A Rational Investment Strategy for the Bull Market: Counter Human Nature with Machines, Refine Intuition with Prediction Markets

GM,

Bitcoin has once again hit a new all-time high — but do you remember exactly what the current ATH (All-Time High) is?

I honestly can’t keep track anymore 😂 Ever since Bitcoin broke past $100,000, the price has started to feel “blurry.” I used to care about whether it was $36,000 or $74,000, but now when I see $110,000 or $120,000, it all just feels like “a hundred-something thousand.” Basically—expensive, and that’s all that matters!

This is actually a well-documented psychological phenomenon known as Left Digit Bias.

Left Digit Bias

Have you ever noticed that Uniqlo’s prices — whether discounted or not — almost always end with a “90”? Take the example below: these pants were originally priced at NT$1,290, but are now on sale for NT$990. When consumers see the price drop from four digits to three, they’re far more likely to make a purchase. This is a classic example of how businesses use Left Digit Bias to boost sales.

The key lies in the fact that our brain isn’t a calculator—it’s a classifier. It doesn’t compute that “NT$1,290 to NT$990 is a 24% discount.” Instead, the moment it sees the leftmost digit change—from 1 to 9—it instantly reclassifies the price into a new “category,” instinctively believing it’s a much better deal.

Research shows that when numbers cross an integer boundary, our brains perceive a large difference. This effect is most obvious in consumer behavior: a price drop from NT$100 to NT$99—barely a 1% discount—makes people significantly more likely to buy. Nobel laureate Daniel Kahneman explained this in Thinking, Fast and Slow: in everyday judgments, we rely on System 1 thinking—fast, intuitive, and reluctant to analyze deeply. It’s great at categorizing but terrible at calculating.

In shopping, left digit bias makes us feel things are cheaper and pushes us to buy. But in investing, the effect is reversed—when the leftmost digit doesn’t change, we may miss the right time to buy or sell. Fighting this bias is a core skill for elite traders.

For the rest of us, there’s a simpler solution: let machines handle it.

Machines Against Human Nature

“Is it still a good time to buy Bitcoin?”

That question pops up every time the market rallies. I used to say, “Just take the money you won’t need for the next five years and buy blindly.” I never tracked who actually followed that advice, but I’m sure very few did—bear markets are long and brutal, and it’s hard to hold on without conviction.

Strictly speaking, asking whether to buy Bitcoin is just small talk—not a real question. But for those who do want to take it seriously, I often quote LikeCoin founder Chuangjian Kao’s advice: Dollar Cost Averaging (DCA). Buy a fixed amount—say NT$100—every day, in any currency or token you choose. Then, when the price steadily breaks new all-time highs, switch to selling a fixed amount regularly. This not only reduces the risk of buying all at once but also solves an even tougher problem than timing your buys: knowing when to sell.

To be honest, though, this isn’t easy to stick with. Chasing highs and panic-selling lows is human nature—DCA takes both time and discipline. What’s more, some people don’t even own any Bitcoin yet and are itching to jump in. Since last year, I’ve been recommending them a DCA bot (advanced version) instead. Now that Bitcoin is hitting new ATHs again, this is the perfect time to use it!

These advanced DCA bots are available on all major exchanges, though they differ in names and mechanisms. MaiCoin calls it the DCA Bot, while on OKX and Binance, it’s known as the Martingale Bot. I’ll use MaiCoin as an example—it’s the perfect cure for that “itch to buy at ATH” syndrome.

The advanced DCA bot invests the same way humans wish they could—buy low, sell high—but without obsessing over buying at the absolute bottom or selling at the absolute top. Its only rule is simple: if the cost is low enough and the profit high enough, it exits. That’s something most humans (lacking discipline) find nearly impossible to do.

Once activated, the bot makes its first buy immediately at the current market price, then places a series of buy orders at preset intervals below it. You can configure how wide those intervals are and how many orders to place.

The chart below shows the parameters I set a little over a month ago:

- Each order: US$910

- Buy every 1% drop

- 10 total orders

- Sell once profit reaches 10%

If the price keeps rising after I launch the bot, none of those additional orders get triggered—but I don’t feel FOMO, because I already hold some Bitcoin. Once that initial US$910 in BTC becomes US$1,001—a 10% profit—the bot automatically sells. Round complete.

But at that time, I encountered the exact opposite situation. The price started dropping right after I launched the bot — from $115,000 down to $107,000. Following the preset strategy, the bot automatically executed seven buy orders of $910 each, accumulating BTC for me along the way. When the price later rebounded to $122,000, hitting the 10% profit target, the bot sold everything automatically — both principal and profit — and reinvested it for the next round.

Looking back at those historical trades, the human “left-digit bias” becomes even more obvious. $115K, $107K, $122K — they all just feel like “ten-something.” Without the bot, I probably wouldn’t have realized I was down 6% and then up 10%. Although the advanced DCA bot can cure the “itch to buy at ATH” syndrome, it comes with a clear side effect — what if the market just keeps falling?

Using the Market to Counter Intuition

The advanced DCA bot assumes prices will eventually rebound, which makes it suitable only for bull markets. Once a bear market begins, the bot will keep buying on the way down without realizing it’s entering a bottomless pit. My approach is to turn off the bot near the end of a bull market and sell manually. But how do you know whether it’s a bull or bear market right now?

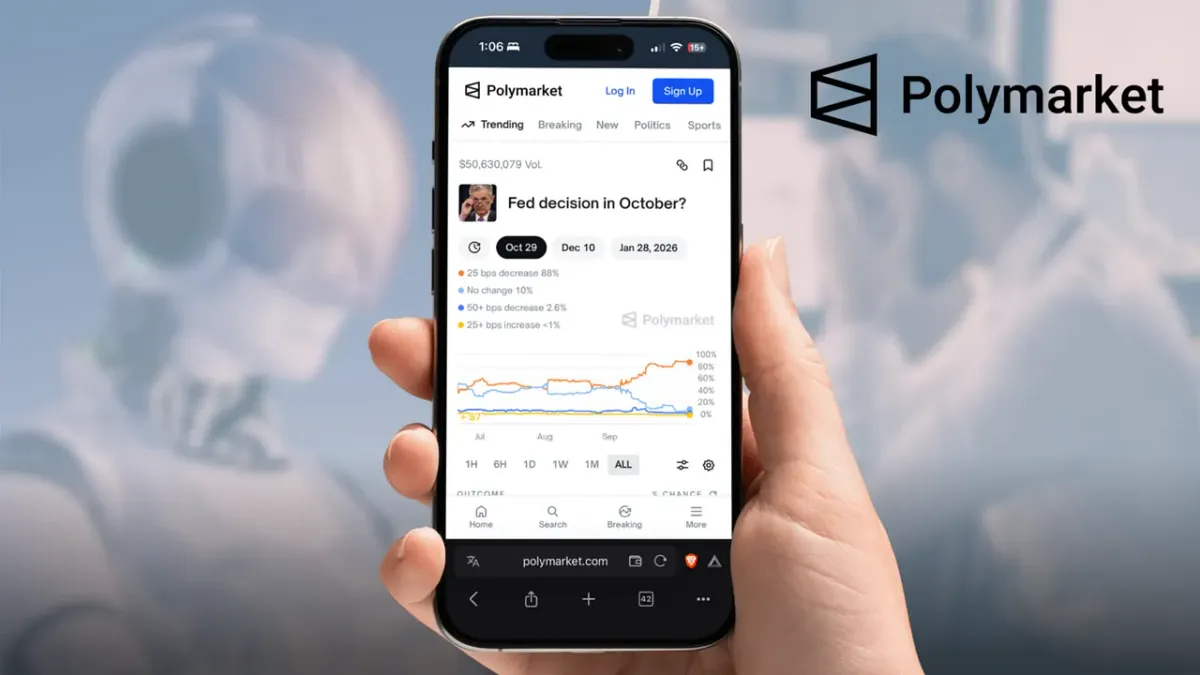

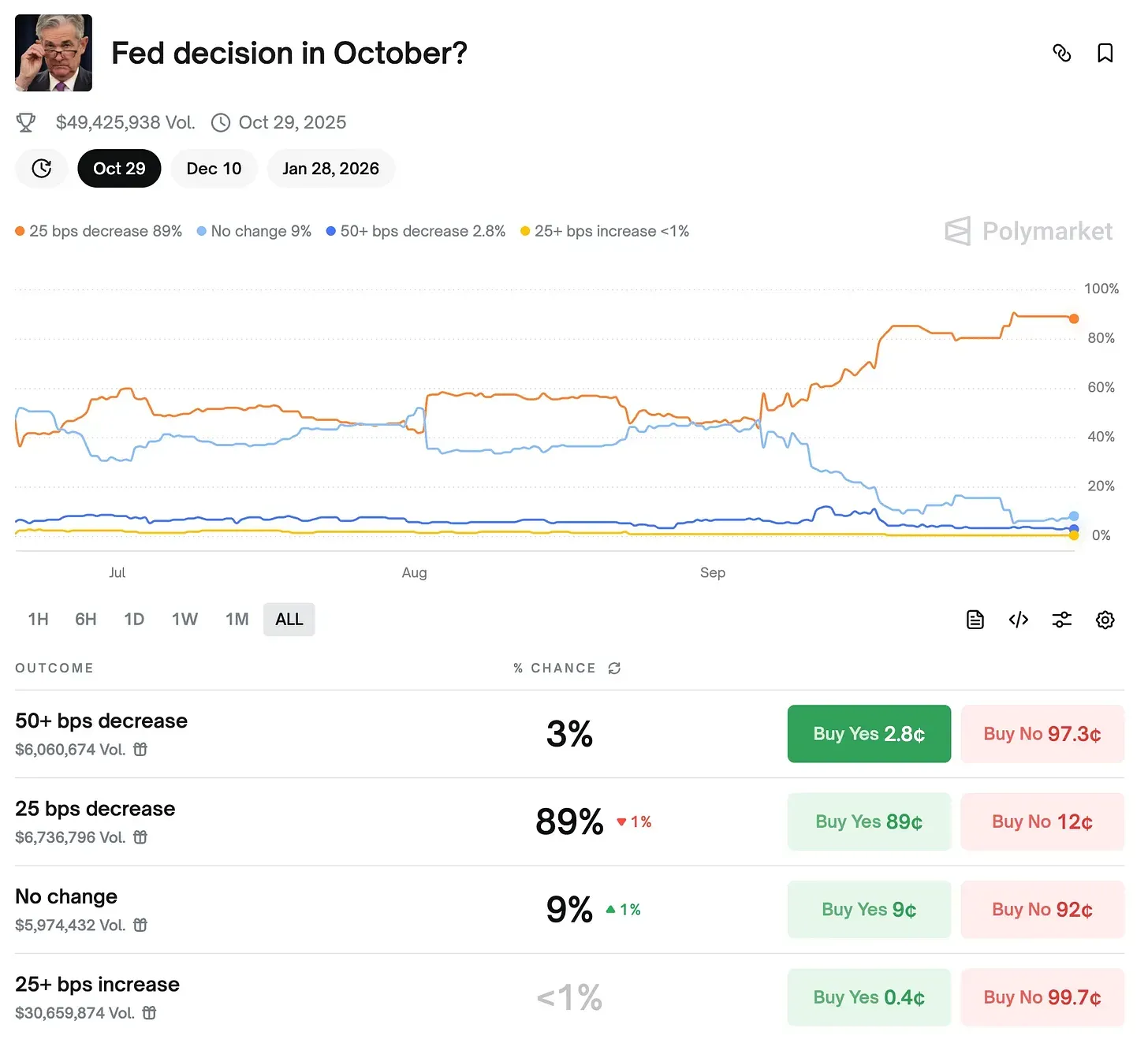

Some people rely on quotes from “legendary investors” reported by the media. I, however, trust Polymarket’s prediction markets more. For example, people place bets on whether the U.S. Federal Reserve will cut interest rates, and the resulting prices reflect the market’s expectations for the broader economy. If there’s one thing I’ve learned after going through two full bull and bear cycles, it’s this: never bet against macroeconomics.

In 2021, I recorded a podcast with macroeconomics expert Wang Boda, who shared a remarkably simple investment principle — timing the market according to the Federal Reserve’s interest rate policy. When the Fed announces rate cuts, it’s like turning on a faucet — bank liquidity flows into the market, and risk assets like stocks and cryptocurrencies naturally rise. Conversely, when rates go up, liquidity gets drained, and prices fall.

For most people, it’s impossible to know exactly how likely future rate hikes or cuts are — that’s where Polymarket becomes a real-time barometer. As of now, Polymarket shows an 89% probability that the Fed will cut rates by 25bps in October. And just last month, the Fed made its first rate cut of the year. That means capital is already flowing out of banks and back into the market. At times like this, I wouldn’t sell my crypto — let alone turn off the DCA bot — because the rally likely isn’t over yet.

So how long will the rally last? My personal indicator is when Polymarket’s prediction for the “next rate cut probability” falls below 60%. That’s usually when market consensus starts to diverge — a signal that the rate-cut cycle may be ending and a new rate-hike phase could be starting. No matter how much I like BTC or ETH, that’s when I’ll sell most of my holdings and wait to accumulate again when the bear market arrives.

Rely on Tools, but Also on Yourself

After Bitcoin broke past $100,000, left-digit bias became even more obvious — and active investing got harder. Now, if a so-called “legendary investor” predicts Bitcoin will reach $150K, the media might not even bother reporting it — it sounds too close. So the market starts floating targets like $500K or even $1 million. Let’s be honest: those numbers are simply products of how our brains categorize figures. Otherwise, why does no one ever predict $490K?

At Blocktrend, I rarely talk about investing, because that’s not where I spend most of my time. Writing this isn’t about turning into an investment guru — it’s about sharing a decision-making process anyone can replicate. I can’t promise it’s the most profitable strategy, but it has helped me stay calm and focused on work while prices climb.

There’s no investment method that guarantees quick wealth. Even with bots to automate execution, you still need your own judgment. In this bull market, I’m experimenting with machines to counter human nature and the market to counter intuition. The rest, I’ll leave to time.

1 On-Chain Prediction Markets Explode in Popularity! Polymarket Bets on the Future Amid Chaos