FTX Initiates Repayment: Six Must-Know Truths

GM,

I’m writing this article in the hospital (accompanying a patient), and I’ll upload the audio recording later. Let’s get straight to the point.

FTX is finally paying people back! Looking back to November 2022, hardly anyone would’ve believed the FTX saga could wrap up this quickly. At the time, we were witnessing one of the most catastrophic collapses in crypto history — the world’s second-largest exchange crumbling in just a few days. Millions of users were locked out of their funds, and Sam Bankman-Fried (SBF), once hailed as a genius founder, was exposed as a fraud.

The two-year-long FTX saga is finally nearing its end, and the repayment process has progressed much faster than expected. The bankruptcy team’s efficiency is rare in major financial collapses. To everyone who endured this storm, I want to say—you’ve been through a lot. We didn’t just witness history; we became part of it.

But as expected, rumors are swirling online. In this article, I’ll break down the current situation with six key questions and answers, along with my firsthand experience.

1. Has everyone been paid back?

False. February 18 marked only the first wave of FTX repayments, and it was limited to “small creditors” with claims under $50,000.

The court-approved repayment strategy follows a “small first, large later” approach to compensate as many users as possible right away using the least amount of funds. The second wave is set to begin on May 30 and will include:

- “Large creditors” with claims over $50,000

- “Small creditors” from the first wave whose payments were delayed

However, this timeline only applies to users going through the U.S. bankruptcy process. Those who opted for the Bahamas proceedings will follow an entirely different schedule.

2. Why haven’t I received my money yet?

You’re not alone. My family and I had five FTX accounts (all classified as small creditors under $50,000). Four of them were successfully repaid, but one was marked as “disputed.”

Disputes can happen for several reasons, the most common being discrepancies between the declared claim and FTX’s records—usually due to tokens or NFTs that are now worthless. If your account is flagged, you just need to wait for FTX to issue a notice ( 1 and 2) and respond within the specified time frame to accept their proposed settlement. It’s really just a matter of time, so there’s no need to stress.

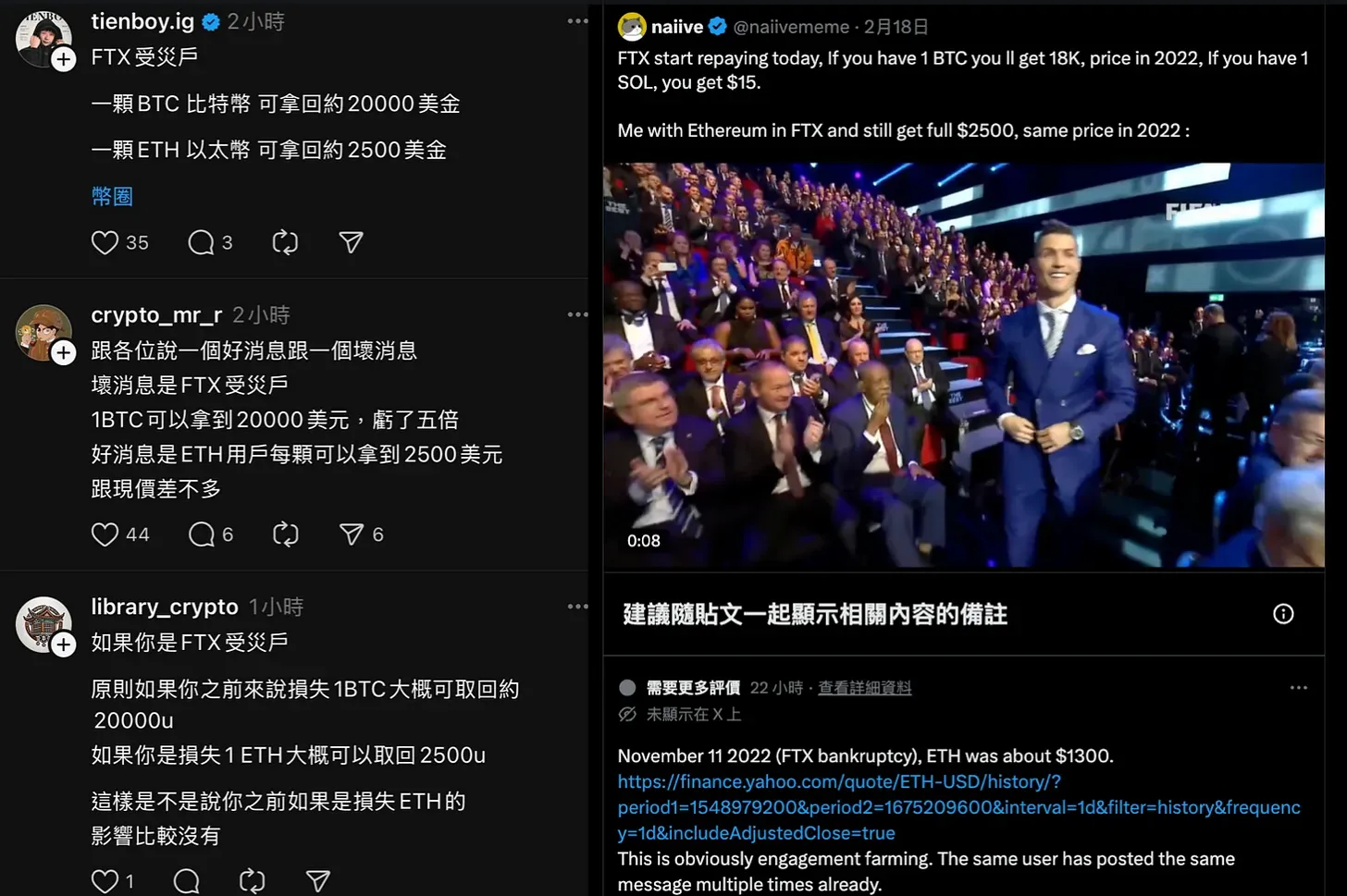

A particularly wild rumor has been circulating online recently, claiming that “ETH’s current price is the same as when FTX filed for bankruptcy in 2022”. It’s been widely shared but is completely false.

3. Can I get $2,500 back per ETH?

Wrong. This rumor has been spreading globally, but very few people have taken the time to verify it. Checking ETH’s historical price is simple—just Google “ETH,” and you’ll see a chart of its price history, similar to stock charts.

The truth is: when FTX filed for bankruptcy, ETH was priced at $1,258. Today, it’s around $2,700—more than double. So why are so many people spreading such obviously false information?

The main reason is that ETH has underperformed over the past year, creating the perception that it “never goes up.” This fake news played perfectly into that sentiment, giving people an excuse to mock ETH. The post got plenty of likes, shares, and engagement. Even though some knew it was false, they still spread it, likely with bad intentions.

According to official bankruptcy court documents, all crypto assets were valued based on their prices at the time of FTX’s bankruptcy filing in 2022, and creditors are being repaid in USD. Here’s how major cryptocurrencies were priced back then:

- BTC = $16,871 (~18% of its current price)

- ETH = $1,258 (~47% of its current price)

- SOL = $16 (~10% of its current price)

- USDT = $1 (100% of its current price)

The biggest losers were users holding SOL, followed by BTC and ETH holders. Only those who held stablecoins like USDT avoided any losses. Despite this, the FTX bankruptcy team has claimed in court that creditors are receiving 119% of their claims—painting an overly optimistic picture and glossing over the reality that many users are still facing substantial losses.

4. The Misleading “119% Repayment” Narrative

When FTX’s bankruptcy team took over, they discovered something unexpected—FTX wasn’t entirely out of money; it had simply lost track of its assets. In the end, they recovered far more than the company owed. The court approved repayments with a 9% annual interest rate, resulting in creditors receiving 119% of their claims (valued in USD) after more than two years of liquidation.

However, that 119% is based on the USD value at the time of FTX’s bankruptcy filing—not the current market value of the crypto assets. For users who held BTC, ETH, or SOL during the collapse, the losses remain significant despite the so-called full repayment. Why does the bankruptcy team keep highlighting the “119% repayment”?

It comes down to conflicting interests. The bankruptcy team charges by the hour and needs to showcase “strong results” to justify their hefty fees to the court. Even though they know the current repayment plan is unfair to many victims, they lack any financial incentive to push for a more equitable solution. That’s why the “119% repayment” figure, while technically correct, ends up being misleading to the public.

5. What Should You Do With the USD Repayment?

Once you get your repayment, there are essentially two options:

- Wire the USD to your bank account

- Convert it into stablecoins and keep it in the crypto market

The current crypto market is highly polarized. On one side, there’s the mindless meme coin mania; on the other, complex DeFi protocols with steep entry barriers. With few accessible and engaging applications for the average user, many have chosen to cash out entirely.

If you plan to wire the money to a Taiwanese bank, there are some pros and cons to consider:

- Pro: The remittance can count towards your annual overseas tax-free allowance (up to NT$7.5 million).

- Con: Some banks might reject transfers from crypto exchanges like Kraken.

From community feedback, foreign banks tend to be more crypto-friendly, while local Taiwanese banks can be hit-or-miss. CTBC Bank (中國信託) is notoriously anti-crypto, so proceed with caution.

Personally, I decided to keep most of my funds in the market. I used Kraken to convert my USD repayment into stablecoins, while setting aside a portion as a travel fund—a way to celebrate getting through this entire ordeal. Although many have now successfully received their repayments, this process is still in its early stages. There’s a long way to go before the FTX saga is truly behind us.

6. What Impact Will This Have on the Market?

FTX is set to repay up to $18 billion in total, with the first wave of repayments amounting to $1.2 billion, less than 7% of the overall funds. It’s still too early to predict how this will affect crypto prices in the long run.

Rather than focusing on short-term market movements, I’m more concerned about whether people have truly learned anything from this debacle. How many will move their assets into self-custodied wallets for greater security? Honestly, I’m not optimistic.

The problem doesn’t lie with users but with the technical barriers. Even though I’ve been actively promoting the advantages of multi-signature wallets, the user experience remains complex. Even Coinbase’s flagship product, the Passkey Wallet1, which emphasizes “ease of use,” admitted during its earnings call that market adoption has fallen short of expectations. Most people still prefer to go with exchanges that “seem trustworthy” or reluctantly buy a cold wallet despite the extra hassle.

Looking back at the short history of cryptocurrencies—just over a decade—we've already witnessed far too many exchange collapses. After every crisis, the community loudly echoes the phrase “Not your keys, not your coins,”emphasizing the importance of self-custody. Yet, as new users flood in and the sense of crisis fades, people inevitably return to exchanges.

I believe exchanges serve a necessary purpose, but history has shown that their evolution has been brutally unforgiving. The collapse of Mt. Gox led Japan to establish some of the world’s most advanced cryptocurrency regulations, while the downfall of FTX ushered in an era of heavy regulation in the United States. This regulatory safety often comes at the cost of painful lessons learned from major disasters. No one can say with certainty that FTX will be the last collapse. If you only want to witness history rather than become part of it, a personal wallet remains the simplest and most reliable choice.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.