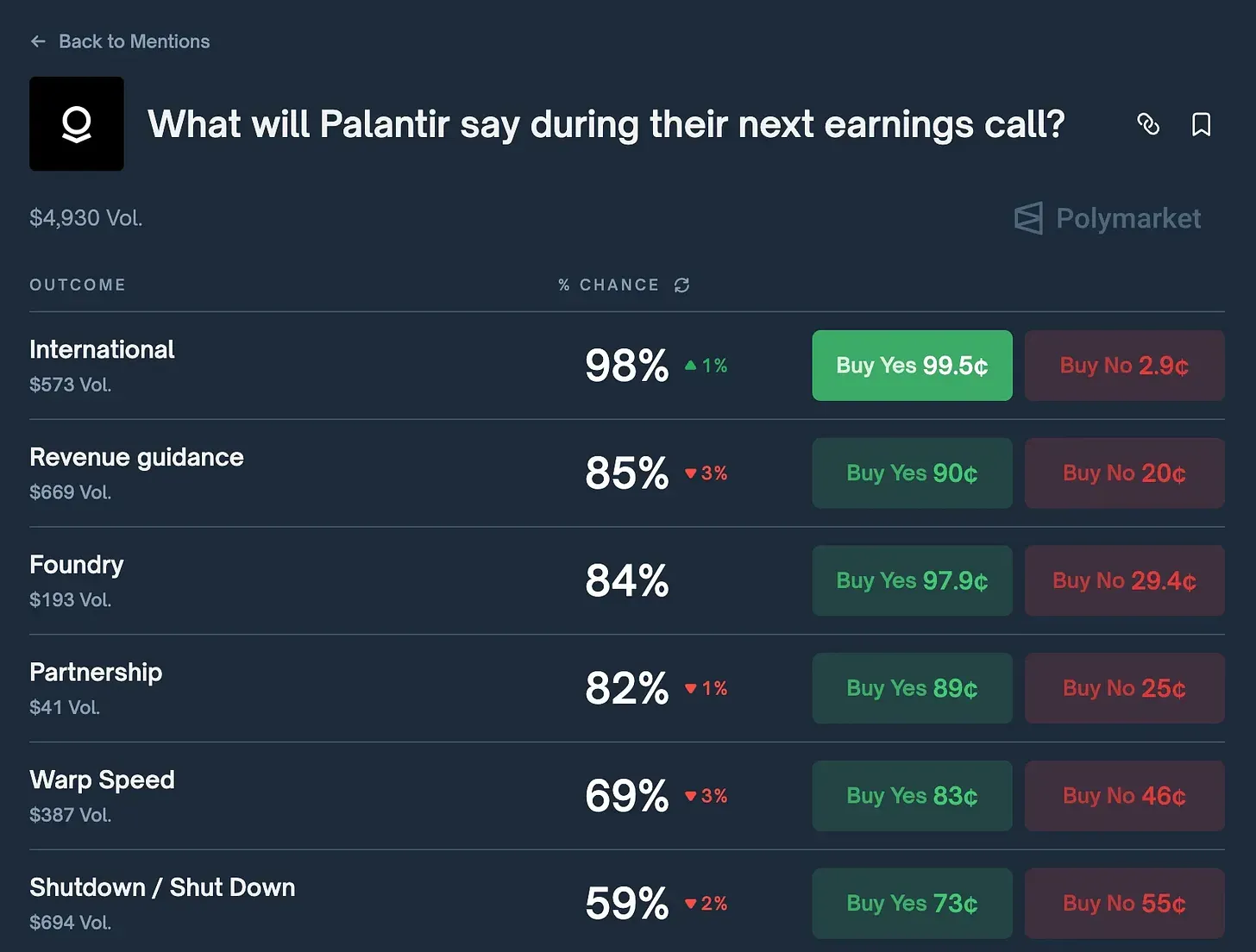

For example, the image below shows a Mention Market on Polymarket for Palantir (PLTR). For each keyword—say, International—investors can bet on whether it “will” or “will not” be mentioned. If the keyword is indeed spoken during the call, those who bet “will” win, and that option settles at $1. If it isn’t mentioned, those who bet “will not” win the dollar instead, while the other side gets nothing.

From the chart above, participants clearly believed that Palantir, a company known for its defense technology, would inevitably mention “international business.” The market price reflected this consensus—betting on “yes” seemed to carry minimal risk. Anyone choosing to challenge that consensus by betting on “no” stood to earn a much higher potential reward, but that would mean wagering that Palantir’s executives would go against their usual talking points and deliberately avoid that keyword throughout the entire call.

Coinbase’s earnings call had a similar prediction market, with keywords such as SEC, custody, stablecoins, and trading volume. However, both the total amount wagered and the number of participants were quite small—the total trading volume was only $84,000. When Armstrong saw the market, he noticed that he hadn’t yet mentioned Bitcoin, Ethereum, blockchain, staking, or Web3, so he decided on the spot to read them all out loud.

Perhaps Armstrong simply wanted to make a playful gesture—a little “Easter egg” for listeners—but it unexpectedly sparked controversy.

Did Morris Chang Steal a Tea Egg?

Some people thought Armstrong’s move was “cool,” praising him for breaking the monotony of a typical earnings call. Armstrong himself said it was all “just for fun.”

But Jeff Dorman, Chief Investment Officer of the digital asset investment firm Arca, didn’t see it that way. He strongly condemned the act as “blatant market manipulation.” Dorman argued that Arca had spent years and significant resources trying to make cryptocurrencies a legitimate, investable asset class accepted by mainstream institutional investors—and Armstrong’s careless behavior could easily undermine that effort.

Is it really that serious? To draw a comparison, think of it like betting in professional sports. Imagine a baseball player who sees that there’s gambling action on his team’s game and then decides to influence the outcome through his own performance. Such actions usually come with a clear motive—the player has money riding on the game or stands to profit in some way. Otherwise, why would he deliberately alter the result?

But Coinbase’s case is different. Armstrong said he didn’t participate in the prediction market, nor did he profit from it. Besides, the total market volume was only $84,000—manipulating a few keywords could, at most, make someone a few hundred dollars. Compared to Armstrong’s personal wealth, that’s like Morris Chang (founder of TSMC) walking out of a supermarket with a tea egg he forgot to pay for—more likely an oversight than an act of greed.

Armstrong was more likely just amused that people were betting on what he might say—and decided to “help them out” while cracking a joke. But others saw the incident as exposing a fundamental flaw in prediction markets: they can easily invite blatant insider trading, and even worse, devolve into self-fulfilling prophecies.

These critics argue that prediction markets should function like opinion polls—an objective observation mechanism that aggregates collective judgment and reflects the “wisdom of the crowd.” They’re not supposed to influence the very outcomes they predict. Once the subjects or events being predicted can interfere with and alter the result, the market’s predictive power collapses. It’s like an election where the vote count changes just because you placed a bet on who would win.

Armstrong’s joke also highlighted the complexity of prediction markets. They aren’t like opinion polls, which merely observe without intervention. Participants wager real money—but it’s not the same as traditional gambling either. In prediction markets, every bet immediately affects the market price, and that price in turn becomes new information, shaping how others think and act. In this way, prediction markets both observe events and influence how those events unfold.

Many people have blamed Armstrong for compromising the fairness of the market. Others believe it reveals the lack of proper regulatory frameworks. But I think those explanations only scratch the surface—the deeper issue is that technology has made reflexivity far easier to occur.

Technology Intensifies Reflexivity

In the 1980s, George Soros, founder of the Quantum Fund, introduced the concept of reflexivity, arguing that market prices don’t merely reflect reality—they also shape it. When investors believe a company’s stock price will rise, they rush to buy it, pushing the price up and thereby fulfilling their own prediction. This creates a positive feedback loop between belief and reality.

Bitcoin’s quadrennial halving cycle 1 is a classic example. The Bitcoin protocol, as written by Satoshi Nakamoto in the 2008 white paper, stipulates that the rate of new Bitcoin issuance is cut in half roughly every four years. Everyone already knows this schedule, yet each halving is followed by a bull market the following year—a ritualized “halving rally.” This isn’t driven by new information but by a collective belief that halving will trigger a bull run. Investors buy in anticipation, and their belief becomes reality. In other words, the halving rally is a self-fulfilling prophecy born of collective conviction.

Prediction markets make reflexivity quantifiable—and therefore more observable. In the past, when people talked about the “halving rally,” the explanation might have been media hype or social buzz: people talk, and it happens. But prediction markets go a step further by assigning numerical probabilities and prices to beliefs. You no longer just know what people are discussing—you can see how much money they’re willing to bet on those beliefs coming true.

When a prediction market shows a 98% probability that Palantir’s earnings call will mention “international business,” doesn’t that make you feel it’s even more likely to happen? And perhaps, in turn, influence Palantir’s CEO to actually say those words.

Technology has dramatically shortened the feedback loop of positive reinforcement. Blockchain and cryptocurrencies have made the flow of both capital and information faster and more transparent than ever. People can place bets instantly and watch price changes and market reactions unfold in real time. This accelerates reflexivity, making it stronger and more extreme.

The GameStop uprising—the “Wall Street rebellion” led by Reddit users—is another vivid case. Once a struggling, overlooked video game retailer, GameStop became a Wall Street sensation through the collective belief of Reddit communities and Robinhood retail traders. Belief spurred action, action reshaped reality—the soaring stock price gave GameStop new cash reserves and the resources to pursue digital transformation. What began as “hot air speculation” ultimately led to a genuine corporate revival.

A single joke from Brian Armstrong was enough to move market prices—similar to the “Ma Financial Advisory 2” phenomenon in Taiwan, where Jack Ma’s comments alone could sway thousands of investors’ decisions. Prediction markets bring such dynamics out from behind the curtain, revealing how technology amplifies collective judgment and makes reflexivity both measurable and brutally transparent.

This is a new era where the crowd’s conviction forges reality. Prediction markets aren’t just about betting on the future—they empower those who understand them to summon the future through belief itself.

1 Bitcoin Halving Countdown: The Tradition of Price Surges and the Miners Left Behind

2 Bitcoin Crash: “Ma the Market Guru” and the Anti-Fragile System