No Exchange Registration Needed! A Hands-On Test of Zero-Fee Bank-to-Wallet On/Off Ramps

GM,

If you’ve ever bought cryptocurrency, you’ve definitely run into the issue of how to move money in and out. “On-ramping” means converting New Taiwan Dollars (NTD) into crypto, while “off-ramping” is the reverse. This has always been the biggest barrier to entering the blockchain world. In Taiwan, users typically need to register with a centralized exchange in order to conveniently purchase crypto with NTD. But in the future, the process will get even simpler!

Recently, I moved Blocktrend’s company account from Hong Kong to the U.S. After opening a U.S. bank account, I finally got to experience just how seamless crypto on- and off-ramping can be in America. Users can not only transfer deposits from their bank directly into their wallet and convert them into crypto, but also do the opposite—transfer crypto straight into their personal bank account. The whole process requires no exchange at all. This article is my first-hand test.

On- and Off-Ramping: As Simple as a Bank Transfer

Back in January, Blocktrend published “U.S. Dollar Deposits On-Chain in One Step! Coinbase Builds a Decentralized Bank Account.” At that time, I discovered that the Coinbase wallet had taken the lead by integrating bank account functionality. Even users in Taiwan could apply for a dedicated bank account linked to their Coinbase wallet, allowing them to receive U.S. dollar deposits directly from bank transfers.

Recently, Taiwan-based cold wallet manufacturer CoolWallet also announced the launch of the same feature. According to the press release:

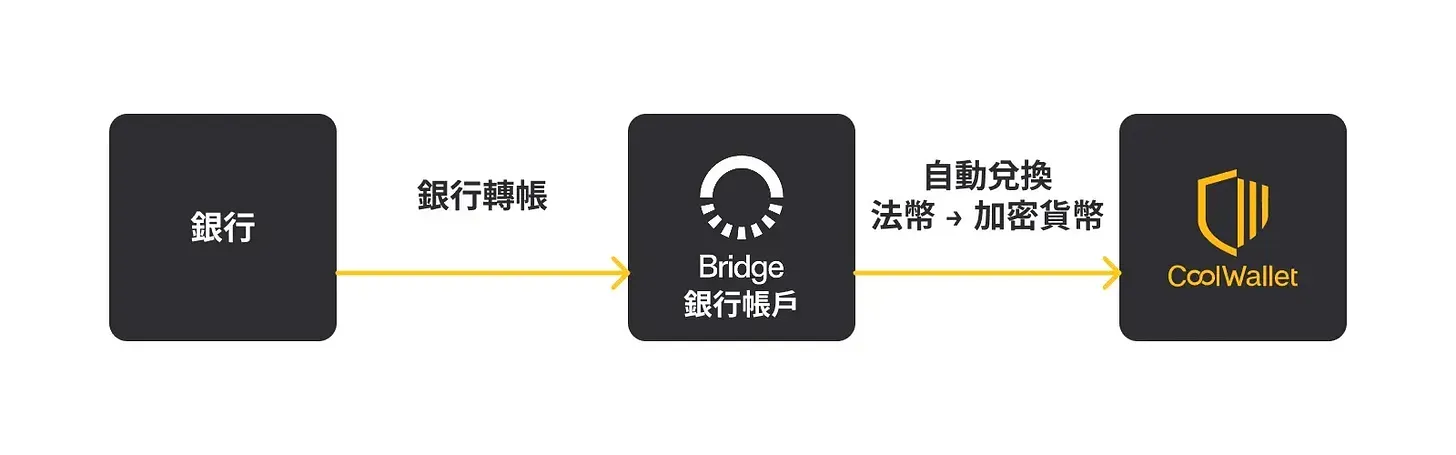

CoolWallet, in partnership with Bridge (a U.S.-based payment service provider under Stripe), has officially rolled out its new “fiat on-ramp” service. Starting now, all you need to do is make a bank transfer. Using a free, newly created bank account, you can exchange U.S. dollars (USD) or euros (EUR) for designated cryptocurrencies, which will then be deposited directly, securely, and quickly into your CoolWallet wallet address. The process is simple, safe, and compliant—making crypto on-ramping more intuitive than ever.

The highlight of this feature is that buying crypto becomes as easy as making a bank transfer. The process itself hasn’t changed at all—you’re still just transferring money to a bank account. The only difference is that the deposit automatically shows up in your wallet as crypto. It feels like magic!

CoolWallet explains this process in detail. In reality, your bank deposit isn’t transferred directly to your wallet. Instead, it’s sent to a bank account that Bridge partners with. They convert your fiat currency into crypto on your behalf and then transfer it into your wallet. By linking these steps together and executing them quickly enough, it creates the illusion that your wallet can directly receive fiat currency.

Unfortunately, most people in Taiwan still can’t enjoy this convenience, and the key issue lies in that middle step. The bank accounts that Bridge partners with currently don’t accept international wire transfers (SWIFT); they only support ACH transfers from U.S. domestic banks. For Taiwanese users who want to try it out, they need to take a detour by opening a Wise account that supports ACH transfers as an intermediary. First, wire U.S. dollars to Wise, then transfer them out via Wise. But this extra step not only adds another stop but also incurs fees—so it’s more suited for experimentation than regular use.

In fact, there have always been multiple ways to on-ramp. For example, buying crypto with a credit card has been around for years. But that only converts bank money into crypto—it doesn’t allow you to cash out crypto back into the bank. By comparison, bank transfers not only come with lower on-ramp fees but also make off-ramping easier. Take the Coinbase Wallet as an example: transferring $10,000 from a bank account gets you 10,000 USDC in your wallet, with no fees charged at all. This greatly simplifies the on-ramp process while saving on exchange trading and withdrawal fees.

But the focus of my test this time was off-ramping—directly entering a bank account number into the recipient field of the wallet, and watching crypto magically turn into U.S. dollar deposits!

Fluidkey: Zero-Fee Off-Ramp

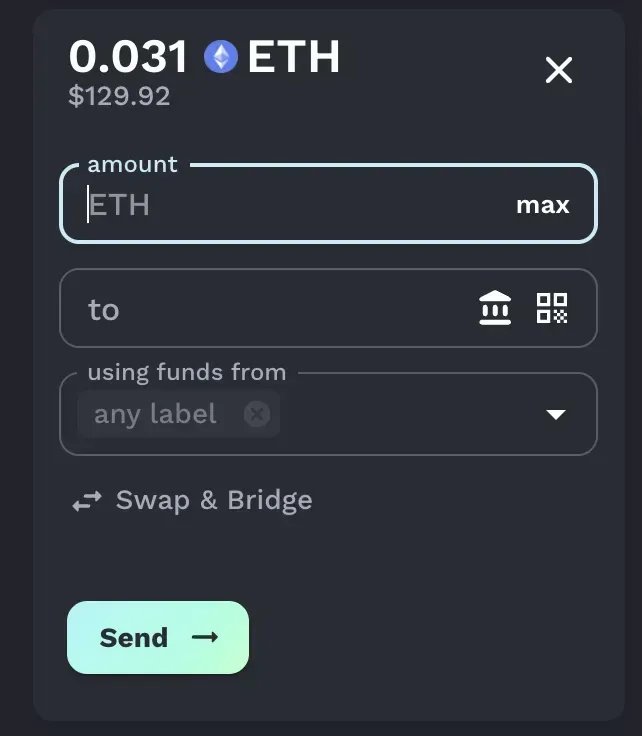

Most wallets today still don’t support bank transfer on-ramps, and wallets that can directly off-ramp crypto into bank accounts are even rarer. As far as I know, the only wallet currently capable of direct off-ramping is Fluidkey. As long as user assets are on the Base chain, you can withdraw funds straight from the wallet to a U.S. bank account (via ACH transfer).

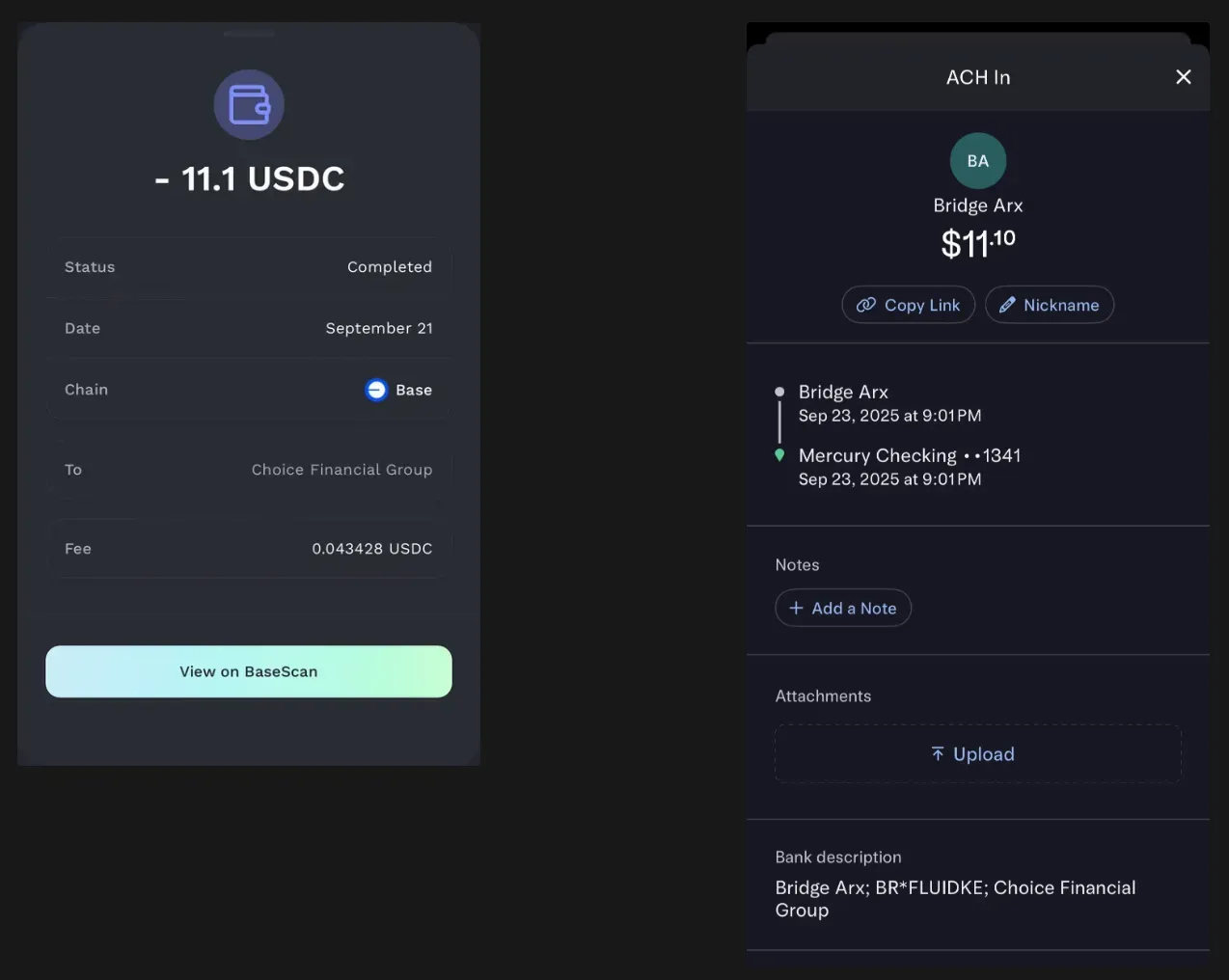

I’ve personally tried it several times, off-ramping stablecoins and ETH from my wallet to a U.S. bank. The whole process is exactly the same as a regular on-chain transfer, except the recipient field is no longer a 0x address but a bank account number. Each transaction still comes with an on-chain transaction ID (txid), and the fees are just as cheap.

The next day, my bank sent a notification: the money had arrived. What’s surprising is that Fluidkey charges no fees at allfor this process. It’s essentially zero cost to convert on-chain assets back into bank deposits. This skips multiple steps at once: no need to move assets to an exchange, no need to manually sell them back into fiat, and no need to withdraw to a bank.

Below is a screenshot of my Fluidkey operation. In the recipient (to) field, you can enter not only a wallet address starting with 0x or an ENS domain ending in .eth, but also a bank account number directly. If you transfer out USDC, Fluidkey exchanges it at a 1:1 ratio—you receive exactly what you send. In this case, I transferred out ETH, and the system automatically converted it into the equivalent amount of U.S. dollars via an on-chain decentralized exchange. All the steps are handled in one go—super convenient!

Aside from convenience, another key feature Fluidkey emphasizes is privacy protection. With CoolWallet’s bank-onramp service, because the bank account assigned to each user is ultimately handled by Bridge, Bridge is likely to have access to both the user’s wallet address and their KYC data — and could therefore track on-chain activity. By contrast, Fluidkey’s design routes each bank in- or out-flow through a one-time stealth address. That automatically isolates a user’s fiat transfers from their everyday on-chain operations, making direct linkage and tracking much harder.

My test proves that “bank ↔ wallet” can already be bridged bidirectionally. In the short term, this feature may mostly serve a few arbitrageurs as a fee-avoidance channel. But in the future it could fundamentally change how ordinary investors enter and exit crypto—no longer needing to detour through exchanges.

What direct connectivity means

For a long time, exchanges have been the bridge between fiat and crypto worlds. But if wallets can have dedicated bank accounts and send/receive fiat directly, on- and off-ramps no longer require exchanges.

For users, funds don’t have to sit on an exchange, so there’s no worry about exchange insolvency. In the future, people might only go to exchanges when they actually need to trade; fiat on- and off-ramps would go straight through “bank ↔ wallet” channels.

Banks stand to benefit most from this new model. People always say stablecoins will drain bank deposits. Flip that around: why can’t banks issue their own stablecoins? In theory they could launch on-chain versions of their own stablecoins, or partner with providers like Bridge to integrate stablecoins into their existing services. Users would circulate bank-issued USD stablecoins on-chain while the underlying dollars remain in the bank’s custody.

Exchanges should be worried. Many users currently treat Taiwan exchanges merely as a “U-swap” gateway—buy stablecoins locally then immediately move them to international exchanges to trade. If banks can also “swap to U” directly, exchanges must find ways to convince users and capital to stay—by offering a wider token selection than banks, more flexible financial products, or more attractive airdrops and incentives.

People are used to keeping their money in banks, and exchanges will find it hard to compete on that front. Centralized exchanges may need to refocus on specific niches—those who need leveraged derivatives, frequent traders, or users chasing airdrops. But for most people who treat exchanges as simply an entry/exit point, the optimal path is likely to become a direct “bank ↔ wallet” channel. After all, many real crypto use cases occur outside exchanges—shopping, subscriptions, or tipping.

However, with easier fiat on- and off-ramps, scams and hackers will also evolve. If law enforcement and prosecutors don’t speed up their ability to trace flows, criminal activity could become even more difficult to investigate than it is today.

- Interview with Fluidkey Co-Founder: Building the Ultimate Privacy Wallet, Integrating Auto-Yield DeFi, and Weekly Curated Token Airdrops

- The Most Powerful One-Time Address Management Tool! Fluidkey Makes On-Chain Payments No Longer Expose Your Identity

- No More Exposing Your Wallet Address! Fluidkey Gives You a Fresh Address for Every Transaction 🔐

- My Go-To Tool for Receiving Payments: Fluidkey and the Stealth Address That Ends On-Chain Doxxing ft. imToken Chief Scientist Changwu Chen