E-Commerce Giant Shopify Integrates USDC: Defining a Stablecoin Payment Standard — Crypto Is No Longer Just for Buying Pizza

GM,

The Blocktrend Lifetime Membership campaign is underway. By popular demand, I’ve added a credit card payment option and extended the offer until Thursday, June 26 at 24:00. That said, I still encourage everyone to pay with cryptocurrency—don’t miss the rare chance to actually spend crypto. Also, when you pay with a credit card, 13% gets taken by the platforms (Substack takes 10%, Stripe takes 3%). In contrast, crypto payments are only charged a 1% fee, and the funds go directly to my wallet. For me, crypto is clearly the more cost-effective way to receive payments.

Today's article is also about this topic! Recently, global e-commerce giant Shopify announced a partnership with Coinbase and Stripe to officially support USDC payments for over 6 million online merchants, positioning it alongside credit cards as a default payment method. Following the announcement, Visa and Mastercard stock prices took a hit. While the market anticipates that crypto will disrupt traditional card payments, I have a different take. Let's start by looking at what business Shopify is actually in.

Shopify Adds USDC Payment Support

Shopify is the silent giant of the e-commerce world—1 in every 10 online stores globally is built on Shopify. It operates a B2B business model, meaning you and I have likely benefited from its services without even realizing it.

Let’s say I’m a coffee roaster looking to start an online business. In the early days, I might open a “Min-En Coffee” shop on Shopee to test the market at the lowest cost. Once I gain some brand recognition and steady customers, I decide to open a physical store in Taipei so customers can also shop in person.

But challenges quickly arise: How do I sync my online and offline inventory? How do I generate consolidated sales reports? And how can I identify returning customers who’ve visited my store before? Shopee can’t solve these problems—but Shopify can, all in one place. In addition to integrating inventory, sales, and checkout systems, Shopify also comes with a built-in CRM (Customer Relationship Management) tool, helping me shift from just “selling stuff” to “building a brand.” It’s the perfect assistant for entrepreneurs looking to stand on their own.

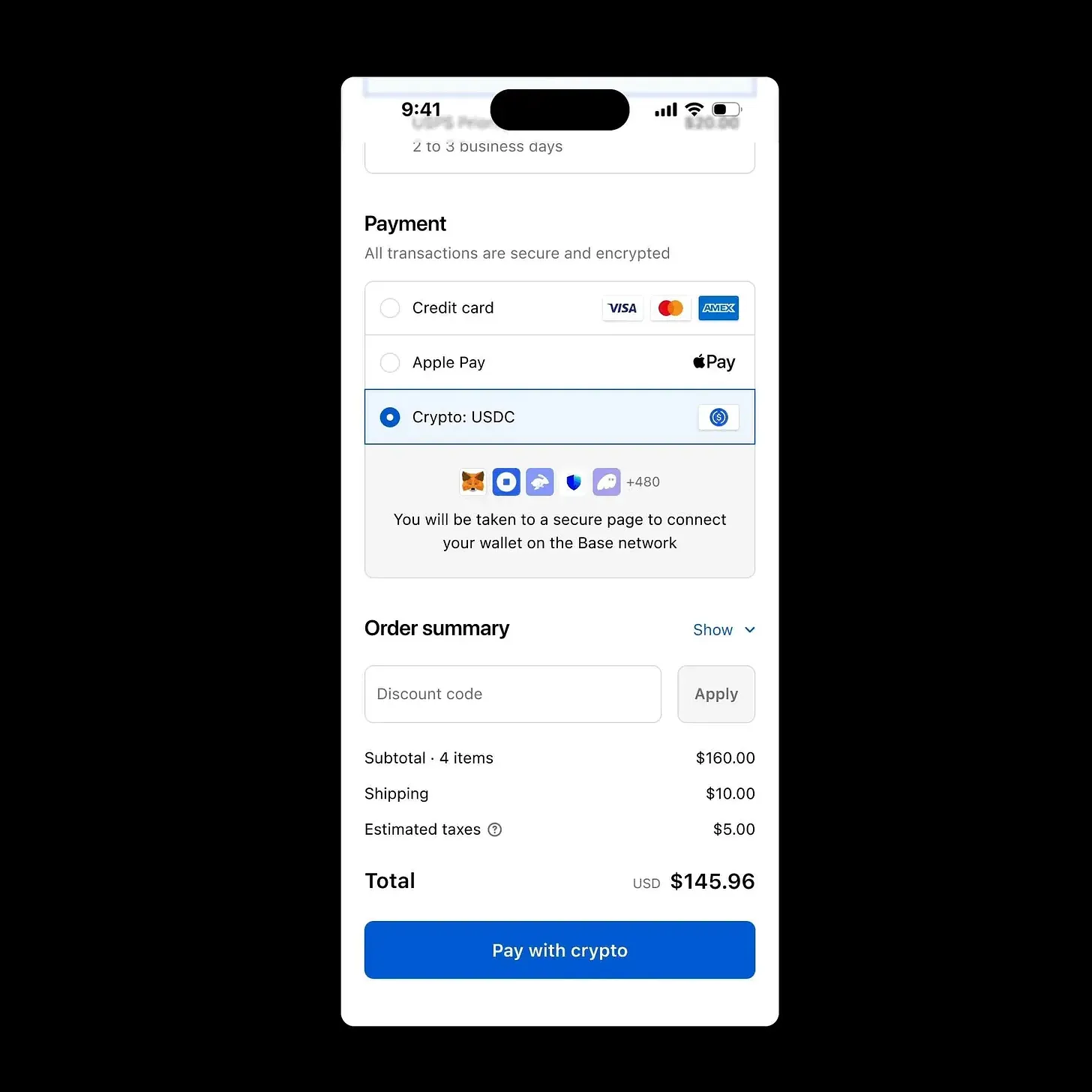

The most critical part of running a store is getting paid. When merchants use Shopify’s own payment system, Shop Pay, customers can pay by credit card or Apple Pay. Even for in-store purchases, if a customer later reaches out online, I can instantly look up the time and details of their transaction and handle after-sales support seamlessly.

Recently, Shopify rolled out a new feature — USDC payment support. According to the company, this feature is now fully live. Unless a merchant specifically disables it, USDC will automatically appear alongside credit cards as a default payment option.

According to Shopify (I’ve paraphrased it into a more conversational tone):

Stablecoins are changing the way money moves around the world. Stablecoins like USDC already see over a trillion dollars in monthly transaction volume, but until now, it’s been rare to see websites accept crypto during checkout. That’s about to change. Shopify has partnered with Coinbase and Stripe to enable merchants to accept USDC payments directly on the Base network—without needing to change their website setup or integrate a separate payment gateway. Everything is already built-in.

As long as you have USDC, you can now check out directly on a Shopify store—an appealing option for crypto-native users. Previously, if you shopped with a credit card, you’d need to withdraw funds from an exchange to pay off your bill later. That meant extra fees and tax headaches. With USDC, it’s a one-step process—more convenient and cost-effective. Shopify supports over 480 wallets, including Coinbase Wallet, MetaMask, and Phantom. You can even check out as a guest without logging in.

For merchants, the payment process remains unchanged. When a customer pays with USDC, Shopify automatically converts it into fiat and deposits it into the merchant’s bank account based on their existing settings—with no additional fees. If the merchant is crypto-savvy, they can also choose to withdraw the USDC directly to their own wallet.

Most coverage of Shopify’s update has focused on the headline: “Millions of merchants now accept USDC.” But in my view, the real breakthrough is this: Shopify has fully integrated crypto into mainstream e-commerce payment infrastructure—not just supporting transfers, but also handling things like delayed settlements and refunds. And the key technical enabler behind all of this is Coinbase.

Defining the Payment Flow

Coinbase has recently been actively promoting the standardization of crypto payments. Previously on Blocktrend, I introduced Coinbase’s x402 protocol 1, which was designed for AI agents. This time, they’re launching a new commercial payment standard tailored for real-world consumer scenarios: the Commerce Payment Protocol.

Coinbase kicks off their explanation with Bitcoin Pizza Day, making it instantly relatable:

Crypto payments have been around for years, dating back to that now-famous transaction 15 years ago when someone bought two pizzas for 10,000 BTC. Yet to this day, the vast majority of on-chain payments remain simple, one-off transfers. While that works for basic payments, it’s far from sufficient for commercial transactions. Real-world commerce involves much more than just “clicking pay.” A customer might cancel an order last minute, a seller might run into inventory issues, or unexpected situations like tax adjustments or partial refunds might arise.

Coinbase and Shopify launched the Commerce Payment Protocol to transform crypto from a simple transfer mechanism into the infrastructure layer for commercial payments.

Let’s say a customer places an order and pays in USDC at “Ming-En Coffee.” While preparing the order, I realize that one of the coffee beans is out of stock. The problem? The USDC has already landed in my wallet—there’s no concept of a pending charge. My only option is to contact the customer directly and ask them to swap for another item of equal value or send a manual refund via crypto transfer. The whole process is inconvenient and can feel sketchy or untrustworthy to the buyer.

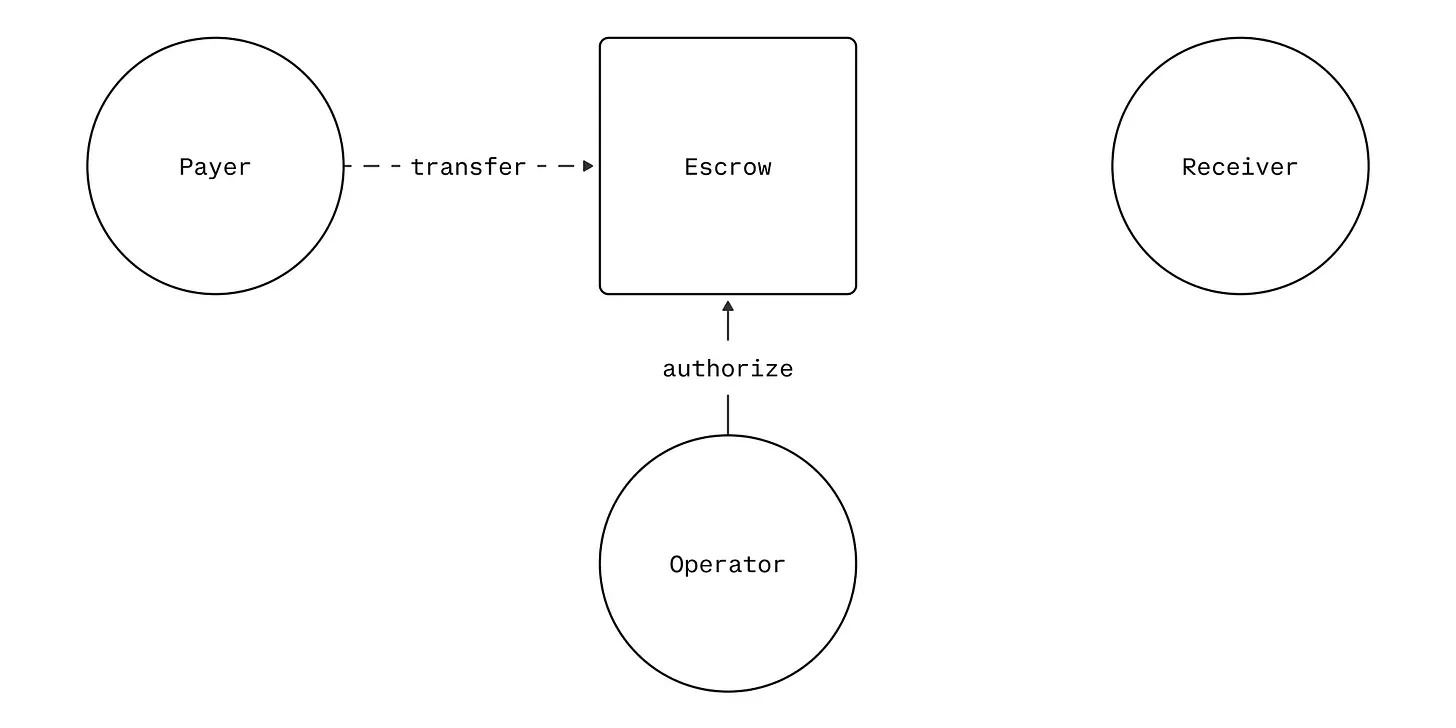

This is precisely the kind of problem the Commerce Payment Protocol aims to solve. It introduces a staged payment process: customers authorize the payment amount upfront, but the funds are temporarily held in an escrow smart contract. Only after the merchant confirms the order is ready to ship does the payment get captured.

Using the classic Pizza Day as an example, the transaction is split into two phases: authorization and capture. The pizzeria receives an authorization first, and the funds are only released once the pizza is delivered. If the customer changes their mind or their selected flavor is out of stock, the merchant can charge only part of the amount or cancel the authorization entirely—automatically refunding the customer. The entire process is automated, with no manual action or back-and-forth with customer service required.

In the past, only a handful of merchants familiar with blockchain technology supported crypto payments, because if a transaction went wrong—whether due to incorrect transfers, refund issues, or disputes—they had to handle everything themselves. Shopify, on the other hand, serves millions of merchants and global customers. It’s simply unrealistic to expect every store owner and employee to understand how blockchain works. With this standardized, automated system in place, merchants can now integrate crypto payments without setting themselves up for unnecessary headaches.

Coinbase actually took a page from the credit card industry. Every credit card transaction we make today follows a protocol—ISO 8583, a set of specifications established nearly 40 years ago by the International Organization for Standardization (ISO). It defines how different parties communicate to complete processes like authorizations, captures, and refunds.

The Commerce Payment Protocol is essentially the crypto version of that. It defines six standardized transaction operations and modularizes on-chain payment flows, enabling interoperability between various wallets and e-commerce platforms. Merchants don’t need to understand blockchain; by simply enabling Shopify, they can accept crypto payments as seamlessly as they do credit cards.

Although paying with USDC is faster and cheaper, it still has a long way to go before it can shake up Visa and Mastercard. That’s because credit cards are more than just a payment tool—their real strength lies in the robust credit system behind them.

Two Kinds of Wealthy People

At its core, credit is the ability to borrow money. The stronger your repayment capacity, the more willing banks are to front the money for your purchases—allowing you to buy now, pay later. But USDC payments are purely based on how much is in your wallet. There’s no identity, no credit history involved. That’s why I don’t believe USDC can directly challenge the credit system underpinning credit cards. Instead, it meets the needs of a different group of users.

Credit cards are suited for the establishment’s wealthy—those with bank records, stable salaries, and high credit scores. They enjoy cashback rewards and installment options. Crypto payments, on the other hand, are more suited for non-traditional wealthy individuals—investors, content creators, and others whose assets come from diversified income streams that might not be recognized by banks. These individuals may not qualify for large bank loans, but that doesn’t mean they’re any less financially capable. Cryptocurrency gives them a place to spend their money, offering an alternative payment system.

For Shopify, supporting USDC is undoubtedly a win. Not only is Shopify CEO Tobi also a board member at Coinbase, but this integration opens up a new market for both the platform and its merchants—customers who already hold crypto but may not have a credit card. Especially while competitors have yet to support crypto payments, Shopify is getting a head start, positioning itself to attract the Web3 audience.

What I admire most is Coinbase’s business strategy. Ever since the launch of the Base blockchain 2 3 4, Coinbase has integrated seamlessly with the decentralized world. While other global exchanges like Binance and OKX remain stuck in the “crypto casino” model, Coinbase is already demonstrating how to use blockchain technology to generate real revenue for a publicly listed company.

By shifting from a traditional exchange and wallet service to foundational infrastructure, Coinbase has positioned every USDC transaction to run on its own blockchain. What it’s locking in isn’t just one application—it’s the entire payment ecosystem. This bottom-up strategy of capturing value at the infrastructure level is truly impressive.

That said, the impact of these strategic moves might not be immediately felt. For merchants, unless their customers are already from Web3 or don’t have credit cards, adding USDC as a payment option likely won’t change their revenue at all. For consumers, paying by card or Apple Pay is already second nature, and few will deliberately choose to pay with USDC.

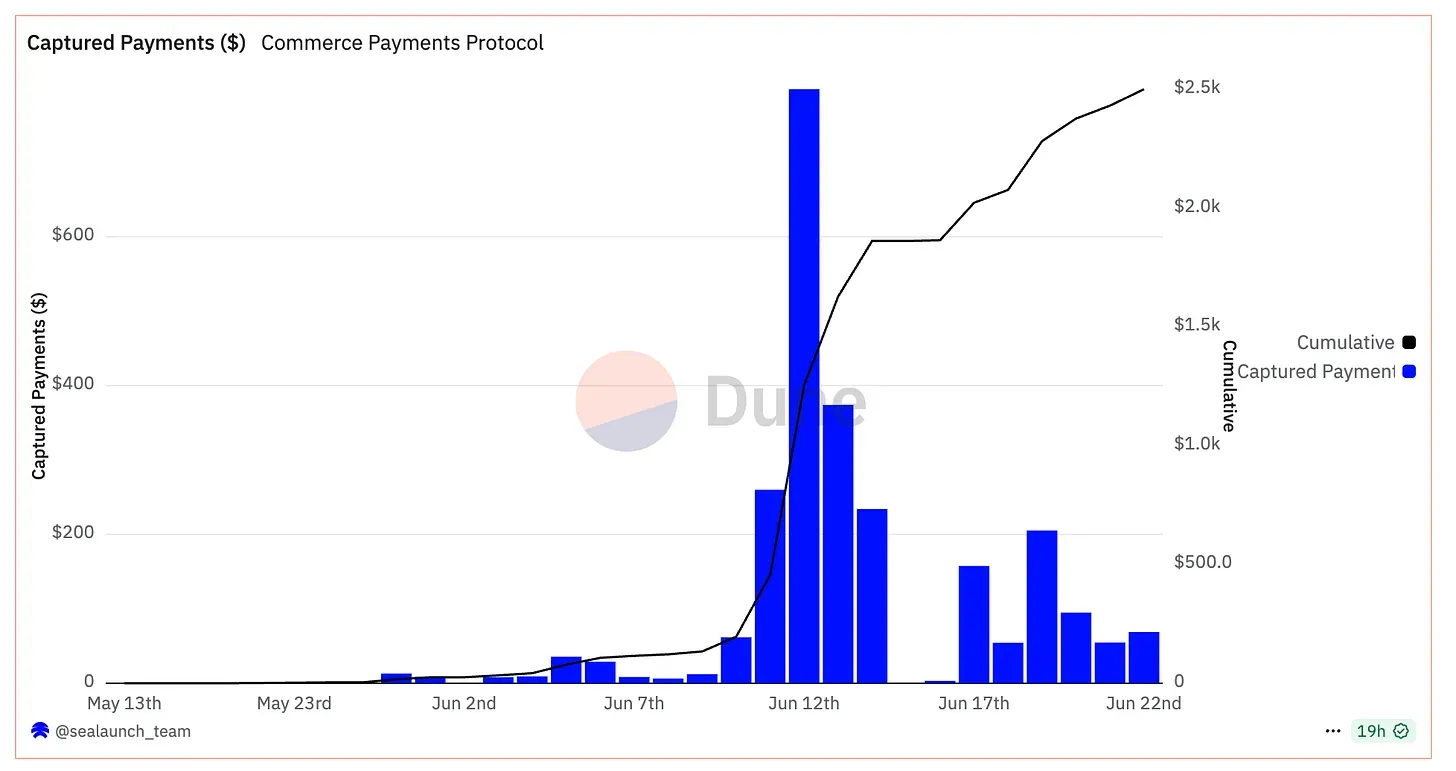

Shopify and Coinbase are clearly aware of this, which is why they’ve announced an incentive plan: merchants will receive a 0.5% subsidy and customers 1% for every USDC transaction. But habits don’t change easily. According to available data, the total transaction volume during the first week was only around $2,500. That matches my own experience. Blocktrend has long supported crypto payments, but the vast majority of users still choose to pay by card. No one is going to spend money just because "you can pay with crypto."

Still, this is a milestone worth noting. Crypto payments were once an unattainable ideal—buying pizza was just an exception 5. In everyday spending scenarios, virtually no one used cryptocurrency. But in recent years, we’ve seen a gradual shift: starting with crypto payment cards and moving toward actual wallet-to-wallet transfers. What used to be passive deductions is now becoming active payments.

The only reason Blocktrend has been able to accept crypto payments is because I happen to understand blockchain technology well enough to handle the technical issues. But even with that know-how, I’ve always hoped a better system would come along and replace what I built. Not just because it would save me work—but because it would benefit everyone.

P.S. I'm moving this week—leaving Beitou after four years, and finally shedding the status of a renter. I originally planned to take a break from publishing, but there have been too many exciting topics lately, and I just couldn’t bear to skip an issue. So here I am, writing while deep-cleaning my apartment. I’m not sure how spotless the place is now, but when it comes to the quality of the article—I’m confident it’s solid.

1. The Forgotten 402: How It Became the Most Important Payment Gateway in the Age of AI

- Coinbase Builds an Ethereum Layer 2 Network to Push Users Out of the Exchange

- The BASE Chain: Turning On-Chain Into Online — Coinbase’s Secret Plan

- Base: In Trying to Retain Developers, Coinbase Accidentally Created the World’s Second Largest Ethereum L2

- Bitcoin Pizza Day: You Have to Spend It for It to Truly Last