MicroStrategy Ups Its Leverage: The Bitcoin Treasury Company and the Institutional Endorsement Trap

GM,

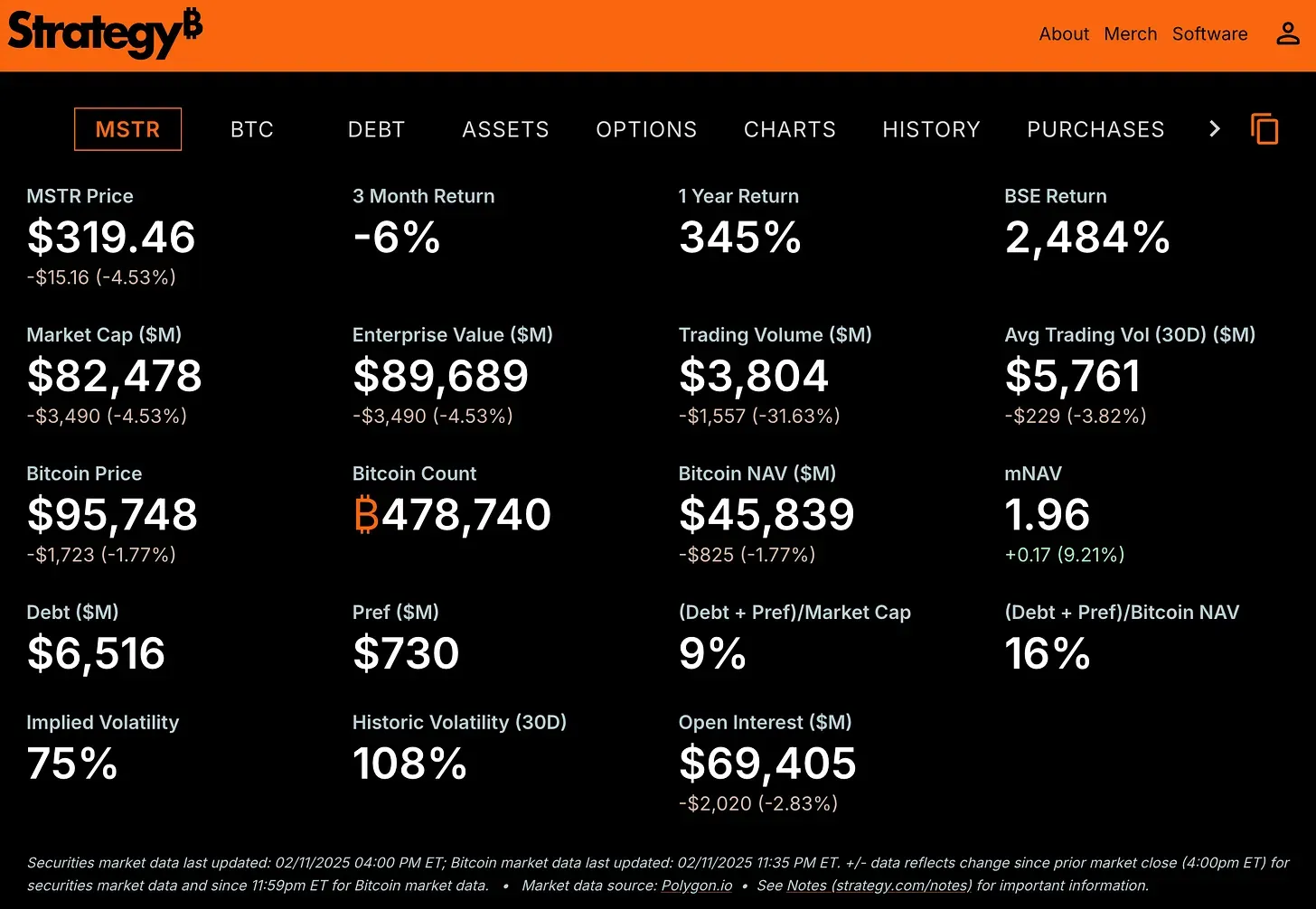

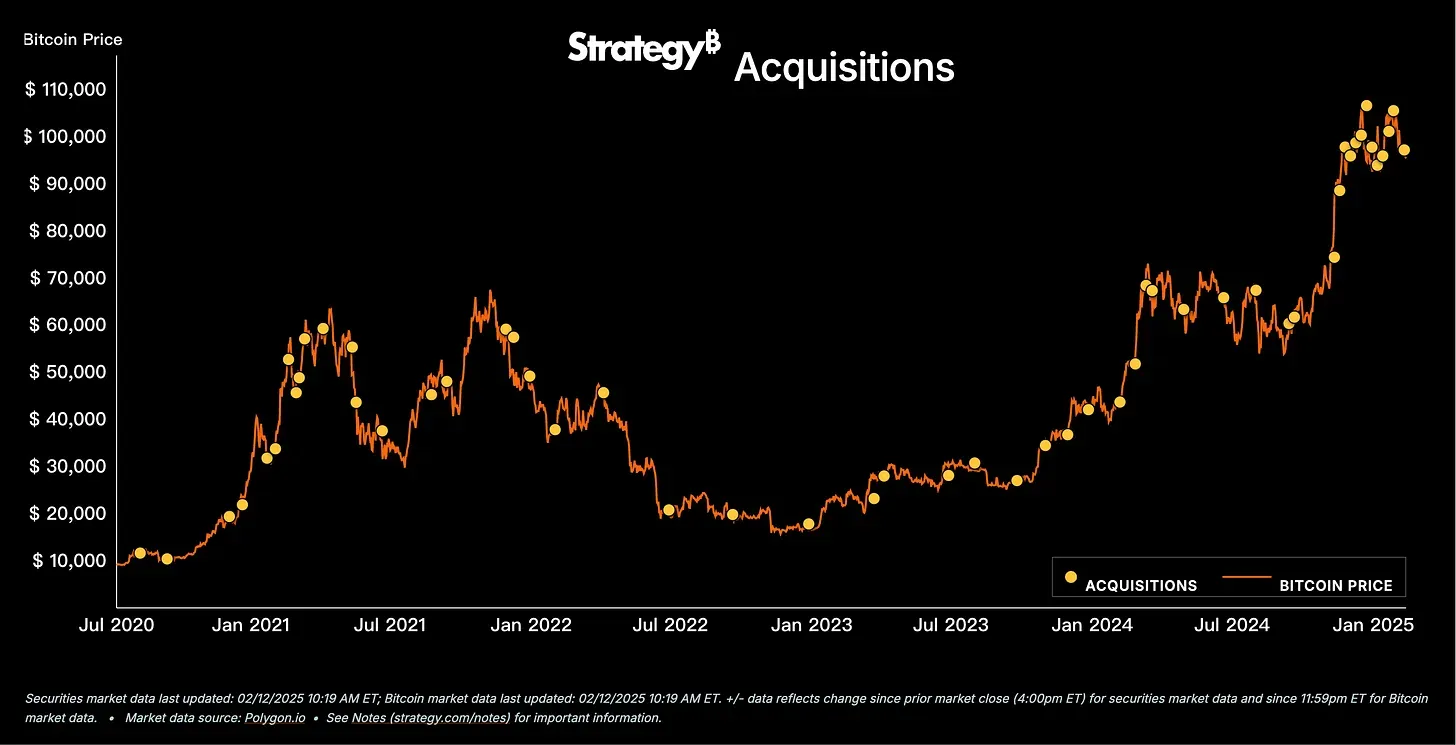

MicroStrategy has bought more Bitcoin again—hardly news at this point. As the publicly traded company with the largest BTC holdings in the world, MicroStrategy now owns nearly 480,000 BTC, which is ten times more than the second-largest corporate holder. Last year, MSTR's stock price surged 359% alongside Bitcoin's price, ranking second in the Nasdaq 100 index, surpassing high-growth stocks like PLTR.

Last week, MicroStrategy released its Q4 2024 earnings report and announced that the company is rebranding as "Strategy." The revamped website makes it clear that the company’s core business is buying Bitcoin. The latest earnings report reveals that Strategy has once again increased its BTC leverage, and institutional investors remain highly interested, bringing in fresh capital. In this article, I will first analyze the key takeaways from the earnings report before discussing the pitfalls of institutional endorsements.

Bitcoin Treasury Company

Below is the newly redesigned website of Strategy. Not only has the Bitcoin symbol been integrated into the company’s logo, but the corporate color scheme has also been changed to Bitcoin’s signature orange. The entire company has fully embraced the Bitcoin identity—even launching branded merchandise. Strategy’s CEO, Phong Le, emphasized that this is far more than just a name change. It is a declaration to the world that the company has officially transformed from a software firm into the world’s largest Bitcoin Treasury Company.

But what Phong Le didn’t say is that this transformation was out of necessity. When company founder Michael Saylor first bought Bitcoin, it was to solve the problem of having “too much cash.”¹ What he didn’t expect was that one purchase would turn into an obsession, fundamentally reshaping the entire company.

“Bitcoin Treasury Company” is a term invented by Strategy itself. A treasury is meant to hold as much wealth as possible, and for Strategy, that means accumulating more Bitcoin. The company has even introduced two new KPIs: BTC Gain and BTC Yield, completely disregarding traditional revenue and profit metrics.

BTC Gain represents the expected increase or decrease in the company’s Bitcoin holdings, while BTC Yield measures changes in the amount of BTC per MSTR share. In 2024, Strategy added 140,538 BTC, boosting its BTC per share by 74.3%. For 2025, the company aims to increase this metric by another 15%, which means acquiring at least 67,000 more BTC—a purchase that, at current prices, would require $6.7 billion.

What’s even more shocking is that by mid-February 2025, Strategy had already bought 31,000 BTC. At this point, the obvious question arises: Where is all this money coming from?

The Art of Money Creation

Strategy can keep buying Bitcoin because it continuously borrows money from the market. In 2024, its favorite tool was zero-interest convertible bonds. Investors lend money to Strategy at a 0% interest rate to buy Bitcoin, and when the bonds mature, they have the option to either take back their principal or convert the debt into MSTR shares.

If MSTR's stock price surges, converting the bonds into shares is the most profitable choice—hence the term convertible bonds. But even if the stock price crashes, investors can still recover 100% of their principal, losing only the potential interest. This low-risk, high-reward setup is particularly attractive to major financial institutions, which is why Taiwanese banks like Fubon, CTBC, and Cathay have all become MSTR’s creditors.

Recently, Strategy came up with a new way to borrow: issuing preferred stock. In January 2025, the company issued perpetual preferred shares with an 8% annual yield, raising another $563 million. CEO Phong Le emphasized, "Preferred stock gives us a more flexible way to hold more Bitcoin. Unlike convertible bonds, which require repayment of principal upon maturity, preferred stock allows us to focus on long-term Bitcoin accumulation."

Think of it like a mortgage. Convertible bonds are similar to a mortgage with a five-year interest-only period, where you don’t have to pay the principal at first but must settle it all at the end. Perpetual preferred stock, on the other hand, is like a mortgage with no maturity date—as long as the company can keep paying 8% interest, it can borrow indefinitely. While preferred stock has a higher cost, it's essentially rented money with no worries about principal repayment. By alternating between convertible bonds and preferred stock, Strategy not only secures more funding but also reduces repayment pressure, ensuring it can keep accumulating Bitcoin.

For institutional investors, Strategy’s preferred stock is highly attractive—it offers controlled risk with unlimited upside. Preferred stock allows the company to pay dividends in shares instead of cash. If MSTR’s stock price soars, investors are happy to receive more stock. Even if the price underperforms, they still get a guaranteed 8% fixed return. And in the worst-case scenario—if the company collapses—preferred shareholders have priority over common stockholders when it comes to asset claims.

Do you see the trap? Institutional investors are pouring money into MSTR convertible bonds and preferred stock, not just because they believe in the company, but because they’ve hedged their bets. Even if MSTR underperforms, convertible bondholders can recover their principal, and preferred stockholders still get 8% in returns. But retail investors who buy MSTR stock outright? They have no safety net—only the hope that the price keeps going up. If retail investors think they’re playing the same game as institutions, they’re gravely mistaken.

At its core, MSTR means something entirely different to institutions and retail investors—and their outcomes are the exact opposite. Institutions invest in MSTR to capture Bitcoin’s upside with limited downside risk, while retail investors buying MSTR are effectively taking on leveraged exposure. While everyone hopes MSTR's price will rise, if the market crashes, retail investors will take the biggest hit.

Ultimately, MSTR’s fate hinges on Bitcoin’s price. Bitcoin price is king. But this also exposes the biggest contradiction: MSTR, a publicly traded company, derives its value entirely from the assets it holds rather than the value it creates.

An Existential Crisis

Strategy’s stated goal is to increase the Bitcoin "density" per MSTR share—but does buying Bitcoin actually count as a business? Companies exist to create value and generate profits, yet Strategy doesn’t appear to be creating much of anything beyond borrowing money to buy more Bitcoin. It’s not mining Bitcoin, nor is it developing Bitcoin-related services. Meanwhile, its software business is in decline, and R&D spending is shrinking. More than ever, the company’s fate depends entirely on market forces beyond its control.

If a company’s sole purpose is to hold assets, how is it any different from a fund? Today, retail investors who want Bitcoin exposure already have Bitcoin ETF2. Compared to ETFs, buying MSTR comes with less liquidity, less transparency, and additional corporate financial risks. While Strategy continues to introduce new financing tools—seemingly preparing for potential downturns—these complex financial maneuvers only add uncertainty rather than reducing risk.

Simplicity is the ultimate complexity.Ironically, despite being the largest corporate holder of Bitcoin, Strategy’s approach is the complete opposite of Bitcoin’s philosophy. Bitcoin emphasizes simplicity, as reflected in Satoshi Nakamoto’s message embedded in the Genesis Block: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." Yet, Strategy operates like an over-engineered Bitcoin investor, constantly devising ways to hedge risk while ignoring the simplest principle of all: Holding spot Bitcoin without leverage is the lowest-risk investment strategy.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.