Blocktrend AI Experiment | Google Builds Its Own Financial Blockchain: Private Business in Public Infrastructure

GM,

For the past five years, every Blocktrend article has come with an audio recording. That was something I did after finishing the writing and editing — spending another half hour late at night to record the narration. Over time, it has added up to more than 400 recordings. Starting this week, I want to try something new: using Google’s AI tool NotebookLM to turn each article into a Traditional Chinese “conversational audio file”, temporarily replacing my live narration. For content creators, this feels like an honor — content is not only being read, but also being discussed. A month from now, I’ll check in with everyone to see how you feel about it and whether we should continue.

Also, a quick reminder: many people might not know that you can connect Blocktrend to Apple Podcasts or Spotify through RSS Feed. That way, when you’re driving or exercising, you can follow articles by listening — much more convenient. This week’s topic also has to do with Google.

Last week, Google announced the launch of its independently developed blockchain, Google Cloud Universal Ledger (GCUL). Interestingly, Google’s head of Web3 seems almost like a Blocktrend reader, sharing the same perspective on current events. He said: “Tether won’t use Circle’s blockchain, and Adyen might not use Stripe’s blockchain. But any financial institution could build on Google’s chain.”

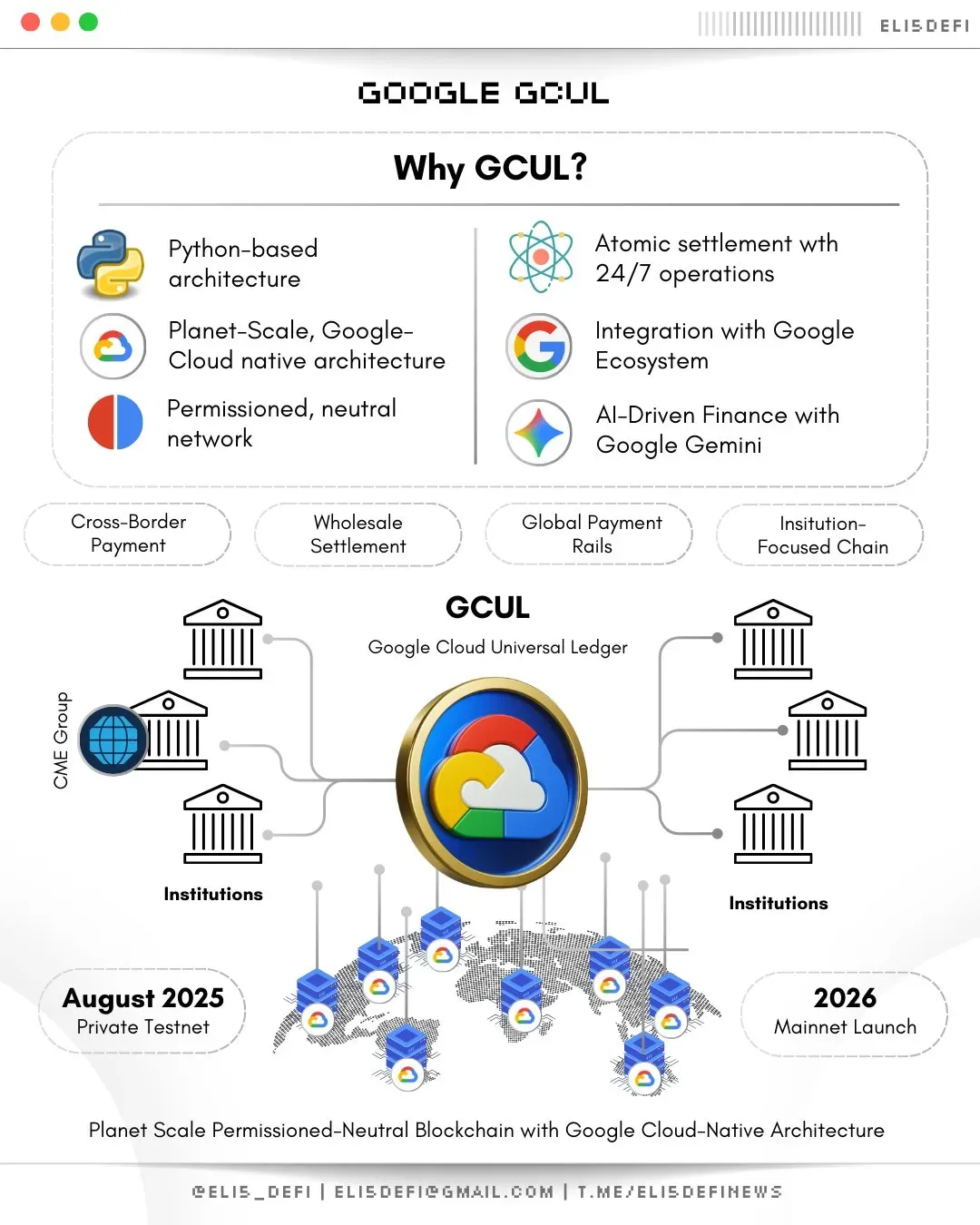

Google says that the world’s largest commodity futures exchange — the Chicago Mercantile Exchange (CME) — has chosen to run its tokenization and payments experiments on Google’s chain. Google’s blockchain highlights three core features: high performance, Python support, and credible neutrality. No one would doubt Google’s technical strength in delivering the first two features. This article will focus on the third — how Google aims to achieve credible neutrality, and why it matters so much for blockchains. But before that, I want to start with a story about Amazon, the world’s largest e-commerce platform.

Amazon’s Promise of Neutrality

Amazon was founded in 1995. Originally, the company was called Cadabra, but after a lawyer misheard it as cadaver(corpse), the name was changed to Amazon. Founder Jeff Bezos chose the new name for two reasons: first, the letter “A” appears at the beginning of the alphabet, making it more visible; second, the Amazon River is the world’s largest river by basin area, and Bezos wanted Amazon to become the world’s largest online bookstore.

In its early days, Amazon was the “best friend” of bookstores and publishers, helping them sell books online. The site operated with a light model: only after receiving an online order did Amazon purchase the book from publishers and ship it to customers. This model quickly attracted other types of sellers, who asked Amazon to open online channels for them as well. One could say Amazon’s early success came from focusing entirely on helping sellers do business, positioning itself as a neutral e-commerce platform rather than competing directly with them.

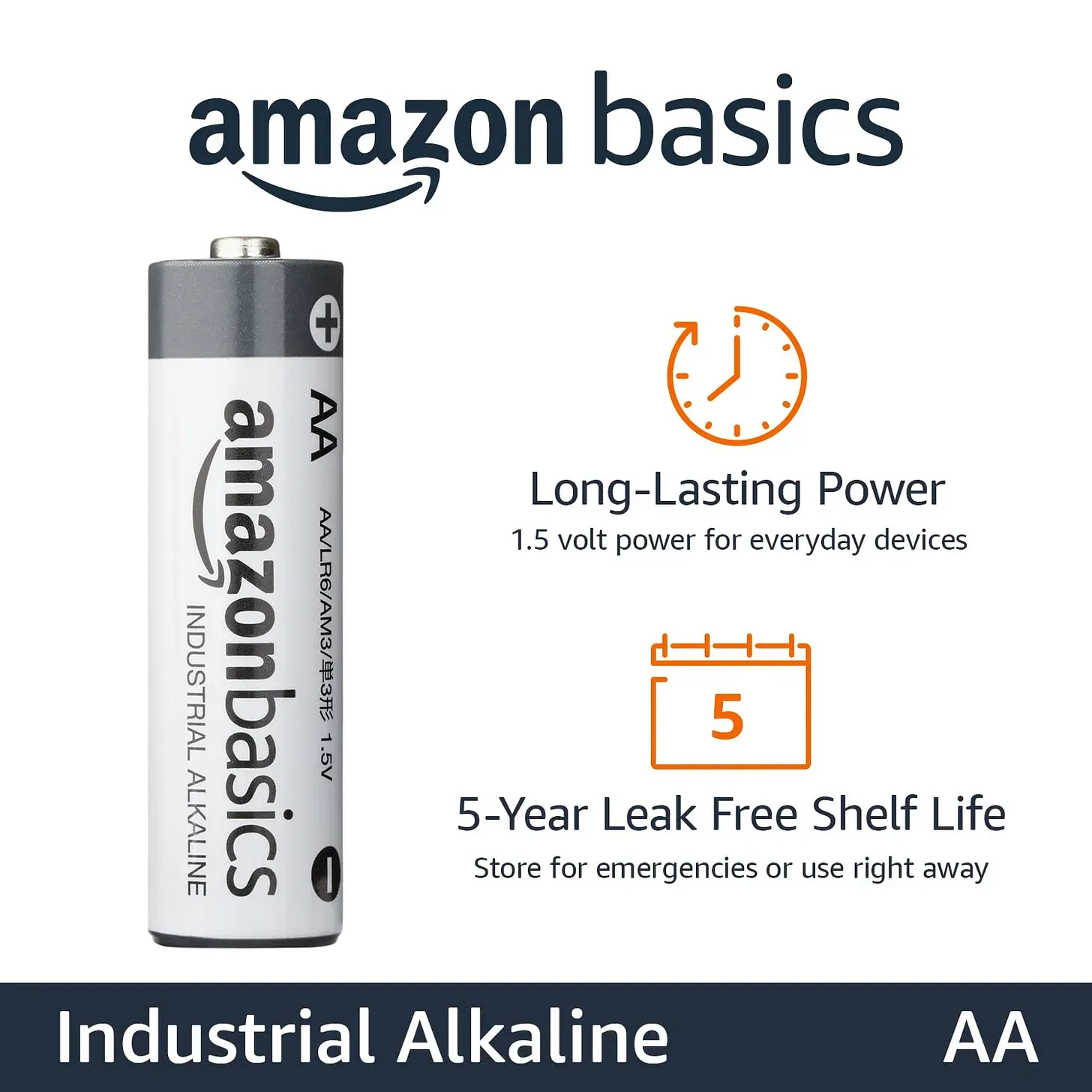

But as the business grew, this non-competition promise began to waver in 2009. That year, Amazon launched its own private label, Amazon Basics. The products were simple in design but stood out for being cheap and practical. The classic example is batteries. Batteries are a daily necessity with steady demand. Amazon Basics batteries were affordable and reliable, and search results on the platform often ranked them above well-known brands like Duracell and Energizer. With the dual advantage of low price and high visibility, sales of Amazon Basics batteries steadily climbed, and by 2018 they captured 30% of the U.S. online battery market.

At this point, merchants on the platform realized that Amazon’s original promise was long gone. What made it worse was that Amazon wasn’t just competing directly — it was also using sales data from the platform to precisely identify which best-selling products Amazon Basics should copy next.

A platform going back on its word is nothing new; a platform keeping its promise is the real news. Last week, Google announced the launch of its blockchain, Google Cloud Universal Ledger (GCUL), branding it as “credibly neutral”public infrastructure. Google pledged not to compete itself, but instead to focus on helping financial institutions move money onto the blockchain.

The Meaning of Google’s Blockchain

To understand Google’s chain, one has to start with Google Cloud. Google’s Web3 division has long been part of Google Cloud, which directly shapes how Google approaches blockchain. The focus isn’t on building decentralized applications from scratch, but on running blockchain as a business — specifically, to make money for Google Cloud.

Over the past few years, Google has provided node-hosting services, blockchain APIs, and infrastructure support for exchanges and DeFi developers to run applications on Google Cloud. In essence, it played the role of an “arms dealer.” But with the launch of Google Cloud Universal Ledger (GCUL), Google is now stepping onto the field itself. In its official blog, Google explained this pivot: today’s financial systems are fragmented, costly, and slow. The financial infrastructure of the future will likely be built on blockchains, and Google wants to position itself as the supplier of this new infrastructure.

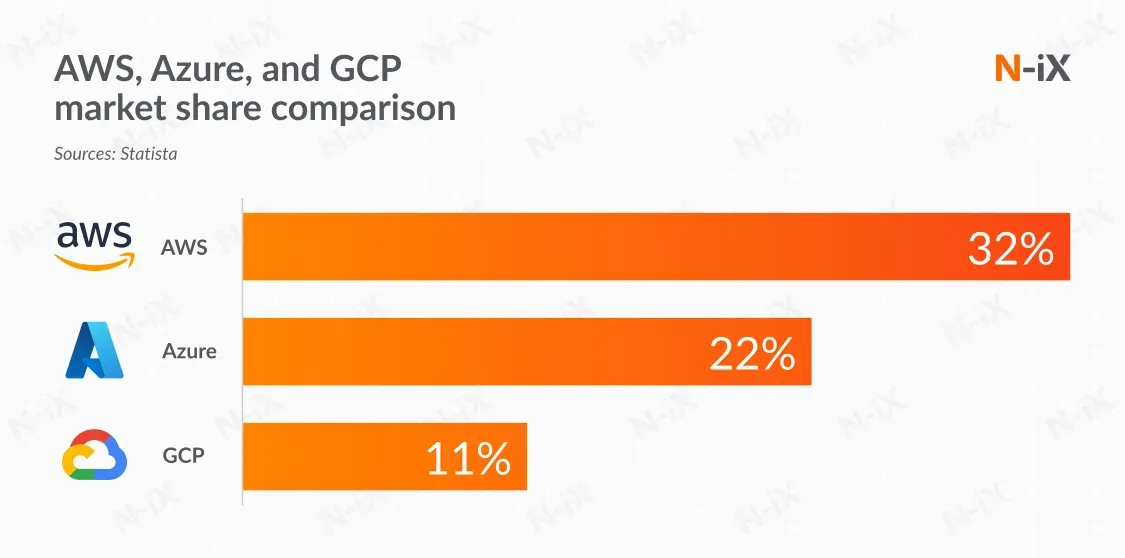

This is what you might call an overtaking-on-the-curve strategy. In the cloud market, there are three dominant players: Amazon AWS, Microsoft Azure, and Google Cloud — with Google trailing behind the other two. Meanwhile, financial institutions are now actively considering whether they should move on-chain. And if so, which chain should they choose? In the past, Google would present a list of blockchains it supported and let financial institutions pick one. But after hearing the same question repeatedly, it’s only natural that Google began to wonder: “Why not just build a blockchain of our own?”

For financial institutions, the choice becomes much simpler. Take CME as an example: they had already signed a 10-year cloud contract with Google Cloud. Since they were already using Google’s services, it was only natural to test tokenization on a blockchain launched by Google. By contrast, moving operations to Ethereum or Solana would mean adapting to an entirely different technical environment and operating model from Web2 cloud systems, and convincing executives to approve such a move would be far more difficult. With this context in mind, Google’s positioning of its blockchain becomes much clearer.

Google defines GCUL as a regulated, permissioned blockchain. Since it isn’t an open public chain, there’s no need to design a token economy or solve complex issues like “how to incentivize miners.” This makes it highly unlikely that Google will issue its own cryptocurrency. Instead, users simply pay based on Google Cloud’s existing pricing model. GCUL’s main selling point is its “credible neutrality” — meaning it won’t favor insiders the way Circle’s or Stripe’s blockchains might. Google promises that GCUL will remain a neutral settlement platform, focusing solely on lowering costs and improving efficiency, without competing against its financial clients.

This is essentially selling a blockchain the same way it sells cloud services. The financial sector is the most profitable segment of the cloud market, and also the least likely to switch infrastructure providers once locked in. For Google, the core goal of launching GCUL isn’t decentralization, but rather expanding Google Cloud’s market share in finance. Its critique of traditional finance as slow and inefficient may simply reflect the fact that Google Cloud’s presence there is still relatively small and burden-free. Even though Google has promised neutrality, who can guarantee it won’t one day move directly into financial services?

Don’t Be Evil

Google doesn’t have a banking license, so in the short term, the financial services it can offer are indeed limited. But the convergence of technology and finance is clearly an unstoppable trend.

Angela Strange, a partner at well-known venture firm a16z, once predicted that “every company will eventually become a fintech company.” Providing financial services not only boosts profitability but also increases customer stickiness. For example, Shopify originally just helped merchants set up online stores and charged a monthly fee. But it later realized that the most crucial part of doing business is getting paid and accessing credit. So it launched payment and lending services. Today, nearly half of Shopify’s revenue 1 comes from financial services — and merchants have become even more dependent on the platform.

Uber, for example, has launched dedicated financial accounts and the Uber Pro debit card for its drivers, offering cashback, fuel discounts, and repair perks. These services not only increase driver satisfaction with the platform but also reduce the likelihood of them switching to competitors. More recently, Stripe announced the launch of “Stablecoin-as-a-Service 2”, which is even more pivotal. Any company can now issue its own stablecoin simply by integrating with an API, further lowering the barrier to entry.

If, in the future, Apple, Facebook, and Amazon all begin issuing stablecoins, can Google still maintain its boundary of “not competing with its clients”? And with the vast trove of financial transaction data GCUL controls, could it eventually become the next Amazon Basics?

Ethereum co-founder Vitalik Buterin once defined credible neutrality as a system that does not favor anyone, is open and transparent, and can be verified by all. What Google emphasizes as credible neutrality is entirely different — not a set of institutionalized rules, but rather the promise of a tech company. It is reminiscent of Google’s early slogan, “Don’t be evil” — asking people to trust that Google will do the right thing at critical moments. But a company’s mission is to generate profits for its shareholders, not to safeguard the public good.

Although GCUL is branded as an L1 blockchain, its true competitive arena lies with corporate-built “intranets 3” like those of Stripe and Circle, not with Ethereum’s “internet.” This distinction is critical: the future of our financial infrastructure could diverge into two very different paths — one maintained by corporate promises, the other safeguarded by institutional design, where anyone can verify the system.

Infrastructure built by private companies might give us a landscaped community courtyard, but it can never become the roads and bridges that connect us to the world.

p.s. In the audio recording, sometimes it says GCUL and sometimes GCLU, but they’re both referring to the same thing 😂

2 MetaMask launches a token! Stripe becomes a stablecoin arms dealer — what does this mean for USDC?

3 Circle and Tether build their own blockchains: What impact will this have on Ethereum?