Circle Files for IPO! The First Public Stablecoin Company—Where Is Its Moat?

GM,

I’ll be taking a day off next Tuesday—Blocktrend will resume publishing on Wednesday. Also, at this week’s second Web3 Badminton Club session, the crypto payment rate hit 100%. Six people paid using crypto wallets, and one person used an exchange transfer. If you're free on weekday afternoons, feel free to join us for a game. Now, let’s get to the main topic.

Circle, the issuer of USDC—the world’s second-largest U.S. dollar stablecoin with a market cap of $60 billion—has recently filed for an IPO. This article, based on its publicly available prospectus, breaks down what business Circle is actually in, what its moat is, and what challenges it faces.

Born from Payments

Even as Skype is shutting down, banks still rely on traditional wire systems for cross-border payments. These transfers can cost thousands of New Taiwan Dollars in fees and take several hours, at best, to complete. For anyone familiar with cryptocurrency, this inefficiency is hard to accept.

Founded in 2013, Circle’s first product aimed to make cross-border transfers as simple and cheap as making a Skype call. The key behind this? Bitcoin. Let’s say I want to send money from Taiwan to Japan. I would deposit New Taiwan Dollars into Circle’s bank account, and Circle would automatically convert the funds into BTC. When the recipient in Japan withdraws the money, the BTC is sold and automatically converted into Japanese Yen for the transfer. The entire process was fee-free.

At the time, one BTC was worth $400. Circle launched a promotional campaign offering new users $10 in BTC upon registration—equivalent to 0.025 BTC. At today’s prices, that’s worth around NT$68,000, making it arguably one of the most generous marketing campaigns in crypto history.

Although Circle used Bitcoin to solve the cross-border payment problem, it wasn’t well-suited for the payments business. If BTC’s price fluctuated, the amount sent and received wouldn’t match. Sometimes users would lose money, other times they’d make a profit. Eventually, as transaction fees on the Bitcoin network skyrocketed, Circle was forced to shift its cross-border operations to Ethereum, which offered lower fees.

Circle’s early development wasn’t smooth. It wasn’t until 2018—when it partnered with Coinbase to launch a joint venture and issue the USDC stablecoin—that it finally found its “calling.” Pegged to the U.S. dollar, USDC solved the problem of price volatility. Within just three months of launch, its market cap exceeded $300 million.

Issuing USDC

USDC is essentially the U.S. dollar on the blockchain. With USDC as a medium, cross-border payments no longer carried the risk of Bitcoin’s price swings. But instead of treating stablecoins as a side business, Circle recognized their potential and decisively shut down its years-long consumer payments operation to focus entirely on stablecoin issuance—betting that this would be the foundation of future finance.

The world’s largest dollar-pegged stablecoin, USDT, had been around since 2014, making USDC a relatively late entrant. But Circle carved out its own space by positioning itself as compliant and regulation-friendly, successfully establishing a strong market presence.

By 2021, the total issuance of USDC surpassed $10 billion. Global payments giant Visa even announced it would treat USDC as a “settlement currency,” allowing financial institutions to use it for clearing transactions 1. For example, if you swipe your Visa card in Taiwan to buy coffee, the merchant could choose to receive USDC instead of NT dollars, with Visa handling the conversion and pricing. Legal compliance, paired with backing from major financial institutions, formed the core of Circle’s early competitive moat.

In 2022, at the height of its momentum, Circle announced plans to go public 2. But within months, both the FTX exchange and Silicon Valley Bank collapsed, causing USDC to briefly lose its peg. After shelving its IPO plans twice, Circle is now trying for a third time. This time, its prospectus gives the public a rare look into the business model behind stablecoins.

The Stablecoin Business

Issuing stablecoins might just be the best business in the world — you give me dollars, I give you stablecoins — and Circle earns interest by parking those dollars in banks and investment funds. In the past two years (2023 and 2024), Circle reported net profits of $270 million and $150 million, respectively, with more than 99% of its revenue coming from interest earned on its U.S. dollar reserves. If Circle successfully goes public, it will undoubtedly be the purest stablecoin stock on the market.

While Circle’s business model seems like “money for nothing,” its profitability depends heavily on two factors: U.S. interest rates and distribution costs. One of the biggest revelations from Circle’s prospectus was that it officially split from its long-time partner, Coinbase, at the end of 2023.

Circle’s sharp drop in net profit in 2024 (from $270 million to $150 million) wasn’t due to a decline in revenue — it was because payments to Coinbase increased significantly. Originally, Circle and Coinbase co-founded a joint venture to issue the USDC stablecoin. Both parties shared the same goal: grow USDC’s total market cap. The larger the market cap, the greater the reserve income, which was then shared proportionally. But in late 2023, the two companies renegotiated their terms — Circle took full control of USDC issuance, while Coinbase became just one of many USDC distribution channels.

This also upended the profit-sharing model. Under the new agreement, Circle retains all the interest income from reserves, but must pay Coinbase a “distribution fee” based on how much USDC is held on the Coinbase platform. In other words, the more USDC stored on Coinbase, the more Circle owes them.

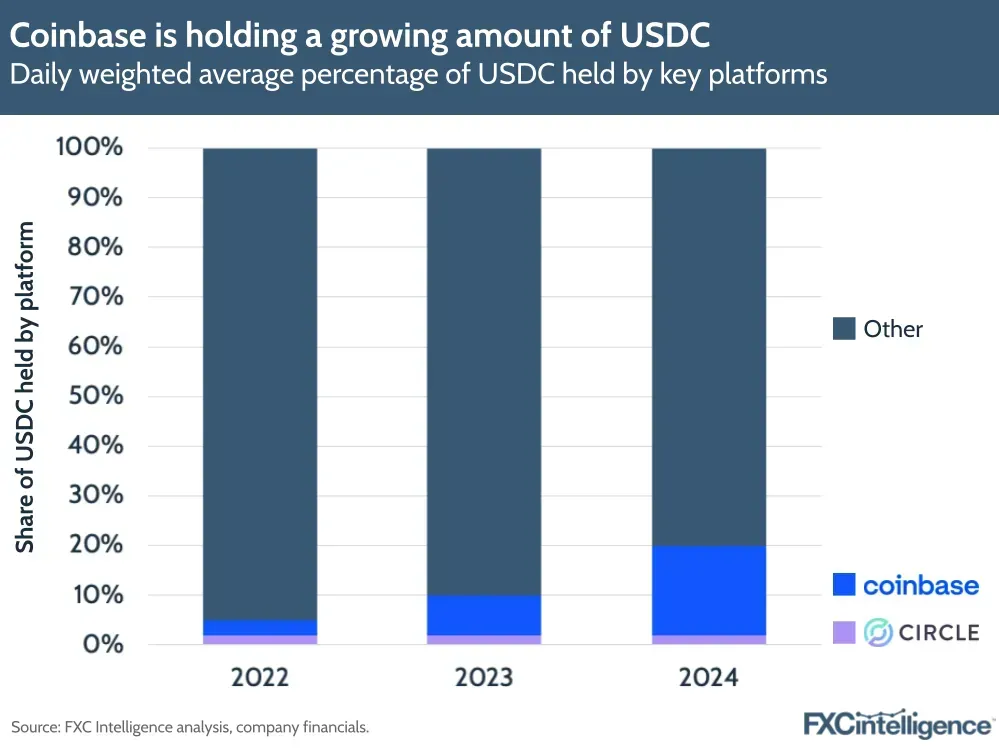

Different incentives lead to different behavior. The new structure essentially encourages Coinbase to keep as much USDC on its platform as possible, whereas Circle still wants USDC to circulate widely across all blockchains and applications. As expected, Coinbase launched a series of USDC incentives 3 in 2024 — whether users hold USDC on the exchange or in their Coinbase Wallet, they earn a generous 4.7% yield — effectively encouraging deposits and retention of USDC on its platform.

From the data, it’s clear that the proportion of USDC held on Coinbase rose sharply — from 8% at the start of 2024 to 20% by year-end. Circle ended up paying an additional $217 million to Coinbase that year. What was once a revolutionary partnership could soon turn into a tug-of-war due to diverging financial interests. And if the U.S. announces interest rate cuts in the future, Circle’s interest income could be squeezed even further.

That’s why Circle’s IPO ambitions go beyond becoming the “first publicly listed stablecoin company.” The deeper reason is to raise capital and build new moats through diversification.

Building New Moats

In response to mounting challenges, Circle is focusing on three fronts to build new moats: distribution, geography, and assets.

On the distribution front, the prospectus revealed that Circle paid Binance last year to get USDC listed on the world’s largest exchange. Although USDC typically lags behind USDT in trading liquidity, this was Circle’s first step toward diversifying its channels and reducing its dependence on Coinbase. In addition, Circle has been actively promoting the Cross-Chain Transfer Protocol (CCTP) to integrate into the on-chain DeFi ecosystem — positioning itself as a cross-chain infrastructure provider, not just a stablecoin issuer.

Geographically, Circle also had a breakthrough last month in Japan: USDC received government approval, becoming the first legally tradable dollar stablecoin in the country. I only learned from the news how complicated crypto trading used to be in Japan. Since USD stablecoins were previously not legal, most Japanese exchanges only offered JPY/BTC trading pairs. To get USDC, users had to convert JPY to BTC, transfer to an international exchange, and then trade for USDC. Although USDC is still new in Japan and volumes remain low, expanding its international footprint is the second pillar of Circle’s diversification strategy.

The final strategy is asset diversification. In Europe, Circle has recently been promoting EURC — a euro-backed stablecoin issued by Circle itself. Because Circle is the sole issuer, it can keep all reserve interest income without sharing it with Coinbase.

As regulatory clarity improves, compliance will become the standard, and competition will only intensify. Circle must establish new moats. Other players are already circling — such as payments giant PayPal, which has launched its own PYUSD 5 stablecoin. Even if Circle currently enjoys strong partnerships with payment networks like Visa 6 and Stripe 7, there’s no guarantee they won’t eventually think, “Maybe we should just issue our own stablecoin,” transforming from partners into competitors.

I believe stablecoins will gradually become a core component of the financial system, but you can’t directly invest in a stablecoin. If Circle successfully goes public and becomes the first listed stablecoin company, it will finally stand on equal footing with other competitors dabbling in the stablecoin space — because Circle is the purest stablecoin company out there. Investing in Circle would be like investing in the broader trend of financial transformation. As an OG in the crypto space, Circle knows the key to survival is endurance. The more solid your footing, the longer you last.

1 Visa Integrates Digital Dollars (USDC) into Its Global Payment Network

2 Circle Is Going Public: The Infrastructure Company Behind the Future of Money

3 Why Is XRP Surging? | Coinbase Airdrops USDC | Trump Endorses a DeFi Project

5 PayPal Launches Its Own Stablecoin: An Open Payment Tool Bridging Two Worlds