Ethereum’s 10th Anniversary: The Blockchain That Entered the World With Me

GM,

Today (July 30) marks the 10th anniversary of Ethereum's genesis. You can click to mint a limited-time commemorative NFT. Before diving in, let me share a short personal story.

A Decade of Ethereum

Ten years ago, I had just graduated from graduate school and officially shed my student status.

I was thrilled at the time, because I had never been a high-achieving student. The way I preferred to learn was to first get hands-on experience and then circle back to fill in the knowledge. But the school system taught us that you had to get good grades before you were allowed to explore. As a result, my desire to discover kept getting pushed back, and my motivation to study was low—I just aimed to scrape by. Ironically, I did pretty well in my electives, because those were the subjects I was truly interested in.

To me, graduating meant that my “class schedule” was now a blank slate—I could fill it in however I liked. Coincidentally, that same year—July 30, 2015—the Ethereum genesis block was born. In the decade since, Ethereum has gone through 16 system upgrades of various sizes 1, yet it has never experienced downtime. Compared to traditional banks and exchanges that go offline for maintenance for hours at a time, Ethereum’s ability to upgrade its core system without ever needing to shut down is nothing short of a miracle. And this is only its first decade.

To celebrate the 10th anniversary, the Ethereum Foundation recently launched the “Ethereum Torch NFT,” enabling the global community to pass it along like an Olympic flame—one person at a time, in a continuous relay. Each person may hold it for only 24 hours before handing it off. The final NFT will be “burned” on July 30, symbolizing the preservation of Ethereum’s decade of achievements. The first torchbearer was Ethereum co-founder Joseph Lubin 2, followed by Audrey Tang 3 from Taiwan. These days, few would dispute that Ethereum is the most important blockchain aside from Bitcoin. But if we rewind to 10 years ago, online commentary about Ethereum was often brutal—many dismissed it as “good for nothing.”

From Good-for-Nothing to Industry Benchmark

In 2014, Ethereum founder Vitalik Buterin first introduced “Ethereum” on a Bitcoin forum. In hindsight, it felt like he was challenging the establishment. Back then, Bitcoin was synonymous with the entire crypto industry. A “Bitcoin forum” was essentially the “blockchain forum,” and people’s imaginations about decentralization were largely limited to Bitcoin.

But Vitalik wasn’t alone. A wave of early adopters inspired by Bitcoin began exploring decentralized applications beyond currency. Let me give two examples representing two schools of thought: the “independent camp” and the “improvement camp.”

Launched in 2011, Namecoin belongs to the independent camp. It was a new blockchain forked from Bitcoin with the goal of decentralized domain name registration—recording domain ownership on-chain. While the idea was similar to Ethereum Name Service (ENS), Namecoin had to recruit its own miners, develop its own infrastructure, and lacked compatibility with other applications.

Namecoin was like buying a whole cow just to drink milk. Some people thought that was unnecessarily complicated. Why not use Bitcoin as the underlying infrastructure and simply embed new meanings into transactions?

That’s where Mastercoin (later renamed Omni Layer), launched in 2012, came in as the best-known improvement model. The world’s largest U.S. dollar stablecoin, USDT, was originally built on Omni Layer. In its early days, every USDT transaction involved sending a special kind of transaction on the Bitcoin blockchain—transferring just one satoshi (the smallest Bitcoin unit). But under Omni Layer's protocol, that transaction would be interpreted as a USDT transfer. This approach allowed developers to create entirely new applications without building a whole new blockchain. Instead, they could borrow Bitcoin’s infrastructure to innovate.

But Vitalik argued that both of those approaches were inadequate. The independent camp couldn’t interoperate with other applications, while the improvement camp was constrained by Bitcoin’s infrastructure. To use a mobile phone analogy: developers shouldn’t have to build a phone from scratch just to launch an app, nor should they be developing complex apps based on the system of a Nokia 3310. What Vitalik envisioned was a brand-new operating system—and Ethereum would be the Android of the crypto world.

What Vitalik was challenging wasn’t just the technical status quo—it was the very deity of the space: Satoshi Nakamoto. At the time, many critics said Vitalik was too young and naïve. Bitcoin’s limited functionality, they insisted, was intentional. Satoshi had deliberately kept things simple to avoid blockchain congestion and reduce the attack surface for hackers.

In hindsight, Satoshi’s concerns weren’t entirely unfounded. But without Ethereum, we might still be using the Bitcoin blockchain to transfer USDT today. Nowadays, few startups choose to build on Bitcoin. Turing-complete blockchains—led by Ethereum—have become the industry standard. However, as the number of applications grows, so do concerns over scalability and privacy.

The Trade-off Between Efficiency and Decentralization

Why is blockchain often inefficient? Because decentralization is dragging it down.

The tension between efficiency and decentralization in blockchains still has no universal solution. I like to explain it in terms of the trade-off between economic efficiency and democratic decision-making. Just last weekend, Taiwan held a recall election—a reminder of how resource-intensive voting can be. Wouldn’t it be more cost-effective and efficient if a few elected representatives could just decide for us? The more decentralized a decision-making process is—like a national referendum—the higher the cost. Blockchains are no different.

Take Solana, for example—a blockchain that prioritizes high throughput. To achieve near-instant finality and low transaction fees, Solana has significantly raised the hardware requirements for its validator nodes. We’re talking about at least a 24-core CPU and 512GB of RAM. Building such a machine can cost over NT$300,000 (about USD $9,000), and even cloud-based alternatives aren't cheap. As hardware requirements increase, the number of participants who can run nodes naturally decreases. While this reduces transaction costs and boosts speed, it also increases vulnerability—fewer nodes make it easier for collusion to occur. Sometimes, this trade-off is intentional, especially when defending against hacker attacks.

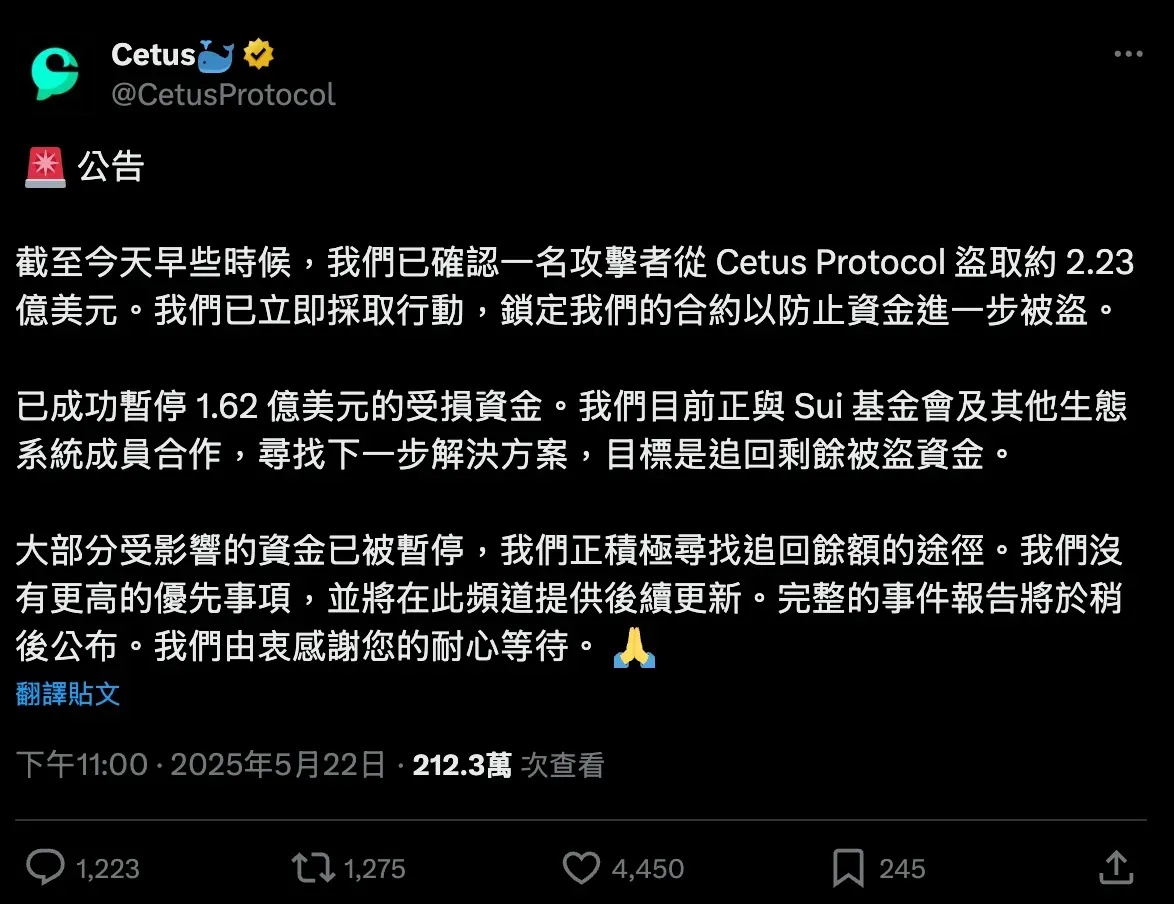

For instance, Cetus, a decentralized exchange on the emerging blockchain Sui, was recently hacked, suffering losses of over $260 million USD. In response, the Sui Foundation, along with other nodes, acted swiftly to freeze the stolen funds on-chain—making it nearly impossible for the hacker to escape with the loot. This kind of “benevolent collusion” was effective, but also sparked debate: where should the line be drawn? If Sui had the power to freeze a hacker’s funds instantly, why weren’t previous victims of similar attacks granted the same protection? Once a blockchain intervenes like this even once, all future victims will expect the same safety net. And if that happens, people will stop believing in decentralization altogether.

So, does Ethereum’s commitment to decentralization actually make it better?

Ethereum can’t achieve ultra-low fees and instant finality on its base layer the way Solana does. While Layer 2 (L2) networks have emerged to solve these issues, they’ve also made things more complicated. For everyday users, figuring out which wallets support which chains and tokens feels like navigating a digital maze. And if a hack occurs, the Ethereum community often has no choice but to accept the loss. To this day, there’s no simple solution to prevent or mitigate losses from scams and hacks.

Over the past ten years, Ethereum has attempted to address two major challenges raised by Bitcoin’s emergence: how to make decentralized applications mainstream, and how to balance efficiency with decentralization. As for what comes next—besides improving user experience—Vitalik’s current top concern is privacy.

The Next Decade

Recently, many companies have begun rolling out crypto services. PayPal now supports crypto payments, and Stripe has expressed interest in issuing a stablecoin. As people begin to actually use cryptocurrencies, the severity of privacy issues quickly becomes apparent. Every transaction is not only visible to the company—it’s publicly viewable by anyone online. If a company pays salaries in crypto, both bosses and employees have to worry about whether everyone can see exactly how much was paid. Is that really acceptable?

Unfortunately, today, building on-chain privacy tools may be legally riskier than running a scam. For example, Roman Storm, a developer of Tornado Cash 4, is currently on trial and faces up to 45 years in prison—simply because North Korean hackers laundered money through a tool he built. Other privacy-focused tools like ZKP2P 5 and Fluidkey 6, previously featured by Blocktrend, may also face legal challenges. Right now, there’s no clear line defining what constitutes legitimate privacy versus criminal facilitation.

Ethereum’s ten-year journey is also my own—I entered the workforce the same year it launched. Back then, I didn’t fully understand the idea of decentralization. After all, life in Taiwan wasn’t particularly oppressive, and things were generally okay. But exploring new possibilities through Ethereum gave me a taste of the freedom I had once longed for but never quite found.

Who would’ve thought? Ten years later, not only have I been “brainwashed”—even companies and governments are gradually being drawn into this so-called “cult.” And now, I really am beginning to believe: maybe decentralization is a real possibility for the next decade.

4 U.S. Sanctions Tornado Cash: A Privacy Tool Stigmatized by Money Laundering Allegations

5 KYC-Free, Lightning-Fast Onboarding! A P2P Marketplace Protected by Zero-Knowledge Proofs

6 The Ultimate One-Time Address Manager! How Fluidkey Enables Private On-Chain Payments