Instant On-Ramping Without KYC! A Zero-Knowledge Proof-Secured P2P Trading Marketplace

GM,

The long-awaited public funding event is back! This time, the funding pool is $100,000, and I encourage everyone to support Blocktrend by casting your votes with spare change to help it receive matching funds. Here are some recommended projects: DHK DAO, GreenSofa, ArchiveHK, Funding the Commons, and ETH Daily. Now, let’s get to the main topic.

I originally planned to introduce the Safe multisig wallet, but today’s spotlight unexpectedly goes to ZKP2P. Using the most cutting-edge zero-knowledge proof (ZKP) technology, it has created an on-ramp and off-ramp service that anyone can use. The real-world test was nothing short of mind-blowing.

In just three minutes, I converted $5 from my Wise account into 4.926 USDC in my wallet, with a slippage of about 1.5%. The process required no KYC, just a series of zero-knowledge proof "magic tricks"1 that felt like watching a live performance. I was so amazed that I kept taking screenshots.

I would say ZKP2P is currently the most tangible and impactful application of zero-knowledge proofs (ZKPs). Even if you don’t need to exchange crypto, you can still earn a spread as a liquidity provider. This article will first explain what problem ZKP2P solves and then explore its innovative aspects.

Instant On-Ramping in 60 Seconds

During the Lunar New Year, did anyone ask you how to invest in crypto? Last year, at a family gathering, I was asked this exact question.

My answer was straightforward: "Give me $100, and I’ll immediately help you create a wallet and transfer an equivalent amount of crypto to you." To my surprise, one of my relatives pulled out $1,000 on the spot, saying, "Let’s do it now." A few minutes later, the transaction was complete, and everyone at the table was fascinated.

This was the simplest form of P2P trading—no KYC, no bank account linking, and no compliance issues.

However, this method is only practical for small amounts. My wallet holds a limited amount of crypto, and if the transaction size were larger, I’d have to ask about the source of funds. Moreover, Taiwan doesn’t allow unregistered private crypto exchanges, so using a centralized exchange is generally safer. But just like exchanging foreign currency abroad—some people go to a bank, while others find exchange partners in Facebook groups—P2P trading fills the gap left by centralized platforms, though users must bear the risks themselves.

ZKP2P enhances the security of P2P transactions with zero-knowledge proofs, promising on-ramping in just 60 seconds! Think of it as a decentralized version of Binance P2P. It currently supports Venmo, Cash App, Revolut, and Wise, and in the future, it may add Jiekou Pay (街口支付) and LINE Pay, which are popular in Taiwan. I recommend that everyone start by creating a Wise account (since the other three services aren’t available in Taiwan) to experience this innovation firsthand.

The deposit process is simple. On ZKP2P’s Swap page, enter the amount and select your preferred payment service. The system will show you how much crypto you’ll receive. Since all transactions are internal transfers, funds are settled instantly. After making the payment, the system will guide you to submit a payment proof to a smart contract. Once verified, the crypto will be credited to your wallet. ZKP2P is revolutionizing the way people access crypto—quickly, securely, and without unnecessary friction.

Some might ask, “Is someone in the background converting USD to USDC?” That’s exactly what liquidity providers are doing.

Zero-Knowledge Proof

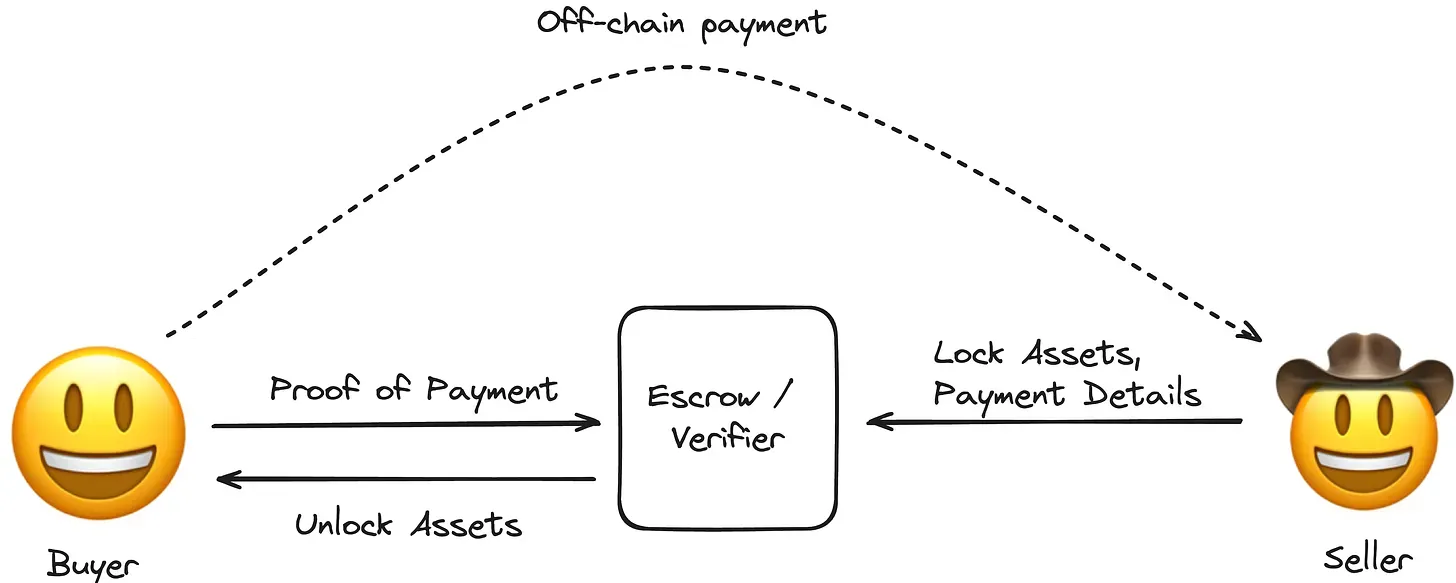

ZKP2P automates the most basic form of online transactions—you want to buy, I want to sell, and the only remaining issue is ensuring the security of the transaction.

Currently, most people rely on centralized platforms like Binance P2P, which function like a department store—each counter offers different exchange rates, and disputes are mediated by Binance. In contrast, ZKP2P operates like a vending machine—sellers preload crypto into smart contracts and set prices in advance, allowing buyers to exchange, say, 1 USD for 1.01 USDC (just as an example) at any time.

ZKP2P focuses on minimal information disclosure and completes transactions via smart contracts. The key innovation is converting payment proofs into blockchain payment instructions. According to the official introduction:

ZKP2P V1, launched in November 2023, is the first fully decentralized on-ramp and off-ramp solution. Sellers deposit USDC into a smart contract, and buyers use ZKEmail to prove they've paid via Venmo—immediately unlocking the funds without needing a middleman to resolve disputes.

The latest V2 version goes even further—now you can use Venmo, Cash App, Wise, Revolut, and other payment tools to directly purchase ETH, USDC, SOL, or even meme coins, with no fees and no identity verification required.

ZKEmail is the backbone of this entire system, and its operation is straightforward. Just like how we take a screenshot after transferring money to show the recipient, ZKEmail verifies the payment confirmation email sent by Venmo, extracts the payment amount and recipient information, and then uses zero-knowledge proof technology to generate a payment proof for the smart contract. Once verified, the funds are released.

Automating verification with code instead of manual checks is the key to ZKP2P's ability to complete on-ramping in just 60 seconds. It prevents forgery, leaves no trace, and the entire process is automated—resulting in higher efficiency and better privacy protection.

Now, ZKEmail has been upgraded into a browser extension tool—PeerAuth. Instead of reading emails, it directly verifies the web response from payment platforms, further improving both accuracy and privacy. While the mechanism sounds complex, anyone can easily complete transactions by following the step-by-step instructions.

Whenever we discuss on-ramping, the most common follow-up question is: “Can I off-ramp as well? Can I convert crypto back to USD and withdraw through Wise?”

The answer is yes—as long as you become a ZKP2P liquidity provider. You can set your own exchange rate and earn a spread. When a buyer uses your liquidity, their USD is sent to your Wise account, which then triggers the smart contract to automatically release the crypto. Currently, ZKP2P is actively recruiting liquidity providers from Binance P2P, inviting them to conduct business on a decentralized platform.

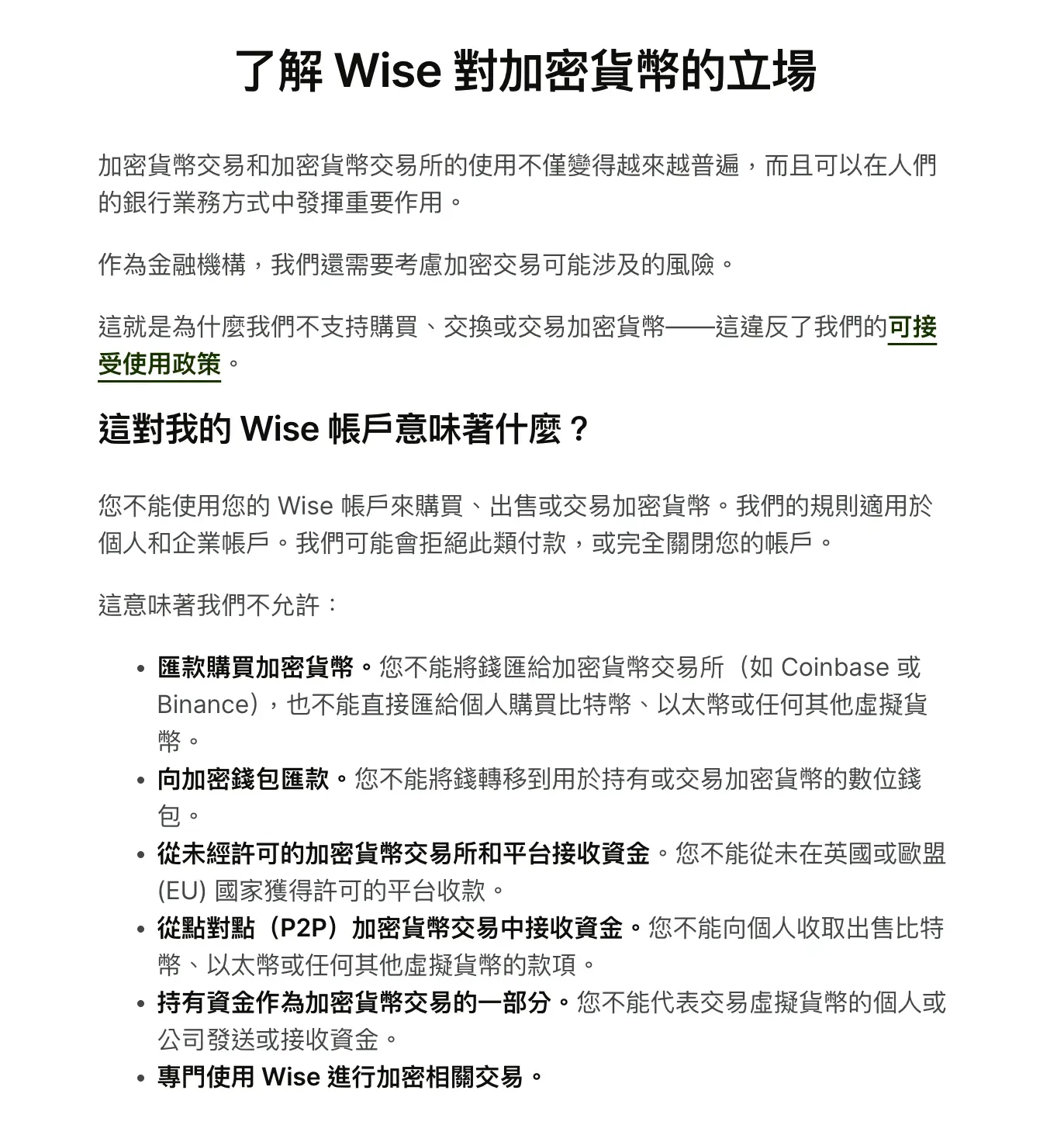

While ZKP2P’s technology is impressive, it could also face the same risks2 as Tornado Cash. After all, bias against crypto remains strong in both political and commercial spheres.

Known Risks

Wise has explicitly stated its anti-crypto stance. Whether it's sending money to an exchange or receiving income from crypto-related transactions, both violate Wise’s terms of service and could lead to transaction rejections or even account closures.

In comparison, Venmo, Cash App, and Revolut all have their own crypto services, making them relatively lower-risk platforms for these transactions.

As a P2P trading platform, ZKP2P also faces risks related to the source of funds. Just like how you might unknowingly buy stolen goods on Shopee, you could end up dealing with illicit funds here as well. This issue is not newon Binance P2P—there have been cases where users purchased USDT that turned out to be stolen by hackers. As a result, the exchange refused to process deposits or even froze user accounts—a situation that wouldn't occur on a regulated exchange.

The risks of off-ramping are just as significant. Suppose you want to cash out $100,000 USDC—even if the buyer has already sent you the payment, they could still initiate a chargeback through the platform's dispute system. However, by that time, your USDC has already been sent to their wallet, making it impossible to recover. This is a risk that ZKP2P cannot resolve but does explicitly warn users about.

Additionally, ZKP2P may face regulatory risks similar to Tornado Cash. Even though Tornado Cash was merely a transaction tool, it was sanctioned by the U.S. government due to misuse by North Korean hackers, and even its developers ended up behind bars. I believe that if ZKP2P grows large enough, it could inevitably be misused by bad actors, attracting regulatory scrutiny.

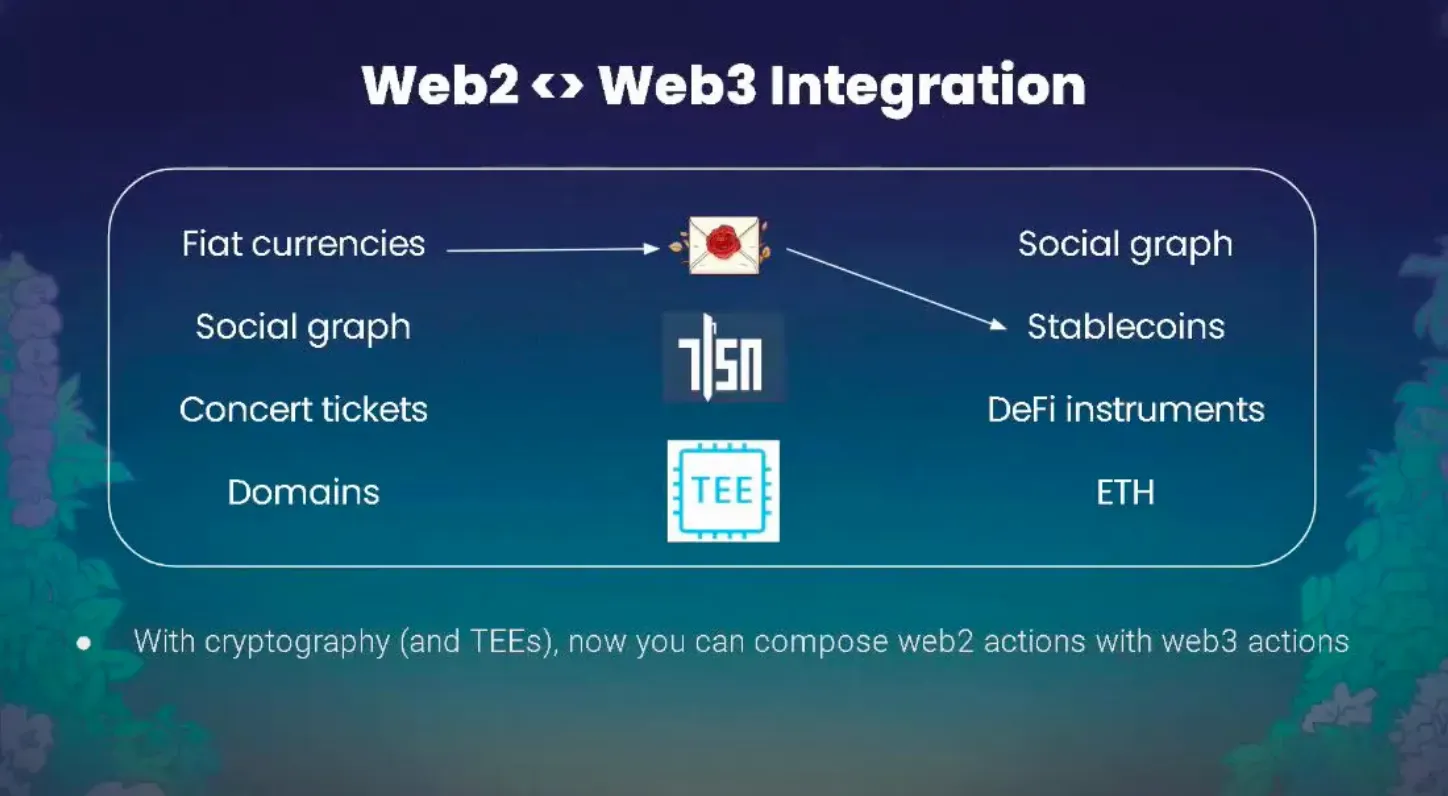

That said, on-ramping and off-ramping are not the only use cases for ZKP2P. According to developer Richard’s presentation, many P2P transactions—from fiat currency trades and concert tickets to website domains—suffer from trust issues. Even Facebook groups struggle to guarantee fair transactions. These areas could all benefit from ZKP2P’s decentralized trust mechanism, adding an extra layer of security to P2P trades.

ZKP2P has a wide range of applications, and choosing on-ramping and off-ramping as its first feature was clearly a well-thought-out decision. Despite the legal risks, it remains the easiest use case for people to understand. I see ZKP2P as something akin to an unmanned store on the streets of Taipei. While most people are still used to shopping at traditional retail stores, the unmanned store introduces a new possibility. Zero-knowledge proofs are the "black magic" behind these unmanned stores, and what makes ZKP2P so compelling to me is that it creates a space to showcase this magic, allowing anyone to explore it freely.