Are Stablecoins Wildcat Banks? An Analysis of the Central Bank Governor’s Three Major Misconceptions

GM,

Last week, Central Bank Governor Yang Chin-long delivered a keynote speech titled “Digital Innovation in Payments and the Role of the Central Bank” at the Financial Information Service Co. annual conference. His talk focused on three major topics: stablecoins, tokenization, and central bank digital currency (CBDC). This video is a three-minute highlight reel of the speech.

Governor Yang cited the example of 19th-century American “wildcat banks”, arguing that stablecoins are unlikely to become mainstream and that the wholesale CBDC currently being tested by the central bank has far greater potential. Honestly, when I first saw the news reports, I couldn’t believe the governor was so out of sync with global trends. After verifying the details, I realized his understanding of why stablecoins are low-cost and efficient is strikingly similar to Blocktrend contributor Chü-po’s arguments — which is deeply concerning.¹

In this article, I will fully reference the Central Bank’s official transcript and presentation slides to outline three major misunderstandings Governor Yang has about blockchain and cryptocurrencies. I will first describe his claims, then explain what’s wrong, and support the explanation with facts. Let’s begin with the wildcat banks.

Misunderstanding #1: Stablecoins Are Like Wildcat Banks

In 19th-century America, before the creation of the Federal Reserve System, local banks could issue their own banknotes backed by their gold reserves. At its peak, the United States had over 8,000 different types of banknotes issued by various banks. And where there is abundance, there is rot. Many banks set up branches in remote regions known only for wildcat sightings, and they often collapsed without warning — leaving people holding banknotes that suddenly became worthless.

Yang cited this episode in history and referenced a 2021 academic paper, Taming Wildcat Stablecoins, drawing an analogy between stablecoins and wildcat banks:

Due to the insufficient price stability of various stablecoins and the fact that many issuers are registered in jurisdictions lacking proper regulation, some scholars believe this is no different from a modern-day version of the “wildcat banking” era.

What he meant was that if money is issued by private institutions, it could lead to the same kind of monetary fragmentation and trust issues seen during the wildcat bank era—ultimately leaving the central bank to clean up the mess. These concerns are not baseless. The algorithmic stablecoin UST (Terra/Luna 2), which dominated headlines in 2021, has since fallen to zero. Even the two leading stablecoins, USDT and USDC, have experienced depegging events due to bank runs 3, causing their prices to deviate from 1 USD and sending waves of panic through the market.

Zhang Fei Fighting Yue Fei

I refer to this argument as Zhang Fei fighting Yue Fei. How could historical figures from completely different eras possibly fight each other? Stablecoins in 2025 are already in a new era. More has happened in the past year than in the previous ten combined, and regulatory direction has swung 180 degrees.

The pivotal turning point came in July this year, when U.S. President Donald Trump signed the GENIUS Act 4. To address the risks of “wildcat banking,” the act explicitly requires issuers to obtain regulatory approval, maintain 1:1 reserves in U.S. dollars or highly liquid assets such as short-term Treasuries, regularly disclose reserve composition and issuance amounts, and bans the issuance of algorithmic stablecoins altogether.

Today, from Wall Street to financial regulators, no one views stablecoins as wildcat banks anymore. Instead, they have begun integrating them into the financial system.

Larry Fink, CEO of BlackRock—the world’s largest asset manager—publicly criticized Bitcoin in 2017 as an “index of money laundering.” Yet BlackRock now not only issues the world’s largest Bitcoin ETF but also manages the U.S. dollar reserves 5 backing USDC. Just last week, Larry Fink publicly admitted that he had been wrong in the past. Paul Atkins, chair of the U.S. Securities and Exchange Commission, likewise stated outright that the U.S. financial system will be fully tokenized within a few years.

In contrast, Taiwan’s central bank seems to be living in a parallel universe. It is already the end of 2025, yet it is only now citing academic research from 2021 as a warning—and has completely failed to keep up with changes in the global regulatory landscape.

Since the central bank is concerned about the risks of wildcat banking, how should Taiwan respond to international trends? The governor’s answer is CBDC (Digital New Taiwan Dollar). If issued directly by the central bank, it certainly wouldn’t be wildcat money.

Misconception #2: CBDCs Are the Ultimate Solution

The governor did not completely dismiss stablecoins. He believes stablecoins may have a place in the future, but ultimately they must be built on top of a CBDC. A CBDC, being the most upstream of all, is more deserving of investment than stablecoins. He then explained that there are two types of CBDC models: retail and wholesale. The former allows the central bank to bypass private-sector intermediaries and issue digital currency directly to users—essentially functioning like a government-issued stablecoin. The latter tokenizes central bank reserves and is primarily intended for financial institutions.

Over the past year, the central bank held six public hearings and worked with various government agencies to launch the Hakka Coin pilot and the NT$10,000 universal cash distribution program, all to test the effectiveness of retail CBDCs. But in his speech, the governor candidly admitted that so far, demand appears limited. The reason is simple: TWQR, the mobile payment system managed by Financial Information Service Co., is already so convenient that the general public sees no incentive to switch to a government-issued CBDC—no matter how trustworthy it may be. As a result, the central bank recently decided to shift its focus to wholesale CBDCs, confident that at least financial institutions would appreciate a currency issued directly by the central bank…right?

The Giant in the Ivory Tower

The central bank is a giant in an ivory tower—full of knowledgeable experts well-versed in theory, yet unfortunately far removed from the market.

What are stablecoins actually used for? The central bank may not even be able to answer the most basic question correctly. In April, it released a promotional video for the Digital New Taiwan Dollar showing use cases such as buying breakfast and giving out pocket money. This reflects the central bank’s imagination of what stablecoins are for. No wonder that when designing use cases for a retail CBDC, it chose to focus on daily payment scenarios like the Hakka Coin pilot and the NT$10,000 universal cash distribution. It even used the success of TWQR as an excuse to pat itself on the back.

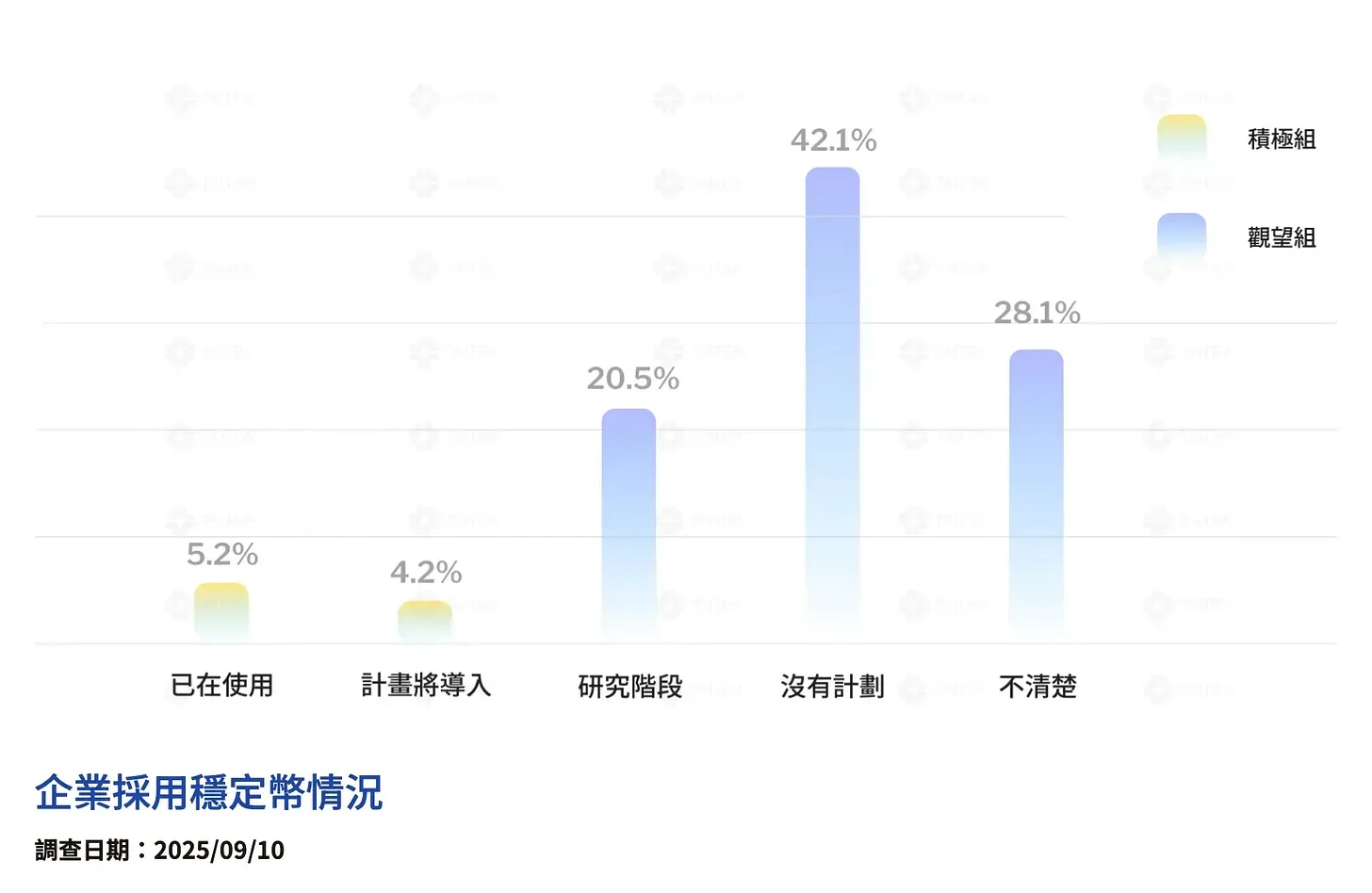

But if the central bank simply asked banks and exchange operators what they have been busy with lately, they would all give the same answer: “Figuring out how to receive stablecoins for clients.” Even if they stayed in the office reading reports, they still shouldn’t be this disconnected from reality. The Taiwan External Trade Development Council recently released data showing that about 5% of Taiwanese companies are already using stablecoins for cross-border business. Cross-border remittances are currently the most important use case for stablecoins.

The central bank is still avoiding the real issue. The governor claims that U.S. dollar stablecoins mainly affect high-inflation countries, where locals hold them to maintain purchasing power. But this fails to explain why Taiwanese businesses are using stablecoins too—has the New Taiwan Dollar suddenly become hyperinflationary? Of course not. Taiwan is an export-oriented economy. Our electronic components are sold worldwide, and naturally we receive payments from companies around the globe.

Over the past year, more and more foreign companies have been requesting to pay in stablecoins. Yet not only has the Taiwanese government failed to establish proper receiving procedures for companies to follow, the central bank continues promoting the outdated “wildcat bank” narrative and assumes that once it launches a wholesale CBDC, financial institutions will automatically adopt it. But among all the U.S. dollar stablecoins currently circulating in the market, which one is backed by a CBDC as its reserve asset? If the answer is none, where does the central bank’s confidence come from?

The disconnect between perception and the market is troubling enough, but what’s even more perplexing is that the central bank seems to be ignoring professional knowledge altogether. The central bank questions whether stablecoins can still deliver fast and low-cost services if they must comply with anti–money laundering and counter-terrorism financing regulations. This completely reverses cause and effect. Stablecoins are fast and low-cost not because they circumvent regulation, but because they are natively built on borderless blockchains. It’s like making a free international call on LINE—not because you are dodging regulation, but because the service inherently runs on the internet. The central bank mistakes the low cost brought by technological innovation for regulatory arbitrage, which explains why it is so sensitive to “wildcats.”

Misconception 3: Stablecoins lack consumer appeal

If the central bank cannot even get its own domain expertise right, its misunderstandings of DeFi are even more glaring. Governor Yang ultimately echoed the same argument 6 made by Chairman Tung Jui-bin, claiming that NT-dollar stablecoins resemble EasyCards, which follow a “Pay Before” model. Users must load value before they can spend, unlike debit cards (Pay Now) or credit cards (Pay After). The implication is that stablecoins have limited appeal for cost-conscious consumers.

This use case is relatively new, so it’s understandable the governor might not be aware. But anyone who has used a crypto payment card knows that most cards today allow your assets to keep earning yield until the very last moment—funds are only deducted at the time of payment. This is similar to the Pay Now model of debit cards. Ether.fi’s 7 Borrow Mode goes further by allowing users to borrow against their wallet assets as a credit line, repaying later with interest—effectively achieving the Pay After model of credit cards. For central bank officials who have never used crypto, it is unsurprising they cannot understand why crypto payment cards are appealing.

I suspect that because the central bank is the largest shareholder of Financial Information Service Co. (FISC), it keeps pulling FISC into building new platforms. Yet blockchains are decentralized by design. As long as systems follow internationally adopted token standards (such as ERC-20), domestic and foreign financial institutions can interoperate—FISC need not serve as a middleman. This puts FISC in the same awkward position as SWIFT: in the future financial landscape, it simply cannot find its place.

“Your seat determines your mindset.” On the surface, the central bank seems adventurous—experimenting with CBDCs since 2022 and now ambitiously advancing to the next phase. But on the other hand, even though 5% of Taiwanese businesses already use stablecoins, the central bank remains uninterested, casually dismissing them with labels like “wildcat banks,” “regulatory evasion,” and “rejected by consumers.” Ultimately, what the central bank truly fears is not wildcat risks—it fears that future innovation will occur on platforms it does not control.

Many companies and governments worry: what if the blockchain suddenly shuts down? Anything outside their own control feels unsafe to entrust to the market. This is a systemic mindset. But those who understand public infrastructure know that it should be built on open standards—like the internet—not on another centralized platform. The central bank must overcome its psychological barriers and step onto the blockchain.

As a Taiwanese person, I hope that one day Taiwan will also be able to export stablecoins, not just depend on the dominance of the U.S. dollar. That is the direction the central bank should be thinking about—because in the long run, the best defense is a good offense.

2 UST Depegs: Price Defense Battles, Death Spirals, and Irreversible Loss of Confidence

3 USDC Depegs: How Banks Dragged Down Stablecoins and Exposed a Fractured Financial System

4 The U.S. Passes a Stablecoin Act! Why Skip Launching a CBDC and Still Win?

6 An Open Letter to Chairman Tung Jui-bin: EasyCard Is Not a Stablecoin — Here’s the Key Difference