MetaMask Issues Its Own Token! Stripe Becomes a Stablecoin Arms Dealer—What Does This Mean for USDC?

GM,

The world’s most widely used crypto wallet, MetaMask, has finally issued its own token! But instead of launching a governance token, it has introduced a U.S. dollar stablecoin called MetaMask USD (ticker: mUSD). With USDT and USDC already dominating the market, why does MetaMask feel the need to release its own?

This article will explain the logic behind issuing stablecoins and where the business opportunities lie. I boldly predict that in the future, the number of stablecoins in the market will be dizzying—what we’re seeing now is only the beginning.

Stablecoin Arms Dealers

MetaMask is the world’s most widely used crypto wallet, boasting 30 million monthly active users in 2024. MetaMask announced that its U.S. dollar stablecoin, mUSD, is not only the first native stablecoin launched by a wallet provider but will also be the default currency on a forthcoming Mastercard payment card. But the most important line in the entire press release is this:

mUSD is a collaboration between MetaMask, Stripe’s subsidiary Bridge, and M0.

By 2025, the model for launching stablecoins has completely changed. When Circle issued its stablecoin, it had to acquire licenses, manage reserves 1, and balance liquidity—all done in-house. Now, MetaMask simply has its engineers integrate Bridge’s newly released stablecoin API, and the coin can go live within weeks. In other words, issuing a stablecoin no longer requires deep financial expertise; it has been simplified into a straightforward engineering problem—as long as you can call an API, you can issue one.

Turning complex financial processes into APIs has always been Stripe’s forte. Stripe became the global leader in online card payments by solving the pain point of small businesses accepting credit cards. In the past, if Blocktrend wanted to accept credit card subscriptions, it would have had to establish a company, sign contracts with Visa, and comply with payment security regulations—something small businesses could never manage. Stripe packaged all of this into an API, marketing it as “accept payments in just 7 lines of code,” which fundamentally changed the way online payments worked.

Last year, after Stripe acquired stablecoin startup Bridge 2, many assumed it would issue its own U.S. dollar stablecoin. But in a May AMA, Stripe’s two co-founders personally dispelled the rumor, saying their goal is to become the “arms dealer” of stablecoins, enabling any application to issue its own stablecoin via API. In other words, the future will be an all-out stablecoin free-for-all. MetaMask’s launch of mUSD is simply the first case study of this arms dealer model.

But why does MetaMask want to issue a stablecoin?

Building an On-Chain Bank

The answer is simple: keep the profits in-house.

MetaMask is no longer the barebones wallet of the past that only sent and received tokens. Today, it looks much more like an on-chain bank. Open MetaMask and beyond the basic functions, you can already buy crypto with a card, swap across chains, and earn yield through DeFi. Soon, it will also integrate payment cards for everyday spending. That covers the core functions of a bank: deposits, foreign exchange, transfers, and wealth management.

Although wallets are the entry point into Web3, they have yet to find a stable way to make money because users’ assets aren’t “in their pocket.” Transaction gas fees are hard to skim, so MetaMask has relied on small commissions from swaps and DeFi products. But users are savvy—they know these services are more expensive on MetaMask, so they simply don’t use them.

So what if MetaMask is the most widely used wallet? Most wallet developers either struggle to survive or end up acquired. It wasn’t until Bridge drastically lowered the barriers to issuing stablecoins that MetaMask finally found a new path forward: issuing its own U.S. dollar stablecoin.

Issuing stablecoins is the most profitable business in the world, with Tether and Circle as prime examples. Previously, since MetaMask had no assets of its own, even the best tools only helped others profit. When users held USDC via MetaMask, Circle reaped all the reserve income. With mUSD, however, MetaMask can now keep that income for itself—and even use it to subsidize users. This transforms MetaMask from a simple wallet into a genuine on-chain bank.

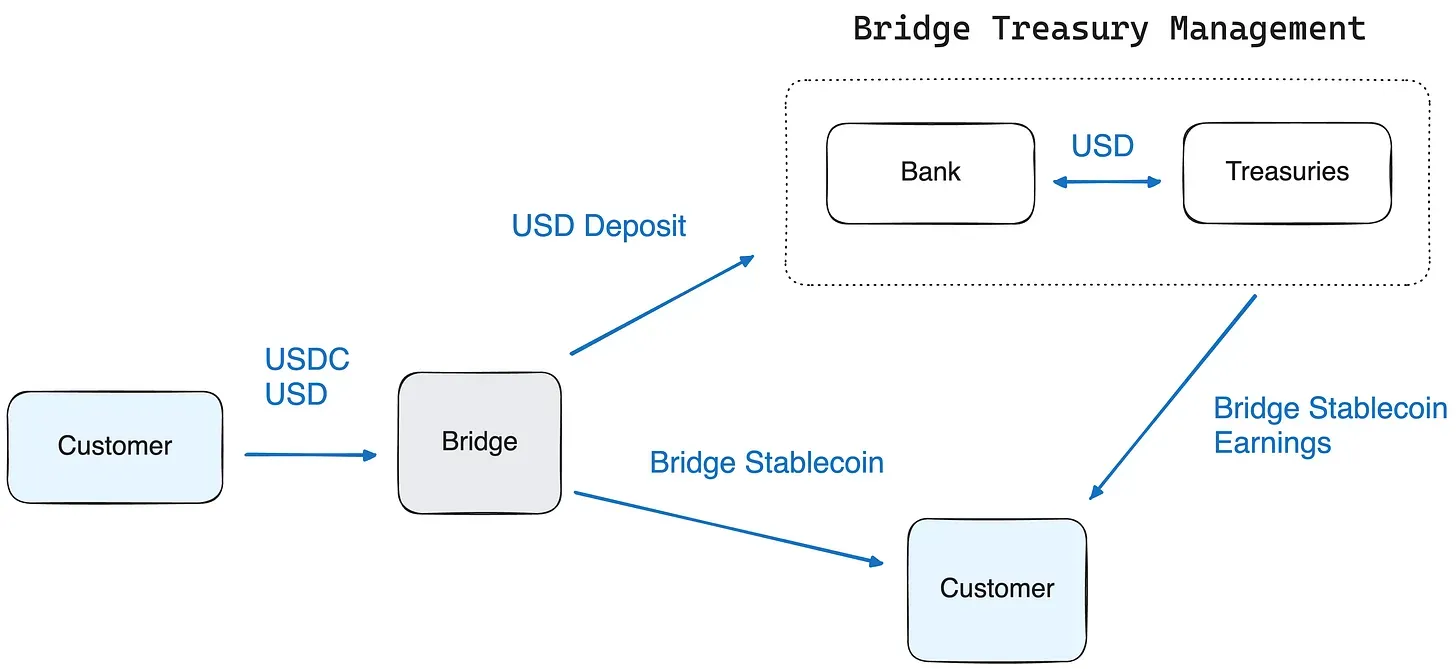

The U.S. dollar reserves behind users’ mUSD holdings are managed by BlackRock and Fidelity, two of the world’s largest asset managers, under Bridge’s mandate. The reserves generate yield through short-term U.S. Treasuries and money market funds 3. Bridge has promised that most of this yield will go back to the issuer, while MetaMask will redirect it as subsidies to reward mUSD holders. This creates a complete on-chain U.S. dollar deposit function, enabling MetaMask to provide bank-like services without holding a banking license. If this model spreads at scale, the first to be impacted will be banks, since their deposit bases will inevitably shrink.

In the past, digital deposits could only be safeguarded through centralized institutions. Governments therefore imposed strict regulations, allowing only licensed financial institutions to legally hold user funds. No matter how money moved, it would ultimately flow back into a bank account. But with the issuance of mUSD, MetaMask has cleverly sidestepped this restriction. MetaMask does not directly hold user assets and does not need a banking license, yet it can still provide the same “U.S. dollar deposit + interest” services as banks.

If, in the future, companies like Nintendo or Starbucks were to issue their own stablecoins using the same model, bank deposits could flow out into the wallets of one application after another. But MetaMask’s launch of mUSD doesn’t just affect the traditional banking system—it also challenges the current duopoly of USDT and USDC in the stablecoin market.

The Strengths and Weaknesses of USDC

Circle has been the biggest winner of this stablecoin wave. Following the passage of the U.S. Stablecoin Act, Circle’s stock price—touted as the “first stablecoin stock 4”—doubled in a short period. The use cases for USDC have expanded beyond DeFi protocols and exchanges to Web2 payment scenarios like Shopify 5. Circle successfully secured the first-mover advantage, making it difficult even for PayPal’s stablecoin to compete.

However, USDC’s greatest weakness is that Circle lacks direct access to users. Circle does not operate a wallet or payment interface, and instead must rely on exchanges and partners for distribution. This is why Circle has made aggressive infrastructure investments this year and has been willing to spend heavily on subsidies at exchanges like Coinbase and Binance. Circle understands that USDC’s survival depends on its distribution channels.

Now Stripe has entered the battlefield with its “stablecoin API,” placing the power to issue stablecoins directly into the hands of applications. Investors once assumed that these applications would naturally become potential distribution channels for USDC. But Stripe has stirred the waters. With its “arms dealer model,” stablecoins are flourishing, and every company will soon have to ask itself: “If I’m going to accept stablecoin payments, why shouldn’t I issue my own?”

Stripe will not only erode USDC’s market share, but also force Circle to consider whether it must give up some profits. In the past, smaller stablecoins attempted to share yield with users, but lacking distribution channels and everyday use cases, they posed little threat to USDC. However, if mainstream applications begin offering yield on their own branded stablecoins, it will reshape user expectations—subsidized stablecoins could become the norm.

That said, USDC is not so fragile. Stripe will first disrupt closed-loop ecosystems, such as helping Xbox, Amazon, or Facebook issue their own coins. But when it comes to deposits on exchanges or circulation in DeFi protocols, USDT and USDC will likely remain the most widely used standards.

As I noted last week when discussing Circle’s plan 6 to launch its own blockchain, the downfall of internet cafés wasn’t caused by a bigger internet café, but by the arrival of broadband in every home. The story today is the same. The challenger to USDC isn’t a larger stablecoin, but rather an API that enables every application to issue its own. When control over money moves from a handful of financial institutions to tens of thousands of apps, the future of finance could resemble cloud computing—seamlessly embedded into our digital lives. But before that vision materializes, users will first be driven crazy by the endless variety of stablecoin names.

- USDC Depegged: How Banks Drag Down Stablecoins and the Fragmented Financial System

- The Biggest Acquisition in Crypto! Why Did Stripe Spend $1.1 Billion to Acquire Stablecoin API Startup Bridge?

- More Stable Than Stablecoins! BlackRock Tokenizes U.S. Treasuries and Launches BUIDL to Become Crypto’s Bank

- Circle Files for IPO: The First Publicly Listed Stablecoin Company and Where Its Moat Lies

- E-commerce Giant Shopify Integrates USDC: Defining the Standard for Stablecoin Payments, Crypto No Longer Just for Buying Pizza

- Circle and Tether Build Their Own Blockchains: What Does It Mean for Ethereum?