Holding No Stocks, Yet Commanding the Most Liquidity: Ondo’s Zero-Inventory Strategy as a Tokenized U.S. Equity Issuer

GM,

This weekend marks the Lunar New Year holiday, and Taiwan’s stock market is about to close for the break. For stock investors, no matter what major events unfold around the world, everything can wait until after the New Year. But such “annual holidays” may soon become a thing of the past—because a 24/7 stock token market has already arrived.

Last week, Ondo Finance, the world’s largest issuer of tokenized U.S. Treasuries and U.S. equities, held a summit in New York. Ondo directly pointed out that past RWA (Real World Assets) efforts focused on tokenizing illiquid assets such as fine art and real estate—arguably the wrong direction. The true potential of RWA, they argue, lies in making already highly traded liquid assets like stocks and bonds even more accessible through tokenization.

Investing in U.S. stocks has been extremely popular in Taiwan in recent years. Many people have opened accounts with Firstrade, Charles Schwab, or Interactive Brokers. Isn’t that simple enough already?

The Hidden Costs of Investing in U.S. Stocks

For Taiwanese investors, there are two main ways to invest in U.S. equities:

- Through a Taiwanese brokerage via sub-brokerage (複委託).

- By directly opening an account with an overseas brokerage.

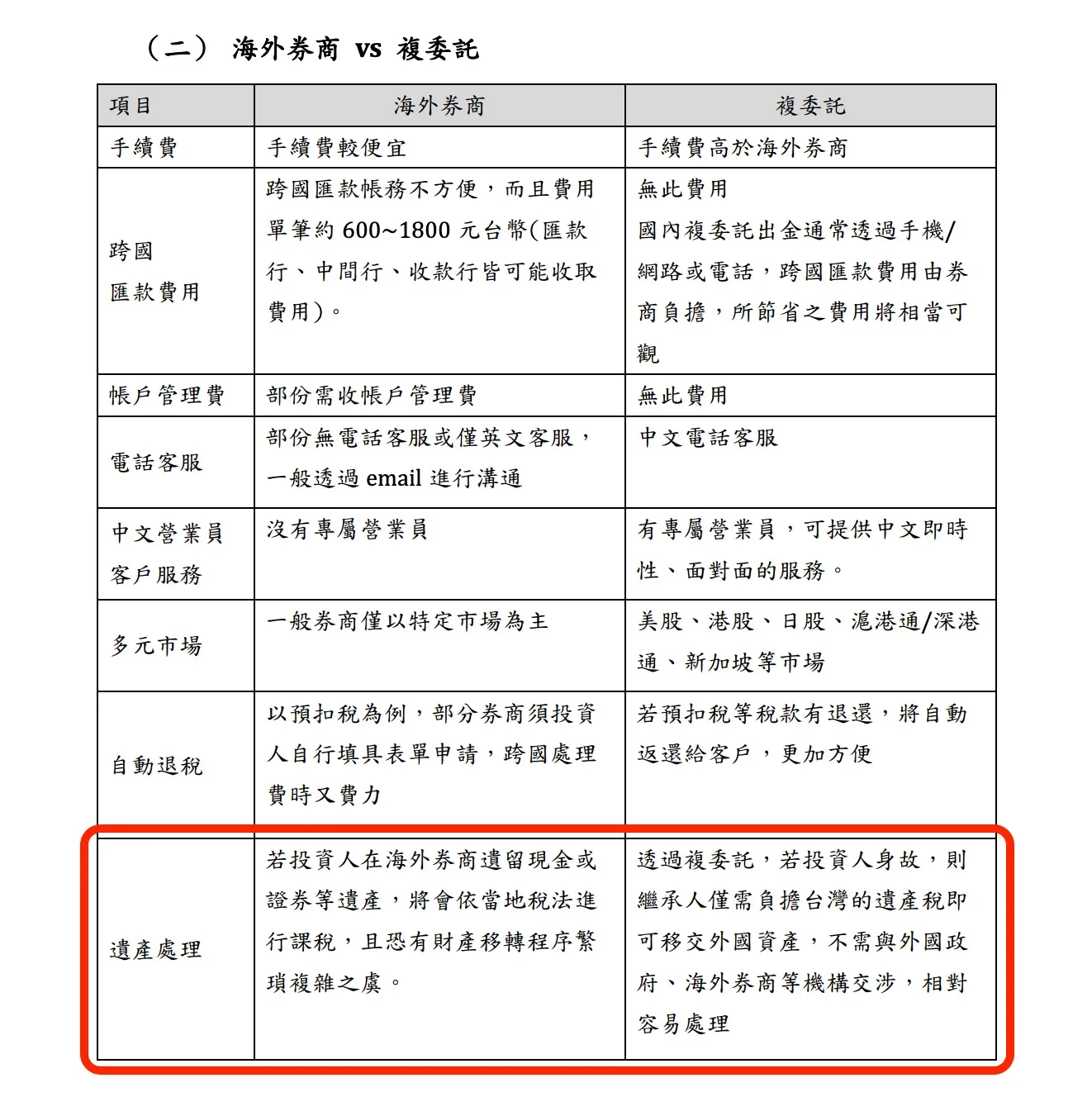

Many experts suggest that if your investment amount is small and your trading frequency is low, using sub-brokerage is sufficient. Even though the fees are higher, it saves a great deal of operational hassle. Overseas brokerage accounts, on the other hand, are better suited for investors with larger capital and more frequent trading. Over time, the savings on transaction fees can be substantial.

However, opening an overseas brokerage account comes with two major hidden costs: cross-border wire transfer feesand estate tax of up to 40%. Previously, I wrote about how stablecoins and the built-in personal U.S. bank accounts in the Fluidkey wallet can reduce wire transfer fees by as much as 99%¹. But the impact of estate tax is potentially far greater—yet it receives far less discussion. According to online user experiences:

When Taiwanese investors open U.S. brokerage accounts and hold more than USD 60,000 (approximately TWD 1.95 million) in U.S. assets, estate tax becomes an issue upon the account holder’s death. The U.S. is extremely strict with non-residents.

For U.S. citizens, the estate tax exemption exceeds USD 10 million. But for “non-U.S. persons” (including Taiwanese investors), the exemption is only USD 60,000. Any amount above that may be subject to estate tax ranging from 18% to 40%.

If you have USD 500,000 in your account, you might first have to pay around USD 140,000 to the U.S. government before the remaining funds can be transferred.

What’s even more daunting than the tax itself is the lengthy administrative process. Many people mistakenly believe that “once you pay the 40% tax, the remaining money can be immediately withdrawn.” This is a major misunderstanding. For family members, paying the tax is only the beginning of the ordeal. The truly exhausting part is the cross-border administrative process that can last one to two years.

Estate tax has thus become a major selling point for domestic brokerages promoting sub-brokerage services.

For example, in CTBC Securities’ sub-brokerage trading manual, estate handling is explicitly listed as one of the advantages. The key selling point is that only Taiwan’s estate tax needs to be paid in order to transfer foreign assets—without having to negotiate back and forth with foreign governments or overseas brokerages. Taiwan’s estate tax exemption is TWD 13.33 million (approximately USD 420,000), significantly higher than the U.S. threshold of USD 60,000. And for those seeking legal tax planning, it is relatively easy in Taiwan to find professionals familiar with the system to provide assistance.

For a long time, sub-brokerage fees, cross-border wire transfer costs, and how to handle estate tax have all been part of the homework Taiwanese investors must complete before investing in U.S. stocks. Most people have grown accustomed to these frictions, even seeing them as unavoidable costs of accessing overseas markets.

But viewed from another angle, these “taken-for-granted” preparations reveal that—even in a place like Taiwan, where financial services are sophisticated and investment channels are diverse—there are still considerable frictions involved in cross-border trading of U.S. equities. This led Ondo Finance to pose a provocative question at its summit: “Why can’t investing in U.S. stocks as a foreigner be as simple as buying and selling Bitcoin?”

Instant Minting

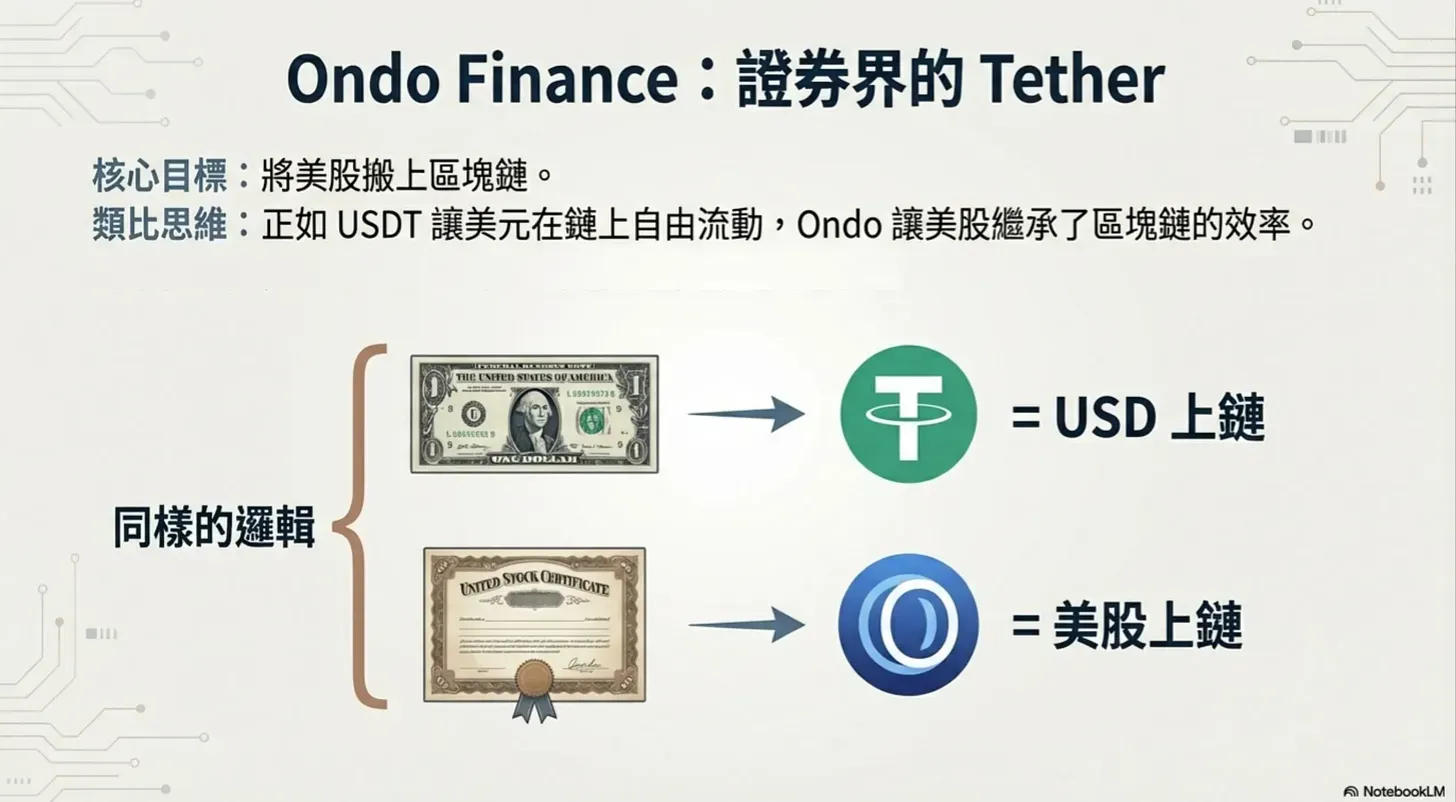

Ondo describes itself as the Tether of the securities world.

USDT, issued by Tether, brings U.S. dollars on-chain. What Ondo aims to do is bring U.S. equities on-chain.

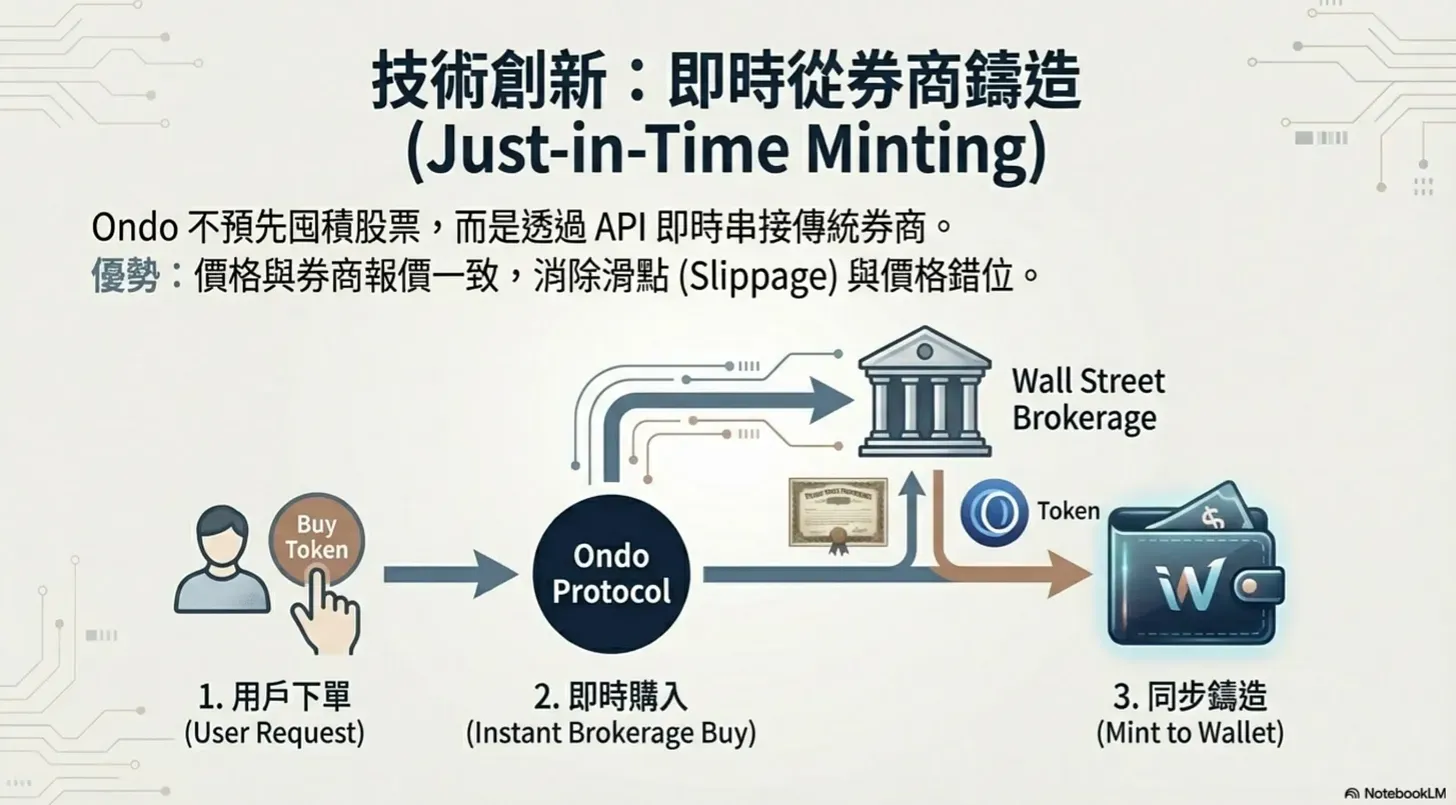

Like many others, I previously had a preconceived notion about the “tokenization of U.S. stocks,” assuming it was merely a self-referential tool for crypto investors—characterized by poor liquidity and unclear investor protections. However, Ondo’s recent summit gave me a fresh perspective on the latest developments in equity tokenization. The key lies in their proposed issuance mechanism: Just-in-Time Minting—minting directly from brokerages on demand.

According to Ondo:

In tokenized asset markets, slippage, liquidity, and price dislocation are interconnected factors that significantly impact trading efficiency and price stability… Ondo’s tokenized stocks address these issues through instant, low-cost minting and redemption, inheriting liquidity from traditional markets. This enables arbitrageurs to quickly and efficiently correct price discrepancies, reducing token slippage and spreads from day one.

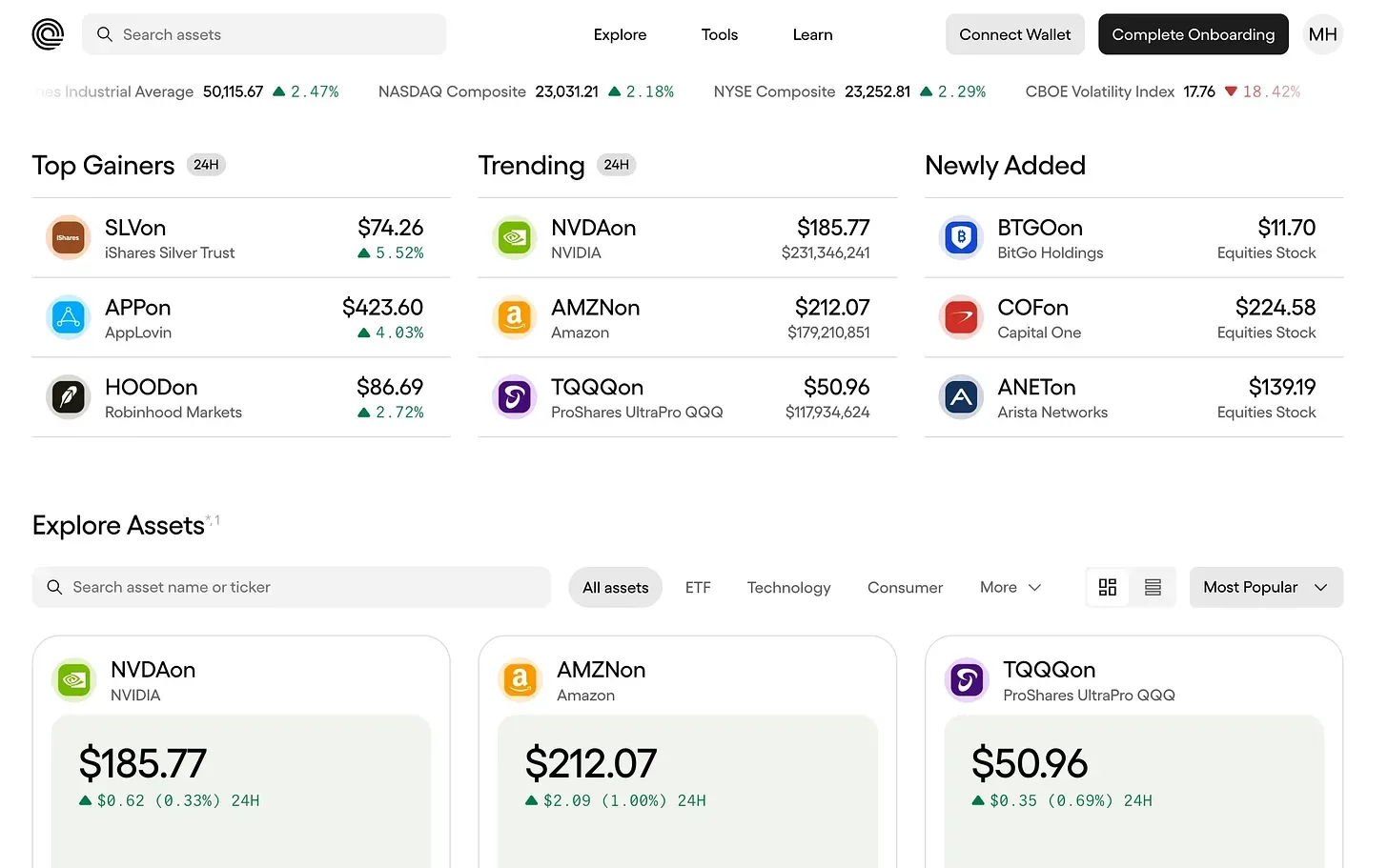

The screenshot below is from Ondo Finance’s website. You can think of it as another U.S. stock brokerage platform. Users must complete identity verification (KYC) to open an account before they can begin trading stocks.

If an investor places an order for one share of NVDAon, Ondo will immediately acquire one share of NVDA through its partner traditional brokerage, mint a corresponding on-chain token, and deposit it into your personal wallet for self-custody. As long as you’re not purchasing hundreds of thousands of dollars’ worth in a single trade, the execution price will generally match the quoted price you would receive by buying NVDA directly through a brokerage. This is because Ondo mints tokens just in time, sourcing the shares from traditional financial markets before tokenizing them—rather than pre-minting a batch of stock tokens and leaving them on-chain to await trading.

What are the advantages of this approach? The answer becomes clear when compared with the pain points Taiwanese investors face when trading U.S. stocks. When purchasing tokenized U.S. equities through Ondo, all you need is U.S. dollar stablecoins. This preserves the advantages of both sub-brokerage and overseas brokerage accounts—without incurring sub-brokerage transaction fees or dealing with expensive cross-border wire transfers. As for estate tax, well… you know the answer. It’s similar to other cryptocurrencies—tax authorities may need some time to catch up with the latest developments.

Past stock tokenization projects often struggled with the so-called “cold start” problem. For example, platforms like FTX or Backed would typically purchase a batch of overseas depositary receipts or physical shares first, then mint corresponding on-chain tokens for investors to trade. In the early stages, however, limited investor participation meant low trading volumes. Observing insufficient liquidity and wide bid-ask spreads, other investors hesitated to join—creating the classic chicken-and-egg dilemma.

Ondo’s approach is more pragmatic. Instead of attempting to build an entirely new “on-chain Wall Street” from scratch, it directly bridges Wall Street’s existing liquidity onto the blockchain. Through its instant minting and redemption mechanism, token prices are tightly linked to traditional financial markets. This not only significantly enhances liquidity but also sidesteps the cold start problem.

In addition, Ondo claims to have designed a legal structure that isolates bankruptcy risk. In other words, even if Ondo were to encounter operational difficulties in the future, the stock tokens held by investors would not be used to cover corporate liabilities.

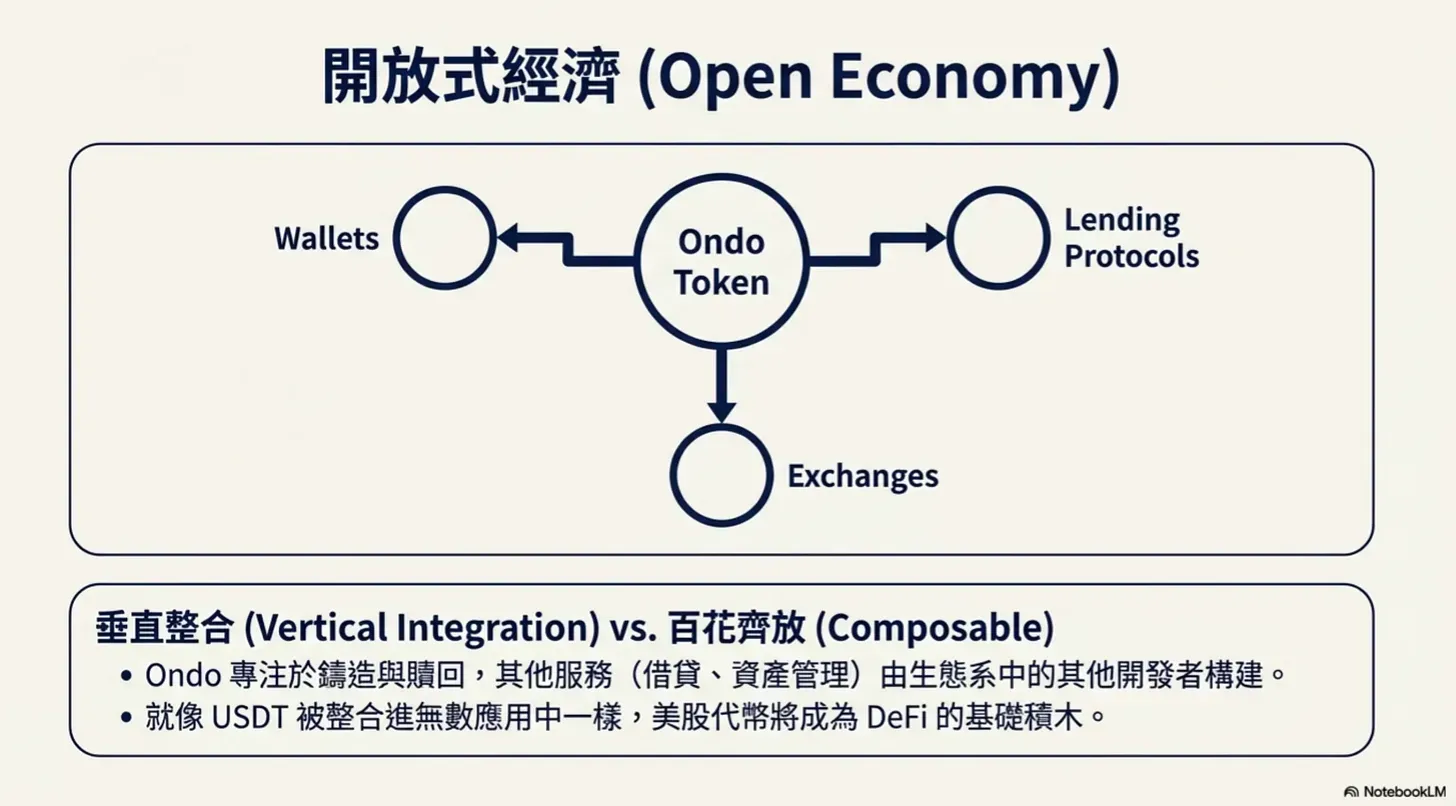

Compared with the New York Stock Exchange’s planned tokenized stock trading platform, Ondo’s model is closer to the operating logic familiar to crypto investors. It focuses on connecting traditional brokerages with blockchain infrastructure, specializing in custody, minting, and redemption at the foundational layer. As for what investors choose to do afterward—using these stock tokens for lending, providing liquidity, or transferring them peer-to-peer—that already belongs to the secondary market, beyond Ondo’s control. Anyone who has witnessed the rapid rise of stablecoins over the past year can better imagine how many new possibilities stock tokenization may unlock.

What struck me most is that, in the future, every investor could potentially create their own personalized ETF. Although there is already a wide variety of thematic ETFs on the market, with AI tools assisting portfolio construction, in theory anyone could assemble an investment portfolio the way they curate a Spotify playlist—and even allow others to copy their “personal ETF.”

Technically, this is already feasible. But it also goes beyond Ondo’s current scope, highlighting just how early the development of tokenized U.S. equities still is.

An Open Economy

Although investors can now trade tokenized U.S. stocks through Ondo, this alone is not enough to persuade users of Firstrade, Charles Schwab, or Interactive Brokers to switch platforms. The missing piece in the market is a dedicated “brokerage app” designed specifically for tokenized equities.

What Ondo currently provides is only the most basic trading functionality. Traditional brokerages, by contrast, deal directly with investors and offer portfolio management, performance tracking, tax reporting, and even live customer support to resolve complex issues. I predict that Ondo is unlikely to vertically integrate all these services itself. After all, decentralized ecosystems have never excelled at vertical integration—they thrive on diversity and modular growth.

Just as USDT’s strength does not come from Tether building every application itself, but from being widely integrated into exchanges, wallets, and various on-chain services—becoming an indispensable foundational component within other products. And before integrating USDT, these applications do not need Tether’s permission. That is what defines an open economy.

Experts steeped in traditional finance often conflate the open economy with regulatory arbitrage²³, assuming that the reason USDT enables cheap and fast cross-border transfers is simply because it bypasses compliance costs. When Ondo tokenizes U.S. equities in the future, these experts may similarly conclude that such convenience must come at the expense of regulation—without recognizing that this actually represents an entirely new division-of-labor framework. In other words, finance itself may be reassembled in different ways.

3 To Chairman Tung Jui-bin: EasyCard Is Not a Stablecoin—Here’s the Key Difference