Google Lets AI Shop for You! Blockchain’s Back-End Adoption

GM,

Blocktrend’s 2025 satisfaction survey opened last week. Thank you to the first nearly one hundred members who have already filled it out. I also invite readers who haven’t yet responded to take 10 minutes to share your thoughts.

Over the weekend, I read through every piece of feedback one by one. One comment in particular really resonated with me:

Blocktrend subtly guides readers to shift from an investor (or speculator) mindset to a user mindset, and ultimately to become true Web3 citizens.

In an era when AI can generate a complete report with a single click, personal experience and value-based choices—right or wrong—are the hardest things to replace. Now, let’s get into it.

Last week, in the “2026 Major Events Overview 1”, I mentioned that AI could become a potential user of cryptocurrencies, and might even replace humans as the main protagonist of the on-chain economy. This week, Google and e-commerce giant Shopify jointly launched the Universal Commerce Protocol (UCP), aiming to enable AI to shop autonomously. When I saw this news, my first reaction was actually: “How many protocols does AI really need before it can actually buy something?”

AI Shopping Hits a Wall: Able to See, Unable to Buy

Have you ever had an AI-assisted shopping experience? Recently, my family switched to an electric vehicle, and there’s been a lot to relearn. Just choosing a charging adapter was enough to give me a headache. With gas-powered cars, you simply pick 92 or 95 octane fuel, and even if you get it wrong once in a while, it’s no big deal. But EV charging isn’t just about fast charging versus slow charging—it also involves a whole array of adapters that aren’t compatible with one another.

To buy a charging adapter, I would normally have done my own research online. The laziest approach is to open PChome or momo, search with a few keywords, and let the platform recommend products while also vetting sellers and handling payments. This time, I asked AI for recommendations instead. Unlike humans, who usually start with a familiar platform and then look for products, AI searched across the entire internet and eventually gave me what it considered the best option.

It sounded ideal, but in practice it was a bit awkward. Because AI still couldn’t check out on my behalf, I had to go back and search for which merchant actually sold the item. In the end, I returned to the original shopping flow. With or without AI, the experience didn’t feel all that different.

The key issue is that merchants’ shopping flows were never designed for AI in the first place. Even if AI can “see” the products, it doesn’t know how to complete the checkout process. The Universal Commerce Protocol (UCP), jointly launched by Google and Shopify a few days ago, aims to bridge this final gap and enable truly autonomous AI shopping.

Unlocking Autonomous AI Shopping

According to Shopify:

Commerce is one of humanity’s oldest activities. Although it happens every day, the rules of transactions can differ completely around the world … Different countries have their own payment methods, discount rules are complex, shipping options are overwhelming, and each store has its own unique specifications … The Universal Commerce Protocol (UCP) was created to bring order to this chaos—a standard that allows AI to understand the differences between stores and complete purchases according to each merchant’s rules.

Compare this with how humans shop. I choose a platform first and then look for products because I want a familiar shopping experience. AI, however, has no habits and won’t abandon a better deal just because it’s “too lazy to register an account.” If AI’s optimal strategy is to cast a wide net across the entire internet, then a shopping flow should be built specifically for AI from the ground up—one that truly allows it to place orders and compare prices across tens of thousands of merchants.

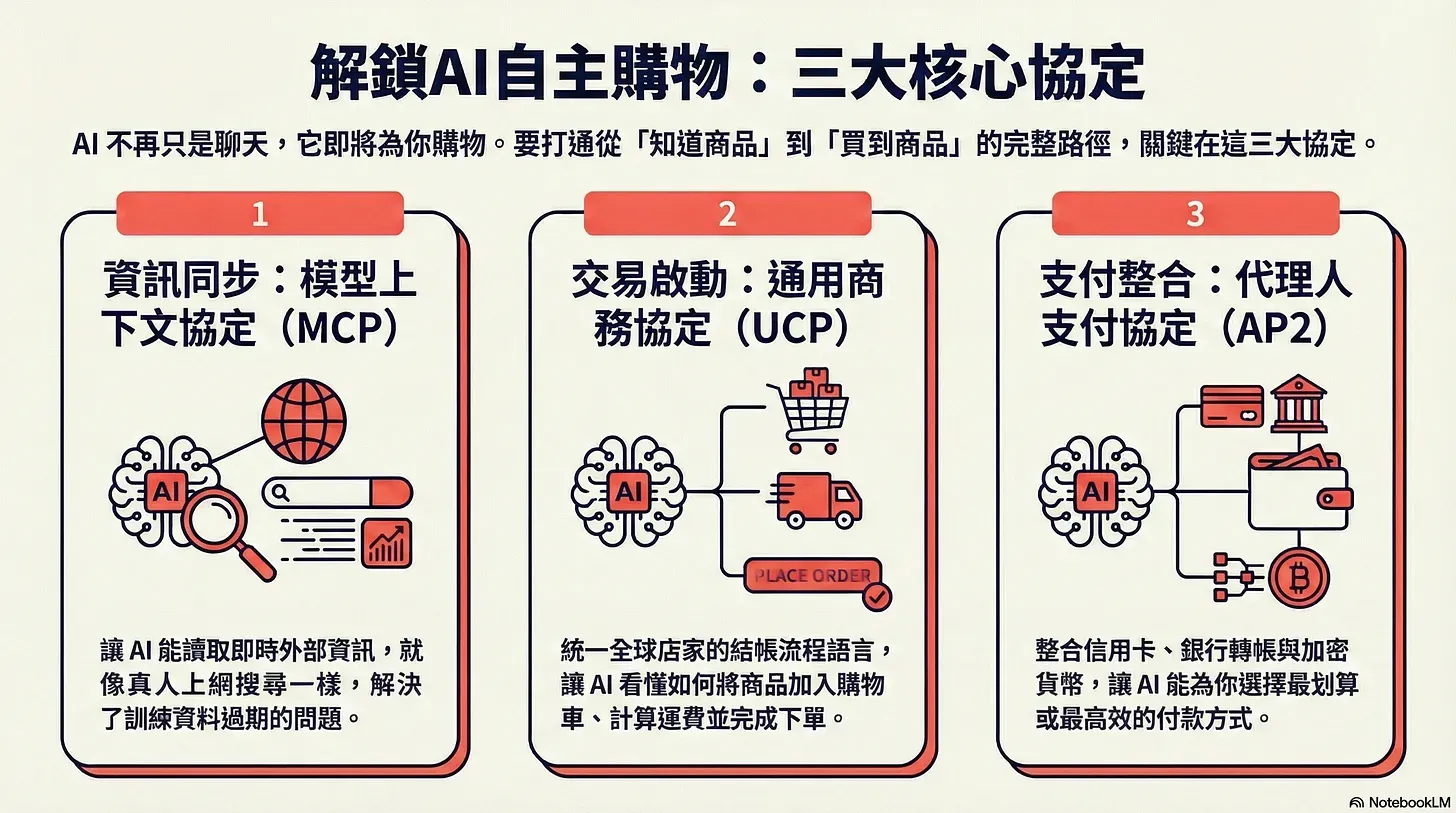

The AI shopping process can be roughly divided into two stages: synchronizing information, and then initiating transactions.

In the past, the most common warning when using AI was that its “training data is outdated.” If you asked about today’s weather, it would reply that it knew nothing about the real world because its training only went up to a few months ago. With the advent of the Model Context Protocol, however, AI can now read real-time external information, much like a human browsing the web.²

But “knowing” about a product and actually “buying” it are two very different things. Every merchant has a different checkout flow, and sometimes even humans get stuck. This is why Google and Shopify introduced a new protocol—UCP—to persuade merchants worldwide to describe their checkout processes in a unified, AI-readable language. This allows AI to understand how to add items to a cart, what the free-shipping thresholds are, and which delivery options are available.

Once items are successfully added to the cart, the final hurdle is payment. At checkout, AI will rely on another Google-built standard: the Agent Payment Protocol. This protocol unifies credit cards, bank transfers, and cryptocurrencies into a single payment interface, enabling AI to choose the optimal payment method.

So, returning to the question at the beginning: how many protocols does AI need to actually buy something? Humans, out of convenience, tend to solve all their needs on a single platform, with the experience defined by a handful of companies. AI has no such habits. These protocols exist to pave the road for AI—clearing the bottlenecks that would otherwise block it during the shopping process.

Precisely because AI has no habits, cryptocurrencies may finally find their way into the everyday lives of people in Taiwan within our lifetime. I call this “back-end adoption.”

Front-End Adoption vs. Back-End Adoption

Over the past few years, I’ve often been invited to give talks around the country. My biggest takeaway is this: getting cryptocurrencies into everyday life in Taiwan through front-end adoption is extremely difficult.

Only people in high-inflation countries are driven by survival to proactively download wallet apps and manage private keys. In Taiwan, most people don’t have such concerns. Existing financial services are already stable and good enough. Even if, in the coming years, all the technology were to fall into place—seamless cross-chain transfers, massive on-chain throughput, wallets with social recovery—I still believe a large group of people would continue to keep cryptocurrencies at arm’s length simply out of habit. As long as life is manageable, crypto is something they will never actively touch in their lifetime.

I know habits are hard to change. But back-end adoption quietly slips into people’s existing habits. Two major shifts are happening in the world right now:

- AI is changing user behavior: we’re moving from “Googling” to “asking AI,” and eventually to “having AI shop on our behalf.”

- Financial assets are moving on-chain: more and more assets—bank deposits, U.S. Treasuries, funds—are being tokenized on blockchains because settlement is more efficient.

So far, these two trends may seem unrelated—until the day AI can shop autonomously.

It’s already an objective fact that completing transactions on blockchains is cheaper and more efficient. Payment rails that allow AI to pay with cryptocurrencies are also already in place. When humans reach the checkout stage, AI will naturally recommend using blockchain-based payments, because they’re simply more cost-effective.

Even if consumers’ deposits remain in bank accounts, once financial institutions support on-chain payments, users won’t need a wallet at all to pay with cryptocurrencies. No need to actively learn anything, higher efficiency—what reason would there be to refuse?

That’s back-end adoption. It’s not humans choosing to use cryptocurrencies; it’s AI automatically making that choice for them. And when humans are no longer the only users on-chain, the long-overlooked values of censorship resistance and decentralization become more salient than ever—because they directly determine whether AI can complete transactions smoothly.

After all, for most people in Taiwan, being told that a small everyday payment might be arbitrarily blocked tends to feel far more real than being warned that a bank could fail someday. Wouldn’t you agree?

1 A 2026 Overview of Major Events: Goodbye to the Four-Year Cycle