Interactive Brokers Opens Stablecoin Deposits: A New Battleground for U.S. Stock Brokerages

GM,

Lately, I’ve been seeing Firstrade ads all over my social feeds, tempting me to invest in U.S. stocks (as shown below). If you make your first wire transfer deposit of more than USD 2,500, Firstrade will reimburse USD 25 of the wire transfer fee. But this ad may not last much longer, because Firstrade’s competitor, Interactive Brokers (IB), has already announced support for stablecoin deposits.

This dramatically lowers the barrier for crypto investors to move their funds into U.S. stocks—almost devilishly so. Let’s start with what the current funding experience looks like.

Brokerage Moats

If you’re still funding your U.S. brokerage account via traditional bank wire transfers, chances are you’re paying an unnecessary premium.

I previously shared how using Fluidkey as an intermediary 1 can cut cross-border wire transfer costs by up to 99% and shorten settlement time to same-day arrival. After that article was published, I received a large number of messages from readers asking whether the overseas brokers they use would work with this method. Based on everyone’s hands-on tests, among the three overseas brokers most commonly used by Taiwanese investors, only Firstrade did not work—Charles Schwab and Interactive Brokers both successfully accepted deposits via Fluidkey.

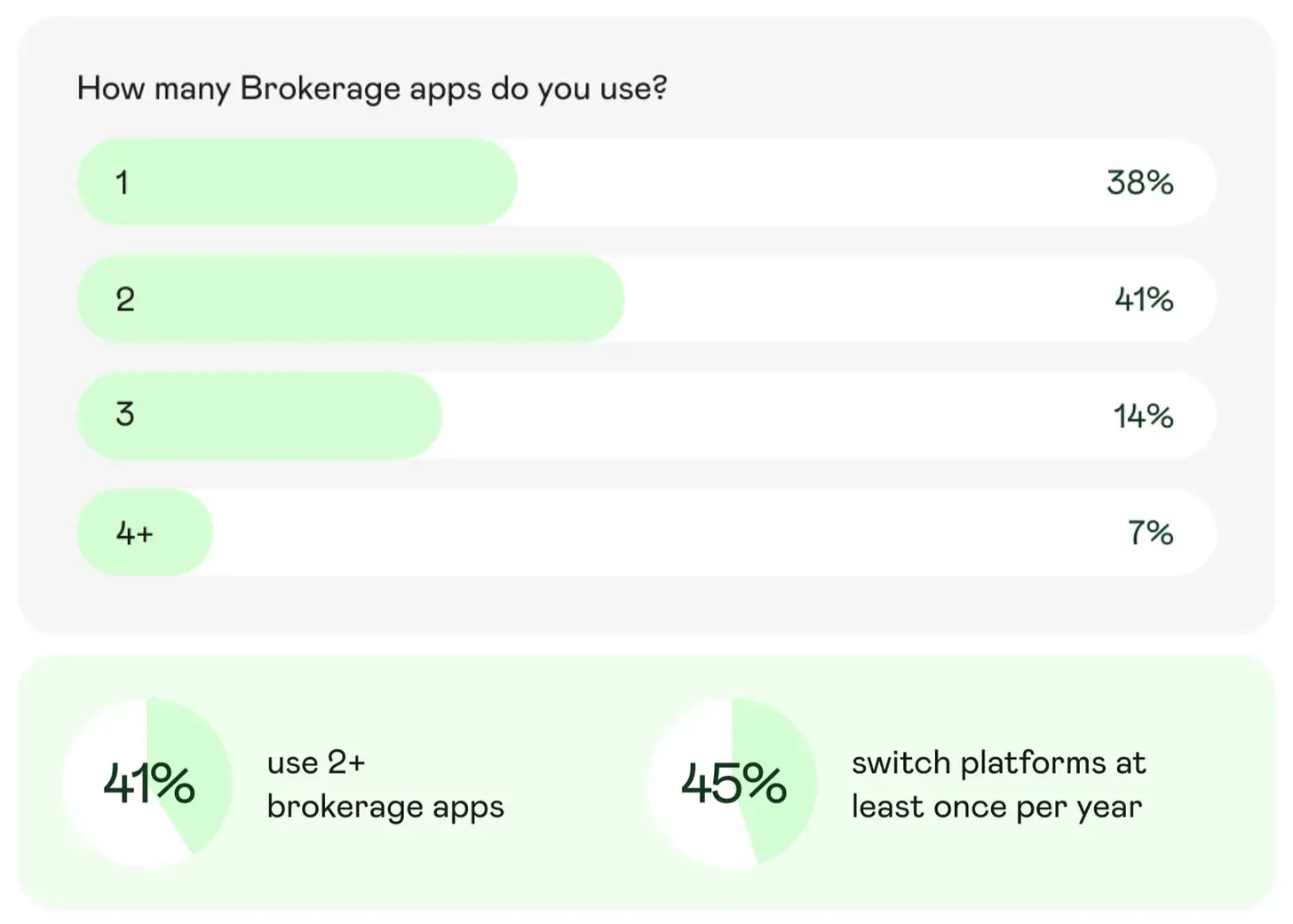

As a result, many people went on to open additional accounts with Schwab or Interactive Brokers, and some even decided to switch brokers entirely. I initially thought this would remain a niche choice, but another survey suggests that competition among brokerages is far more intense than expected. After surveying 2,000 overseas brokerage users worldwide, the report found that as many as 62% use more than one brokerage app, and 45% switch to a different broker every year.

Low User Loyalty

Users show little loyalty to platforms. High remittance fees and slow funding times are the two biggest pain points. Only 38% of users are satisfied with their current funding experience, and more than half of respondents say they have missed optimal investment opportunities due to delayed deposits.

These complaints are only going to become more common. This week, the New York Stock Exchange formally submitted an application to the SEC to launch nearly 24-hour stock trading, allowing investors to trade up to 23 hours a day. The awkward reality is that cross-border remittances are still stuck in the last century. For Taiwanese investors, a wire transfer sent on Friday may not be credited until the following Tuesday. Missing an opportunity is one thing; the anxiety during the wait is often the hardest part.

Brokerages are well aware of where the problem lies. This week, Interactive Brokers fired the first shot by announcing support for stablecoin deposits.

Stablecoin Funding

Interactive Brokers was founded 48 years ago. Its 81-year-old founder and chairman, Thomas Peterffy, personally confirmed the news at a Goldman Sachs conference:

I am very excited about stablecoins, and I am pleased to announce that Interactive Brokers will introduce stablecoins this year. By the end of the year, we will accept stablecoins from Tether, Ripple, PayPal, and Circle. Investors will be able to deposit, withdraw, and hold funds using stablecoins, which will help increase the velocity of money.

On the same day, Interactive Brokers’ stablecoin partner, zerohash, immediately released a demo video highlighting three key features: 24/7 availability, instant settlement, and lower funding costs. However, sharp-eyed viewers quickly noticed that depositing via USDC in the video (at the 27-second mark) was not free. A fee of 0.3% of the deposited amount is charged. For a single deposit over USD 1,000, the fee approaches NTD 100—prompting many people to consider sticking with traditional bank wire transfers instead.

It turns out that Interactive Brokers is not managing cryptocurrencies itself. Instead, within the app it guides users to deposit stablecoins into wallets managed by the payment service provider zerohash. Once zerohash receives the funds, the account balance is then synchronized and displayed in the Interactive Brokers account.

Putting aside how dizzying the process looks, the deposit fee itself feels like an “idiot tax.” You might find this puzzling: just last week, when Stripe charged merchants a 1.5% fee on stablecoin payments, I defended it. So why do I slap the “idiot tax” label on Interactive Brokers for stablecoins? The key difference lies in the value being provided.

For merchants, using Stripe to accept payments has never been free. When customers pay by card, merchants pay Stripe 2.9% plus a fixed USD 0.30 per transaction. Switching to stablecoins brings the fee straight down to 1.5%. Stablecoins make an already paid service cheaper, so merchants are naturally happy to accept it.

Interactive Brokers’ situation is the exact opposite. Deposits were originally a free feature—Firstrade even subsidizes them. Interactive Brokers was the first to support stablecoin deposits, yet it passed operating costs that should have been absorbed by the platform on to users. In the end, users not only fail to save money, but may actually end up paying more.

Perhaps usage-based pricing is simply part of Interactive Brokers’ partnership agreement with zerohash, but this is likely only temporary. Supporting stablecoin deposits is like opening Pandora’s box—once opened, there’s no going back. Many people are still on the fence about stablecoins simply because the existing process isn’t terrible. But once they realize how cheap and efficient stablecoin cross-border transfers can be, they will quickly turn around and demand that Firstrade and Charles Schwab support stablecoin funding as well.

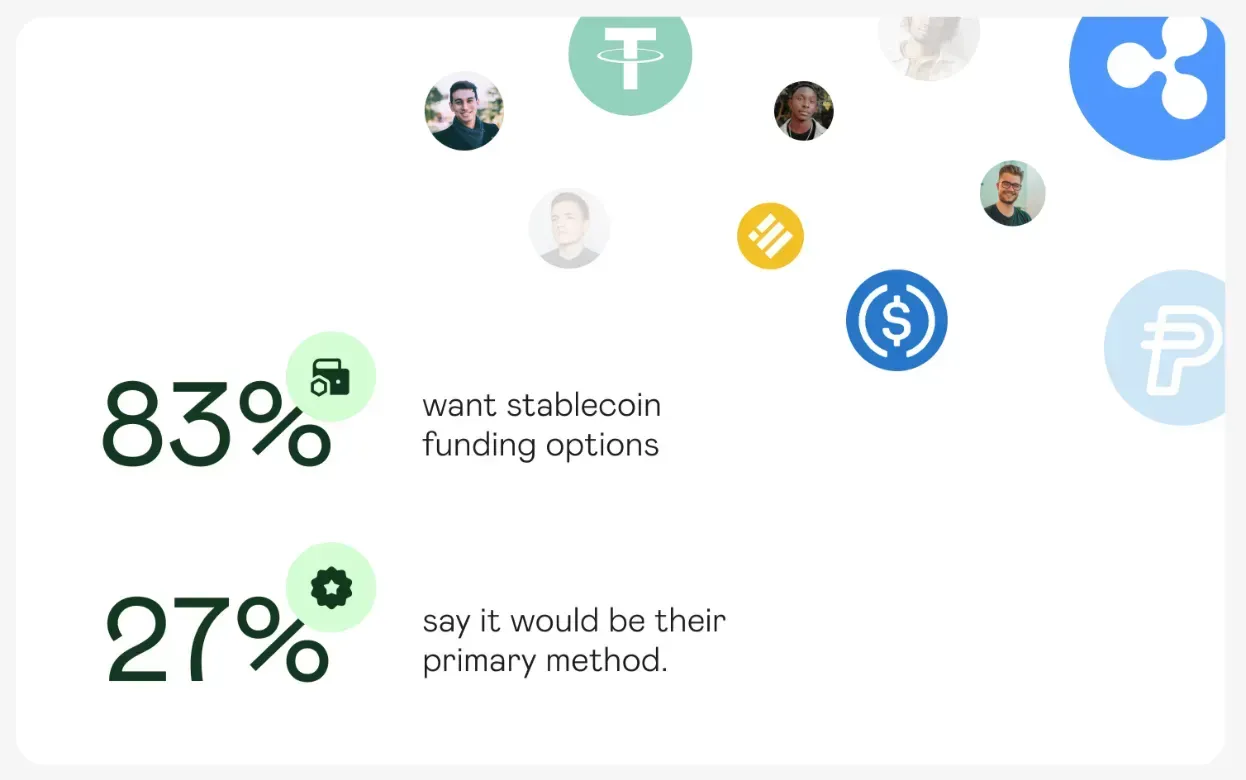

When every platform offers the same feature with little differentiation, price cutting becomes inevitable. Moreover, surveys already show that 83% of users want platforms to provide a stablecoin deposit option. In such a fiercely competitive market, it’s hard to imagine other players choosing to sit back and do nothing.

Using stablecoins to fund overseas brokerage accounts is one of the few real, tangible crypto use cases that Taiwanese users can truly feel. At long last, people are beginning to shift from merely investing in cryptocurrencies to actually usingthem. This not only makes investing in U.S. stocks more convenient, but also reshapes expectations around the speed of money.

Expectations That Can’t Be Reversed

Some netizens pessimistically argue that once brokers open up stablecoin deposits, capital will flow out of the crypto space even faster—perhaps even forcing companies focused on tokenized stocks (RWAs) to shut down. Their reasoning is that in recent years U.S. equities have become more attractive; trading through brokers is the “real” way to own stocks, while on-chain tokenized equities suffer from low participation, poor liquidity, and questionable security.

All of this is true. What they overlook, however, is this: once people become accustomed to “crypto-grade” money movement speeds, how will existing financial infrastructure keep up? We may not have the answers, but SEC Chair Paul Atkins has made it clear that U.S. financial markets will move on-chain in the coming years.

Recently, crypto prices have pulled back from their all-time highs. Some media outlets mocked the situation, reporting that Harvard University had placed a massive USD 400 million bet on Bitcoin ETFs only to be caught in a market downturn, even name-checking other U.S. universities that “stepped on the same landmine.” But anyone familiar with financial markets knows that university endowments and pension funds are not designed to chase short-term performance.

As individual investors are drawn in by brokers’ stablecoin deposit options, capital can flow more freely between different markets. In the short term, the influence of hot money on crypto prices naturally diminishes. At the same time, the proportion of capital willing to stay allocated to crypto for the long haul gradually increases, leading to a healthier market structure. Seen this way, capital flowing out of crypto isn’t necessarily a bad thing—it may simply be the natural metabolism of a growing ecosystem.