I Got Phished! First-Hand Test and Breakdown of Two Common Scam Tactics

GM,

ETH has risen 55% over the past 30 days, now just a step away from its all-time high of $4,800; BTC is also hovering around the $120,000 mark. At times like this, unless you’re already all in, it’s hard not to feel like, “I didn’t buy enough.”

I feel the same way. In the past, I would try to live with that feeling and act like a “mature adult.” But this time, I’ve been using the advanced version of the DCA bot I shared before. From personal experience, turning the bot on instantly takes the pressure off. If prices rise, my first purchase is already in profit. If they fall, even better — the bot automatically buys the dip. By investing in batches, the stress is much lower. The only time it feels like the money isn’t working is when prices stay flat for a long time. If you want to try it out, feel free to use my exchange referral link. Now, onto the main topic.

Lately, crypto phishing scams have been rampant, and it’s all too easy to fall victim. Instead of just telling people to “be careful,” I decided to test them myself so you can see exactly how the money disappears. Right now, the two most common phishing scams circulating in the community are: giving out seed phrases and selling fake USDT by Chinese scammers.

Giving Out Seed Phrases

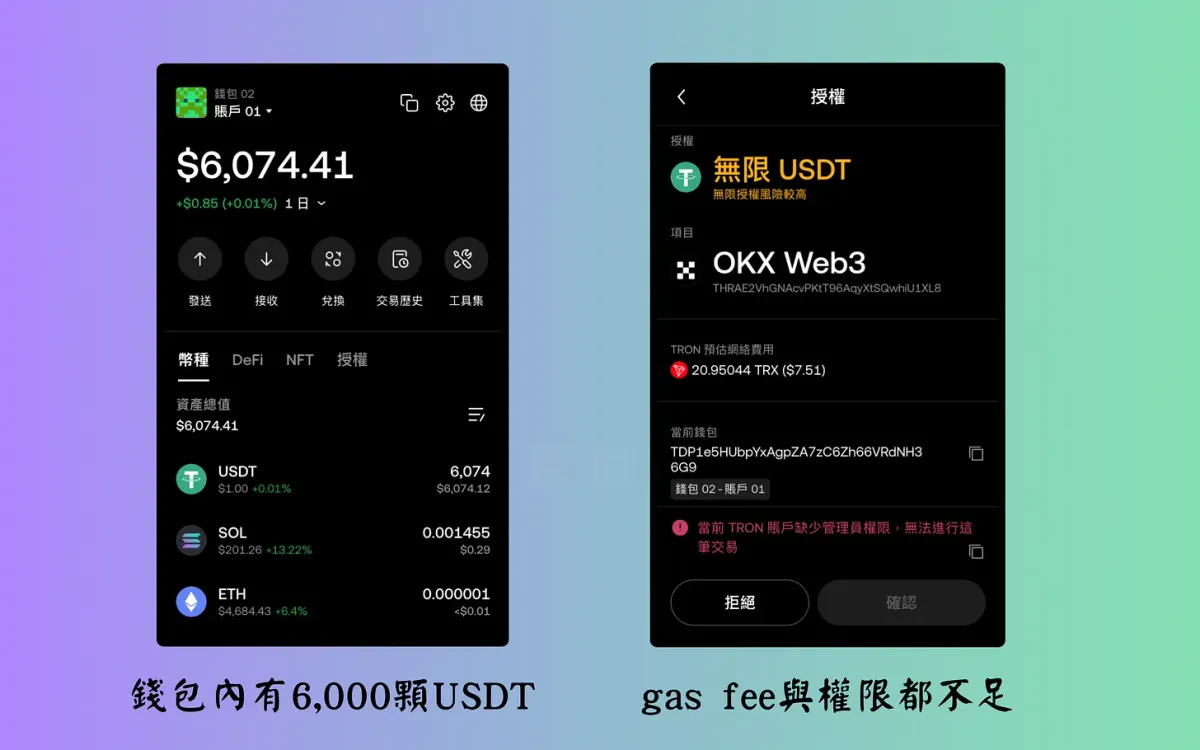

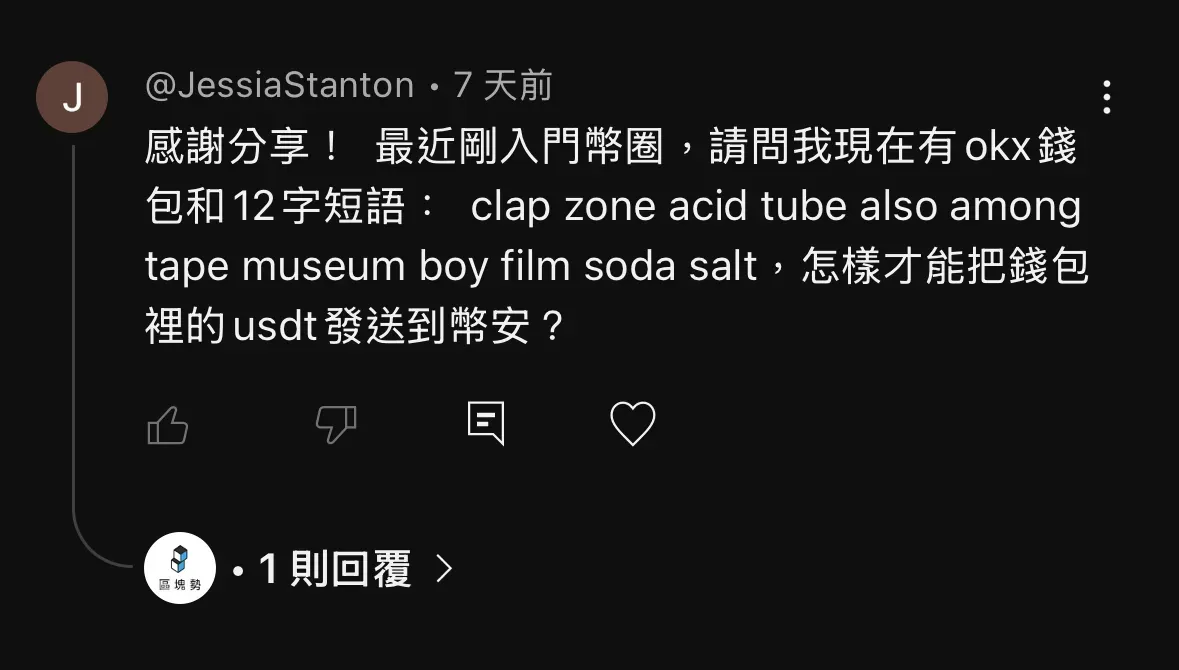

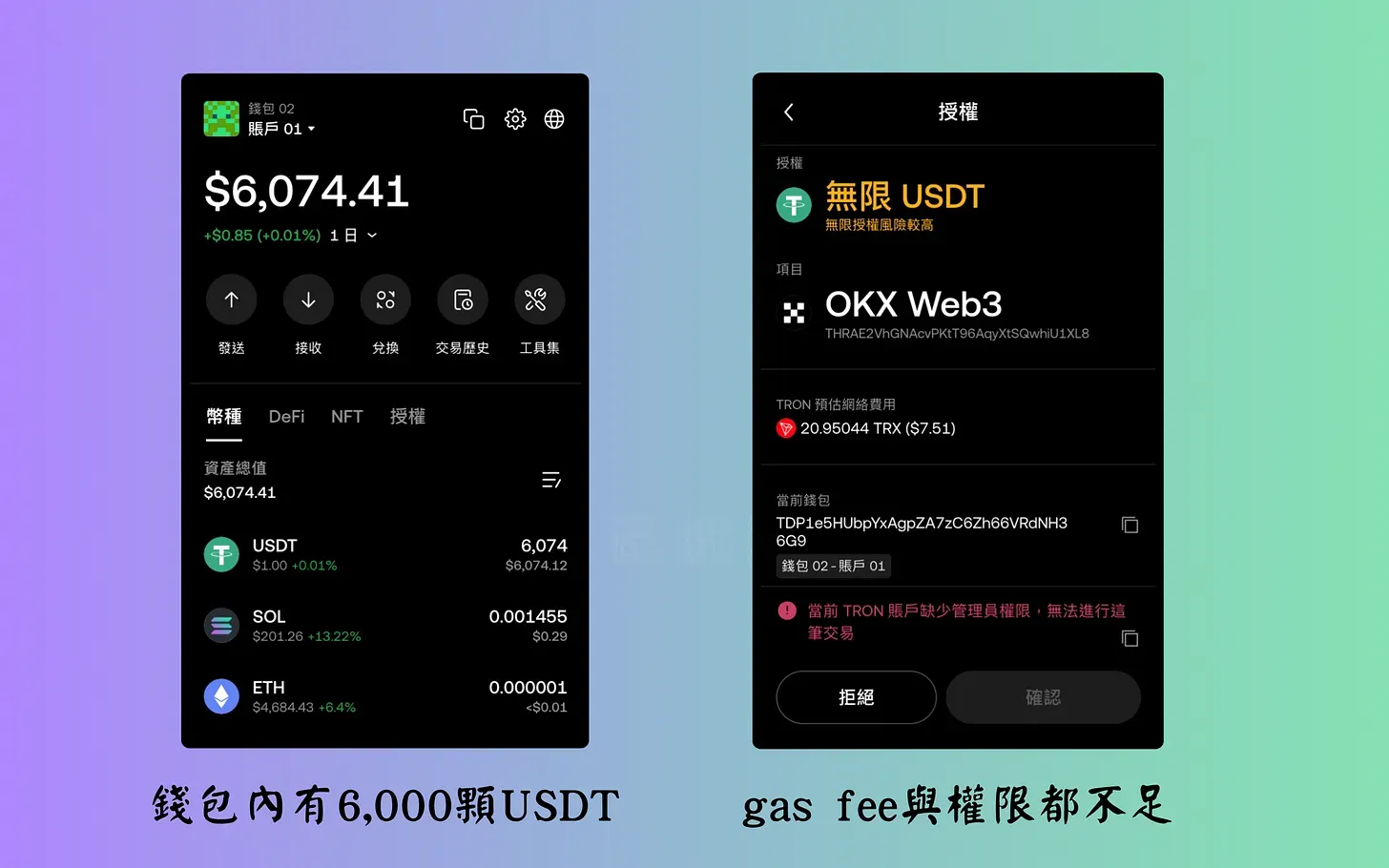

The screenshot below shows a recent comment under a Blocktrend YouTube video. This netizen blatantly posted their seed phrase — something you’re supposed to keep private — and even asked how to transfer the USDT in their wallet to Binance. At first glance, it looks like a rookie mistake in asset security, but it’s actually the most typical phishing scam lately — the seed-phrase bait.

With those 12 English words, not only could you “help” them transfer the funds — you could even do it for them. It makes you wonder: are there really people that gullible? There’s no such thing as a free lunch. In the past, I would just ignore these things to avoid any hidden risks I might have overlooked. But over time, my curiosity would kick in — how much money is actually in the wallet, and how tempting is it? Without getting scammed once myself, I might never scratch that itch 😂. So, I took out an old backup phone, entered the seed phrase, and sure enough — there were crypto holdings on both the BNB Chain and the Tron Chain, showing roughly $1,000 and $6,000 respectively.

The situation on the BNB Chain was simpler. Although it displayed $1,000, the token name “Tedra USD” (USD.T) was suspicious at first glance. The whitepaper and official website looked professional, but they couldn’t withstand third-party verification — a quick search on the blockchain explorers BscScan or OKLink revealed that while the wallet did indeed contain 1,000 units of USD.T, the value was shown as zero, confirming it was a worthless fake token.

The scam syndicate likely studied the price data sources of certain wallets beforehand — for example, referencing CoinMarketCap quotes — to trick the wallet’s display into making users believe that USD.T was an actual U.S. dollar stablecoin.

Their real target is your gas fee. To transfer assets on the BNB Chain, you first need to top up BNB. People who don’t realize the trap might assume that some friendly stranger simply forgot to add gas fees, which is why the transfer didn’t go through. But the moment you deposit BNB, the hacker’s automated scripts will drain your account in the very same second.

Do people actually fall for this? I checked the transaction history of this address — in just one month, it had received nine deposits of BNB, thankfully totaling only around NT$900. But this is just one of the scam syndicate’s wallets. Tracing upward reveals multiple layers, where all the stolen BNB is pooled together.

This kind of scam exploits human nature: it makes you think you’re the mantis stalking the cicada, without realizing the oriole is right behind you. But there is a way to beat it.

Since everyone has the seed phrase, in theory, if you can write a transfer program that’s faster than the scammer’s, you could snatch every incoming BNB first. The scammers know this too — that’s why on the BNB Chain, they only dare to use fake tokens (USD.T) as bait. But on the Tron Chain, they boldly display 6,000 genuine USDT, because they’re confident they can’t lose.

Read-only Seed Phrase

According to Trust Wallet’s explanation, this is a special mechanism of Tron Chain’s multi-signature wallets. Such wallets are controlled by multiple private keys: some have full control of assets, while others are for viewing only. The seed phrase given by the scam syndicate is the “read-only” version — it can show you the balance, but it can’t initiate transfers.

The scammers give you the private key without transfer permissions, while they keep the one with full control. The victim believes that to withdraw USDT, they just need to deposit some TRX to cover transaction fees. But once TRX is deposited, the scammer immediately uses their other private key to transfer it all out. The USDT remains untouched, ready to lure in the next victim.

Although the mechanism is different from that of the BNB Chain, at its core it’s still about scamming for gas fees — just with a more attractive bait, making it even more effective. In less than a month, this address has lured nearly 800 deposits, stealing about US$1,640 worth of TRX, mostly from exchanges like Binance, OKX, and MEXC. Ironically, the minimum withdrawal limit set by exchanges ends up becoming the scammer’s “minimum spending threshold.” I don’t recommend anyone try this out, because even a small deposit will be drained instantly.

The good news is that most wallets now proactively warn users not to import seed phrases provided by strangers. Trust Wallet and OKX’s web wallet even flag cases where the imported seed phrase lacks full permissions. Clearly, there have been quite a few victims.

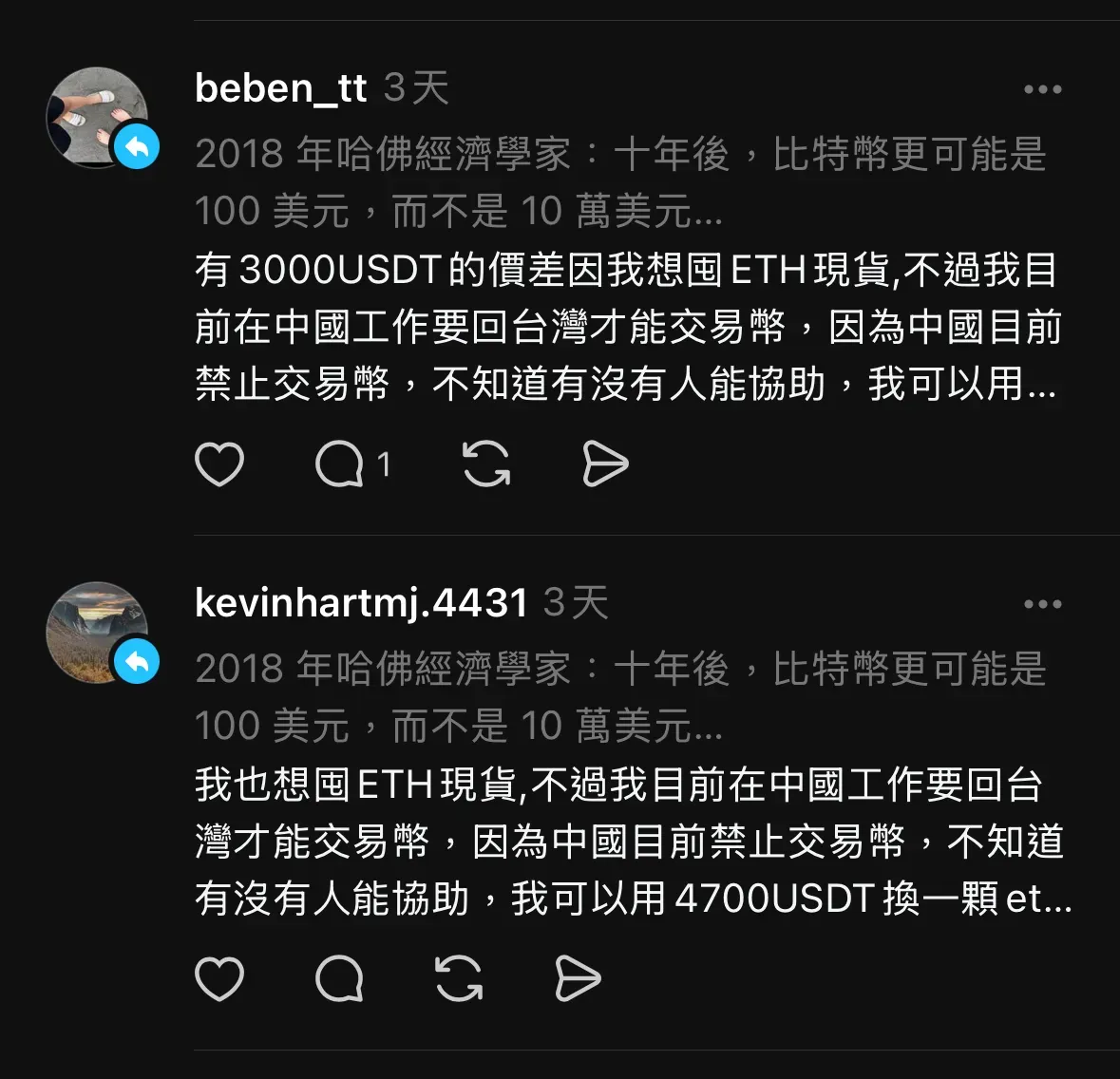

The second common scam method I call “Chinese Sellers of Fake USDT.”

Chinese Sellers of Fake USDT

Below are comments from two different users who replied to the same Threads post on the same day — showing just how fierce the competition is.

Their common tactic is to claim they are based in China, where buying crypto is banned, so they want to purchase ETH at a price higher than market value. The offer was 4,700 USDT per ETH, which at the time was indeed above the going rate. It’s just that ETH’s price rose so quickly over those two days that even the scammers couldn’t keep up 😂. They can’t make the price gap too extreme either — if someone offered US$10,000 for one ETH, everyone would instantly suspect a scam; but if it’s just slightly above market, it’s easier to get people to believe it’s real.

This scam method has actually been around for years. The core idea is to use fake USDT to exchange for your real ETH, and the process is highly standardized:

- First, they invite you to do a small test transaction to “prove” their USDT is real and gain your trust.

- After the test succeeds, they move on to a large transaction — but this time, all the USDT they send is fake.

- You only realize after the trade is over that the USDT cannot be redeemed. They’ll blame it on the exchange, then disappear.

The key behind this scheme is the fake USDT on the ETHPoW1 zombie chain, along with wallets that still support this chain. The scammers first send some ETHPoW-chain USDT to your wallet, then ask you to test whether it can be deposited into your usual exchange. Of course, it can’t. But at the same time, they monitor your wallet address — once they see where you send the fake USDT, they immediately send an equal amount of real USDT to that same exchange. This “perfect timing” easily convinces people that their money is genuine.

Once trust is established, things get easy for them. Every time they send you USDT, you send them ETH according to the agreed rate. After several rounds, they’ve traded all your real ETH for their fake USDT.

My advice is to simply ignore such messages. But if you really want to counter-scam them, your best chance is to find a reason to increase the transaction amount during the very first test — because that’s the only time the scammers will send real money, and it’s their cost.

In the past, I would delete such comments as quickly as possible to avoid anyone falling for them. But since most of these comments are generated by bots, the deletion rate can never keep up with the posting rate. Now I prefer to reply directly under their comment with “This is a scam,” and in the future, I can attach this article from Blocktrend, encouraging people with spare time to treat it as a practice exercise. Unless scammers decide the cost outweighs the return, it’s difficult to drive them out of the market entirely.

1 ETHPoW: Following Speculators’ Moves Ahead of the Ethereum Merge