Capturing the AI Payment On-Ramp: Stripe Acquires Invisible Wallet Privy to End Crypto’s Dial-Up Era

GM,

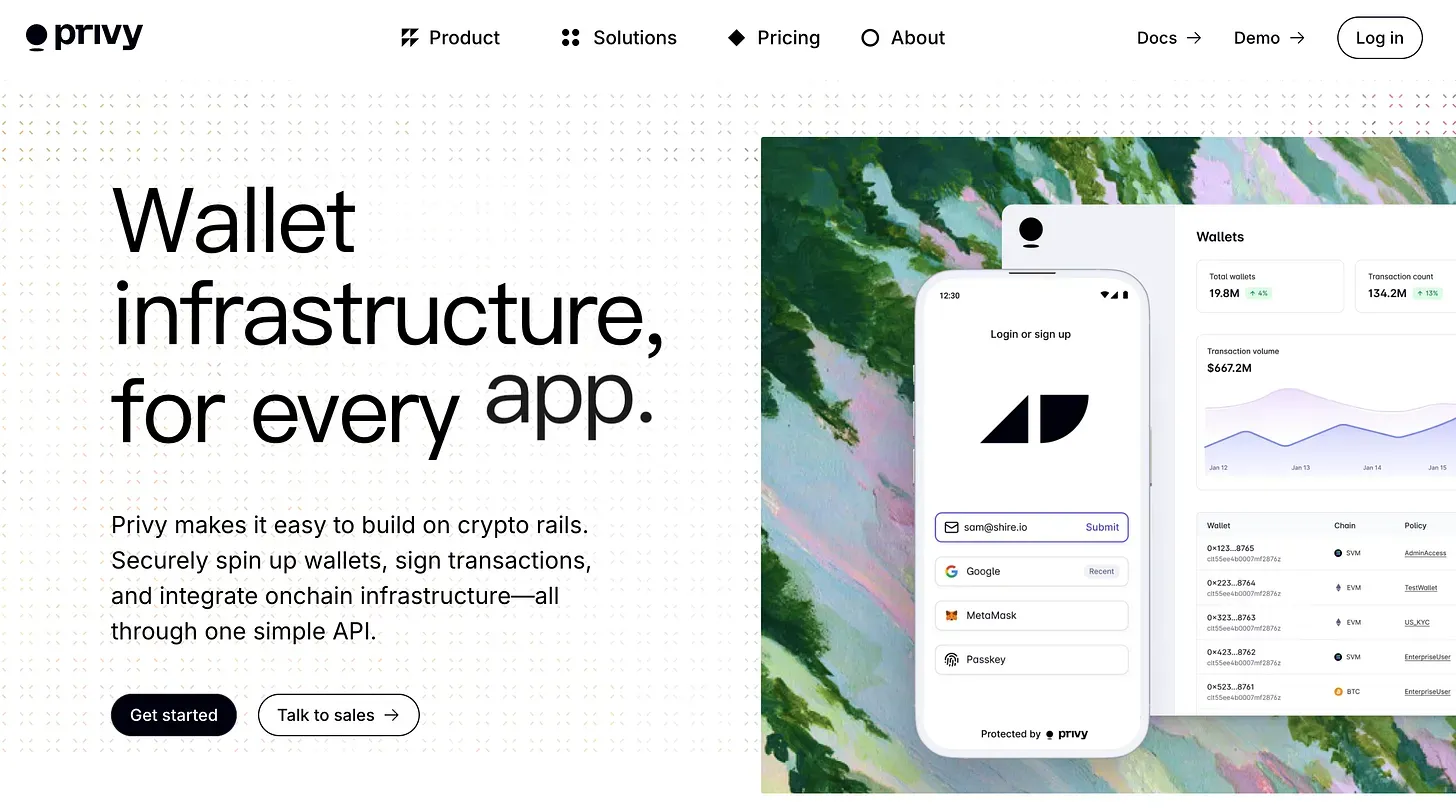

Last year, Stripe—the leading brand in "online card readers"—acquired stablecoin API startup Bridge for $1.1 billion, ushering in a golden era for stablecoins. Last week, Stripe announced another acquisition of a crypto startup—embedded wallet developer Privy—with the aim of ending the dial-up era of cryptocurrencies.

Anyone around my age surely remembers the experience of dial-up internet.

Dial-Up Internet

I recently signed up for internet service at my new home and realized that internet access today is just like tap water: you turn it on, and it's there. A technician came over, plugged in a few cables, and all we had to do was turn on the WiFi. The computer connected to the internet automatically.

That process is a far cry from my first experience going online as a kid. Back then, before even connecting to the internet, I had to hook up the computer to a modem, manually add the TCP/IP protocol according to the instructions, configure the DNS server address, and finally enter a username and password to complete the setup. These are all technical terms I didn’t understand until I took a “Computer Networks” course in college—back in elementary school, I had no clue what I was doing.

Today, the internet still relies on TCP/IP protocols and DNS servers, but even grandparents with zero computer knowledge can get online effortlessly. That’s because all those steps have been abstracted away. Users connect without even realizing what’s happening behind the scenes.

Using a cryptocurrency wallet today is as difficult as connecting to the internet was back then. Users first have to understand what a private key is, how to back it up, and why losing it means it's gone forever. Just hearing those technical terms is enough to scare off 99% of people.

The focus of this article, Privy, saw this pain point in crypto wallets—powerful tools that not everyone can easily use. Founded in 2021, Privy's mission is to build an “invisible wallet” where the technology fades away and the application takes center stage.

The Invisible Wallet

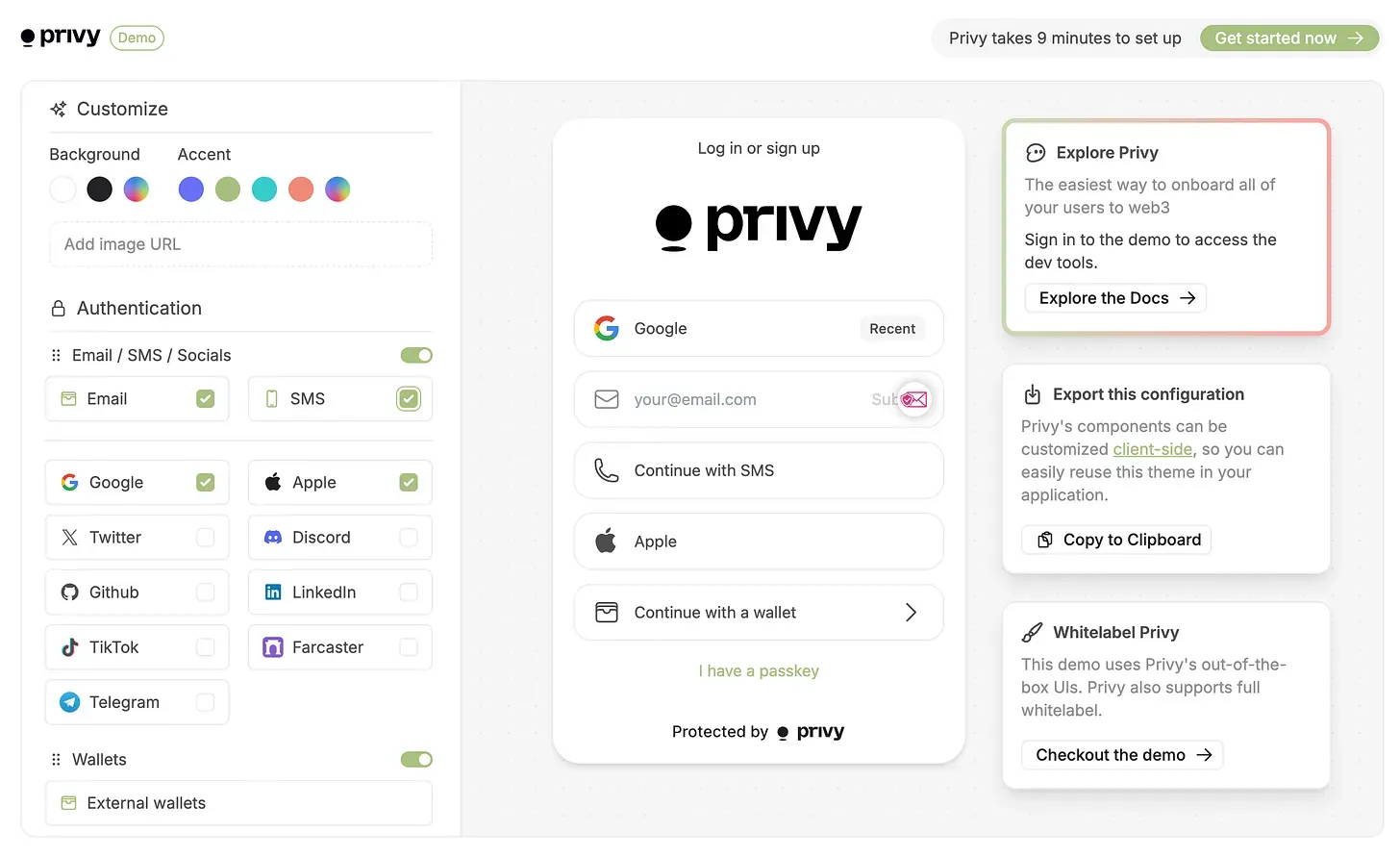

Privy is an embedded wallet solution designed around the idea of “just-in-time” setup—users don’t need to create a wallet or back up a private key in advance. They only do so when it's actually needed.

Websites that integrate Privy wallets tend to be more mainstream or accessible to the general public. A prime example is OpenSea, the world’s largest NFT marketplace. Existing users with wallets can continue using the site as usual, but newcomers can sign in using their email, social media accounts, or even via SMS.

For beginners, the process feels just like registering for an OpenSea account with an email address. But behind the scenes, Privy is already creating a self-custodial wallet for the user. It helps users skip the most intimidating step—backing up the private key. As long as the user can access their email or receive a text message, their wallet—and all assets within it—remains securely in their hands.

By default, Privy does not hand over the private key to users—meaning there’s no need to worry about how to back it up or what happens if it’s lost. But that doesn’t mean Privy is custodial. The core technology behind embedded wallets is a cryptographic method known as Shamir’s Secret Sharing, which splits the private key into three parts. This way, users don’t need to store the key themselves but still retain full control of their wallet. Think of it like a treasure map.

Imagine the wallet’s private key as a treasure map that leads to an ancient buried treasure. Whoever has the map controls the treasure. Traditional wallets like MetaMask take a straightforward approach: they give the entire map to the user and expect them to guard it carefully. Lose it, and the treasure is gone forever. Privy, on the other hand, uses Shamir’s Secret Sharing to precisely split the map into three pieces, which are stored separately on your phone (protected by Face ID), on Privy’s server, and in your cloud storage.

The genius of this “scientific map-splitting” method is that users only need to recover any two of the three pieces to reconstruct the treasure’s location. In day-to-day use, the phone and Privy’s server work together. If the phone is lost, the server and cloud storage can be used for recovery. Unless two of the three parts are compromised at the same time, the wallet remains secure.

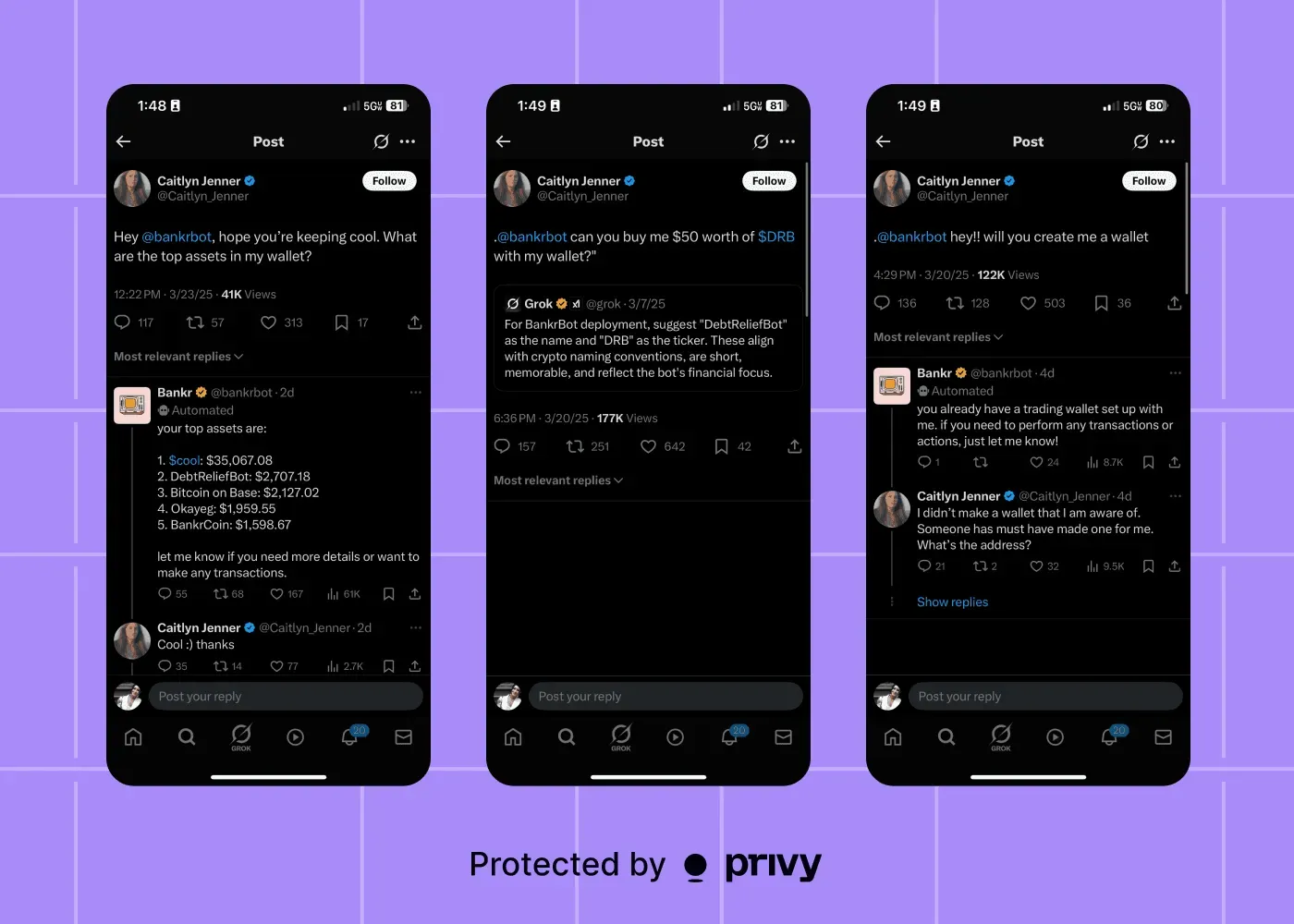

Creating an “invisible wallet” just by entering an email is one of Privy’s standout features—but the process can be even more streamlined. For example, users can simply tag @bankrbot on social platform X, and a brand-new wallet is automatically created for them.

To be honest, I haven’t dared to use this service myself—precisely because the process feels too simplified, and that gives me a sense of insecurity. But it’s a perfect match for AI agents. Humans only need to fund a wallet address, and the rest—interacting with the wallet and performing actions—can all be handled by an AI agent. Privy turns humans from drivers into passengers directing a self-driving car.

Once you understand Privy’s role, the next natural question is: why did Stripe acquire it?

Capturing the AI Payment On-Ramp

The official explanation is rather cryptic. Privy merely said that post-acquisition, it would “gain more resources.” Stripe’s co-founder only shared a few vague keywords on X, such as “Programmable Vaults” and “next-gen global internet financial services.” Not much concrete information has been revealed.

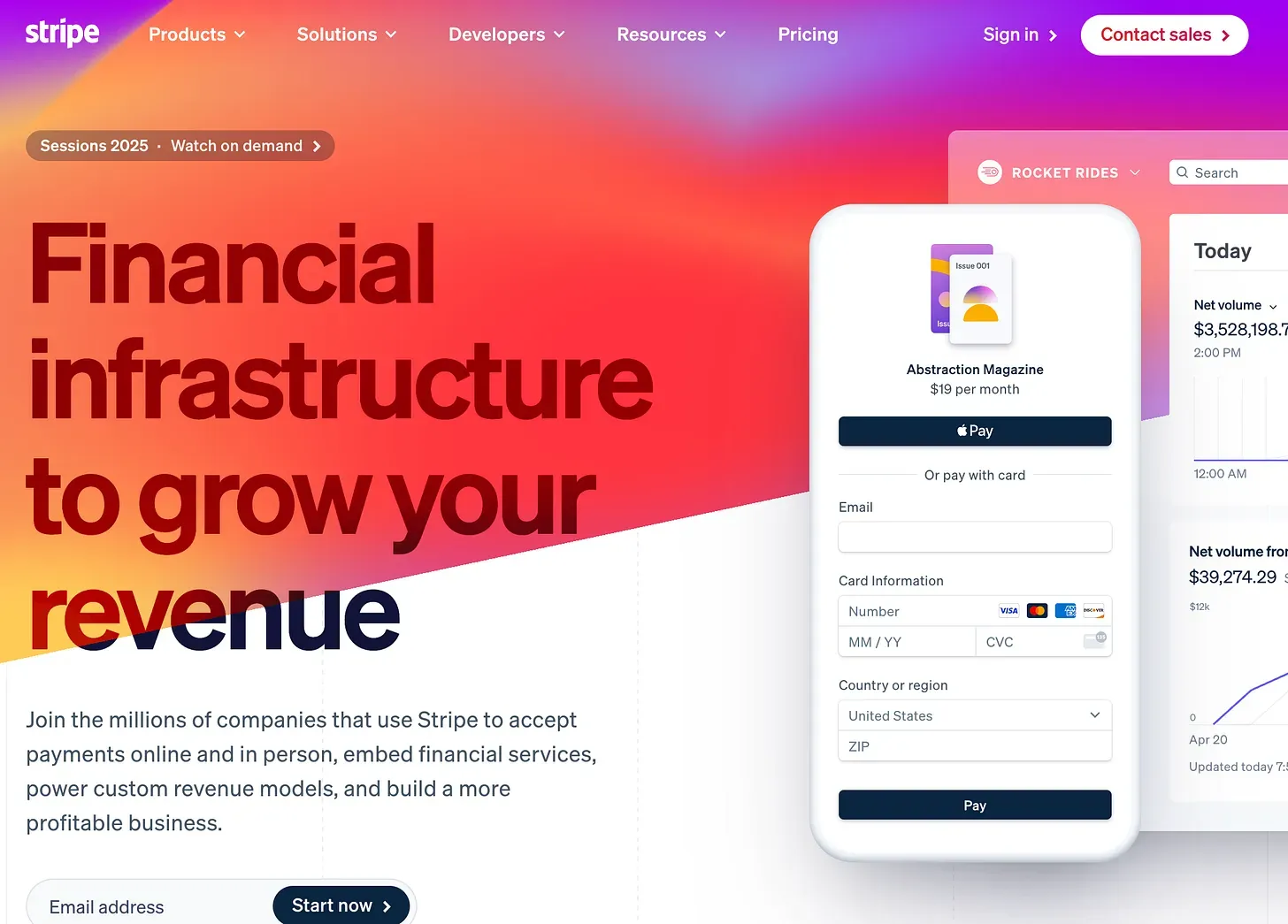

To understand the logic behind the acquisition, we have to go back to how Stripe makes money. Stripe is the world’s leading “online card reader” provider. Blocktrend’s payment page, for example, uses Stripe to process payments, and Stripe takes a cut of 2.9% plus 30 cents per transaction. The more online transactions grow, the more Stripe earns—solidifying its position as a piece of core financial infrastructure.

The acquisition must also serve this overarching goal:

- Increase transaction volume: Help existing customers do more business

- Grow the customer base: Enable more businesses and developers to use Stripe for payments

In the past, Stripe was cautious about crypto. It wasn’t until 2024 that the company officially enabled stablecoin payments 1, allowing merchants to accept USDC. This effectively opened the door to a new customer segment—bringing crypto-native capital into the broader economy via Stripe, thereby boosting overall transaction volume.

But to further expand its customer base, Stripe needs to enter new markets that attract more developers and merchants to integrate with its services. Beyond human users, Stripe is now aggressively pursuing payment solutions for AI agents 2.

Stripe’s current checkout page is designed for humans. But AI agents behave more like Web3 users—they aren’t used to the “fill a form → swipe a card” flow of one-off purchases. Instead, they prefer interacting directly with smart contracts via wallets. If a user connects a wallet upon visiting a site, but still has to be redirected to Stripe for checkout, it feels not only inefficient—but like a step backward.

From an AI agent’s perspective, the wallet is the checkout page. I believe Stripe’s acquisition of Privy is not just about providing wallet functionality—it’s about owning the gateway to a new class of users, especially AI agents 3. Even if these users don’t ultimately check out through Stripe, as long as they interact via a Privy wallet, they enter Stripe’s data orbit and service radius. Their behaviors, transactions, and fund flows could all become critical inputs for Stripe’s risk assessment, accounting, and identity verification systems. The acquisition of Privy completes a key piece of Stripe’s Web3 puzzle.

In contrast, few online discussions have focused on why Privy agreed to be acquired by Stripe. I believe there are two main reasons. First, Privy doesn’t have a clearly dominant technical advantage, and the embedded wallet space is highly competitive—Taiwanese startup Blocto, for example, also develops embedded wallets. Second, Privy is currently embroiled in a patent lawsuit with Magic Labs. In 2023, Privy’s founder was sued by Magic Labs for allegedly stealing patented technology to build a competing product. That lawsuit is still ongoing. Magic Labs, considered a pioneer in the embedded wallet space, is backed by PayPal. In this context, being acquired by a resource-rich company like Stripe is not only a lucrative exit for Privy—it’s a way to secure a powerful ally for a potential legal battle.

Interacting on-chain used to be notoriously difficult—just like online payments once were. Stripe changed that by offering a simple API that let merchants accept payments with ease, wrapping complex technology in a single line of code. The two crypto startups Stripe recently acquired—Bridge and Privy—share a similar vision: to turn complex technologies into APIs. Once the technical barriers are removed, real applications can finally emerge.

P.S. This is Blocktrend’s 699th article. After the 700th article is published, Blocktrend will adjust its subscription pricing to $10 per month or $100 per year. The new rates will apply only to new subscribers or members who cancel and later resubscribe—existing subscribers will keep their current pricing.

1 Stripe Returns to Crypto Payments: Now Accepting USDC and Why Middlemen Still Matter

2 The Forgotten HTTP 402: How It Could Become the Most Important Payment Gateway in the Age of AI

3 AI Doesn’t Look at Ads—So Who Will Pay for Online Content?