Circle Builds a Payment Network: Challenging the SWIFT Transfer System and Disrupting the Status Quo Where Money Doesn’t Move

GM,

After the previous article was published¹, Circle has been on the move, announcing a new mechanism called the Refund Protocol and launching a new product, the Circle Payment Network.

These developments from Circle consistently make cryptocurrency feel one step closer to everyday life—no longer just a solo game in a parallel universe. And since stablecoins are among the few Web3 components actually being used in commercial settings, Circle must now tackle more practical issues. For instance, what happens if someone wants a refund after making a crypto payment?

The Decentralized Alipay

For most online payment tools, refunds aren’t a big deal. But crypto is an exception because the underlying logic is fundamentally different.

Imagine you buy a new pair of hiking boots online with a credit card, but when they arrive, you realize someone has already worn them. You can dispute the charge with your bank and get your money back. This trusted dispute resolution mechanism allows buyers and sellers to complete online transactions without having to know or trust each other. However, stablecoin payments don't come with a refund or cancellation feature. They're more like cash transactions—only involving the buyer and seller, with no intermediaries.

Like cash, cryptocurrency is a final-settlement form of payment. Since there’s no third party holding the funds, you can’t freeze the transaction or initiate a chargeback. Without a refund mechanism, crypto becomes harder to integrate into everyday purchases. If PChome started accepting stablecoins but didn’t allow returns, I wouldn't use it to pay.

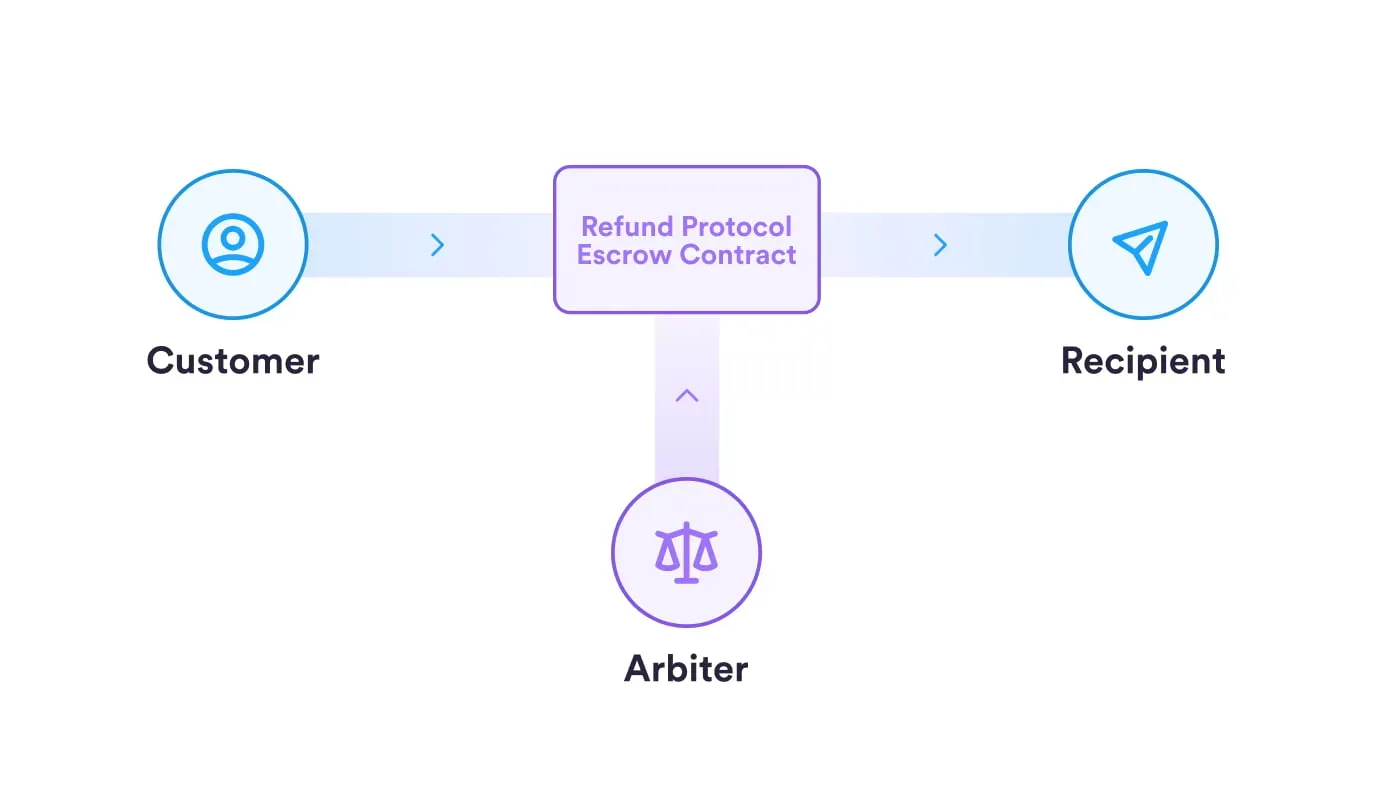

Last week, Circle Research introduced a refund mechanism called the Refund Protocol and open-sourced its code. I call it the Decentralized Alipay—a system that lets you request a refund even after paying with crypto. As illustrated in the diagram below, its working model is quite straightforward: replace Alipay with a smart contract and bring in an arbitrator to decide whether a refund is warranted. That's all it takes.

In theory, enabling refunds for cryptocurrency payments shouldn’t be so complicated. All it would take is convincing the real Alipay to support crypto. After all, whether the transaction is in New Taiwan Dollars or crypto, the rules are largely the same.

The problem is that whether third-party payment companies support cryptocurrencies depends on a complex mix of factors—sometimes it’s about security or ease of use, and other times it’s political. As a result, most third-party payment platforms still don’t support crypto. And if the service provider is an obscure company, you might as well use Circle’s Refund Protocol.

The Refund Protocol is open-source, meaning anyone can integrate it into their own platform. Suppose I launched an online store selling Blocktrend-themed merchandise and implemented this protocol into the checkout flow—any payment made by a customer wouldn’t go straight into my wallet. Instead, it would first be held in a “decentralized Alipay” account. The funds would only be released to me after a lock-up period expires or if the customer actively approves the payment.

But refunds are the real highlight. A refund can be initiated by the seller proactively, or, if a dispute arises, a third-party arbitrator can step in. The Refund Protocol defines some interesting rules—for example, arbitrators are not allowed to transfer funds to addresses outside of the buyer or seller, to prevent misuse or theft. In special cases, arbitrators can even front the refund to the buyer. If the seller requests early disbursement of funds, the arbitrator can also require a portion to be held back to ensure both parties’ rights are protected.

Still, the Refund Protocol has some obvious issues. If an arbitrator acts in bad faith and approves a refund even when the product is flawless, the seller may be forced to take the loss. Are there mechanisms for selecting arbitrators? Do they charge fees? How long does the arbitration process take? These are design gaps Circle intentionally left open for developers to fill in. Even though the core code is available, the current maturity of the protocol feels more like an academic paper than a plug-and-play solution. If actually used in a real-world payment setting, it’s likely to run into many unforeseen problems that don’t show up in theory.

Many people look forward to the day when cryptocurrency achieves mass adoption, but the Refund Protocol highlights how even basic refund mechanisms are still underdeveloped. You can't seriously expect e-commerce merchants to process every refund manually—risking sending it to the wrong address or choosing the wrong blockchain 😂.

On the other hand, although the blockchain world has largely solved the problem of high gas fees in recent years—making both payments and refunds virtually costless—aside from curiosity or novelty, I honestly can’t think of a compelling reason why e-commerce platforms must integrate crypto payments.

Cross-border payments, however, tell a different story. More and more financial institutions are beginning to view stablecoins and blockchain technology as the next generation of financial infrastructure. Circle’s newly launched product, the Circle Payment Network, is a direct response to this growing demand.

Stablecoin Payment Network

The Circle Payment Network is similar in function to Bridge, a stablecoin API startup. Both aim to use blockchain + stablecoins as the foundational layer beneath the financial system, addressing the outdated nature of cross-border payment infrastructure. Last year, Bridge was acquired by Stripe for a staggering $1.1 billion².

The current system used for cross-border transfers between banks—SWIFT—is a telegraph network that predates the internet. SWIFT itself doesn’t move money; it merely sends messages. In fact, its functionality is more primitive than a messaging app on your phone.

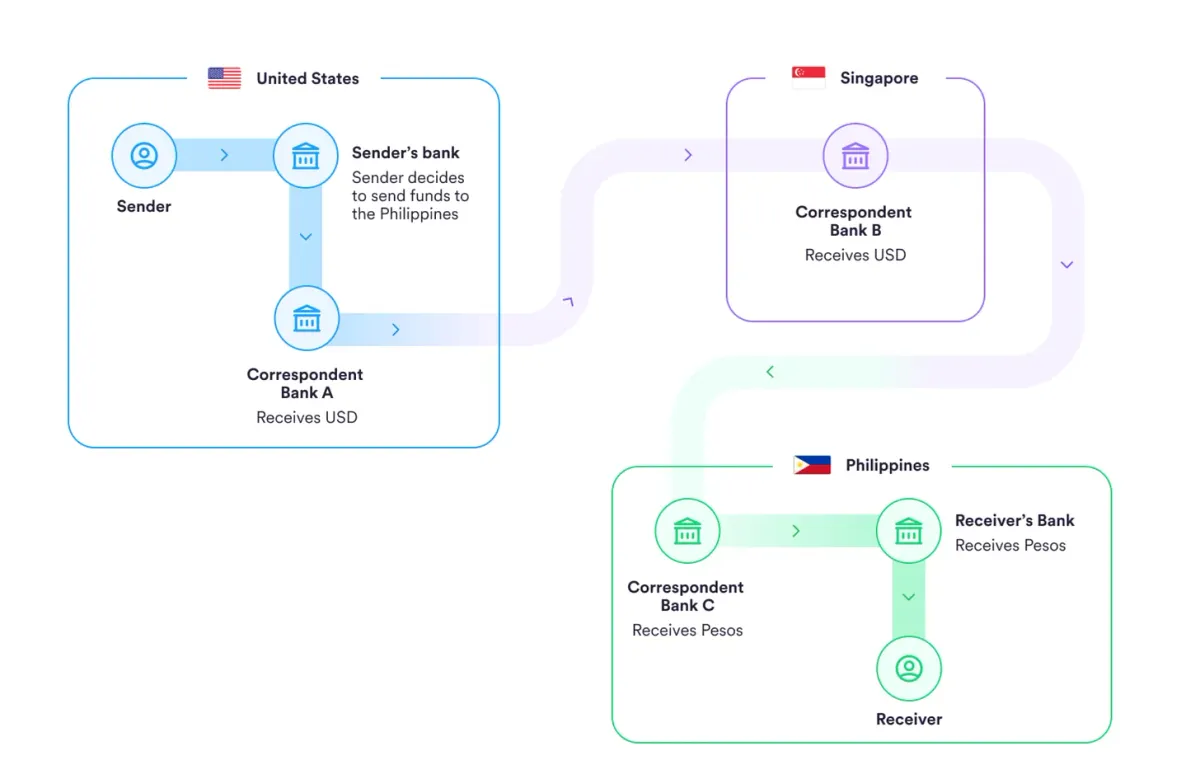

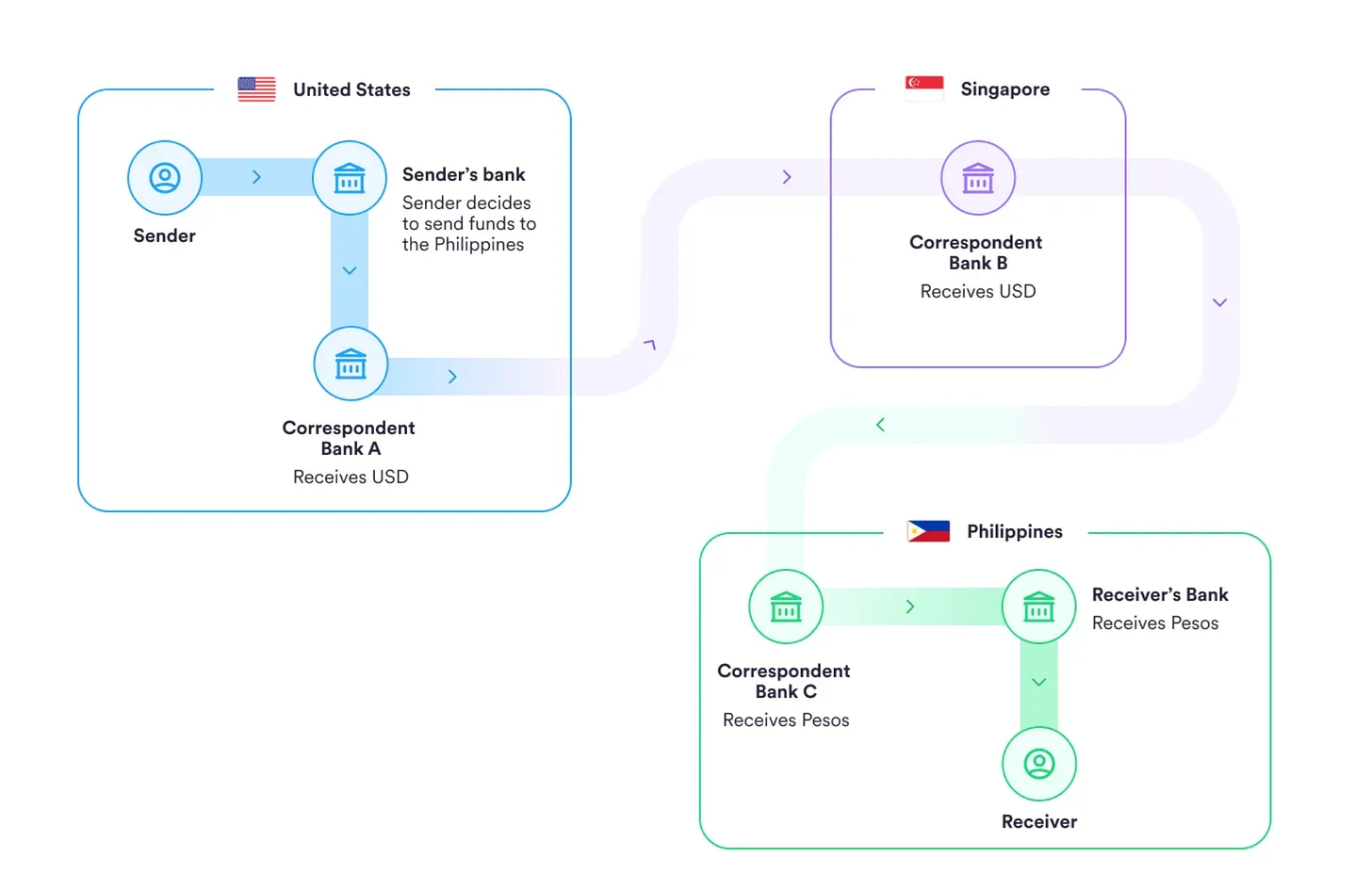

Circle uses the example of transferring funds from the U.S. to the Philippines to illustrate how the current system works, showing how both the messages and money flow:

First, it depends on whether the two banks involved have a direct account relationship—like whether two airports have a direct flight. Given the vast size of the global banking system, “direct flights” between any two international banks are rare. In the case of the U.S. and the Philippines, capital flows aren’t that frequent, so funds often need to make “layovers” before reaching their destination. Since banks in different countries operate on different business hours, even just reading the transfer message introduces delays. Once the message is received, banks still need to reconcile the funds—adding or subtracting balances—before the money is considered settled. The more stops a transaction makes, the longer it takes to arrive. On top of that, telegram fees aren’t cheap, and intermediary banks charge their own handling fees. It’s no wonder so many startups are eager to replace this antiquated system.

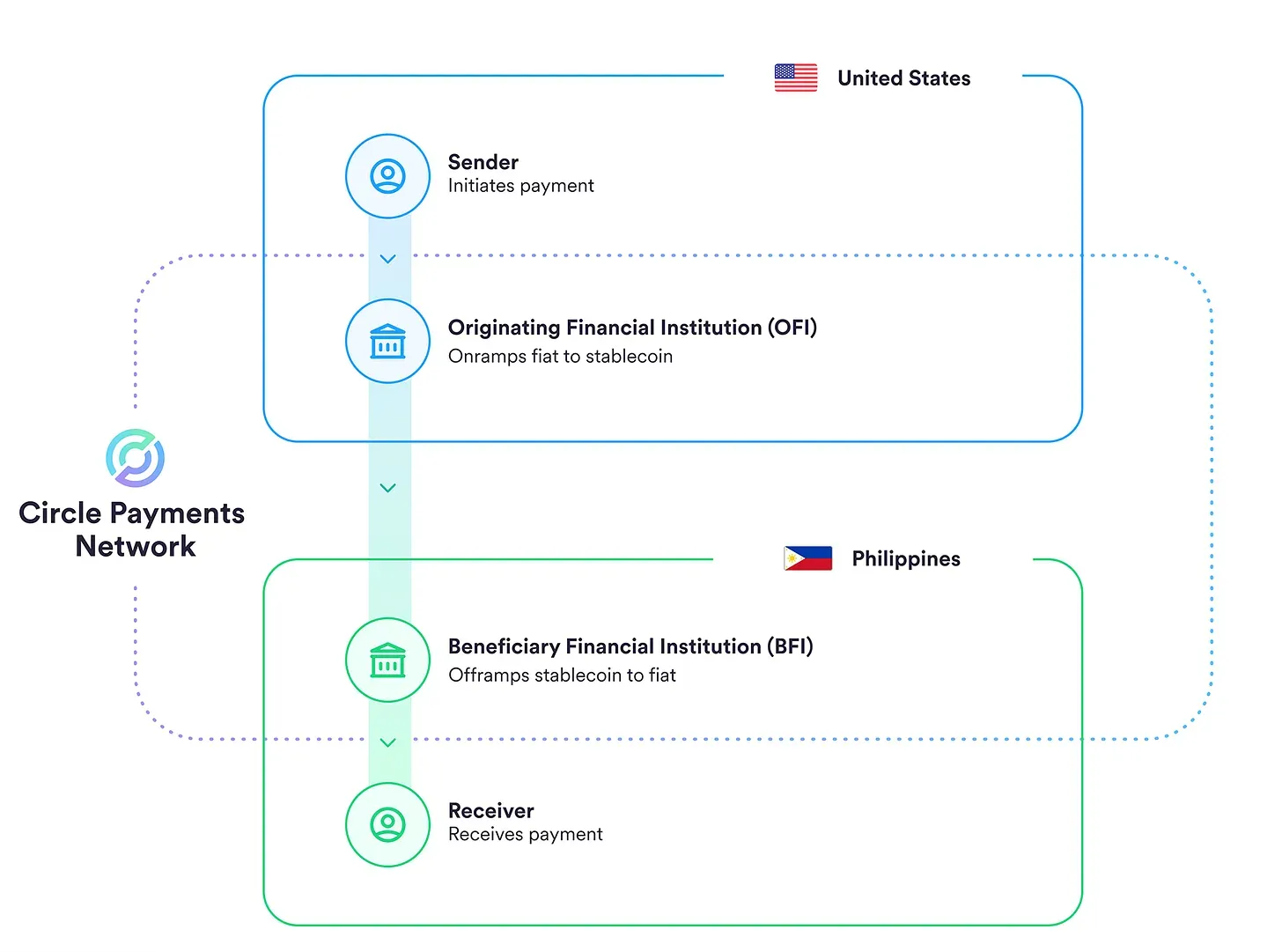

Circle is urging banks to ditch the SWIFT telegram system and instead connect to the Circle Payment Network API. Behind the scenes, it runs on stablecoins and blockchain technology. Circle takes care of the foreign exchange, compliance, and risk management—banks don’t have to worry about any of it. The Circle Payment Network ensures instant settlement of funds and significantly lowers transaction fees. All of this is old news by now, so in this piece, I want to highlight one key difference: the new model challenges the long-standing assumption that “money doesn’t move”—greatly improving how efficiently banks can put their capital to work.

In the SWIFT system, direct “flights” between banks are uncommon because maintaining open pathways requires banks to pre-fund large amounts of money in correspondent accounts (Nostro/Vostro accounts) to handle potential payment demands. These funds are essentially “locked” in various locations and can’t be moved freely, limiting a bank’s capital efficiency. Blockchain enables banks to reclaim and redeploy that capital more flexibly—because now, the money moves. Banks can simply convert funds into stablecoins and send the transfer on-demand, only when there’s an actual need. For banks, this kind of advancement is far more impactful than just saving time or reducing fees.

Moreover, participation in the Circle Payment Network isn’t limited to financial institutions. Multinational corporations can use it to pay salaries directly, and internal treasury operations can also become more agile. In the future, even AI agents making purchases could use this payment network: debiting fiat from a buyer’s designated account, converting it into USDC, and then transferring it to the seller, who receives it in their local currency.

People often say cryptocurrency is programmable money—but unfortunately, most commercial activity still isn’t settled in crypto, which limits its influence. The Circle Payment Network is essentially plugging crypto infrastructure directly into banks, making internal capital programmable. Even when both parties are transacting in fiat, blockchain and stablecoins can serve as intermediaries.

If this business scales successfully, Circle’s USDC could very well become the primary on- and off-ramp for people entering crypto. Users could convert directly from their bank into USDC. As long as the exchange rate is fair, investors wouldn’t need to register with a local crypto exchange—avoiding an extra layer of risk. And as more people get used to sending and receiving payments in crypto, the refund mechanism we discussed earlier will finally have real-world value.

That said, replacing SWIFT won’t be so easy. It’s no longer just a payment network—it has become a key tool for the U.S. to impose sanctions on foreign entities. So the question is: would the Circle Payment Network also comply with U.S. sanctions?

1 Circle Files for IPO! The First Publicly Traded Stablecoin Company—Where’s Its Moat?