2026 Event Roadmap: Goodbye! The Four-Year Cycle

GM,

First, I want to thank the very first readers who filled out the 2025 content satisfaction survey. After all, the scariest thing about sending out a survey is having no one respond. Reading through the feedback feels like looking into a mirror—every year, I notice subtle changes. Still, I need more people to participate before the picture becomes truly clear.

As with previous years, the survey has 20 questions and takes about 10 minutes to complete on average. Most are multiple-choice, with only a few asking you to explain the reasons behind your ratings. I’d really appreciate you taking the time to fill it out. Now, let’s get to the main topic.

Recently, Taiwan’s stock market has been hitting new highs alongside TSMC. My wife casually asked whether it might be time to reassess our asset allocation—a true soul-searching question 😂

Rebalancing assets can’t be done on gut feeling alone. One by one, I read six heavyweight 2026 forecasts and outlook reports published by institutions including BlackRock and Coinbase.

When multiple reports independently point to the same themes, those trends are probably more likely to materialize. Of course, each report also highlights its own set of risks. In this article, I combine their observations with my own judgment to walk you through the changes we may see in the crypto space over the coming year.

Let’s start with the area of greatest consensus: crypto prices.

The Breakdown of the Four-Year Cycle

There is a long-standing legend in the crypto world: prices go through a bull–bear cycle every four years.

Why four years? It’s tied to Bitcoin’s halving mechanism, which occurs once every four years. Seasoned crypto veterans will tell you: “After a halving, Bitcoin’s issuance rate slows, prices take off, and a three-year bull market begins. Once prices hit an all-time high, the bubble bursts, followed by a one-year bear market.” In short, the pattern is “three years up, one year down,” with that single down year often wiping out a large portion of the gains from the previous three.

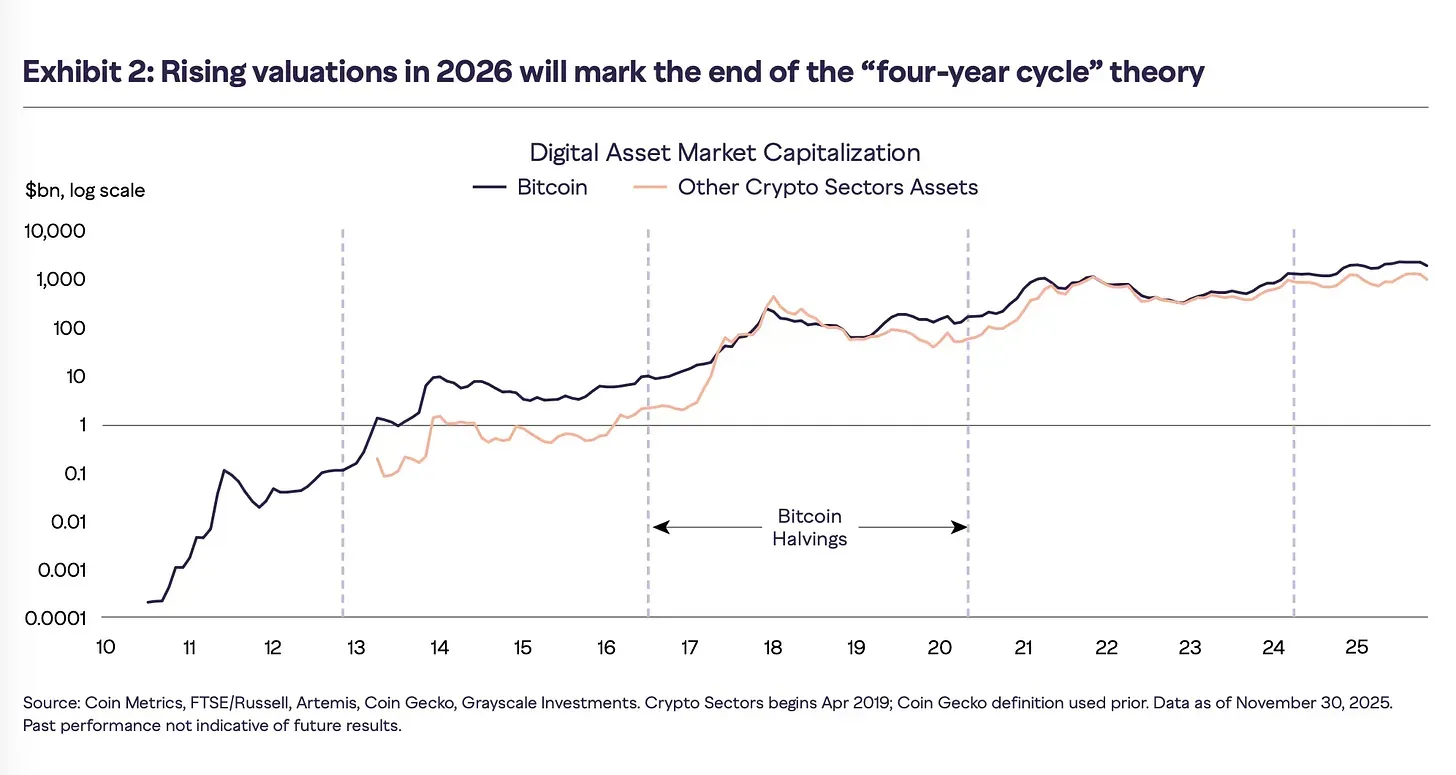

Most people are skeptical the first time they hear this theory—until they see the chart. Bitcoin’s past four halvings took place in 2012, 2016, 2020, and 2024, while prices reached all-time highs in 2013, 2017, 2021, and 2025. In other words, one year after each halving, Bitcoin has reliably set a new record high before pulling back. If this pattern were to hold, the next all-time high would arrive in 2029.

I have one piece of good news and one piece of bad news to share with you. Let’s start with the bad news: if the cycle plays out exactly as the script suggests, then 2026 would be a crypto winter—one that gives back most of the gains from the previous three years.

The good news is that almost all reports predict that this four-year cycle will break down in 2026. In other words, 2026 doesn’t necessarily have to be a winter. Some reports even argue that prices could go on to set new all-time highs.

At this point, the question on everyone’s mind—including mine—is: Why? Is this just crypto’s collective self-comfort? According to these reports, regulatory clarity and central bank rate cuts are the two key forces disrupting the traditional cycle.

Regulatory Clarity

In 2025, we witnessed firsthand the impact on the market after the United States passed the GENIUS Act, a piece of legislation tailored specifically for stablecoins.¹

Even though the law will not officially take effect until 2027, companies have already moved ahead of it. Visa announced expanded support; Stripe² and PayPal³ went a step further by issuing their own stablecoins; and even legacy players like Interactive Brokers and Western Union have begun using USDC for cross-border transfers. Once regulation is in place, companies vote with their feet.

The main event of 2026 will be the CLARITY Act. The bill has already gained bipartisan support in the House of Representatives and is set to be sent to the Senate for deliberation. It clearly delineates the jurisdictions of the two major U.S. regulators: the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

Over the past decade, no one could say with certainty who regulates what between these two agencies. Crypto founders often only found out which regulator they fell under when enforcement officers came knocking on their doors. Even more absurdly, some companies were sued by both the SEC and the CFTC at the same time, with each claiming jurisdiction. Where authority overlaps, gray areas naturally emerge. The CLARITY Act aims to draw clear red lines so that entrepreneurs don’t have to wait until they’re prosecuted to learn they’ve broken the law.

Only when the rules are clear will companies dare to invest. Most institutional capital is deployed on five- or ten-year horizons and simply doesn’t care about four-year bull–bear cycles. As market participants shift, the four-year cycle driven by retail investor expectations is likely to break down.

In addition, markets expect the U.S. Federal Reserve to enter a rate-cutting phase in 2026. As the cost of capital falls, idle money will flow out of banks and into markets, pushing up the prices of risk assets. With multiple factors converging, no one can guarantee that prices will rise in 2026—but it’s fair to say that the once-every-four-years bull–bear script is very likely to start failing from this year onward.

Beyond prices and regulation, what will truly shape the industry’s direction are the real-world applications of blockchain and crypto.

Stablecoins + RWA: A Powerful Combination

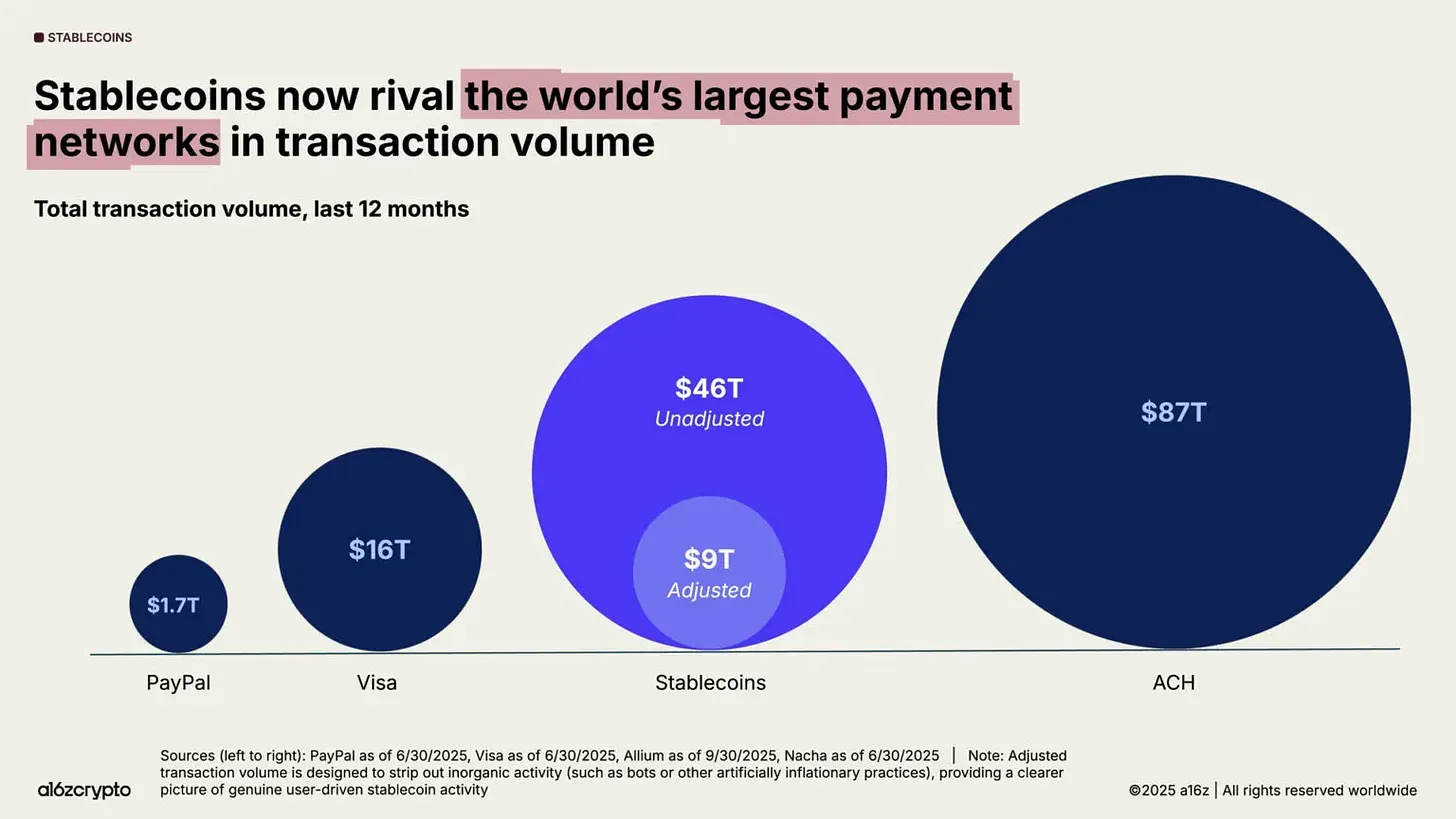

In 2026, stablecoins will no longer be merely tools for price hedging within exchanges. They will gradually become part of the core infrastructure of global finance. According to a16z crypto’s annual report, on-chain stablecoin transaction volume reached $46 trillion in 2025. After stripping out wash trading by arbitrage bots, real transaction volume still totaled $9 trillion—putting it squarely between PayPal and Visa.

What do people actually use stablecoins for? That question is a bit like asking, “What do you use a computer for?” The answer is: too many things to count.

In Taiwan, companies doing business with overseas clients may receive payments in stablecoins, while individual investors deliberately buy stablecoins to save time on international wire transfers and avoid hefty bank fees. For most Taiwanese, stablecoins are simply a tool. But if you shift the context to Venezuela, Argentina, or Turkey, stablecoins become a lifeline—a hedge that preserves value better than local fiat currencies.

As more money flows into stablecoins, more yield-generating opportunities will emerge on-chain, and RWAs will naturally rise alongside them 4. The world’s largest asset manager, BlackRock, has already signaled that eventually all assets will be tokenized. Once “money” has moved on-chain, it must look for corresponding “assets” to generate returns—such as government bonds, corporate debt, or real estate.

The era when stablecoins were only used to buy BTC or ETH is over. In the future, companies will start building entire investment portfolios using stablecoins. With both money and assets on-chain, trades and settlement can be completed in just seconds. It’s no surprise that both Coinbase and 21Shares predict the combination of stablecoins and RWAs will be the primary engine driving traditional finance onto the blockchain at scale.

But this still isn’t the “final form” of stablecoins. There’s another group of potential users on the horizon—AI—which may also need to make payments using stablecoins.

AI Payments and Digital Resumes

AI can already help you generate images and co-author articles; in the future, it will even assist with booking flights or renting servers. However, the pressing question remains: will banks allow an AI to open an account? It has no ID card, nor can it produce business registration certificates. In the financial world, AI is effectively a "ghost population" excluded from the system.

How do the world's unbanked populations access financial services? Through cash or stablecoins. Since AI lacks a physical form for now, paying with stablecoins is the most logical choice. Creating a wallet requires no real-name authentication, making it a natural "bank account for AI." In 2025, Coinbase bet on the x402 payment protocol, anticipating that AI agents might replace humans as the primary protagonists of the on-chain economy.

Recently, while using Cursor and Gemini to build a family bookkeeping tool with my wife, I realized that if AI could bypass processes designed specifically for humans—such as account registration, credit card binding, and login verification—productivity would double again. After all, when these workflows were first designed, who would have thought the user wouldn't be a human, but the AI itself?

When AI gains the ability to pay, it can also solve the "overgrazing" problem highlighted by Cloudflare CEO Matthew Prince 6 7. Currently, AI is like a flock of sheep grazing frantically across the internet; creators' content is being pulled up by the roots without any compensation, which will eventually lead to the exhaustion of the "grasslands." If AI can pay for what it consumes, the content ecosystem can achieve a sustainable, regenerative cycle.

As generative content floods the internet, distinguishing truth from fiction becomes increasingly difficult—raising the question: what is actually worth paying for? Currently, people rely on watermarks in the bottom-right corner of images to identify AI-generated content, but these can be erased in seconds using photo-editing software. Adam Mosseri, the head of Instagram, predicts that in the future, people will care more about who is responsible for the content 8.

One method of identification is through cryptographic signatures combined with on-chain preservation. Creators can attach an immutable digital signature the moment content is completed and record the hash value on a blockchain. Currently, law enforcement and judicial units in Taiwan use this exact method to write data into the "Justice Alliance Chain 9" when handling digital evidence, ensuring that the evidence hasn't been tampered with after the fact.

Writing to this point, one can't help but wonder: what "bad things" are looming on the horizon for 2026?

The Stablecoin Backlash and the L2 Tournament

Bitwise has made a bold prediction: in 2026, emerging nations will publicly oppose stablecoins, arguing that they undermine the stability of their national currencies.

When citizens stop using their local legal tender (fiat), a government's monetary policy is challenged, which in turn shakes national sovereignty. However, the fundamental question remains: if these national currencies were truly stable, why would the people prefer to use stablecoins in the first place?

The true boundaries of a nation are most clearly seen by which currency its people choose to use. In the past, governments could rely on foreign exchange controls to limit capital flow; but on the blockchain, capital flows like water, penetrating every crack. Anyone can download a wallet and hold US dollars. Facing the infiltration of stablecoins, banning cryptocurrencies might only be the first step; some countries may resort to even more aggressive countermeasures.

Another bubble likely to burst is Ethereum's Layer 2 (L2).

Over the past two years, launching an L2 has become too easy. By simply copying and pasting code, developers can claim to be building the "next generation" of infrastructure. The result is a market suddenly flooded with hundreds of L2s without nearly enough users, most of them becoming "ghost chains." 21Shares predicts that 2026 will witness a "Great Extinction" of L2s. In particular, those chains that lack exchange support for withdrawals or where capital cannot flow freely will be eliminated by the market due to a lack of liquidity. Ultimately, capital, users, and developers will consolidate around a few chains with strong network effects, such as Arbitrum, Base, and Polygon.

Returning to my wife's "soul-searching" question: is it time to re-examine our asset allocation? As someone with 95% of my assets in the crypto space, I have been deeply reflecting since the DeFi tsunami at the end of last year. From a risk diversification perspective, it is necessary to readjust these proportions. While consistency is a virtue, the goal for each year shouldn't always be "just breaking even." 😂

- The U.S. Passes the Stablecoin Act! Why Foregoing a CBDC Actually Resulted in a Win?

- The Largest Acquisition in Crypto History! Why Did Stripe Spend $1.1 Billion to Acquire Stablecoin API Startup Bridge?

- PayPal Launches Its Own Stablecoin: An Open Payment Tool Connecting Two Worlds

- A Detailed Look at RWA Development! Why Is Real-World Asset Tokenization the Next Big Wave After Stablecoins?

- The Forgotten 402: How It Became the Most Important Payment Gateway in the AI Era?

- Cloudflare Declares War on AI Crawlers! Enabling HTTP 402 to Charge for Content Creators

- AI Doesn't Watch Ads—Who Will Pay for Web Content?

- In the Age of AI, Do We Still Need to Pay for Content?

- Justice Alliance Chain: A National-Grade Digital Seal and the Possibility of Collapse