A Global Payment Network for AI Agents: PayPal World

GM,

Last week, online payments giant PayPal announced two new products: PayPal World and Pay with Crypto. As the name suggests, Pay with Crypto allows merchants to accept cryptocurrency payments. But PayPal World is even more practical — and more ambitious. It enables PayPal users to travel abroad without needing to download local payment apps. All they have to do is scan a local merchant’s QR code (like WeChat Pay) using PayPal to pay directly. PayPal World is positioned as “the Visa of mobile payments,” aiming to connect the world’s 2 billion mobile payment users.

As Taiwanese, we may have already experienced the convenience of cross-border mobile payments. Two years ago, Taiwan’s mobile payment providers—JKOPay, PXPay, and E.SUN Wallet—began promoting a feature that allowed travelers to scan PayPay barcodes in Japan and pay directly. PayPal World is like an upgraded version of this system, letting users rely on a single app to navigate the world.

The Driving Force Behind Mobile Payment Interoperability

In the past, when Taiwanese tourists visited Japan or South Korea, they mainly relied on cash and credit cards. But over the past two years, local payment providers have aggressively promoted “0% foreign transaction fees” along with limited-time rebates, encouraging people to adopt a new habit while traveling: using the same mobile payment tools they use at home to pay abroad. According to media reports:

E-payment providers are eyeing the opportunity in cross-border spending and have expanded into overseas markets in recent years. In October 2023, JKOPay, PXPay, and E.SUN Wallet launched a partnership with Japan’s PayPay... Behind this partnership is HIVEX, a cross-border payment platform by the fintech company TBCASoft. HIVEX allows mobile payment providers to interoperate without changing their QR code formats, merchants don’t have to modify existing point-of-sale systems, and users don’t need to download a new app. They simply scan the merchant’s QR code and pay with the mobile wallet they already use.

Just like how a Visa card issued in Taiwan works in Japan without any changes—Visa handles currency conversion and settlement—mobile payment systems have historically lacked this kind of cross-border intermediary, which is why interoperability has been so limited. HIVEX aims to become the Visa of mobile payments.

HIVEX focuses on breaking down barriers between regional payment providers and enabling system interoperability. The company’s name, TBCASoft, is no coincidence either—the “chain” in its Chinese name directly reflects its use of blockchain technology to power the HIVEX cross-border payment platform.

The company was founded by Wu Ling, a 57-year-old Taiwanese entrepreneur. His blockchain firm, TBCASoft, successfully integrated with Japan’s leading mobile payment service PayPay, enabling Taiwan’s e-payment providers to seamlessly connect to over 4 million merchants across Japan. “It’s a waste to use blockchain solely for cryptocurrencies,” said Wu, who has an academic background in mathematics and science. Drawing on his earlier experience helping clients implement online payment systems, he realized that traditional cross-border payments suffered from exchange rate inefficiencies, high transaction fees, and centralized data management—all of which introduced vulnerability to hacking. With blockchain, he believed, these problems could be effectively addressed.

TBCASoft maintains a low profile. Its website discloses very little about technical specifics, only noting that it uses a consortium blockchain called HIVEX. It’s likely that HIVEX opted to build its own blockchain network in the early days to accelerate product development and avoid issues like gas fees. But this decision also introduced systemic credit risk—since the trust model is confined within the consortium. On the HIVEX platform, the circulating “stablecoins” are backed by corporate credit guarantees, rather than being collateralized with real assets like USD stablecoins. If just one company in the consortium runs into trouble, the entire network could be at risk.

While PayPal World may have launched two years later, its blockchain and stablecoin infrastructure is significantly more mature. In many ways, it’s an upgraded version of HIVEX.

PayPal World: A Revolution in Cross-Border Payments

PayPal makes its money from currency exchange and transaction fees, with the goal of enabling users to pay with PayPal no matter where they are in the world. However, due to past technical limitations and business barriers, it couldn't even interoperate with its own product, Venmo, let alone other payment platforms.

Now, PayPal World has finally unified its own ecosystem and goes a step further by directly connecting with China’s WeChat Pay, India’s UPI, and Latin America’s Mercado Pago—three dominant payment systems with a combined user base of over 2 billion people. In China, WeChat is a daily essential. In India, UPI is so widespread that even street vendors accept it. PayPal World integrates these networks, allowing users to pay overseas simply by scanning a QR code using their familiar app:

For most people around the world, international shopping and remittances remain difficult. Even though digital wallets are mainstream in many markets, consumers still have to switch to a different payment method when spending abroad. Remittances are also burdensome—expensive, complex, and time-consuming.

With the launch of PayPal World, users will be able to shop at millions of merchants worldwide—including online stores, physical retailers, and AI-assisted services—using their domestic wallets and local currencies to pay international merchants. Money can now move across borders more swiftly than ever before.

In the past, although PayPal claimed to offer “global payments,” cross-border transfers still relied heavily on banks and the SWIFT system. For example, if a user in Taiwan wanted to pay a merchant in Japan using PayPal, the company would first need to open bank accounts in both countries and then rely on SWIFT to manage the fund transfers 1. This model incurs high capital costs, involves slow settlement processes, and requires PayPal to closely monitor account balances across various local banks. The entire operation is cumbersome and inefficient.

Now that blockchain technology has matured and stablecoins are beginning to come under regulatory frameworks, the biggest change is that “money can finally move”. In the future, instead of pre-funding large sums in bank accounts around the world, PayPal can wait for a cross-border payment request and then immediately send USDC, USDT, or its own PYUSD stablecoin 2 over the blockchain. This means faster settlement and lower fees for both users and merchants. It’s a complete rewrite of how cross-border money moves—and what it costs. It also opens the door for any company that understands blockchain to play the role of a “mini Visa.”

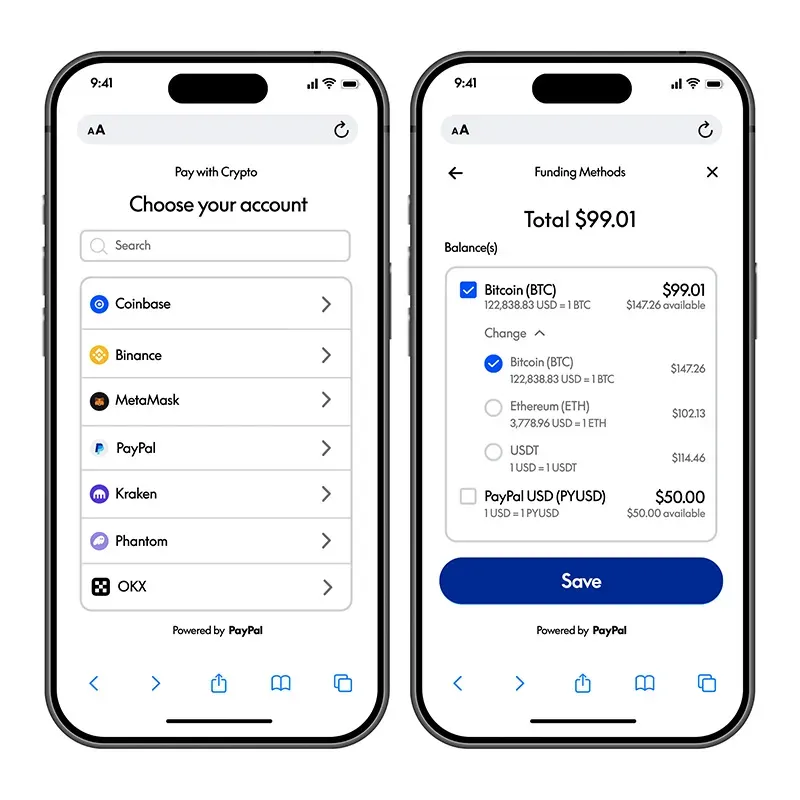

PayPal CEO Alex Chriss, in a recent interview with CNBC, emphasized that PayPal World will heavily rely on stablecoins to enable cross-border payments. On the other hand, PayPal also wants to help merchants attract more international customers, which is why it launched “Pay with Crypto.” As long as merchants activate this feature, customers can connect a wallet or crypto exchange through PayPal and pay directly in cryptocurrency. If the merchant opts to hold PYUSD, they can even earn up to 4% annual yield.

But in my view, neither of PayPal’s two new products is really aimed at “human” users. They’re targeting the emerging market of AI agents.

AI-Powered Payments: Who Will Be the Next Visa?

Not long ago, Shopify announced it would start accepting USDC as a payment method 3, making it a default option alongside credit cards. While the news created some initial buzz, after two months, the results were underwhelming: only about 700 transactions were processed globally. Most consumers are still used to paying with credit cards and don’t feel compelled to switch to stablecoins.

I’m also not particularly optimistic about the adoption of PayPal World outside of in-person scenarios. When shopping online, most people naturally prefer platforms based in their own region. For example, Taiwanese consumers aren’t likely to shop on a website that only supports India’s UPI payment system.

Even though PayPal World connects different payment networks, actual usage may remain limited—only becoming truly useful while traveling. Unless AI agents become part of the consumer journey 4.

AI is evolving at an astonishing pace. From just playing Go or generating images, it has now become my go-to for most of my searches and questions. It’s only a matter of time before AI also takes over product research and purchasing decisions.

If I ask Perplexity to recommend a product, the best deal may not be on the platforms I normally use. Since AI doesn’t have ingrained habits, it might place an order for me on a site I’ve never used before. If those sites are integrated into PayPal World, AI agents could complete the purchase using whatever payment tools they have on hand.

Visa’s dominance is almost untouchable today. But what PayPal is building is a “Visa for mobile payments and AI agents.” One day, we may no longer need to exchange cash when traveling abroad, or swipe a credit card, or even figure out how to spend our leftover change at the airport. Because no matter where we go, we’ll be paying in New Taiwan Dollars.

- Circle Builds a Payment Network: Challenging the SWIFT System and Disrupting the Era Where Money Can’t Move Freely

- PayPal Launches Its Own Stablecoin: An Open Payment Tool Bridging Two Worlds

- E-commerce Giant Shopify Integrates USDC: Defining the Standard for Stablecoin Payments—Crypto Is No Longer Just for Buying Pizza

- The Forgotten 402: How It Became the Most Important Payment Gateway in the AI Era