A Must-Read for U.S. Stock Investors! How to Use Stablecoins to Save 99% on International Wire Transfer Fees

GM,

Exactly one year ago, Stripe announced its $1.1 billion acquisition of Bridge, a startup providing stablecoin APIs — marking the largest acquisition in crypto history. At the end of my article back then, I wrote¹:

The current model of cross-border remittance is built on the assumption that money itself can’t actually move. Stablecoins finally make money truly transferable across borders. Once that assumption collapses, how will financial institutions manage their assets in the future?

If stablecoins can really evolve into a standalone payment category — alongside credit cards, SWIFT, or bank transfers — then Stripe’s $1.1 billion acquisition of Bridge will prove to be a very smart investment.

A year later, that assumption has come true. People now generally recognize the importance of stablecoins — the question is how to actually use them in everyday life. For people in Taiwan, investing in U.S. stocks is the most natural entry point.

The Hidden Costs of Custodial and Overseas Brokerages

Many of my friends are shareholders of NVDA, TSLA, or AAPL, and some invest in indices like VT, SPY, or QQQ. But since these stocks aren’t listed in Taiwan, investors can only buy them through custodial accounts (複委託) or overseas brokerages.

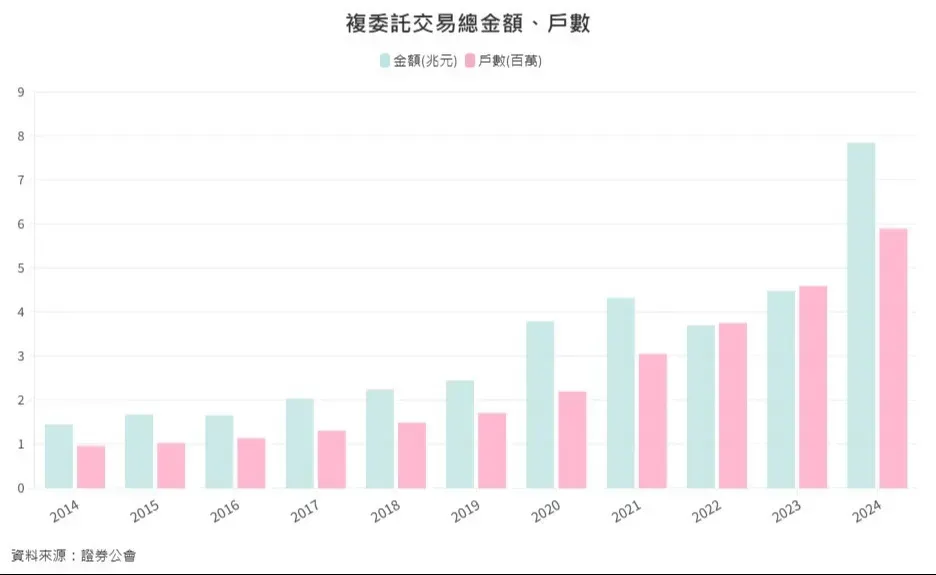

According to E.Sun Securities, in 2024 Taiwan’s total number of U.S. stock custodial accounts surpassed 5.8 million, with a total trading volume of NT$7.8 trillion — both record highs. Custodial services are convenient and secure, but their transaction fees are significantly higher than overseas brokerages, ranging from 0.1% to 1%. For long-term investors, that’s a substantial cost.

Conversely, opening an account directly with an overseas brokerage—such as Firstrade, Interactive Brokers, or Charles Schwab—can save on trading fees, but the trade-off is the high cost of international wire transfers. Cross-border transfers aren’t cheap, often costing over NT$1,000 per transaction, and processing still takes several business days. Many online guides offer tips for reducing wire fees, with the most common advice being: “Transfer a larger amount at once—it’s more cost-effective.” In short, if your investment capital is small, stick with custodial trading; if it’s large, then it’s worth opening an overseas brokerage account.

Stablecoins are erasing that divide. Recently, more and more crypto wallets have begun integrating U.S. bank accounts, directly treating U.S. dollars and stablecoins as interchangeable. These wallets allow users to “Deposit stablecoins and withdraw USD,” or “Deposit USD and withdraw stablecoins.” This setup completely bypasses the SWIFT transfer system, eliminating the need for expensive cross-border wire fees.

When this mechanism is combined with U.S. stock investing, it can help investors save up to 99% of international transfer costs—the smaller your capital, the greater the savings!

Same-Day Settlement, Just NT$20 in Fees

For Taiwanese investors, the traditional way to fund a U.S. brokerage account is to wire money via SWIFT from a Taiwanese bank. According to an experiment by Mr. Market (市場先生), the cost was NT$1,700 per transfer—no wonder many small investors prefer using local brokerages’ custodial services.

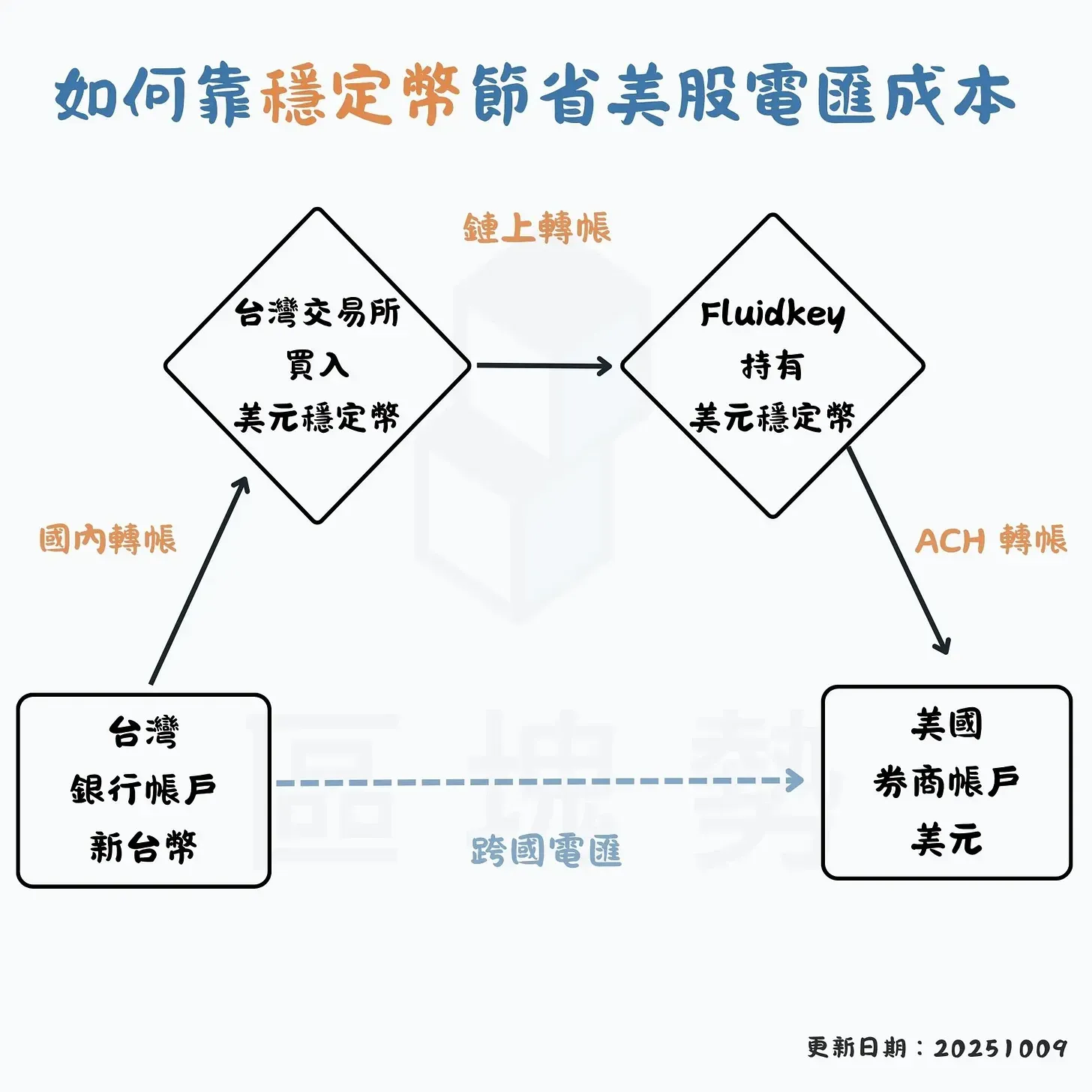

The good news is that stablecoins now offer a cheaper, faster alternative. By converting and transferring funds through stablecoins, investors can move money to overseas brokerage accounts within a day and cut transfer fees down to pocket change. The chart below outlines the step-by-step process I compiled for how it works in practice:

In the past, cross-border wire transfers were both expensive and slow. Now, with blockchain, the whole process can be completed in just a few minutes. It consists of three main steps:

- Buy crypto: TWD → USD stablecoin

- Withdraw: Exchange → Crypto wallet

- Deposit: Wallet → Overseas brokerage account

Step 1: Buying Stablecoins

There’s not much to explain here—each exchange provides its own tutorial on how to convert New Taiwan dollars (TWD) from your bank account into USD stablecoins. I recommend buying USDC, as it’s the most convenient option for the following steps.

Step 2: Withdrawing to a Wallet

For this article, I’ll use the Fluidkey wallet as an example 2. Fluidkey not only allows you to deposit USD and receive stablecoins, but also to withdraw stablecoins and convert them back into USD. However, at the moment, Fluidkey only supports Ethereum-based blockchains, including Arbitrum, Base, Ethereum, and Polygon. This means that the stablecoins you purchase on an exchange must be withdrawn through one of these networks for the wallet to receive them—a critical detail to remember!

Once Fluidkey receives the stablecoins, you can, in theory, transfer them directly as U.S. dollars to your brokerage account. But currently, Fluidkey only allows USDC on the Base chain to be withdrawn as USD. Therefore, you’ll need to use Fluidkey’s built-in cross-chain swap feature to move your USDC onto the Base network. After that, simply enter the bank account details provided by your overseas broker—and you’re done.

Step 3: Understanding the Costs

There are three types of fees involved in the process:

- Exchange trading fee: within 0.1% — for NT$10,000, the fee is about NT$10

- Exchange withdrawal fee: about US$0.10, regardless of amount

- Fluidkey cross-chain swap fee: about US$0.20, also amount-independent

If you’re transferring NT$10,000 to an overseas brokerage to buy U.S. stocks, your total cost loss is roughly NT$20—about the price of a bus ride.

That’s a 99% reduction in remittance costs, dropping from NT$1,700 to NT$20!

Besides being cheaper, the process is also much faster—in theory, it’s same-day settlement. That’s because the time-consuming international transfer step has been replaced by stablecoins and blockchain.

The final leg—from Fluidkey to your brokerage account—is a domestic U.S. bank transfer, meaning a shorter route and quicker arrival.

To confirm that this workflow actually works, over the past few weeks I opened accounts with Firstrade, Interactive Brokers, and Charles Schwab—the three most popular brokerages among Taiwanese investors. Based on my own tests and those of several Blocktrend readers, all three successfully support deposits and withdrawals using stablecoins, though the process varies slightly across platforms. For example, some brokers accept ACH deposits directly; some require account linking before transfers, and others only support domestic wire transfers (FedWire). Regardless of the small differences, one thing is clear: Stablecoins work.

I believe this will be the first time many people in Taiwan truly experience a “useful” application of cryptocurrency in their daily lives.

Financial Infrastructure

Using stablecoins for cross-border remittances is an application that benefits everyone. Whether or not you like cryptocurrencies, you’ll soon be able to save time and money through stablecoins and blockchain technology.

Some may ask, “But LINE Bank and Next Bank already subsidize international wire transfers—why bother going through all this trouble?”

That’s like comparing 3 a computer to a radio back in the day. If you could already listen to a baseball broadcast on a cheap radio, why spend money on a computer and an internet connection? Yet, nobody would say that today.

Cross-border wire transfers are costly and inefficient, while the internet knows no borders. Stablecoins, powered by blockchain, put money directly on the internet, offering far lower costs and far greater efficiency than traditional international banking systems. That’s the same reason we all now use LINE for messages and calls—no one worries about paying NT$3 per text anymore.

Quantitative change leads to qualitative Change. When remitting to an overseas brokerage account via stablecoins becomes this cheap, it’s only a matter of time before local brokerages’ sub-brokerage fees start to look expensive by comparison. In the short term, the stablecoin route still feels a bit rough. Many people may hesitate because they’re not yet comfortable with using exchanges, withdrawing on-chain, or performing cross-chain swaps. They’ll likely stick to their existing methods. But younger users are far more fluent in crypto operations—and I believe overseas brokerages will soon recognize stablecoins’ potential.

Take Firstrade as an example. The brokerage currently reimburses users US$25 in wire transfer fees for any single deposit exceeding US$10,000. As more people use this feature, the firm’s operating costs will naturally rise. But what if the brokerage followed Fluidkey’s lead and provided automatic conversion between USD and stablecoins?

In that case, users could deposit stablecoins directly, and the system would automatically convert them into USD to credit their account balance. The brokerage would save a fortune in wire-transfer reimbursements.

So what’s cryptocurrency actually good for? For most people in Taiwan, the answer has long been “making money from trading.” But in the near future, many will come to realize it can cut 99% of cross-border remittance costs. At last, cryptocurrency won’t just be an investment tool— it will become a part of the new financial infrastructure.

2 No Exchange Registration Needed! A Real-World Test of Zero-Fee Bank-to-Wallet Transfers

3 2021 Year in Review: The Internet Isn’t a Radio, and Blocktrend Is More Than Just a Media Outlet