4% Cashback Across All Channels! Ether.fi Cash: The World’s First Crypto Credit Card That Debits Directly From Your Wallet

GM,

This post is a little push to get you excited about a newly launched crypto credit card: Ether.fi Cash. Normally, I only write about products I've personally tested over a longer period. But I’ve been eagerly awaiting this one for some time¹, and after just a few days of using it, I couldn’t resist sharing early impressions. It boasts three notable “firsts”:

- The world’s first crypto credit card

- Taiwan’s first crypto payment card with real cashback

- Taiwan’s first payment card that directly deducts from your wallet

When I finally got the card, I was as excited as I was back when I applied for the Crypto.com Visa card (hereafter referred to as the CRO card). If you're already thinking of applying, I’ve included my referral link for Ether.fi Cash—feel free to use it. But first, let’s talk about the crypto payment cards I’ve personally used.

A Card for Every Occasion

I consider myself a hardcore crypto user. I have 35 different wallets on my phone, along with access to 20 exchanges and DeFi apps. Even I think it’s a bit over the top—but this is my passion. Only by using products and experiencing the pitfalls myself can I make solid recommendations.

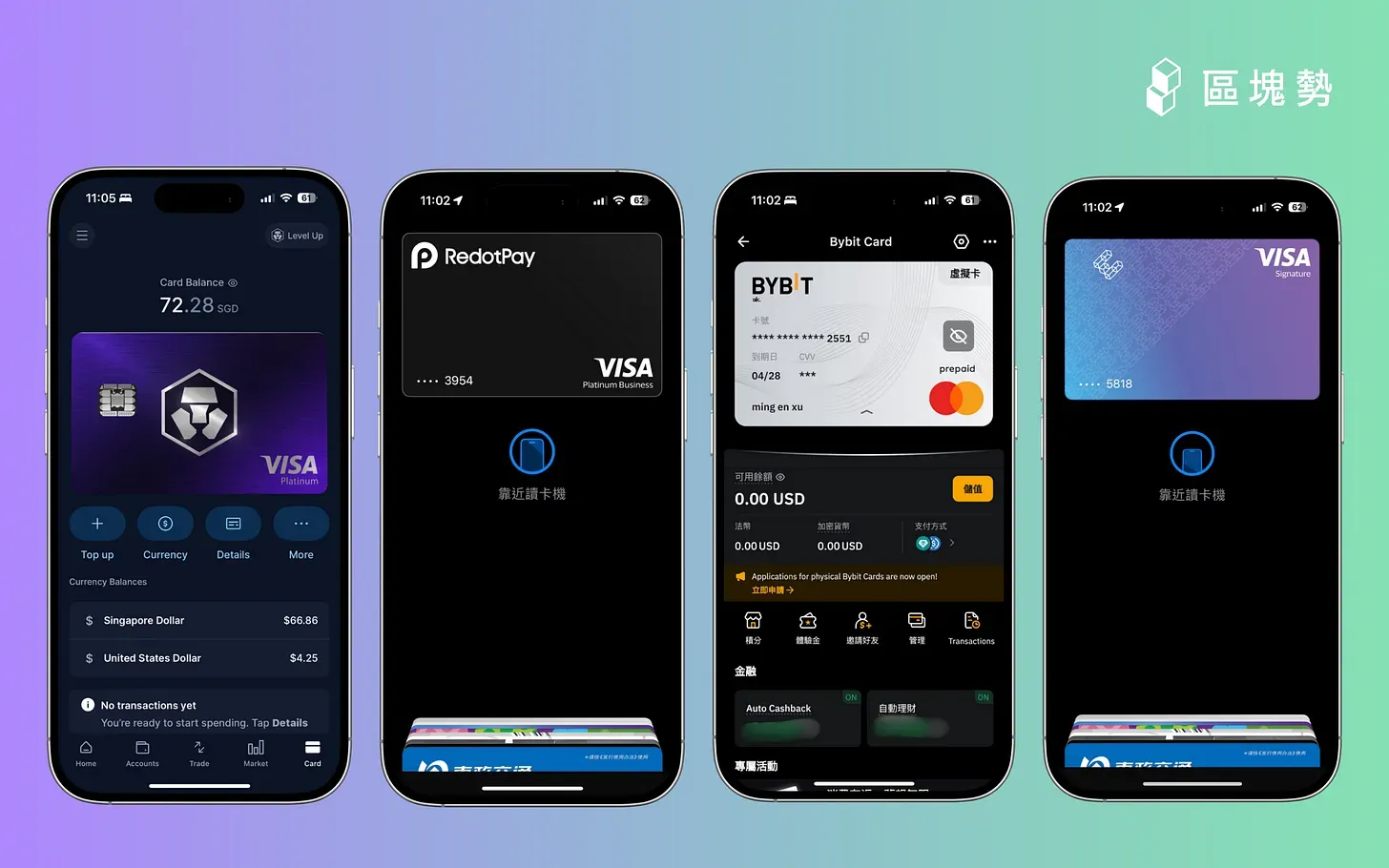

Right now, I actively use four crypto payment cards: CRO, RedotPay, Bybit, and the star of this post, Ether.fi Cash. I don’t sign up for duplicate card types. After all, in practice, we always default to the one that offers the highest rewards. For me, each of these four cards serves a distinct purpose at different stages.

The CRO card was the first crypto payment card I applied for back in 2020. It holds a place much like Bitcoin—more symbolic than practical. Once you crunch the numbers, you'll realize the exchange rate and fees just don’t make sense. Its only real perk is the included Priority Pass for airport lounges, which makes it a fun travel companion. That’s the main reason I haven’t canceled it yet.

Next came RedotPay², my second card. It features a virtual card format, is usable right after approval, and can be linked with Apple Pay. This filled a key gap left by the CRO card. While the CRO’s metal design is top-tier in terms of aesthetics, convenience always wins for everyday purchases—RedotPay is simply more practical.

Bybit is also a virtual card. I signed up during a “10% cashback in the first month” promotion. It works with LINE Pay, and lets you receive rewards in BTC, ETH, or stablecoins. But after the promo ended, I pretty much stopped using it.

I only use each card for a time—not because I like chasing the next new thing, but because they all share one fatal flaw: the more you spend, the more you lose. With traditional credit cards, it’s all about who offers the best cashback. At first glance, crypto cards don’t seem that different—but what really matters are the exchange rates and fees at the time of payment.

Take the CRO card as the most popular example. Each transaction incurs two layers of exchange loss, plus a foreign transaction fee—so three layers of friction total. The card is settled in Singapore dollars, so you first have to convert your crypto into SGD to top up—that’s the first layer. Then if you’re spending outside of Singapore, you get hit with a second conversion. Add in the foreign transaction fee, and you’re looking at a triple hit that makes any cashback negligible. Bottom line: your rewards often don’t even cover the cost of using the card.

Later cards like RedotPay and Bybit simplified things by letting you spend directly from USD stablecoins, eliminating one conversion. Still, without extra subsidies, you're often eating a 2–3% loss per transaction. Yet despite that, crypto payment cards still have strong demand—mainly because they meet a specific need: helping crypto holders spend directly without converting to fiat. That saves on off-ramping fees and, often, tax reporting headaches.

But the real star of today’s article—my fourth card, Ether.fi Cash—takes a very different approach. Based on my testing, it only incurs 0.7% friction, and when you factor in cashback, not only does it cancel out the cost—it can actually turn a profit! This might not sound groundbreaking in the world of traditional credit cards, but in the crypto card space, it’s exceptionally rare. The key is that Ether.fi doesn’t just want to serve crypto whales—it wants to become a decentralized bank for everyone.

A True Cashback Crypto Card

Ether.fi Cash is also a virtual card. One of my friends went from sign-up to approval in just 10 minutes, and was able to immediately link it to Apple Pay and LINE Pay for instant use. Super convenient.

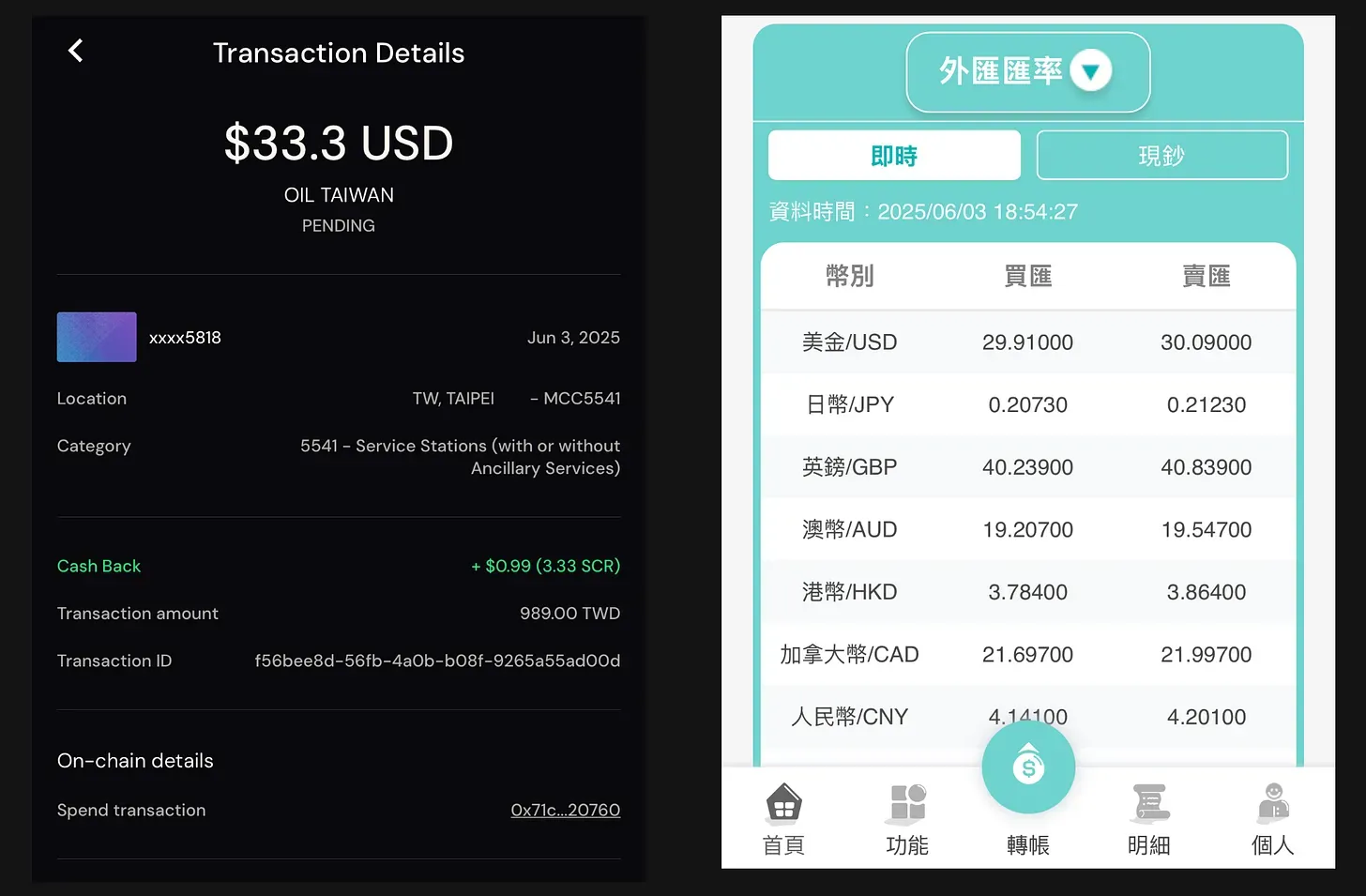

But what matters most to me are the exchange rates and fees. The image below (not included here) shows a transaction where I used Ether.fi Cash to pay for gas, compared against the prevailing USD exchange rate from a local bank at the time.

Here are the details of the transaction:

- Amount spent: NT$989

- Actual deduction: USD $33.3

- Bank exchange rate: NT$996 (33.3 × 29.91 = 996)

- Card friction loss: NT$7 (7 / 989 = 0.7%)

- Instant cashback: 3.33 SCR ≈ USD $0.99 (equivalent to NT$29.6, about 3% cashback)

- Promotional rewards: ~2% in ETHFI

Looking at the results, even though there’s still a 0.7% loss due to currency conversion, the cashback more than makes up for it. Right now, it’s a crypto payment card offering over 4% cashback across all merchants, and it doesn’t require off-ramping crypto—making it highly competitive.

In fact, Ether.fi Cash was announced over a year ago, but it wasn’t until late April 2025 that people actually started receiving their cards. The good news is that, to attract new users, the team is expected to launch a series of promotional campaigns. Last month’s Bitcoin Pizza Day was a great example—anyone who bought pizza using Ether.fi Cash and uploaded a photo could receive up to $30 in pizza reimbursement.

In addition, this card can be linked to the LoungeKey Dining Program on the Visa website, allowing users to redeem free meals at participating airport restaurants. For a card that’s free and available to everyone, this is a great hidden perk. But what excites me most is that Ether.fi Cash is a credit card that can directly deduct payments from a personal wallet.

A Credit Card That Spends From Your Wallet

Most people haven’t heard of Ether.fi because the team originally focused on more technical Ethereum liquid staking solutions. But recently, they’ve repositioned their project with the goal of becoming the “bank” of the decentralized world. With the launch of Ether.fi Cash, they aim to enable users to handle saving, earning yield, and spending—all on the blockchain.

You don’t need to register with a centralized exchange to apply for the Ether.fi Cash card, because you’re the one who actually holds the funds. It works like storing assets in a self-custodied MetaMask wallet—your money stays with you until the moment you swipe the card, when it’s automatically transferred. To use a real-world analogy: Ether.fi Cash is like a payment card linked directly to the cash in your pocket—the moment you swipe it, the money just flows right out.

It’s practically magic! Behind this seamless payment experience lies the latest advancements in blockchain technology, including multi-signature wallets and Layer 2 networks. Without these, all sorts of things would get stuck—for instance, how does the card know to pull from your wallet? Do you need to open your phone to approve every transaction? Who pays the gas fees? Ether.fi Cash hides all of these technical details. And honestly, you don’t need to worry about them. If you know how to top up and swipe a card, you’re good to go.

Some people might say: “I’m not familiar with crypto. I wouldn’t even know how to add funds.” That’s fine too—Ether.fi Cash will soon support bank transfers for top-ups. It’ll provide a dedicated bank account number; simply transfer money there, and crypto will automatically show up in your Ether.fi Cash wallet. It’s as simple as it sounds.

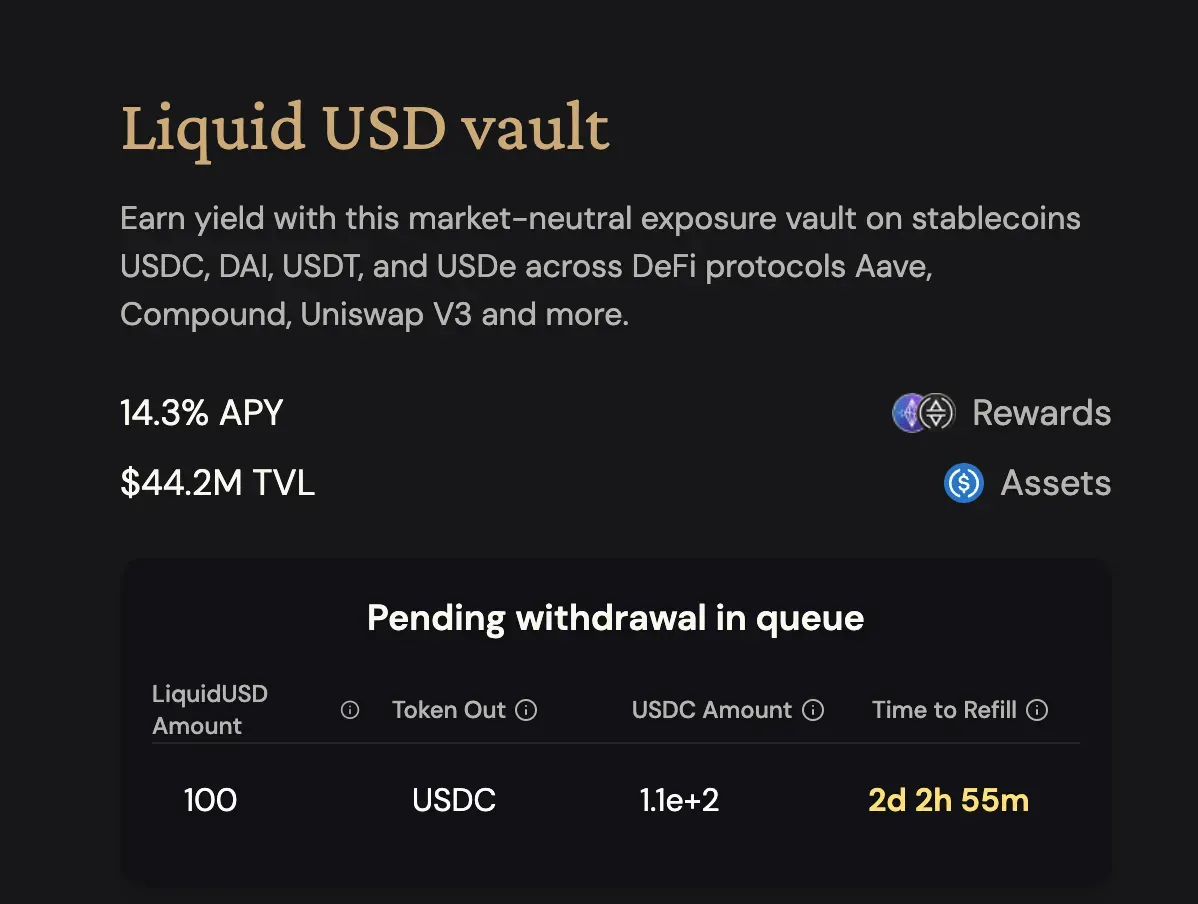

On top of that, this card is quite the money-maker—it lets users earn interest until the very last second. Ether.fi Cash allows you to choose which cryptocurrency to spend, and one of the available options is LiquidUSD. Liquid is a yield service developed by Ether.fi, and its stablecoin currently offers an impressive 14.3% annual yield. When users deposit USDC, the funds are placed into Liquid to earn interest, and in return they receive an equivalent amount of LiquidUSD as a redemption voucher. When making a purchase, you can pay directly with LiquidUSD—eliminating the need to redeem or convert beforehand. It couldn’t be more convenient!

Next, Ether.fi Cash also features a “Buy Now, Pay Later” function. Users can deposit BTC or ETH into their wallet to receive a spending limit. This essentially functions as a collateralized loan—Ether.fi Cash fronts the money for your purchase, and you pay it back later. For now, the borrowing interest rate is 0%, so even if you repay later, there's no extra cost.

That’s why Ether.fi Cash calls itself the world’s first crypto “credit card”—you can spend now and repay later. But this time, the credit limit isn’t determined by a bank. Instead, it’s based on your on-chain assets. The more assets held in your wallet, the higher your spending limit—and you can continue earning interest while spending.

Overall, compared to most crypto payment cards available today, Ether.fi Cash offers better rewards, more features, and eliminates the fear of company insolvency. If there’s one downside, it’s that the product is still somewhat unstable.

A Very New Product

After all, Ether.fi Cash only launched just over a month ago. While the basic top-up and spending functions are working fine and there's a dedicated app, some features are still only available on the web version. The app is currently quite bare-bones and lacks full functionality. The bank wire transfer top-up feature is still under construction, making the product feel more like it’s in beta testing.

Additionally, the built-in yield service Liquid, while developed by Ether.fi, earns returns by allocating funds across various DeFi platforms. While this spreads out risk, responsibility in the case of a DeFi exploit remains unclear.

When using the credit feature, users also need to be cautious about spending limits and market volatility. Since this is still a form of collateralized borrowing, if you deposit $10,000 and spend $9,000, you’ll be at risk of liquidation if crypto prices drop.

Lastly, the current cashback rewards come in $SCR (in partnership with Ethereum Layer 2 Scroll) and $ETHFI(Ether.fi’s native governance token). These are part of a short-term promotional incentive rather than a stable income stream. Over the long term, reward mechanisms may be adjusted. Once these subsidies end, non-crypto-native users may find the card less appealing.

Final Thoughts

All that said, I still recommend giving Ether.fi Cash a try (this is not a sponsored post, but I’ll receive 1% cashback for the next year from referrals). It’s worth experiencing firsthand just how far the most advanced crypto credit card on the market can go.

P.S. This is the 696th article. Blocktrend plans to adjust its subscription pricing to $10/month or $100/year starting from the 700th article. The new rates will only apply to new subscribers or those who cancel and resubscribe—existing subscribers will retain their current pricing.

When Blocktrend moved to Substack five years ago, many readers linked their credit cards and have been paying to support the publication ever since. Since credit cards typically have a five-year validity, we’re now entering a peak period of card renewals. To those who’ve chosen to unsubscribe, I sincerely thank you for your past support. To those willing to update your card and join me for the next five years—I value your continued support even more.

Click here to check your current subscription status.

1 Gnosis Pay: A Visa Debit Card That Pulls Funds Directly From Your Wallet

2 Buying Wonton Noodles with Bitcoin: A Hands-On Test of the RedotPay Crypto Visa Card