Kraken Captures North Korean Hacker|Bitcoin Meme Stock Twenty One

GM,

In last week's article, I mentioned 1 a Dappnode Ethereum mining rig valued at NT$70,000, which ultimately closed at just $5.48! Many probably thought the auction wouldn’t end so soon, but over the weekend, due to a lack of active bidding, the final winner—who placed a total of 60 bids, spending $60 in bidding fees—happily took home a miner worth over $2,000. Now, let’s get to the main topics.

There were several major events last week, and I’ve picked the two most interesting to discuss: first, how Kraken set a trap and caught a North Korean hacker attempting to infiltrate the exchange; and second, how a new company called Twenty One got people to willingly pay five times the market price for Bitcoin.

Kraken Outsmarts North Korean Hacker

Back in February this year, the world’s second-largest cryptocurrency exchange, Bybit, was hacked by North Korean cybercriminals 2, resulting in a record-breaking $1.4 billion loss. More than 96% of the stolen funds remain unrecovered, and the event is still fresh in people’s minds. This week, the North Korean hackers reappeared.

U.S.-based cryptocurrency exchange Kraken published a hot-off-the-press blog post announcing that they had caught a North Korean hacker operating under the alias “Steven Smith.” Steven attempted to infiltrate the exchange by applying for a job. Fortunately, the interviewers noticed something was off early on. Not only did they record the entire interview and make it public, but they also detailed how they identified the suspicious behavior, laid the trap, and ultimately confirmed that the interviewee was indeed a North Korean hacker.

According to reports:

Last October, Steven applied for a software engineering position at Kraken. But something seemed off from the start. During the phone interview, the name he used didn’t match the one on his résumé, though he quickly corrected it. Even more suspicious was that his voice occasionally sounded different, as if someone were coaching him on how to respond.

This raised red flags for Kraken’s interviewers, who promptly reported the situation to the internal cybersecurity team. The reason for their heightened vigilance was that Kraken had received prior intelligence from other firms warning that North Korean hackers were aggressively applying for crypto-related positions. Kraken also maintained a blacklist of suspicious email addresses.

When the cybersecurity team cross-checked the information, they discovered that the email Steven used was indeed on the blacklist. While Kraken could have simply rejected his application outright, Chief Security Officer Nick Percoco argued against alarming the suspect too soon. Instead, Kraken pretended to advance Steven to the next round of interviews, all while closely monitoring his behavior.

Unaware that he had already been identified, the hacker continued through several interview rounds. Kraken noticed that even the way he used his computer was unusual. He would first connect via one layer of VPN to access a remote desktop, then open yet another VPN session within that environment—multi-layered obfuscation that clearly indicated an effort to hide his tracks.

The final interview was conducted by Nick Percoco himself. While Nick pretended to assess whether Steven could fit into the company culture, he had actually prepared several traps. One such tactic involved asking Steven—under the pretense of identity verification—to show his ID live on camera without prior notice.

A forged image of an ID can be easy to fake, but producing a physical ID on the spot without preparation is a much harder task. As expected, Steven was rattled by the sudden request. He initially claimed it was inconvenient to show his ID, and only a few minutes later did he produce what appeared to be a freshly made (and possibly hastily faked?) document.

Another trap involved testing real-life knowledge. Steven claimed to live in Houston and listed gourmet food as a hobby. Nick, playing along, said he would be visiting Houston soon and asked for restaurant recommendations. The hacker slipped again, replying that he didn’t think there was anything good to eat in Houston 😂. Combined with Kraken’s background investigation on Steven, it became increasingly clear that he was indeed the elusive North Korean hacker.

Kraken’s blog post completely changed my preconceived notions about hackers. It turns out they don’t just exploit vulnerabilities in software code—they also target weaknesses in recruitment processes. In the past, defending against hackers might have been solely the responsibility of the cybersecurity department, but now even HR teams need to learn how to spot potential threats.

When hackers can infiltrate from every angle, cross-departmental collaboration becomes more critical than ever. If Kraken hadn’t received a heads-up from industry peers, raised internal awareness, and fostered close cooperation between HR and cybersecurity, they might have unknowingly let a wolf into the fold. Kraken concluded that future interview processes should incorporate life-experience questions or verification steps that AI and bad actors can’t easily fake. But a simpler method might just be to ask candidates to say, on camera during the interview: “Down with Kim Jong-un!”

It’s said that North Korean hackers freeze up when faced with that line. They’d rather get blocked or ghost the interview than risk their lives “job hunting.”

Bitcoin’s New Meme Stock: Twenty One

Let’s say Bitcoin is currently priced at $90,000 per coin. Now, you want to buy some Bitcoin and have accounts at the following three exchanges. Which one would you choose?

- Exchange A: Selling at $90,000 per BTC

- Exchange B: Selling at $180,000 per BTC

- Exchange C: Selling at $450,000 per BTC

At first, I thought everyone would obviously choose the cheapest option. But MicroStrategy was the first to challenge this logic. It proved that if you wrap BTC in the form of a stock, people are actually willing to pay a 100% premium for it. Let me break it down.

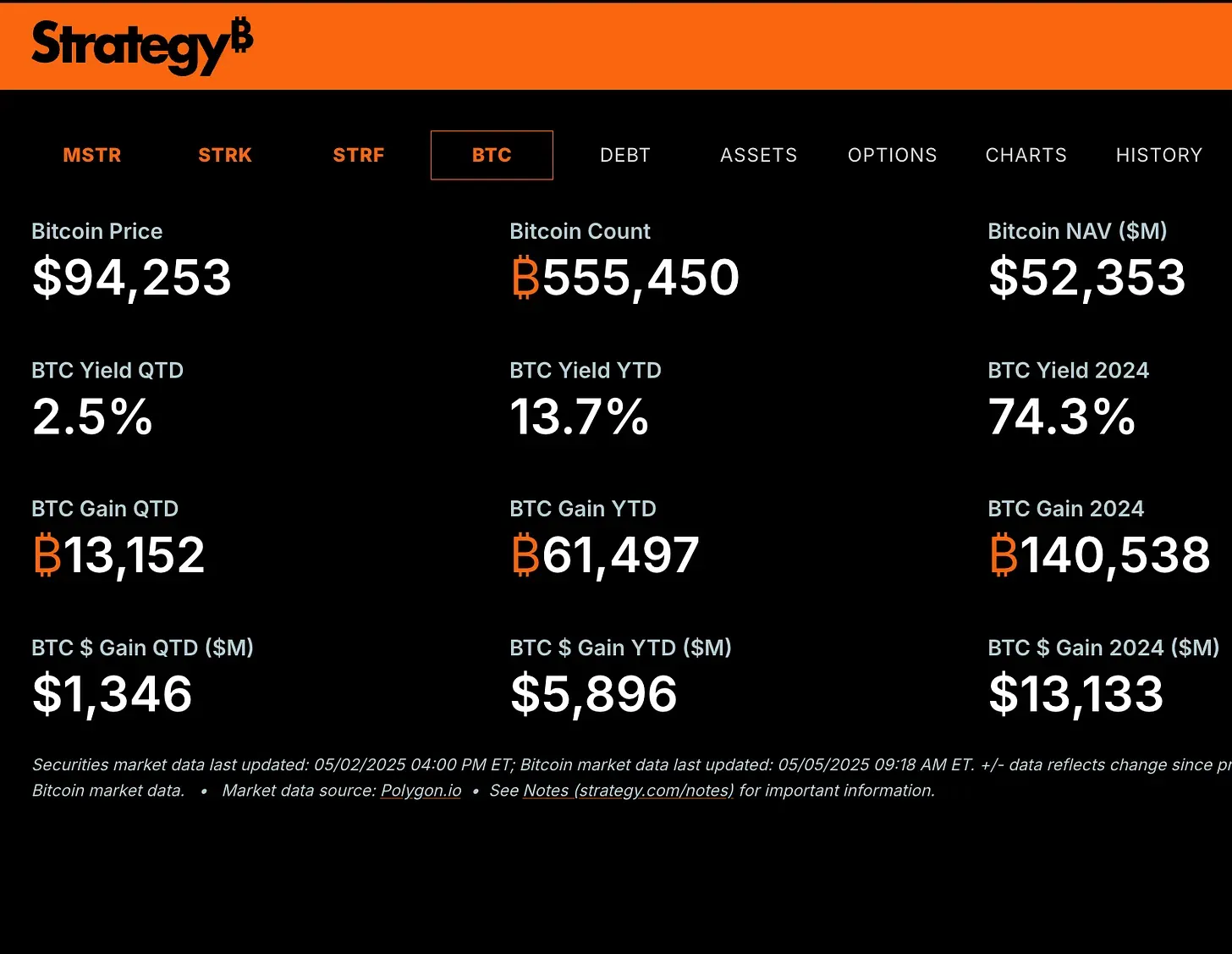

At the time of writing, MicroStrategy holds about 555,000 BTC, valued at roughly $52.4 billion. However, based on its share price, MicroStrategy’s total market cap stands at a whopping $107.8 billion. If an investor is buying MicroStrategy stock primarily for its Bitcoin holdings, then functionally, they’re no different from someone buying Bitcoin at Exchange B—paying double the market rate. Calling MicroStrategy the “overpriced retail version of Bitcoin” wouldn’t be far off.

MicroStrategy’s “success story” has left other companies stunned—and eager to imitate it. Apparently, all a company has to do is announce it’s buying Bitcoin, and a stock price premium soon follows. The most high-profile copycat in recent days is a newly formed company called Twenty One.

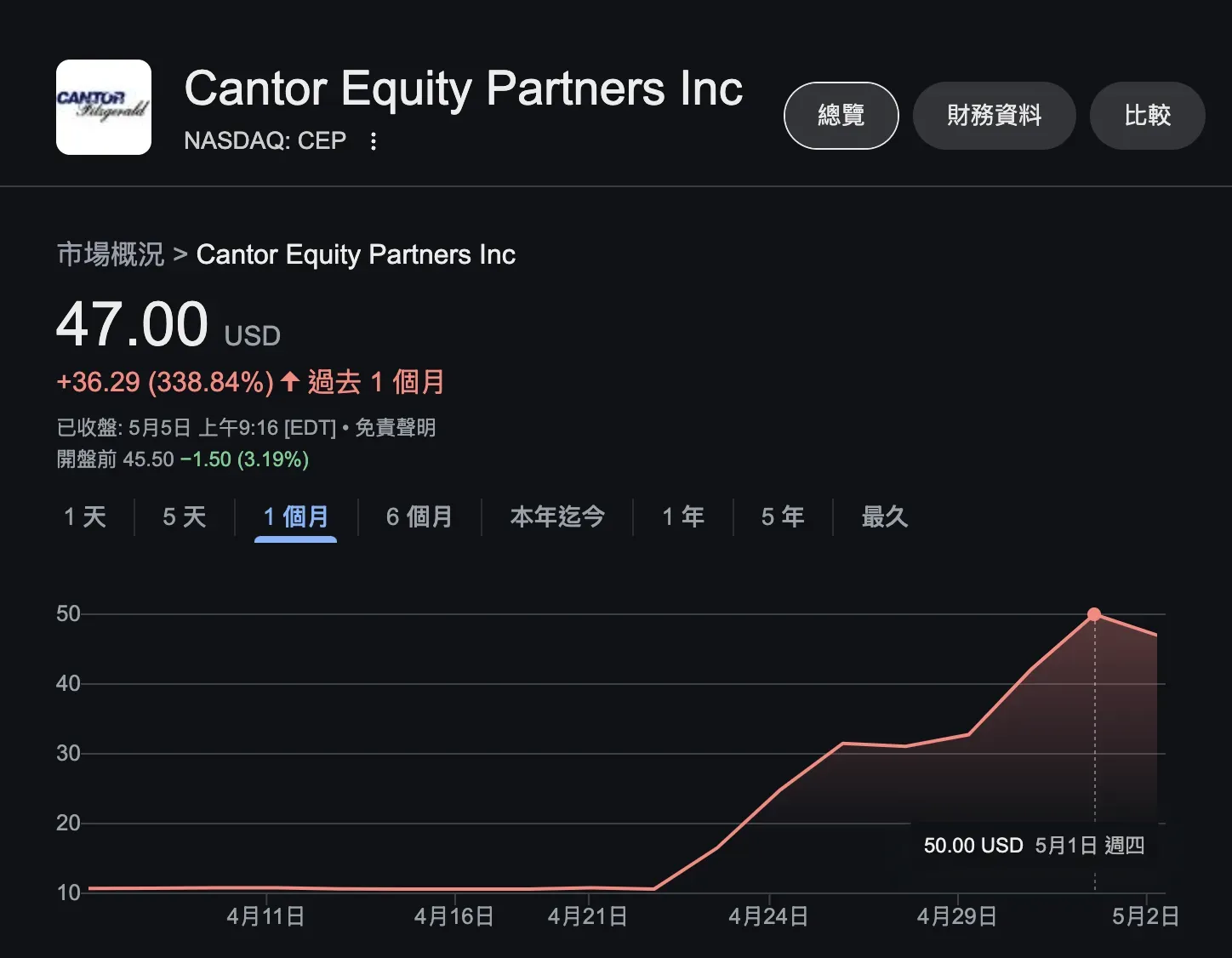

The financial backers behind Twenty One include Tether, the issuer of USDT, and Japan’s SoftBank. After merging with a shell company, Cantor Equity Partners, Twenty One effectively became a Nasdaq-listed company within just a month of its founding, trading under the ticker symbol CEP.

Right out of the gate, Twenty One announced it would hold as much as 42,000 BTC. Its stock price soared in response, rising more than 300% over the past 10 days—earning it the title of Bitcoin’s latest “meme stock.” Unlike MicroStrategy, which still operates a software business unrelated to Bitcoin, Twenty One markets itself as the purest Bitcoin company: nothing else, just Bitcoin.

According to calculations by financial blogger Matt Levine, the Bitcoin held by Twenty One is currently worth around $3.4 billion. However, the company’s projected valuation stands at a staggering $16.3 billion. In other words, if investors are buying the stock purely for the Bitcoin it holds, they’re effectively paying 500% of market price for Bitcoin. By that logic, it's a wildly overpriced move. But are these premium-paying investors simply foolish? Maybe not.

Some investors claim they’re not buying the underlying asset itself—they’re buying the price volatility that Bitcoin generates. Those who invest in MicroStrategy or Twenty One stocks are usually true believers who are extremely bullish on Bitcoin’s short-term price movement. Since they’re betting on BTC going up anyway, the more volatile the asset, the quicker the potential gains. And the reason Twenty One trades at an even higher premium than MicroStrategy is that it promises to be more aggressive in managing its Bitcoin holdings.

As I previously explained, MicroStrategy’s strategy is essentially "borrowing to buy Bitcoin 3"—they create volatility by acquiring BTC, then issue low-interest convertible bonds to raise capital and buy even more. But if you ask Michael Saylor what the company intends to do with all that Bitcoin, he’ll say: “Lock it in a vault to hedge against inflation and serve as digital gold.”

That stance now feels a little too conservative—because Twenty One is saying: “We’ll copy MicroStrategy’s model of borrowing to buy Bitcoin, but we’ll actively put that Bitcoin to work instead of letting it gather dust in a vault.” Twenty One plans to pledge its BTC for loans, and then use that borrowed money to buy even more Bitcoin. In other words, both the company and its assets are leveraged—Bitcoin is being bought with borrowed money, and the Bitcoin itself is being used to borrow more to buy more BTC.

For stock investors, Bitcoin’s price swings are already extreme. MicroStrategy is essentially leveraged Bitcoin; Twenty One is leveraged MicroStrategy. Its stock is destined to be highly volatile. And that’s exactly what some investors want. They’re not clueless bag holders—they’re leverage-hungry gamblers who want exposure to amplified Bitcoin bets through MicroStrategy and Twenty One.

As for me, I don’t touch companies like these. Once market sentiment turns, it becomes a lot harder for MicroStrategy to keep raising funds to buy more BTC. Twenty One’s double-leverage setup is even more fragile and could trigger a collapse reminiscent of Terra/LUNA 4 5. Whether either company survives to see the next bull market remains to be seen. Still, some will argue that the people backing MicroStrategy and Twenty One are powerful, well-connected elites. If nothing else, they’ve got deep pockets.

Maybe they do have a Plan B I don’t know about—but by now, we’ve all seen how quickly these flash-in-the-pan stories come and go. Long-time crypto veterans know: the secret to becoming a Bitcoin millionaire isn’t about how fast you make money—it’s about how long you can stay in the game.

1 Fomo3D Returns! A Charity Auction with a Gambling Twist: Paddle Battle

3 MicroStrategy Soars 10x! The Risks of Leveraged Bitcoin and a Death Spiral

4 UST Stablecoin Depegs: The Price Defense Battle, Death Spiral, and Irreparable Loss of Confidence